Gusto and QuickBooks Payroll are affordable software options for small business owners that both offer full-service payroll with unlimited pay runs and direct deposit payments, as well as payroll tax processing and filing.

Gusto has a wider selection of benefits options and more human resources (HR) tools. QuickBooks Payroll, on the other hand, provides faster direct deposits and connects seamlessly with other Intuit QuickBooks products.

- Gusto: Best for payroll for both employees and contractors with access to HR tools

- QuickBooks Payroll: Best for businesses already using Intuit Quickbooks software

Both Gusto and QuickBooks Payroll are featured in many of our payroll buyer’s guides as top two choices, including our best payroll software for small business users and best payroll software for accountants. For this article, I compared Gusto vs QuickBooks payroll based on affordability, HR and payroll features, and how easy the software is to use.

Gusto vs QuickBooks Payroll: Compared

|  | |

|---|---|---|

Overall Score | 4.68 out of 5 | 4.39 out of 5 |

Best for | Small businesses wanting full service payroll with HR | Current QuickBooks users |

Starter Monthly Pricing | $49 per month + $6 per person per month | $6 per employee plus $50 base fee |

Direct Deposit Processing Timelines | Minimum two and four days; next-day process with higher plans | Minimum next-day process; same-day with higher plans |

Workers' Compensation | Can purchase and manage within all plans | Can purchase and manage within all payroll-only plans |

Payroll Tax Payments, Filings, and Year-end W2/1099 Reports | Yes to all | Local tax payments and filings available in higher tiers only |

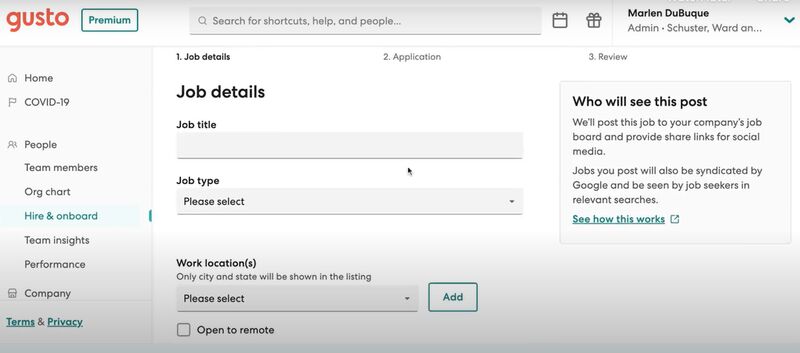

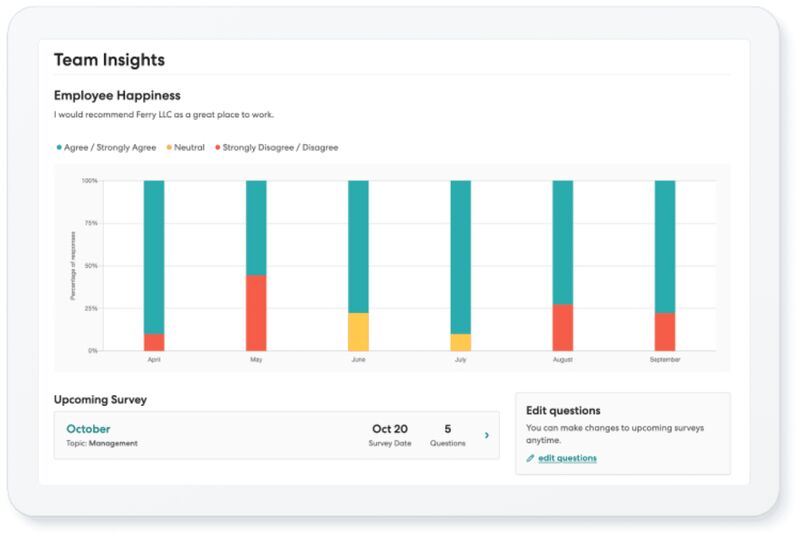

Other HR Features | Job postings, applicant tracking, performance reviews, employee surveys, HR resource center, and HR advisers | HR support center and HR advisers |

Software Integration | Robust | Limited to Intuit products; requires QuickBooks Accounting to unlock all integrations |

Ease of use | Excellent | Excellent |

Customer support | Phone, email, and chat support from Monday to Friday; premium support available in higher tiers | 24/7 chat; phone support from Monday to Saturday; premium support available with Elite plan |

For a deeper dive of each provider, click on the tabs below.

When to Use Something Else

There are instances where neither Gusto nor QuickBooks Payroll is the best option. Consider something else if your business needs any of the following services.

- Professional employer organization (PEO): If you’re looking for a PEO solution with HR payroll software and 24/7 customer support, I recommend Justworks. Neither Gusto nor QuickBooks Payroll offer PEO services. Read our Justworks review to learn more about its offerings, or check out our best PEO companies guide for recommendations.

- International Payroll: QuickBooks does not handle international payroll, and Gusto’s global payroll solutions are extremely limited (currently only supports 12 countries and salary-exempt employees only). If you have a global business, then consider Papaya Global. Read our Papaya Global review to learn more about what it offers, or check out our best international payroll services guide for recommendations.

- Payroll with a complete HRIS: Gusto has a few more HR features than QuickBooks—but if you want a full HRIS that includes payroll, then I recommend Rippling or ADP. Learn about these two in our Rippling review and ADP Run review.

- Free payroll: If you have a very small business and simple payroll needs, then free payroll software might be enough. Check out our list of the best free payroll software. TimeTrex is our #1 recommendation there, though keep in mind that you will be filing taxes yourself. Learn more about it in our TimeTrex review.

If you would like to try other options, check out our best payroll services guide for small businesses.

Gusto and QuickBooks Payroll are highly versatile, easy to use, and well-priced. As such, you’ll find them both (typically in the top 2 spots) in our lists for:

- Best Payroll Software for Small Businesses

- Best Human Resources Payroll Software

- Best Payroll Software for Accountants

- Best ADP Competitors

- Best Payroll Series for Nonprofits

- Best Church Payroll Services

- Best Payroll Services for Trucking Companies

- Best Construction Payroll Software

How do I choose Gusto vs QuickBooks? To help you choose a payroll solution that’s best for your business, start by assessing how many employees you have, along with your budget and need for HR support and software integrations.

Most Affordable: Gusto

Both Gusto and QuickBooks Payroll offer reasonably priced product plans that come with unlimited pay runs. However, Gusto’s lower base fees for its Simple plan make it more affordable than QuickBooks Payroll’s Core plan.

Click the tabs below to learn more about pricing for both Gusto and QuickBooks Payroll.

Gusto vs QuickBooks Payroll Pricing Calculator

If you want to quickly compare starting costs, use our online calculator to compute the estimated monthly and annual fees of the lowest plan for each of these providers.

Best for Payroll Features: Quickbooks Payroll

Gusto vs QuickBooks Payroll is a close call in terms of payroll features, as they have similar feature sets. Both offer automated payroll and tax processing, including year-end tax report preparation and online delivery of Form W-2s and 1099s. However, QuickBooks Payroll comes out slightly ahead because of its penalty-free guarantee, no matter who makes the mistake.

Best for HR Tools: Gusto

With Gusto and QuickBooks Payroll, you get a self-service portal that employees can use to view their pay slips and employee benefits online. Both providers also offer access to expert professionals whom you can contact to get HR, payroll, and compliance advice. However, Gusto offers more services to assist with active employees.

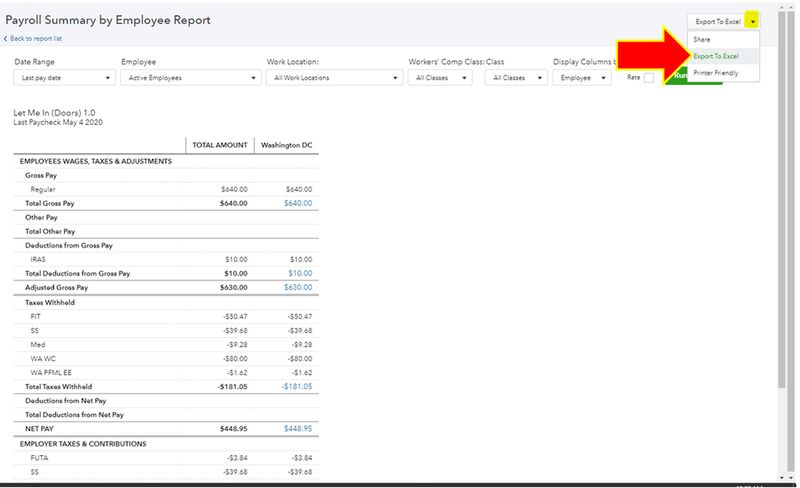

Best for Reporting: Gusto

Expert Tiebreaker Insight: When it comes to reports, Gusto and QuickBooks Payroll are even in the number of offerings. Plus, you can build new reports and customize existing reports on both platforms. Although they tied in this category, Gusto’s reports are slightly more robust. Plus, reporting on QuickBooks desktop version is more detailed than its Online version—and with the desktop version phasing out, it makes Gusto the clear winner in this category.

Best for Ease of Use: Quickbooks Payroll

When it comes to ease of use, Gusto and QuickBooks Payroll have user-friendly and intuitive platforms. Both offer phone support, including access to HR advisers and how-to guides. QuickBooks Payroll was the clear winner in this category earning top marks for its customer support and access to a community forum and setup help even in its lowest tier. However, Gusto has a better how-to section than QuickBooks, and it’s hands-down the better for integrations.

Best for User Reviews: Gusto

Gusto takes the lead here not only for having a higher score from real-world users but also for having more user reviews. However, both products are highly rated by users for features, ease-of-use, and customer support.

Methodology: How Gusto and QuickBooks Payroll Were Evaluated

To compare Gusto vs Intuit QuickBooks Payroll, I started with our rubric for the best payroll services, originally created by Robie Ann Ferrer. From there, Karina Fabian modified it to dig deeper to better compare these two strong payroll providers. I then looked at each provider in terms of price, payroll and HR features, and user feedback.

For this update, I further reviewed our rubric and adjusted the scoring for new and updated features.

25% of Overall Score

We evaluated both platforms for transparent pricing, zero setup fees, and multiple plan options with unlimited pay runs. We then gave extra points for affordability (less than $50 per employee per month). Gusto was more affordable at its lowest tier, while QuickBooks Payroll cost less at its highest tier.

25% of Overall Score

For this criterion, each provider was reviewed for its payroll capabilities. Those with direct deposits in two days or less, multiple payment options, year-end tax reporting, tax payments and filings (federal, state, and local taxes), and a penalty-free guarantee were scored higher. The paycard option was where Gusto stood out, although QuickBooks Payroll’s tax guarantee is more all-encompassing.

10% of Overall Score

While both providers offered the basics for onboarding and self-service, and experts on staff, we gave extra points to Gusto for preparing and filing State new hire forms. In our previous review, QuickBooks Payroll scored higher due to its healthcare coverage; however, Gusto now offers healthcare in all 50 states, allowing it to now take the top spot in this category.

5% of Overall Score

Preference was given to software with built-in basic payroll reports and customization options. Although they both missed the mark for number of reports available (at around 25 available), both Gusto and QuickBooks Payroll allow new reports to be built within the system, resulting in a tie in this category.

10% of Overall Score

Online user reviews and customer service quality trends from popular review sites like G2 and Capterra were considered in this category. Extra points were given for scores over 4 out of 5 and 1,000 or more reviews, making Gusto the clear winner.

25% of Overall Score

Features that make the software easy to use, such as having an interface that’s intuitive and customizable were favorably scored. Extra points were given to providers that offer integration options, set-up assistance, live phone support, and a dedicated representative.

Gusto vs QuickBooks Payroll FAQs

Gusto is a payroll service that offers HR tools like job posting and performance reviews. It integrates with over 150 applications, including QuickBooks. QuickBooks Payroll is part of the Intuit family of products. While it has fewer HR tools than Gusto, it integrates seamlessly with other Intuit products, including QuickBooks Accounting and QuickBooks Time.

Based on our evaluation, Gusto is a better payroll software than QuickBooks Payroll because it offers more HR tools, integrations, and benefits. However, if you’re already using QuickBooks’ accounting software, then QuickBooks Payroll may be a better option. The learning curve will be much lower than you’d get with other small business software.

Gusto’s payroll plans are comparable to other payroll services, and its contractor-only plan is one of the least expensive. However, while QuickBooks payroll is more expensive at its lowest tier, its Premium plan is more affordable than Gusto’s.