When done correctly, real estate is one of the most popular, profitable, and stable investment choices that can generate a high-profit return. There are many benefits of investing in real estate, like the ability to generate wealth, use equity as leverage, build a network, and improve your community. Before jumping in, consider all the pros of real estate investing—as well as some possible cons.

1. Generate Wealth & Build Equity

The first of many advantages of investing in real estate is the power of equity. When you own a house or piece of property, it naturally appreciates or increases in value. As you pay the mortgage down and allow the house to appreciate, you build equity. Equity is an asset that is part of your net worth, making it one of the most straightforward ways to generate wealth. For example, according to FRED, the value of homeowner equity tripled between 2011 and 2023, from $8.6 trillion to $28.7 trillion.

By having equity, you give yourself multiple options to generate cash flow and get a return on your investment (ROI). If you sell the home at the right time, you can get a large profit. On the other hand, you could use the equity as leverage in the form of a home equity loan to increase your investment portfolio even further. While you continue to live in your home, your equity can help you buy a rental property to generate monthly income and double your gains.

2. Reliable Long-term Investment

Another benefit of real estate is that even though the market fluctuates, it is a generally stable investment that continually increases in value. Compared to the stock market, which is a highly volatile investment, real estate is not prone to frequent market swings. Properties don’t immediately change in price based on capital contributions or political volatility, making real estate a safe and stable long-term investment.

The charts below visually show how the stock market and real estate market fluctuate and grow over time. Notice the peaks and valleys the stock market graph displays. While the real estate graph has fewer ups and downs, it grows steadily over time.

In addition, real estate is a physical asset that can always be monetized. Owning real estate benefits the investor by providing ongoing income and tax benefits while the property increases in value. Renting the property provides a cash-on-cash return, and residing and reselling the property provides an ROI.

3. Protection From Inflation

While most people fear inflation, real estate investors don’t have to. One of the most valuable benefits of real estate investment in current markets is that properties are rarely impacted by the effects of inflation. Instead of being negatively impacted, real estate investments generally rise in value along with inflation. In fact, the graph below shows how home prices have stayed consistent along with inflation over the last three decades.

As a real estate investor, increases in your expenses will be relative to the increases in property value and income. If you are a landlord, you can maintain or even increase your cash flow according to inflation by adjusting how much you charge for rent. When it’s time to increase the price of rent for your tenants, make sure you know the laws and regulations, provide the correct amount of notice, and write a professional yet direct letter.

Learn more about increasing rent and use our free letter template in our guide: The Essential Guide to Rent Increase Letters + Free Template.

4. Rental Properties Provide Passive Income

When you invest in real estate, you open the door to generating passive income. Although there is still time, effort, and maintenance required, rental properties generally generate a regular monthly income, and property values naturally appreciate, even if you don’t make updates.

About 45% of rental property owners manage their own properties, which is the most affordable option. However, using the right property management software or service can help you spend less time managing rentals and even improve your ROI with outsourced or automated tenant communications and rent collection tools.

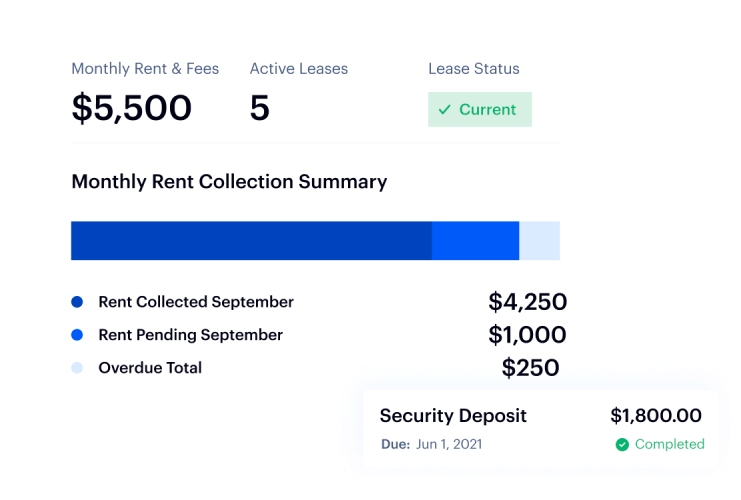

Baselane rent collection report (Source: Baselane)

For example, Baselane is a banking solution designed for landlords. It includes rent payment software to automate rent collection and prevent potential problems with tenants. It also provides bookkeeping and reporting tools to remove many time-consuming tasks from your plate.

5. Benefits the Community & Provides Housing

Most investors focus heavily on the financial benefits of owning real estate, but there are also many unquantifiable reasons why real estate is important. For example, you can greatly impact your community by improving properties and curb appeal, as well as providing new housing. When a dilapidated property is bought and repaired, it results in much more than simply removing an eyesore. It also provides a new home for residents who need it and ensures that more community members are housed in safe, healthy, clean, and fair conditions.

In addition, being a real estate investor naturally makes you more heavily involved in your local community. You’ll work with lenders, real estate agents, home inspectors, and contractors frequently, often employing them for your properties. You’ll also build relationships with community members who may be neighbors, homesellers, or potential tenants. Working with local businesses stimulates your local economy and creates a network of professionals you can recommend and refer to others.

6. Stay Active With Physical Labor

The unlimited financial potential of investing in real estate attracts entrepreneurs of all kinds, but it’s a unique field that requires different interests and skill sets than other types of investing. For instance, investing in the stock market can be done from a desk. On the other hand, most real estate investors spend a lot of time physically visiting properties, evaluating construction, and often making repairs themselves. This may not appeal to many potential investors, but for many others, it’s considered one of the top benefits of investing in real estate.

Whether you invest in vacation properties, long-term rentals, land, or fix-and-flips, investing in real estate allows you to work with your hands as much or as little as you want. You may choose to do simple maintenance tasks, design your properties, develop them, or make money by flipping houses with limited outsourcing. Unlike many other avenues of investing, real estate allows you to combine physical labor with executive and administrative tasks like research, market analysis, financial planning, and strategic decision-making.

If you want to fix-and-flip houses as part of your investment strategy, make sure you know all the ways to find properties to flip. Start by reading our detailed guide on How to Find Houses to Flip for Profit in 7 Ways.

7. Wide Variety of Investment Options

Investing in real estate can mean various things—from buying properties to renting homes to leasing commercial real estate. Most investors view this versatility as one of the top benefits of real estate. The right type of real estate investment will depend on your financial abilities, financial goals, and your lifestyle, but investors get to decide which types of properties and investments to purchase and how to generate money.

Here are a few examples of property types you can choose to invest in:

- Multifamily properties

- Duplexes, triplexes, and fourplexes

- Commercial properties

- Land

- Vacation properties

- Apartment complexes or buildings

- Turnkey investment properties

- Distressed properties

Regardless of which type of real estate investor you become, creating a business plan is key to your success. For example, some investors simply use rental income to save money on top of their existing careers. Others use the rental income to cover expenses so they can travel or expand their portfolio even further. Learn how to create a detailed real estate investing business plan and use our free template in our guide.

Real estate investment business plan template from Fit Small Business

8. Effective Means of Saving for College Funds or Retirement

Because of the consistent growth of the real estate market, strategic real estate investing is a stable way to increase wealth over a period of time. This makes it an ideal method of funding specific types of goals, like college funds or retirement. For instance, parents may buy a rental property with a 15-year mortgage and put the rental income into a savings account. The property could be paid off before the child turns 18, then either sold or used for continual cash flow.

The same process could be used to save for retirement or to supplement retirement funds. Since rental income is remarkably stable, retirees can use the cash flow while continuing to build equity. This long-term stability is one of the advantages of real estate that is particularly appealing to many people, even if you don’t want to become a full-time investor.

9. Relatively Easy to Finance

When compared to other types of investments, real estate is relatively easy to finance. First-time buyers make an average down payment of 6%, and investment properties typically require a down payment of 15% to 25% of the purchase price. That means that investors can borrow 75% to 94% of their investment acquisition cost, and the interest rates are often significantly lower than the anticipated rate of return.

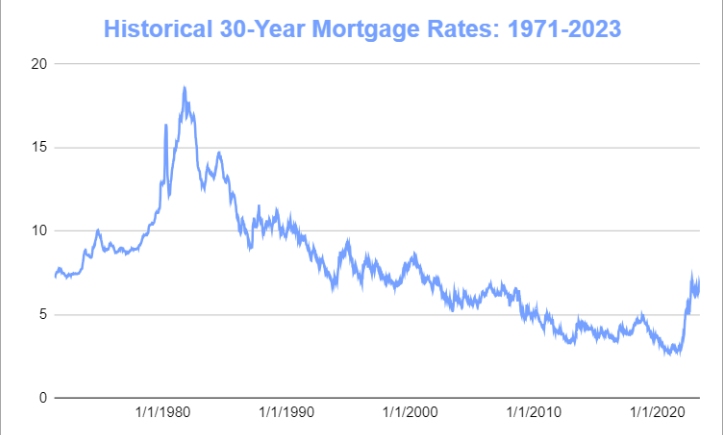

Mortgage rates between 1971 and 2023 (Source: The Mortgage Reports)

For a rental property, it’s relatively common to get an ROI of 8% to 12%. Even though interest rates have averaged between 6% and 7% in 2023, it is still less than the typical rate of return for rental properties. However, it’s essential to understand that the rate of ROI for investment properties can vary significantly, and ROI may not be the only calculation or most important method to define your profits. Instead, depending on the type of real estate investment you make, it’s better to focus on the cap rate or cash-on-cash returns.

10. Ability to Create Leverage

Yet another financial advantage of investing in real estate is the ability to use financing to increase the ROI of a property, which is called positive leverage. For example, if you wanted to invest $300,000 in the stock market, you’d have to put in the full amount of money upfront. In real estate, however, you can invest $300,000 for a fraction of the cost and generate a much higher return on your investment.

For example, with the right financing, you can purchase a $300,000 multifamily home for about $60,000. Your lender puts up 80% of the cash for the investment, but you keep the profits from the property. If the $300,000 stock market investment and the $60,000 duplex investment appreciate at the same rate, your ROI would be significantly higher on the real estate investment since the upfront costs were so much lower.

To calculate the expenses, profits, ROI, cap rate, and cash flow of potential rental properties, use our free calculator and read the full guide: Free Rental Property Calculator: Analyze Your Investment Property.

11. Tax Benefits of Real Estate Investing

It’s common knowledge how real estate sales and rental properties make money. However, there are many more financial real estate advantages that are not commonly understood, like tax benefits. For instance, rental property depreciation expenses help owners significantly lower their taxable income from the property—sometimes even eliminating it.

Other rental property tax deductions can include:

- Mortgage interest payments

- Loan origination fees

- Insurance payments

- Utilities

- Maintenance, repairs, and improvements

- Advertising and marketing

- Homeowner association fees

- Property management

There are also other options that allow investors to maximize tax savings, like Opportunity Zones and Section 1031 of the Internal Revenue Code. Section 1031 allows you to postpone paying taxes on the sale of your property when you reinvest the gains in another property, and opportunity zones allow you to avoid capital gains by investing in a specified piece of land. Of course, these laws can be complex, so it’s vital that you have a thorough understanding of how they work and how they will impact your finances before making decisions.

For more support and information on taxes as a real estate investor, read these guides:

- 5 Best Online Tax Preparation Services for Small Businesses 2023

- What Is a Real Estate Professional for Tax Purposes?

12. Freedom, Flexibility & Autonomy

Most people focus on the financial benefits of investing in real estate, but there are also many personal and non-monetary reasons for this career path.

- No education requirements: You don’t have to have a professional education or career experience to start investing in real estate. However, by making smart decisions, you can build wealth that positively impacts your family and community.

- Residence options: If you own multiple properties, you have the freedom to change your primary residence at any time for almost no cost at all. For instance, many people prefer a two-story house when raising a family but decide to downsize to a one-story in their golden years because it is more manageable for them.

- Creative solutions: There are many ways to start investing or change your investment strategies over the years to suit your needs. For example, you may choose to “house hack,” or live in a duplex unit or triplex unit to start generating rental income and then move into a larger home when you have multiple properties covering your expenses.

- Investment options: Investing is particularly appealing for those with an entrepreneurial spirit since you can invest and generate revenue in so many different ways. You may choose to start a house flipping business, hold properties to let appreciation create wealth, be a landlord and manage properties, outsource all management, or even flip or develop land for commercial businesses.

Since you get to be the boss of your investing business, there is no limit and no restrictions on your decisions. This flexibility can be extremely fulfilling for entrepreneurs. However, it can also be overwhelming to make these decisions when you have limited capital. To help you build a strong foundation as an investor, consider finding a real estate mentor to help walk you through the pros and cons of each decision.

Possible Cons to Investing in Real Estate & How to Avoid Them

There are many pros of real estate investing, but it’s important to be aware of potential drawbacks when you make any important decisions. Knowing the disadvantages as well as the advantages of investing in real estate will help you start with accurate expectations and make smart financial choices.

Some of the potential disadvantages of real estate investing include the following:

Potential Cons | How to Avoid or Prepare |

|---|---|

High Cost of Entry | It’s possible to invest in stocks with as little as a few dollars, but purchasing any type of property requires a fairly large down payment. However, there are creative ways to start investing without paying tens of thousands of dollars, like renting out part of your primary residence. |

Unexpected Expenses | Properties inevitably have unexpected expenses, whether it’s an emergency repair or an increased homeowners association (HOA) fee. Real estate investors must be thoroughly prepared for unexpected expenses with additional savings. |

High Carrying Costs | Owning real estate means you’ll owe monthly mortgage payments, taxes, and utilities at a minimum. In the case of a vacancy or unexpected delay, investors must have at least a few months of carrying costs saved in advance. |

Requires Maintenance | Every type of property will require ongoing maintenance and repairs, which can take valuable time from the investor. Make sure you’re prepared for this time commitment or hire a maintenance employee or a property management company. |

Keeping Up With Laws & Regulations | You must be familiar with your state's landlord tenant laws to ensure you are always operating legally. Laws can be confusing to understand and can change, so make sure you consult with a lawyer to prevent real estate horror stories. |

Dealing With Tenants | Bad tenants can cause extreme stress for landlords and even cause thousands of dollars in property damage. To avoid the hassle of dealing with difficult tenants, make sure you learn how to screen tenants thoroughly and legally. |

Illiquid Asset | Real estate is not a liquid asset, which means it cannot be immediately or quickly sold for cash. Real estate sales take time. You can prepare for this by meticulously managing your finances and keeping a few months of expenses saved at all times. |

Frequently Asked Questions (FAQs)

Yes, real estate can be a great investment with the right research and financing. A few of the benefits of investing in real estate include appreciation, opportunities for passive income, and the ability to generate high returns on your investment.

Real estate provides housing, which is one of the most basic and most important needs. Investing in real estate helps the local economy by creating jobs and providing housing. Making savvy business decisions can also help real estate investors of all experience levels generate wealth.

The stock market and real estate are two very different investment strategies, and neither method is fundamentally better than the other. However, there are a few advantages of investing in real estate as opposed to the stock market, like stable growth over time, protection from inflation, community benefits, and ease of financing.

Bottom Line

While investing in real estate isn’t always easy, it offers many advantages that can lead to financial and time freedom. We’ve gathered some of the most important benefits of investing in real estate to help potential and current investors decide if it’s the right choice to meet their goals. Before committing to real estate investing, check out the pros and cons, as there aren’t any investing strategies that are completely free of risk.