Handling small business payroll includes having to consider everything, from setting up your business as an employer to paying your employees, tax agencies, and other applicable entities. When learning how to do payroll, there are several steps you must follow to ensure that you’re fully compliant with federal and state laws.

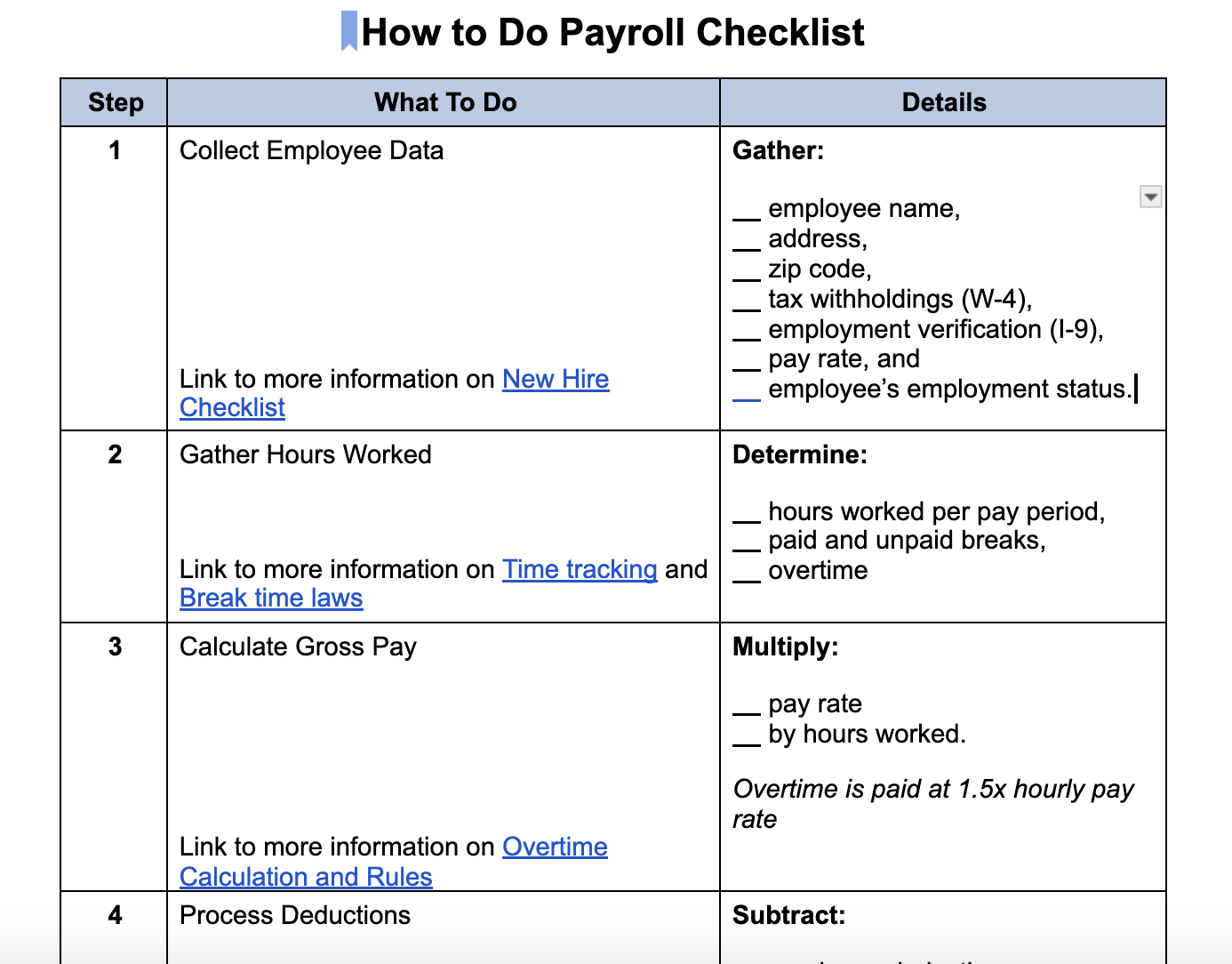

If you’d rather learn how to do payroll yourself, follow our eight steps below. We’ve also prepared an instructional video and a free downloadable checklist to help you.

Step 1: Set Up Your Business as an Employer

Assuming you’ve already established your business and applied for any required licenses, the first step in doing payroll is ensuring that your business has met all the legal requirements to operate as an employer. Consider any industry-specific payroll rules you may have to follow as well.

- Apply for a Federal Employer ID Number (EIN).

- Verify your state tax identification number is the same as your federal one; if not, determine whether you need to apply for one or if it’s automatically assigned.

- Sign up for an account with the Electronic Federal Tax Payment System.

- Start a bank account solely for payroll transactions (separate from your main business account).

- Sign up for any applicable state electronic tax payment accounts.

- Purchase workers’ comp insurance; most states require it.

Step 2: Establish Your Payroll Process

Now, you will need to make some decisions that will impact how you run payroll each period. You’ll need to determine what will work for your business so you can ensure your team is trained on the process properly.

Explore the “why” behind each area. Be sure to consider the needs of both your employees and your business, in addition to any legal requirements.

- Pay period: Will you pay weekly, biweekly, or semimonthly?

- Types of employees (not contractors): Full time vs part time? Exempt vs nonexempt?

- Tracking work time: Will you need to track work hours? If so, how will you do it, and when will they need to be reported to you? Make time tracking easier with one of our top time clocks for small businesses.

- Benefits: Will you be offering benefits? Who will pay for them? If employees are paying for them partially or in full, how will you manage the payroll deductions?

- Taxes: How often will you need to pay taxes, and which ones are you subject to? Will you need to pay state taxes? Local? Find out the rates in advance so you know how much to withhold. You can also check this guide on what federal and state taxes employers need to pay.

- Payroll processing and calculations: Will you calculate and process payroll using Excel, by hand, with a calculator, or with a payroll service? Take note, however, that calculating your payroll on Excel is only ideal for a business with 10 or fewer employees—check our guide on how to do payroll in Excel for more information.

- Paychecks: Will you be cutting checks or paying via direct deposit? Pay cards? Cash?

Consider using a payroll provider to help make the process easier. The right provider can be the difference between investing three days to run payroll vs an hour. To learn how easy it is to do payroll with some of our recommended software, check out provider-specific payroll guides below:

- How to do payroll with QuickBooks

- How to do payroll with Gusto

- How to do payroll with Patriot

- How to do payroll with OnPay

Step 3: Collect Your Employees’ Payroll Forms When Hired

You’ll need some important payroll documents from your employees to run payroll properly—and these are best collected during their onboarding. These include tax and work authorization forms, which the employees need to sign.

You’ll use the data on the forms described below to add the employee to your HR or payroll system if you have one. It’s a good idea to store this information as a paper document or an electronic personnel file.

- Federal W-4: This is a federal tax withholding document that tells you what tax rate to use for the employee. For more in-depth information about W-4, here’s a layman’s guide to W-4 and how it compares with the W-2.

- State W-4 (or equivalent): It is similar to the federal form and may be called by a different name in your state.

- I-9 Form: It verifies an employee’s identity and eligibility to work in the US with a passport or two forms of identification. It should be collected within three days of the employee’s start date.

- Other Payroll Forms: Employees who want to use direct deposit should fill out a form that gives their employers permission to deposit into their bank account. They also need to either provide a voided check or a letter from their bank with their account and routing numbers.

Also, you’ll need to register your employee in your state’s New Hire Reporting Program (generally within 20 days). Make sure that you report all new or rehired employees to your state. Payroll software, like QuickBooks, often files these reports automatically.

For more state-specific details on forms and employee onboarding, check out our state payroll guides—just click on your state in the map below and you’ll be redirected to our state payroll guide.

State Payroll Directory

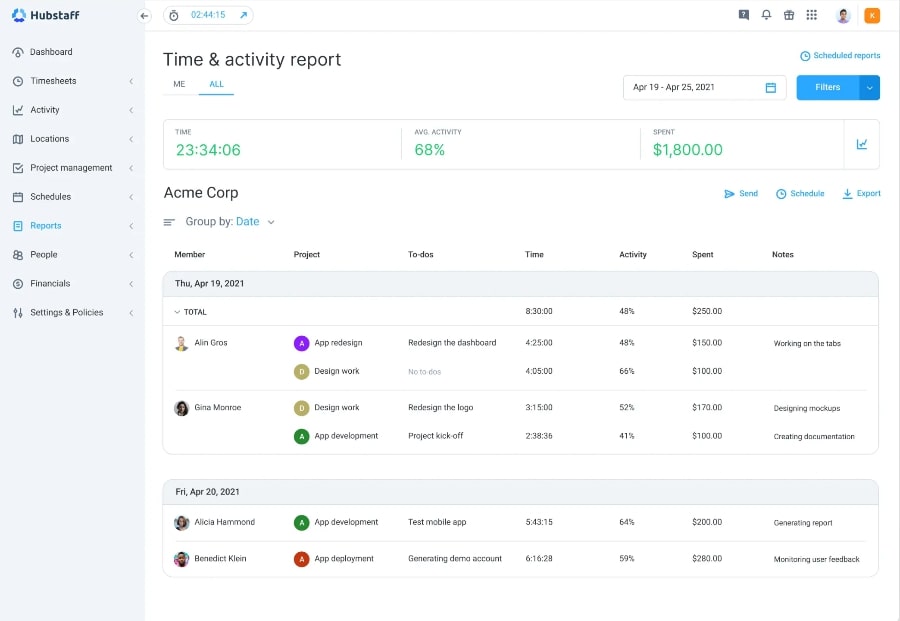

Step 4: Collect, Review & Approve Time Sheets

Now you’re ready to start collecting data on your employees’ work time to help determine how much you need to pay them. You’ll need to find the total hours worked for the period if you’re paying hourly employees. Salaried employees typically receive the same pay each period, but you can still track their work hours for visibility if needed. Calculating hours worked is as simple as having the employee write down their start and end times each day and counting up the hours—lunch breaks are not counted in the total.

Most businesses start with a simple time sheet. As they grow, they often move up to a time and attendance system or time clock to manage employee schedules, break time, and hours worked. Here’s an example of an electronic time sheet from one of our top-recommended free timekeeping vendors, Hubstaff.

Hubstaff digital timesheet (Source: Hubstaff)

Step 5: Calculate the Payroll

Once you know how much an employee has worked for the pay period, you can start figuring out the important payroll calculations. That includes gross pay, taxes due, deductions for insurance premiums and other benefits, and final net pay.

Calculating Gross Pay

Calculating gross pay is as simple as adding up the straight time hours (up to 40 hours within a week) and multiplying by the employee’s hourly rate. Then, add up the overtime hours worked in the pay period and apply the employees’ overtime pay rate to those hours. Straight time is paid at the employee’s regular pay rate, while overtime is generally calculated at 1.5 times the regular rate of pay.

Calculating Payroll Deductions & Taxes

Doing payroll requires you to know in advance what payroll deductions you’re going to make. Deductions include federal and state payroll taxes, benefits you might offer, and things like unemployment insurance or Social Security. Here’s a step-by-step guide on how to calculate your tax for accurate bookkeeping.

We also provided a list of potential deductions with links to more information to calculate your payroll. If you use payroll software like Gusto, deductions are processed automatically.

Examples are:

- Social Security and Medicare (FICA)

- Federal unemployment tax (FUTA)

- Other pre- and post-tax deductions, based on:

- Benefits you offer employees, like health insurance

- Tax deductions based on employee tips

- Miscellaneous deductions such as a uniform expense

To process those deductions, add up all the deductions for each employee to get a total, then subtract that total from the employee’s gross pay. Alternatively, you can list each deduction as a line item and subtract them one by one from the employee’s gross pay until you come up with a net pay amount.

If you’re primarily struggling with the numbers side of payroll, our article on payroll calculations may be a better fit. Just be sure you also have a good grasp of the general steps you should take to run payroll.

Free Payroll Calculators

Use our calculators in the articles below to make doing payroll yourself even easier.

Gross Pay Calculator | Overtime Pay Calculator | FICA Tax Calculator

FUTA Tax Calculator | Time Card Calculator | PTO Accrual Calculator

Employee Mileage Reimbursement Calculator

For more help, check out our payroll calculation guide.

Step 6: Pay Employees, Tax Agencies & Benefits Providers

Once you subtract deductions from gross pay, you’ll know the net amount you need to pay each employee, including totals for employment taxes and benefits you need to pay out. Be sure to follow the pay schedule you initially set so employees always know what to expect (if you committed to paying wages every Friday, give yourself enough time to process).

Taxes and benefit providers have their own due dates. Many employers are required to pay these expenses monthly, but it can vary. You’ll need to pay out the amounts you withheld from your employees’ paychecks in addition to any employer payroll tax and premium amounts your business owes.

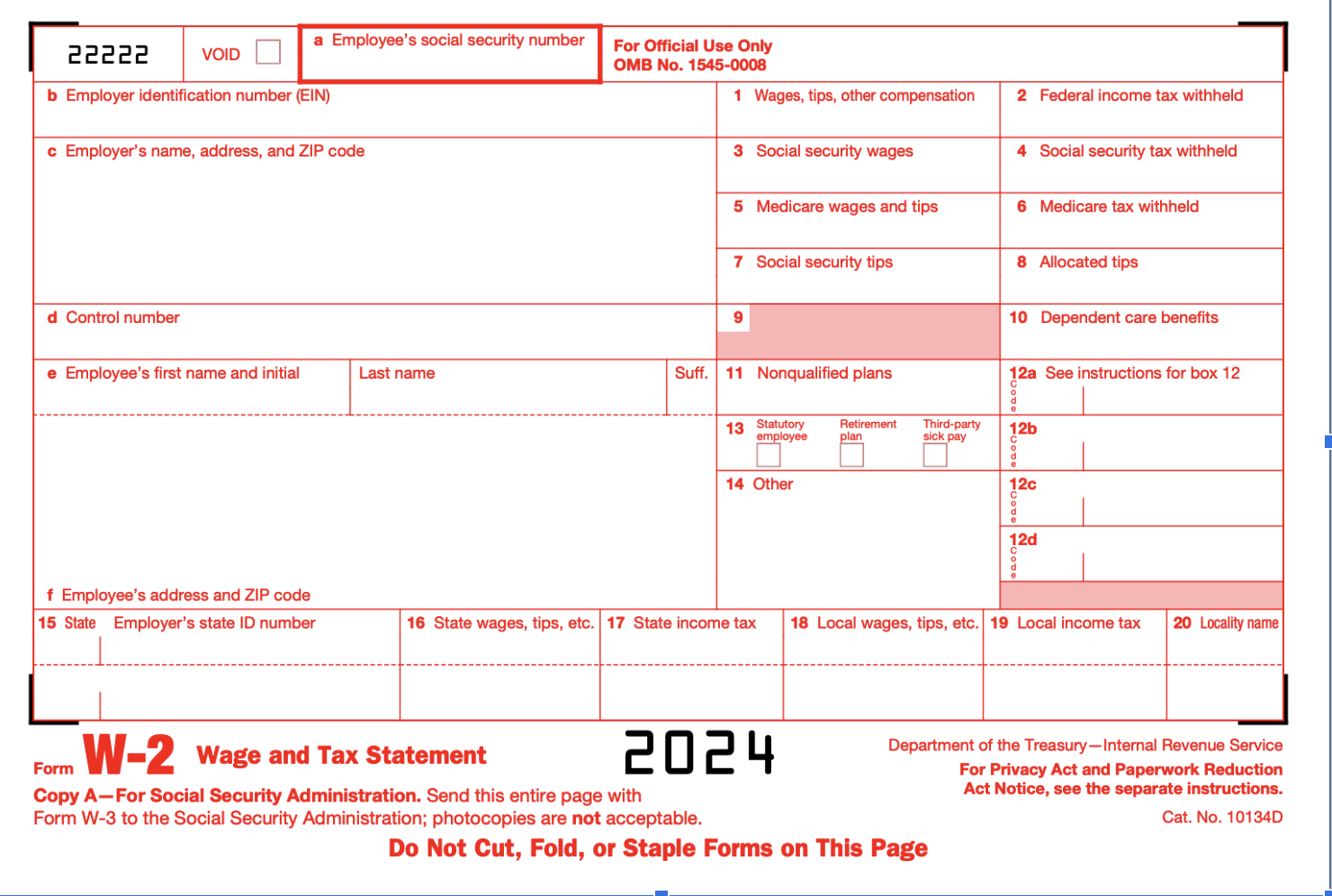

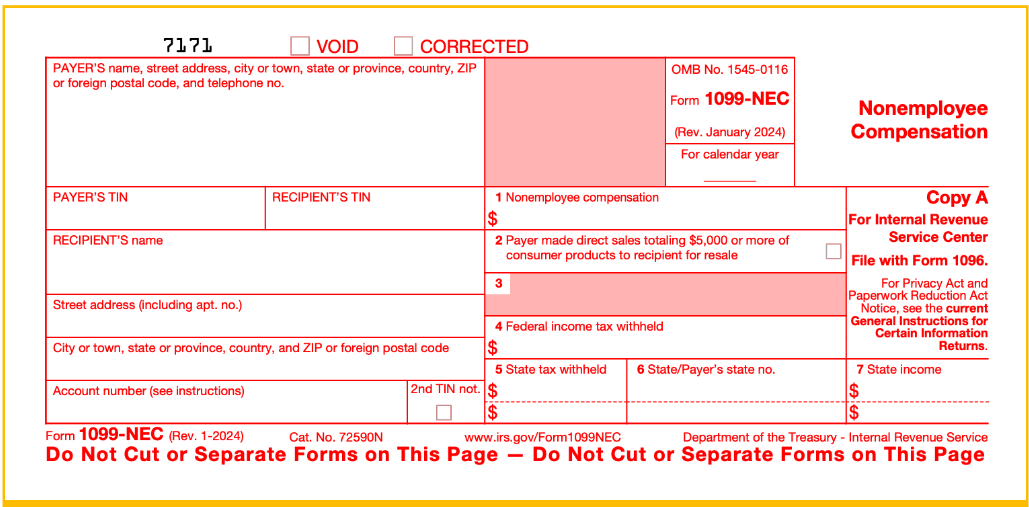

Step 7: Do Year-end Payroll Tax Reports

As the end of the year draws near, you’ll need to prepare to distribute year-end payroll tax reports. Employees must receive their W-2 forms by Jan. 31 of the following year, and the forms must show their total earnings and taxes paid. If you’re paying independent contractors, you’ll need to prepare 1099-NEC forms instead; this will show earnings but no taxes.

Click below to download the latest forms from the IRS website:

Step 8: Document & Store Your Payroll Records

To remain compliant with federal labor laws, you’ll need to document specific data for each pay period. Retain payroll documents—like timecards, pay stubs, and any information regarding pay increases.

If you’re using software like QuickBooks, the documents are already online or can be uploaded and attached to the employee record. If you’re maintaining documents manually, you’ll want to ensure they’re stored securely.

Payroll Processing Options and Alternatives

Processing payroll in-house can be complex and time-consuming, especially for larger organizations or those with more intricate payroll needs. There are several alternatives to handling payroll processing yourself:

- Payroll Software: Consider using dedicated payroll software solutions. These tools are designed to streamline the payroll process, automate calculations, and ensure compliance with tax laws and labor regulations. Popular payroll software options include Gusto, ADP, Paychex, and QuickBooks Payroll. For more options and information, read our guide to the best payroll software.

- Professional Employer Organization (PEO): PEOs are organizations that provide comprehensive HR services, including payroll processing, benefits administration, and compliance management. By partnering with a PEO, you can outsource many HR functions, allowing you to focus on your core business operations. Check our roundup of the best PEO companies to help you get started.

- Bookkeeping or Accounting Firms: Some accounting firms offer payroll processing as part of their services. They can handle payroll calculations, tax compliance, and reporting on your behalf, ensuring accuracy and legal compliance.

- Outsourcing to a Payroll Provider: There are numerous payroll service providers that offer outsourcing services, where they take care of all aspects of payroll processing, from data entry to tax compliance. This can be a cost-effective solution, especially for small to medium-sized businesses.

Unpaid Payroll Tax Penalties

Unpaid payroll tax penalties can vary depending on the jurisdiction and the specific circumstances of the non-compliance. Payroll taxes typically include Social Security, Medicare, and federal income tax withholdings, as well as state and local payroll taxes where applicable.

Penalties for unpaid payroll taxes can be assessed by both federal and state tax authorities. Here are some common penalties associated with unpaid payroll taxes:

- Failure to Deposit: Employers are required to deposit withheld income taxes and payroll taxes periodically, such as monthly or semi-weekly, depending on the size of their payroll. Failing to make these timely deposits can result in penalties. The amount of the penalty depends on how late the deposits are and the amount owed.

- Late Filing: Failing to file required payroll tax forms, such as Form 941 (Employer’s Quarterly Federal Tax Return) or Form 940 (Employer’s Annual Federal Unemployment Tax Return), by the due date can lead to penalties. The penalty amount can increase the longer the filing is delayed.

- Failure to Pay: This penalty is imposed when employers don’t pay the full amount of payroll taxes owed by the due date. The penalty is typically a percentage of the unpaid amount and can increase the longer the taxes go unpaid.

In addition to penalties, interest charges can accrue on unpaid payroll taxes. The interest rate is typically determined by the tax agency and can compound over time.

How to Do Payroll Frequently Asked Questions (FAQs)

Payroll processing refers to the steps and activities involved in calculating, distributing, and managing employee compensation within an organization. It is a critical function in human resources and finance departments, ensuring that employees are paid accurately and on time. It can be done manually, but having an automated process in place ensures an accurate and efficient payroll processing.

Learning how to run payroll yourself is challenging, but not impossible. The difficulty depends on factors like the size of your company, the complexity of your compensation structure, and your familiarity with accounting principles. With dedication and the right resources, most people can learn the basics of payroll processing.

The easiest way to do payroll is to use payroll software or services. These tools automate many aspects of the process, including tax calculations and deductions. For small businesses, options like QuickBooks Payroll or Gusto can simplify the task. Alternatively, using a PEO like Justworks or outsourcing to a professional payroll service provider like Deel or ADP can be easy, albeit more expensive.

Common payroll mistakes include misclassifying employees, miscalculating overtime pay, missing tax deposit deadlines, and failing to keep accurate records. To avoid these, stay informed about labor laws, use reliable payroll software, double-check calculations, and maintain organized, up-to-date payroll records.

Bottom Line

Learning how to do payroll can be a pain. You have to make sure your business registers with all the right agencies. You’ll also need to fill out forms for each employee and purchase workers’ compensation coverage, all on a tight deadline (less than 20 days for most states by law). Even seasoned business owners can get overwhelmed by the complexities of payroll compliance. That is why simple software solutions are the easiest and most time-saving options for business owners overall.