A chargeback occurs when a customer requests a refund through their bank or credit card company to reverse a transaction. Customers will initiate refunds through their bank instead of a business if they don’t recognize the transaction or can’t come to an agreement with the merchant.

In a recent merchant survey, 40% of merchants reported that at least 1% of their company’s revenue is lost to chargebacks—a significant revenue cut, especially for small businesses. Although chargebacks can happen for many reasons (logistical issues, clerical errors, fraud), most are preventable. In this article, we will look at how to prevent chargebacks in your small business.

Key Takeaways:

- Set clear expectations with your customers to avoid unhappy or confused customers.

- Provide transit details to avoid logistical confusion or mistakes.

- Protect your business against fraud.

- Organize your records and processes to avoid backend errors.

- Most chargebacks are preventable, but if you do receive a chargeback, timely chargeback management is key.

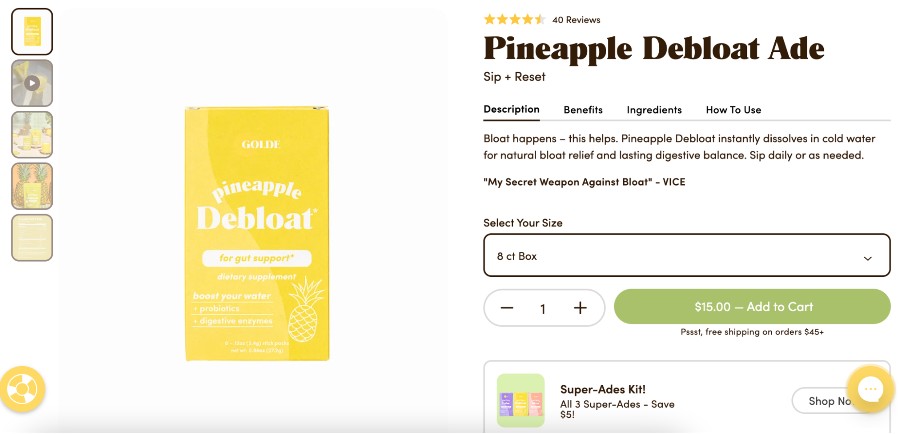

1. Write Crystal-clear Product Descriptions

To help avoid buyer’s remorse or complaints the product isn’t as expected, be clear about what your customer is getting. Write easy-to-understand and comprehensive product descriptions with dimensions or sizing information, product photos from several angles, and even a bulleted “what’s in the box” list of what buyers can expect.

If you sell used items, disclose functional defects and existing cosmetic damage. It can also be helpful to incorporate a reviews section into your product pages so buyers get a glimpse at the item from another user’s perspective before purchasing.

2. Provide Itemized Receipts

Whether physically or digitally (via email/text), you should provide your customers with an itemized receipt upon purchase showing everything they bought. This will prevent them from claiming they purchased items they didn’t. You should also save a copy of the receipts for your own records.

Related: How to Create and Send QuickBooks Online Sales Receipts

In addition to an itemized list of what customers purchased, include explicit payment descriptors. Let customers know what to expect in their statements by including it on the receipt of payment acknowledgment. Consider including your customer service phone number and email address on receipts and charges so shoppers have somewhere to contact before opening a dispute.

3. Set Your Merchant Name on Card Statements

Some customers may file disputes for transactions on their credit cards if they don’t recognize the merchant name on their card statement. Aside from providing itemized receipts, make it easy for your customers to identify your business in their card statements. Make sure that your billing descriptor is recognizable by your customers.

Work with your payment processor to change the way the charge appears. If you operate under a DBA or trade name significantly different from your LLC or what’s listed on your merchant account, you may be more prone to this issue.

4. Be Upfront About Your Return Policy

Another way you can avoid chargebacks is to post your return policy clearly on your website, receipts, and in your store. It’s also a good idea to let people know at the register. Inform every customer of your return policy before swiping their card or accepting payment at checkout. You may also take it further by asking the customer to sign the receipt, where the policy was printed, to indicate that the customer has been informed how returns work.

5. Have Customers Sign Contracts for Subscription Services

Contracts are an excellent way to set expectations, especially for services and subscriptions or any time you use recurring billing. Contracts can also help you dispute chargebacks. Your contract should clarify terms of service and rate charges or changes, as well as indicate when charges are incurred (first of each month, for example). It should also outline how to cancel.

Service contracts should include specific services, rates, and timelines. Subscription services should also send charge reminders and payment confirmation emails for each installment, along with instructions on how to change or cancel the subscription. Check if your provider offers templates for contracts. Square Contracts, for example, allows businesses to create all kinds of business documents, such as service agreements, credit card authorizations, receipt of goods, and waivers, using customizable templates.

6. Keep Order Fulfillment Process Efficient

For merchants that ship products to customers, another major contributor to chargebacks is logistical confusion or mistakes. Mitigate this by making sure your order fulfillment process is efficient by observing practices such as staying on top of your inventory and keeping your warehouse organized. Carefully choose whether to keep your order fulfillment in-house or to outsource it.

If you need to outsource your order fulfillment, make sure to work with a trusted shipping and fulfillment company to prevent lost or mishandled packages and ensure the timely delivery of your products. Read our ecommerce shipping and handling guide for more information.

7. Be Upfront About Fulfillment & Delivery Times

Consumers expect fast shipping—as fast as three days—and delays often cause concerns. Upon checkout, let customers know how long it may take to complete the order before shipping, along with approximate arrival dates if you can provide them.

Some fulfillment companies even offer different shipping times that customers can select based on their schedules. You should also include your approximate dispatch and delivery dates in your confirmation email.

Related: FedEx vs UPS vs USPS: Shipping Rate & Reliability Comparison (2022)

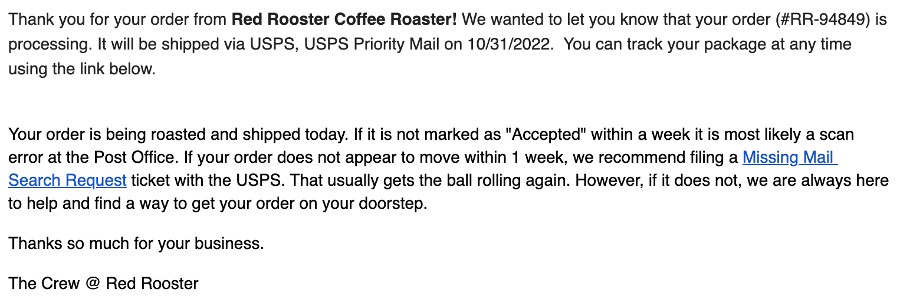

8. Provide Shipping Notifications & Tracking Information

Customers should know when their purchase is on the way and be able to track the package themselves. In fact, as many as 90% of consumers want package-tracking tools.

Related: Best Shipping Software for Small Businesses

When orders ship, send your customers a shipping notification via text or email that also includes their tracking information. If there are any shipping delays or problems with fulfillment, you should also notify your customers and provide an updated timeline.

Red Rooster Coffee, a coffee and tea company, sends out tracking information via email—as well as next steps for customers to take if they can’t locate their package. (Source: Red Rooster Coffee)

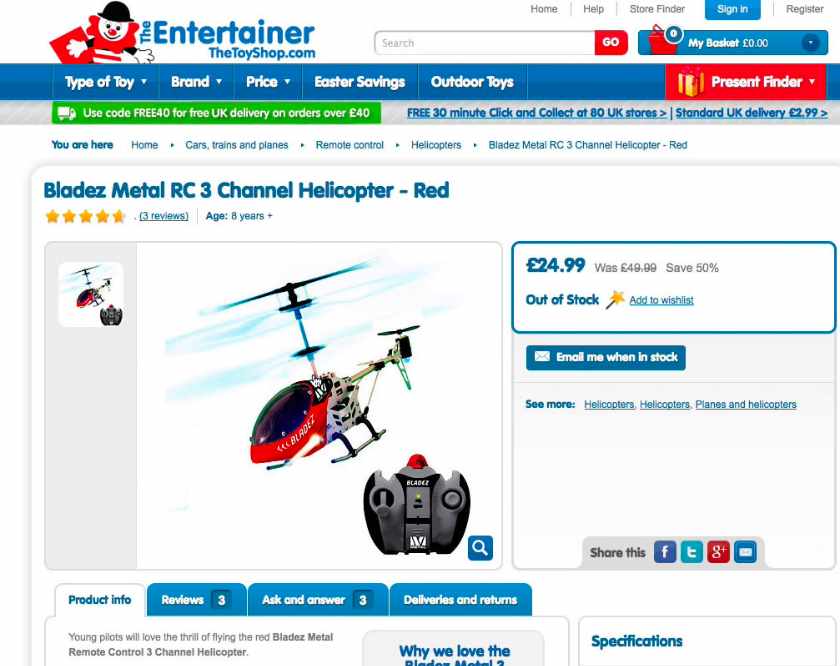

9. Explain Out-of-Stock Listings

If you choose to display an out-of-stock product, make it extremely clear that customers should manage delivery expectations. For out-of-stock items, you should mark the item as gone and also include expected restock, dispatch, and delivery dates. Depending on your website, you might also include a place where shoppers can leave their email to receive a notification when a product is back in stock.

You may also simply decide not to list items that have sold out. Tracking your inventory is a good way to avoid receiving payments for out-of-stock products.

This retailer clearly labels its product as out of stock and leaves a spot where people can drop their email and get notified when it’s back. (Source: Baymard Institute)

The best way to manage your inventory and get real-time stock tracking is to use a point-of-sale (POS) system with inventory tracking. We like Square for a free option with lots of great features and capabilities, but you should check out all of the top POS systems to find the best one for your business.

10. Educate Yourself On Fraud

Up to 85% of chargebacks come from either friendly or criminal fraud. Sometimes, customers are trying to get something for nothing. In other cases, thieves or scammers may be using a stolen credit card to buy products online. There are a lot of potential scenarios when it comes to payment fraud.

True Fraud Chargebacks: This is a chargeback that results from hacking or identity theft, and means that a purchase was made with a stolen card (or card number) without the card owner’s permission or prior knowledge.

Friendly Fraud Chargebacks: This is when a customer disputes a purchase that they knowingly made. This might be because the customer is unhappy with the product, didn’t feel it matched the description, is trying to avoid the hassle of the return process, or simply did not recognize the charge on their bank statement.

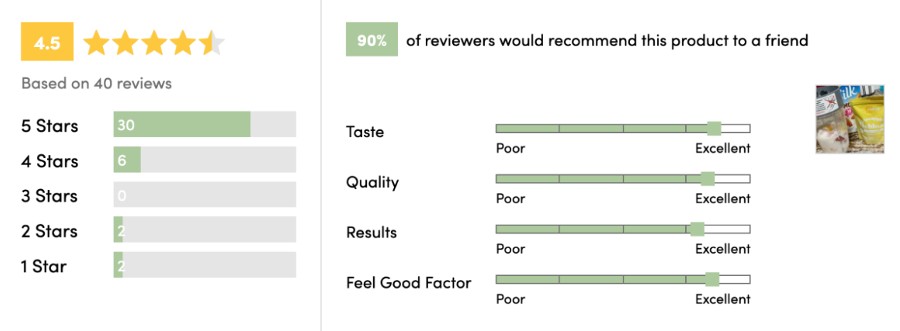

There are three main types of chargebacks.

While it’s tempting to think fraud happens with mostly high-ticket items, the Federal Trade Commission (FTC) reports that the median paid in fraud complaints is only $650. There are, however, measures that you can take to prevent fraudulent chargebacks.

Look Out for Red Flags

There are a number of things you can look for when trying to detect fraud, including:

- Incorrect security codes

- Mismatched billing and shipping address

- Shipping address is a P.O. Box, shipping company, hotel, or vacant property

- Several orders from different cards go to the same shipping address

- Fake email address

- Shipping to a high-risk country

- Request to change the shipping address after inputting a legitimate one

- Weird orders (e.g., 50 pairs of shoes in 30 different sizes)

- Overpaying and then requesting a refund be sent to a third party or by wire transfer (always refund to the original card or bank)

- Request for immediate or next-day shipping, especially for international orders

Another type of fraud you might see is counterfeit money, but we have a guide to help you detect it and avoid scammers.

11. Require Customer, Payment & Order Verification Information

Although chargebacks are when a customer disputes the charge with their bank or credit card, retailers can also work to prevent fraud from standard returns. Require customers to answer verification questions before they can submit a return request. You might request they provide their first and last name, the last four digits of their payment method, and order confirmation information, such as an order number. This will help you ensure that the customer you are speaking with actually did place the order, weeding out any fraudulent requests.

12. Delay Shipping for High-ticket Items

Although prompt shipping is generally best when fulfilling website orders, you can make an exception when it comes to high-ticket items. According to PayPal, fraudsters ask for overnight shipping so they can resell the merchandise quickly. It recommends a 24- to 48-hour delay for expensive and in-demand orders. This also gives customers the opportunity to edit their order, maybe size or color, before dispatch.

13. Use Processing Technology That Can Detect Fraud

Purchases made with stolen credit cards can be a significant source of chargebacks. The best way to avoid this and other scenarios involving fraudulent payments is to use a trusted payment processing platform.

You’ll also want to use a chip reader or contactless payments when possible—they’re the most secure. However, if you must use the magnetic stripe, get a signature and make an impression of the card if possible—this can be evidence in a fraud investigation.

Additionally, you should use payment verification measures for all online purchases. 3-D Secure, for example, uses three parties in the verification process (the customer, the issuing bank, and the payment processor). While required in Europe, it’s still optional elsewhere. Other verification technologies include Address Verification Services (AVS) and card security codes, like the Card Verification Values (CVV) code found on the back of most credit cards.

Stripe Radar is Stripe’s fraud detection tool comes for free for Stripe accounts under standard pricing. (Source: Stripe)

Learn more about accepting credit cards with our comprehensive guide.

14. Use a Chargeback Prevention Service

A chargeback prevention service leverages technology to flag and prevent potential fraudulent purchases. It’s a smart way to take some of the manual management out of chargeback prevention.

Many payment processors offer some sort of chargeback prevention service natively built into their platforms. Some also offer optional paid upgrades for more comprehensive protection. Stripe has its Chargeback Protection feature, while PayPal, Square, and Shopify offer similar options.

You can also sign up for a separate dedicated chargeback prevention service to further protect your business. Check our list of the best chargeback protection providers for options.

15. Keep Detailed Records

In addition to customers making fraudulent claims, another leading cause of chargebacks are clerical errors. In fact, up to 35% of chargebacks, as highlighted in the graphic above, come directly as a result of backend mistakes. These might include inaccurate inventory counts, unprocessed credit, duplicate charges, sending the wrong items, or general poor recordkeeping.

To prevent clerical errors leading to chargebacks, maintain organized records and promptly address any order issues. Accurate record-keeping reduces the risk of backend mistakes and provides a reference point for resolving disputes.

Reconcile your POS system daily to stay on top of your transactions and detect and fix any mistakes right away. You won’t be able to be in your store at all times, and many of your transactions and customer disputes will likely be handled by your staff.

16. Amend Problems Quickly

When you’re running a small business, mistakes happen. Maybe you charged a customer twice or sent out the wrong item—there are countless possibilities. The best thing you can do in these situations to avoid a chargeback dispute is to reach out to your customers as soon as the problem arises.

Reach out directly—by phone, text, or email—and give your customer a detailed account of the issue at hand. From there, you should also provide them with easy solutions, like a free return label or a customer care line, where they can resolve their issues without opening a chargeback dispute.

17. Train Your Staff

If you hire employees, you’re not the only person who needs to know how to prevent chargebacks. It’s important to empower your staff with the knowledge and resources they need to help mitigate chargebacks as well.

Train your employees well to make sure they understand all the protocols for credit card payments. Pay extra care here if you frequently take orders over the phone. Your process may include verifying addresses, getting the CVV from the back of the card, and confirming the expiration date. You’ll also want your staff to:

- Double-check anything they input manually

- Ensure canceled purchases/items are fully voided before continuing

- Spot fraudulent orders

- Verify signatures

- Make sure contracts are signed

- Inform customers of the return policy

- Let customers know what to expect (such as delivery dates and the name to expect on the credit card statement)

- Record the authorization date, time, representative’s name, and dollar amount if they have to call to get authorization

Adequately training store associates involves a range of areas to focus on, including customer service, how to look for signs of fraud, and even how to correctly use your POS system and other payment technologies. Employee handbooks and guides with canned scripts, step-by-step walkthroughs with videos and screenshots, and tips on how to handle challenging situations are great to have on hand in the break room or at the cash register.

18. Keep Your Systems Updated

Outdated systems are more vulnerable to security breaches, glitches, and operational errors that can result in fraudulent transactions and chargebacks.

Regularly update your POS system, network security, device operating systems, apps, and payment processing technology. By staying current with system updates, you not only reduce the risk of chargebacks but also enhance overall security and operational efficiency, leading to a better customer experience. It’s a proactive approach to protect your business and maintain customer trust.

How Chargebacks Impact Small Businesses

While it’s comforting to assume chargebacks are rare and don’t really have a big impact, that’s unfortunately not the case. Chargebacks can result in huge hits to your margins. In fact, the average chargeback ratio, or chargebacks per number of purchases, was 0.56% in 2022.

Here are a few other important stats that all small business owners should know about chargebacks:

- Chargebacks are often shoppers’ first resort: On average, only 4% of customers will call and complain when there’s an issue; the other 96% are at risk of filing a chargeback.

- Chargebacks will cost you: As of 2022, every $1 lost to fraud costs US retailers $3.75, and that number continues to climb.

- Ecommerce retailers are at the greatest risk for fraud: Online retailers lost $41 billion to ecommerce online payment fraud in 2022.

- Gift cards are increasingly prevalent in chargeback scams: According to an FTC data spotlight, in the first nine months of 2021, retailers reported losing $148 million in scams where gift cards were used as the form of payment.

What to Do When Your Business Gets a Chargeback

Sometimes, despite knowing how to prevent chargebacks and taking preventive measures, a business may still receive a chargeback. It can be concerning and frustrating when this happens, but timely and efficient chargeback management can help you minimize the financial impact on your business.

Here is a quick rundown of what to do when your business gets a chargeback:

- Understand the chargeback process

- Review the chargeback notice

- Check the reason for the chargeback

- Prepare compelling evidence

- Craft a rebuttal letter

- Wait for the results

Learn more in our detailed guide on how to dispute a chargeback.

Frequently Asked Questions (FAQs)

Click through the sections below for the most common questions we get about preventing chargebacks.

While you can’t prevent 100% of chargebacks, you can significantly reduce them by setting clear expectations with customers through product descriptions, store policies, product reviews, and transparent shipping timelines. Chargeback prevention software and well-trained employees can also help spot fraud before the transaction occurs.

The number of chargebacks considered normal for businesses varies widely depending on the industry, size, and business model. One report found that the average chargeback ratio for businesses surveyed is 0.56%, which translates to 5.6 chargebacks in every 1,000 transactions.

In general, it’s advisable to aim for a chargeback rate of 1% or less of your total transactions. However, some industries, like ecommerce, may have slightly higher average chargeback rates, while businesses with excellent customer service and fraud prevention measures may maintain rates significantly below 1%.

Customers win chargebacks in a significant percentage of cases, but the outcome can vary based on factors such as the reason for the chargeback, the evidence provided by the customer and the merchant, and the policies of the issuing bank or credit card company. While merchants can dispute chargebacks and often have the opportunity to present evidence, customers may prevail if they can demonstrate that the transaction was unauthorized or if the product or service did not meet their expectations.

Merchants may prevent chargeback loss by disputing it. This involves providing evidence and documentation to support their dispute. The success of disputing a chargeback depends on the strength of the evidence, the reason for the chargeback, and the policies of the card issuer. While it is possible to dispute and potentially reverse a chargeback, it is not guaranteed, and merchants should be prepared to provide compelling evidence to support their case.

Yes, chargebacks can be denied. Merchants can dispute chargebacks with strong evidence, clear policies, and proof of legitimate transactions. The outcome depends on the specific case and the policies of the card issuer.

There are several ways businesses can deal with chargebacks: engage a chargeback protection service, focus on chargeback prevention strategies, and strengthen their chargeback dispute procedures. Businesses can also regularly monitor their chargeback ratios, which can help identify potential issues, allow for proactive resolution, and ensure that their staff is trained to handle chargeback disputes effectively.

Bottom Line

If you’re having problems with chargebacks, conduct an analysis to see what the most common causes are and then look for targeted ways to fix the issue. As a reminder, you can prevent chargebacks by keeping detailed records, training employees on operational compliance, using clear payment descriptors, setting accurate product and delivery expectations, and keeping your eye out for fraudulent activities.

If it’s too much work, there are chargeback management services that can handle disputing chargebacks for you. While they have expertise in this area, you should weigh the cost of these services over what you can do on your own.