Owning a rental property takes extensive research and decision-making to determine if it’s a viable investment for you. To prepare for getting your first rental property, start by writing a business plan, conducting a rental market analysis (RMA), and reviewing landlord-tenant laws. Additionally, you will need to learn how to fund your investment and use different formulas for determining profitability, like capitalization rate (cap rate), gross rent multiplier (GRM), and cash-on-cash return.

To help you get started, we’ve provided these 20 tips for buying rental property.

1. Decide if Being a Landlord Is Right for You

Before you rush to make an offer on a property, consider if you’re cut out to be a landlord. Buying your first rental property can be an excellent way to build wealth and generate income. Still, it requires finding, evaluating, funding, buying, and managing your real estate investment.

Some benefits you get include saving money with rental property tax deductions and creating a stream of monthly revenue. At the same time, some challenges you may encounter are difficult tenants and low asset liquidity. Here are some pros and cons and what to know about buying a rental property:

| PROS | CONS |

|---|---|

| Tax benefits: Rental property tax deductions and depreciation allow you to keep more money in your pocket | High cost of entry: Buying a rental property requires a down payment and potential repair expenses |

| Reliable monthly income: Having rental properties can provide a regular source of income to support your lifestyle | Not a liquid asset: You can’t immediately sell rental properties for cash, and if you don’t reinvest profits from a sale, you’ll pay capital gains tax |

| Long-term wealth: Real estate has historically proven to be an excellent catalyst for building wealth | Unexpected expenses: This may include repairs, vacancies, or changes in operating costs |

| Stable long-term investment: There is always a need for housing, so you can generate profit even in slow markets | Dealing with difficult tenants: Property damage or unpaid rent can put your investment at risk—evictions can cost a lot of money |

Evaluate these pros and cons, then take the quiz below to determine if you’re prepared for the challenge of investment property ownership.

Are you ready to buy your first rental property?

2. Define Your ‘Why?’

Real estate is generally a solid investment that can provide a return and reliable income. However, investing in real estate is not a good choice for everyone, even if the financial data looks good. Buying your first rental property comes with highs and lows, including the long-term commitment of property maintenance, marketing vacancies, and qualifying and managing with tenants.

Your “Why?” will keep you motivated and focused when challenges arise.

Therefore, you must consider your reasons for becoming a real estate investor. When determining your reasons, include your financial impetus, which could generate income and build future wealth. Also, consider the personal opportunities it affords, like more time with family, freedom from the nine-to-five, retirement planning, or starting a college fund.

When challenges arise, these reasons for being a landlord will help you make intelligent long-term decisions toward becoming profitable, successful, and reaching your goals.

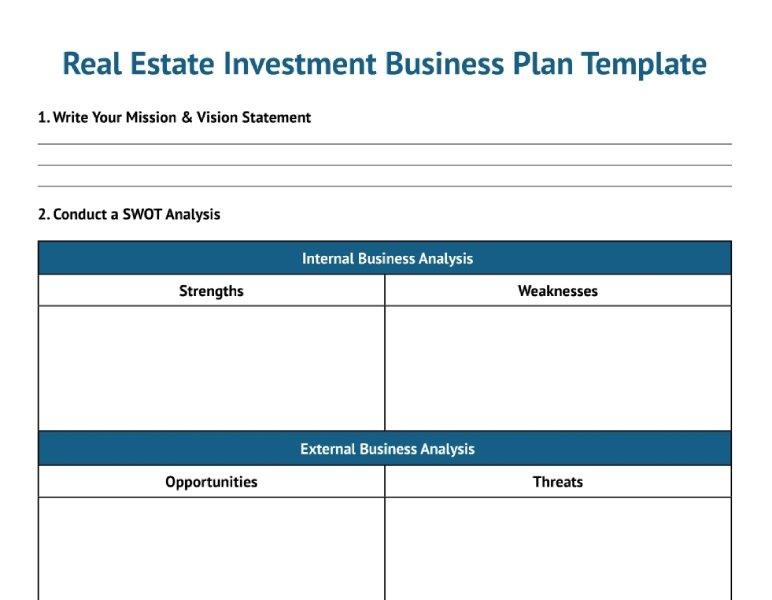

3. Create a Real Estate Investment Business Plan

To build a successful real estate investing business, you need a business plan. Your plan will act as a guide to help you achieve your goals and keep you focused on the reasons you just determined. It’s not something you write and then stick on a shelf somewhere. A business plan is a dynamic document that acts as a roadmap to move you toward a profitable endeavor.

A successful real estate business plan has many elements, including the following:

- A clear mission statement

- Analyzing the business’ strengths, weaknesses, opportunities, and threats (SWOT)

- Specific, measurable goals

- Financing for your business

- Marketing strategy and implementation plan

- Lead generation and nurturing strategy

- Cash flow projections and financial analysis

You can read more details about the process in our guide How to Write a Real Estate Business Plan: Elements, Examples & Free Template (+ Goal Calculator). We’ve also provided a real estate business plan template for you to download and use alongside these tips for buying a rental property:

4. Prepare Yourself Financially

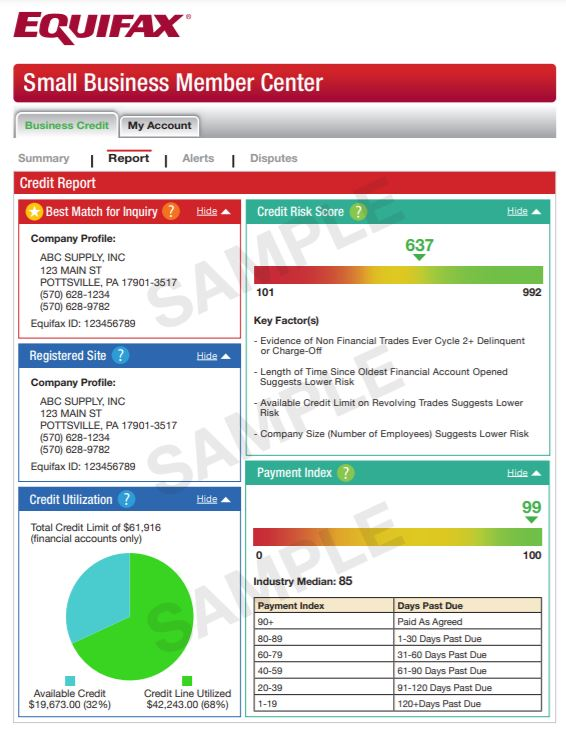

One of the top tips for buying a rental property is to ensure you are financially prepared to buy your first rental property. A bank evaluates the buyer’s finances and the property’s financial data. Therefore, you want to get your finances in order ahead of time.

Start by getting a free copy of your credit report from Annual Credit Report.com or Credit Karma to ensure you have no late or outstanding debts. Also, check for errors and follow the steps in the report to correct them. Knowing your credit score is helpful when choosing the right financing since various lenders have different minimum requirements.

Example credit report (Source: Equifax)

A bank will look at your debt-to-income ratio (DTI), so if you carry high credit card balances or loans, pay them off or lower the amount owed. Additionally, consider where you will pull the down payment for a property from—savings, retirement accounts, liquidated paper assets, inheritance, or a partial gift.

Have three to six months of money tucked aside to ensure you have enough to cover rental property expenses if the property has extended vacancies or experiences significant repairs. It is also wise to save at least six months of regular living expenses in an emergency fund so you’re not financially struggling if the rental property requires you to put more money into it.

Understanding investment property finances and expenses will help you prepare for buying rental property and reduce the risk of overvaluing a property and becoming cash flow negative. Ideally, you want a certified public accountant (CPA) on your team to advise you on investment property taxation and financial planning. Still, it’s good to have a basic understanding of what to expect. Some common rental property operational expenses include:

- Real estate taxes

- Property insurance

- Legal and accounting services

- Business entity setup and annual fees

- Property management fees (including property management software)

- Utility bills

- Municipal water and sewer costs

- Advertising and marketing vacancies

- Travel and auto expenses

- Snow and rubbish removal

- Property banking and credit card fees

- Repairs and maintenance costs

- Cleaning services

- Office supplies

- Any other property-related costs

Operational costs are the expenses you incur that are related to the upkeep and daily operations of the property. These don’t include your mortgage principal and interest. However, when evaluating a property, make sure the rents cover all expenses, including your loan, closing costs, and down payment, to ensure you get a return on your investment.

In addition to your real estate taxes, you will pay taxes on rental property income and profits. Therefore, you want to ensure your accountant gets you as many tax deductions as possible to offset taxable revenue. Most expenses can be deducted.

Additionally, the IRS allows you to depreciate your property over several years based on the property type. This depreciation also decreases your overall tax burden. However, if you sell the property before the end of those years, the IRS will assess a recapture fee to recoup the depreciation for the years you claimed it.

To learn more about rental property tax deductions and how depreciation recapture works, check out these articles:

- Top 12 Rental Property Tax Deductions & Benefits

- Rental Property Depreciation: How It Works, How to Calculate & More

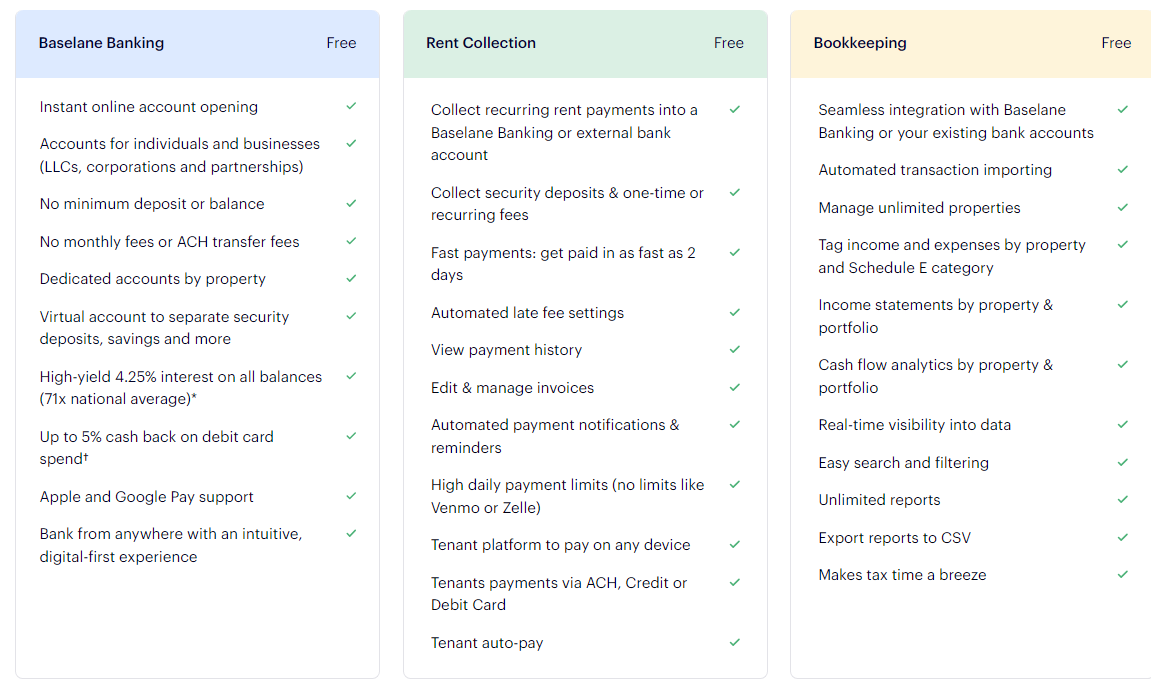

A look at Baselane’s features (Source: Baselane)

With so many rental property expenses to manage, it’s an excellent idea to do your banking and accounting online from one free and easy-to-use software. Baselane’s banking platform is built specifically for independent landlords. It offers an array of accounting and banking tools and rent collection features, like automated payments, fees, and reminders. Getting started takes less than five minutes for you and your tenant, so visit Baselane to sign up today.

5. Choose the Right Financing

To make wise investment decisions, first-time real estate investors must understand rental property financing. Carefully researching and selecting the best options for financing an investment property can help keep your carrying costs low, maximize cash flow, and help you stay prepared for unexpected repairs or further investments.

Choosing the right financing depends on your project, experience, financial situation, and property type. Here are some options for rental property financing:

- Conventional financing: Offered by traditional banks and credit unions, and often have the lowest interest rates.

- Government-backed mortgages: Conventional financing backed by Fannie Mae, Freddie Mac, the U.S. Department of Agriculture (USDA), the Veterans Administration (VA), or Federal Housing Administration (FHA).

- Seller financing: The seller becomes the lender. The buyer makes monthly principal and interest loan payments to the seller for an agreed-upon term and interest rate. The buyer provides a down payment.

- Hard money loans: Non-traditional short-term loans of one to five years. These often carry higher interest rates and fees. Hard money lenders are typically used for properties or buyers that a lender can’t fund.

- All cash: Some buyers purchase a property without financing, paying the total purchase price in cash.

- Rehab loans: There are specific funding options for rehabilitation projects, including FHA 203(k), private and hard money, loans, and investment property line of credit (LOC).

- Commercial real estate funding: Commercial loans are offered by many lenders and used to purchase commercial real estate.

- Crowdfunding: Profits are shared when multiple investors pool money for investment property purchases.

6. Learn From Experienced Investors

Among the essential tips for buying rental property is to learn from experienced investors. Thousands of real estate investing books, podcasts, coaches, and online resources offer advice on buying rental property. However, networking with other investors provides opportunities to learn firsthand from people who are out there doing the work.

Joining local real estate investing groups through Facebook can also put you in touch with lenders and connect you to potential deals. A few recommended landlord and real estate investing groups are:

- National Real Estate Investors Association (REIA)

- Landlord Association

- National Association of Independent Landlords

- American Real Estate and Urban Economics Association (AREUEA)

- American Apartment Owners Association (AAOA)

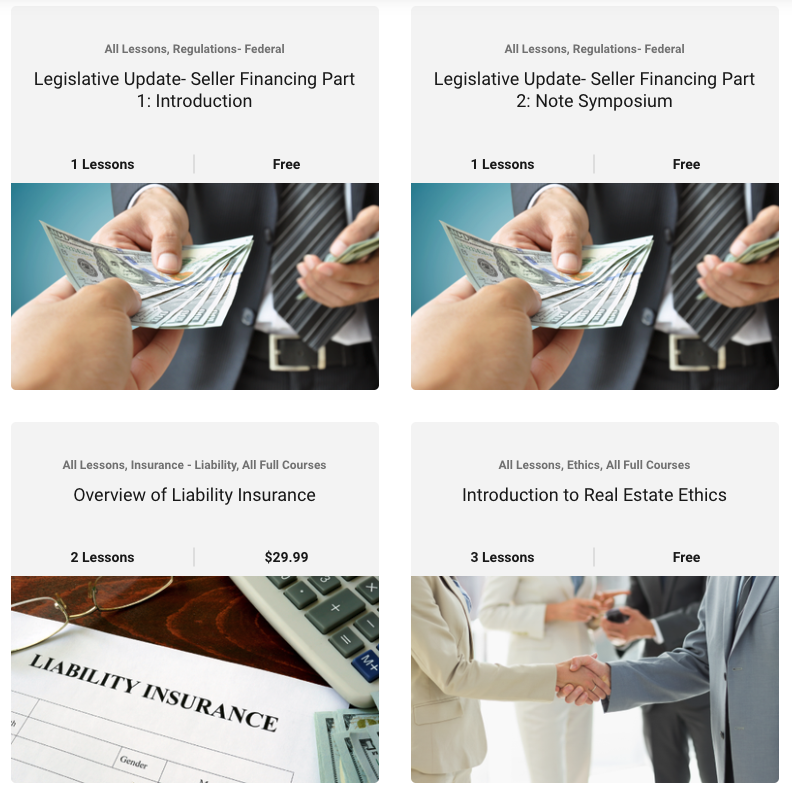

Real estate investing courses (Source: National REIAU)

Many landlord and investor associations offer free or low-cost tools, resources, and courses. For example, NREIA offers a Professional Housing Provider (PHP) designation and courses on important topics, like real estate ethics, private loans, accounting tools, and Fair Housing.

7. Consider Turnkey Real Estate

Investors often run into a choice between a property that needs a lot of work but could provide a high rate of return or a turnkey property with a lower potential rate of return with all the cash flow systems already in place. Unless you have experience planning, implementing, and managing renovation projects, the wrong property can put you behind before you begin.

When reviewing first rental property tips, consider something that is rent-ready, such as turnkey real estate. A turnkey property is an investment property where all the renovations are complete. Units are rented or rent-ready, and some turnkey real estate companies offer property management services.

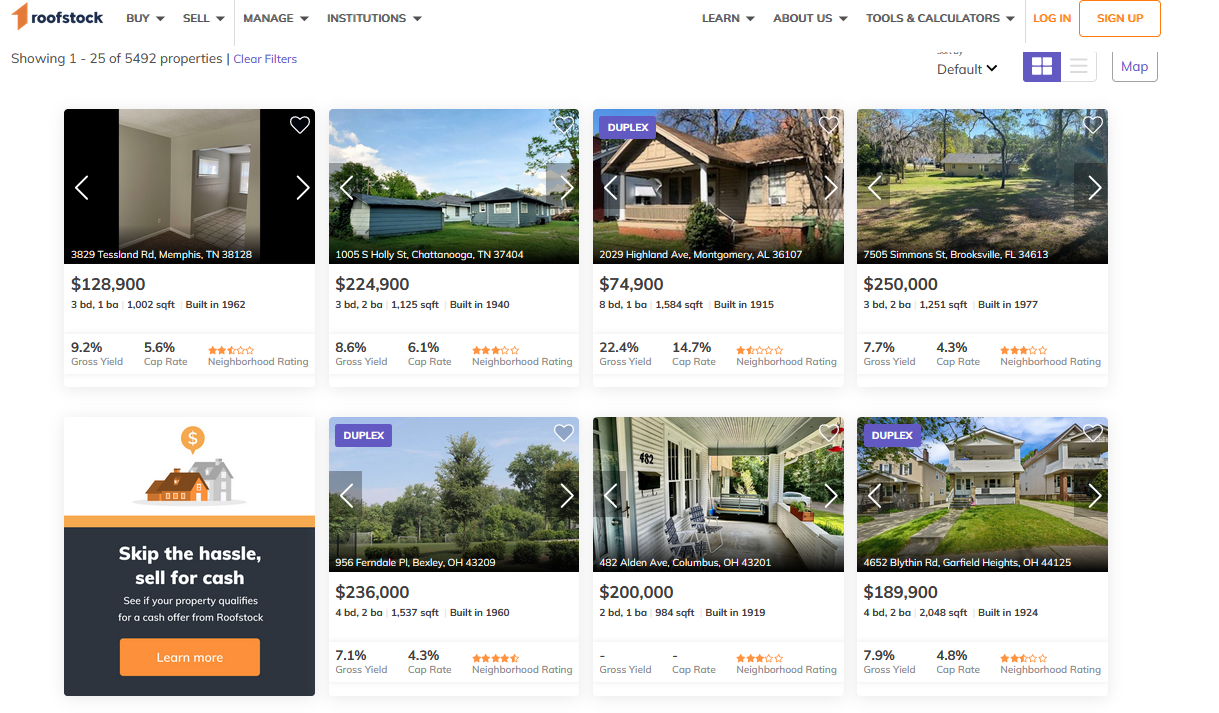

Roofstock investment property listings (Source: Roofstock)

Begin your search with a turnkey company like Roofstock. Searching for properties in 40 different rental markets at various price points is easy. You can even search for single-family portfolios. The extensive financial data, cap rate, and inspection reports show what you need to know to invest in the right rental. Start using Roofstock for free.

For more in-depth information on Roofstock and other turnkey investment companies in your area, visit our guide to the 6 Best Turnkey Real Estate Investment Companies in 2022.

8. Choose the Right Property Type

There are many rental properties. You can purchase one type or create a multi-property-type portfolio. You also need to decide if you want residential or commercial properties. Residential properties provide places for people to live in or vacation. You may want single-family homes or a duplex, triplex, or fourplex. Commercial properties include offices, industrial, and retail spaces.

Each investment type has benefits and drawbacks, and offers potential profits. Buying an apartment complex may provide higher monthly cash flow than a single-family, but it requires more intensive management and has higher expenses. Therefore, due diligence is necessary to ensure you don’t get over your head.

A few options for choosing your first rental property include:

Learn more about purchasing specific property types from these articles:

- How to Buy & Manage a Vacation Rental Property in 7 Steps

- How to Buy a Multi-family Property in 10 Steps

9. Perform a Rental Market Analysis (RMA)

Before you purchase, you must perform a data-driven analysis of the property location and rental market. In some rental markets, the demand for apartments is higher than purchasing single-family homes. Performing a rental market analysis (RMA) will show you the best property type for that location, which neighborhoods have high demand, and how much to charge for rent.

Many investment property tips tell you to analyze everything you can about the property and its potential profits. You can get almost all this data in an RMA by researching the properties, neighborhoods, and then comparing the properties. The RMA also informs how much to charge for rent, local occupancy, and vacancy rates. Once you have the projected rent growth, expenses, and maintenance estimates, you can determine if the property will generate future equity and cash flow.

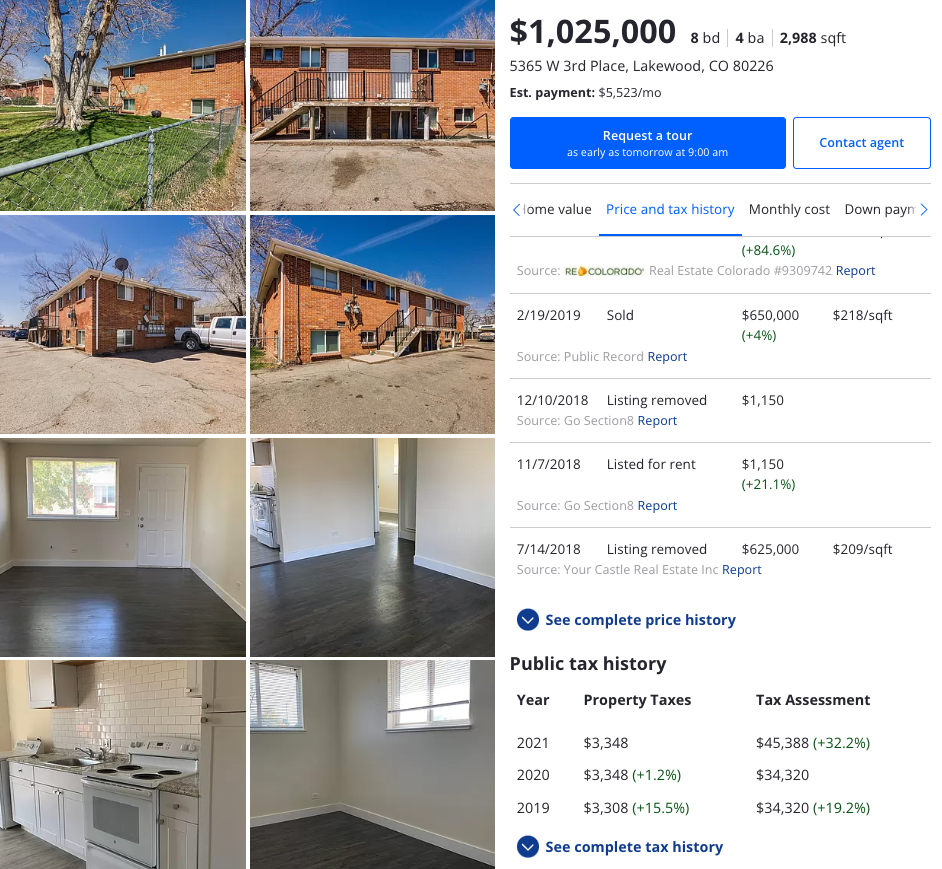

Multi-family property listing (Source: Zillow)

It’s easy to gather property data from Zillow. The site’s listings include square footage, property type, and details like flooring types, appliances, and the type of foundation. Zillow also estimates the home’s fair market value, past transactions and rental income, and property taxes. It’s free to browse on Zillow, and it’s a valuable tool for investors to buy, sell, and post vacancies.

10. Evaluate the Location

Don’t get caught up in property features and amenities without evaluating the location. Two properties can rent for massively different prices based on their locations. When evaluating locations, look for the property’s proximity to other apartment buildings, shopping, public transportation, and the quality of the school districts.

Also, check out local commerce for restaurants, retail stores, and thriving businesses. Compare the market rents for different locations and look at the property taxes for the types of properties by location. If the area’s population is growing, that’s a good sign. However, if there are high vacancy rates, it shows that the rental demand is low and can be a significant challenge.

For additional tips on how to find properties and choose a location, check out our article, How to Find Investment Properties for Sale in 5 Ways.

11. Focus on the Return on Investment (ROI)

Many first-time investors focus on the upfront costs of acquiring rental property. However, when buying your first rental property, the price is not the most reliable metric for the property’s potential. Instead, focus on cash flow now and equity potential in the future to determine your ROI.

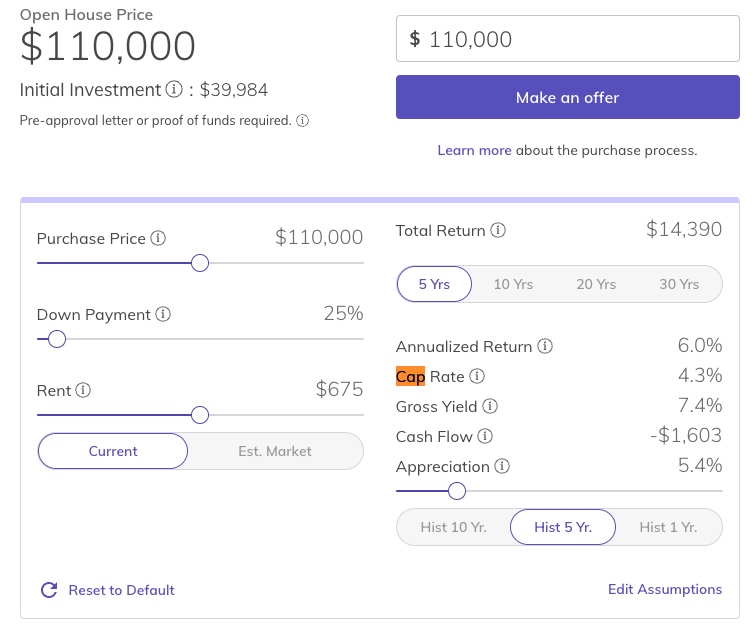

Property cap rate calculations (Source: Roofstock)

One tool to evaluate a property’s ROI potential is the cap rate. A cap rate is the current rate of return on a property based on its net operating income (NOI) and property value. This metric excludes your mortgage principal and interest. If you’re looking for turnkey properties, Roofstock listings provide the property’s cap rate from the listing’s financial information. Still, do your due diligence to test for accuracy.

Read our complete guide on cap rates vs return on investments vs cash-on-cash returns for more details.

12. Ensure the Property Is Cash Flow Positive

Unless you’re investing solely for future equity and growth, one of the essential tips for buying your first investment property is to ensure that your rental property has positive cash flow. A positive cash flow is when income exceeds all the property’s expenses, including your mortgage, and factors in unexpected repairs and vacancies.

Positive cash flow is when your property is putting money in your pocket.

When calculating the property’s income and expenses, add a margin of error and plan for additional expenses. Suppose your evaluation shows a positive cash flow. In that case, it’s more likely that your investment will weather tough economic times and generate a return on investment in the long run.

13. Don’t Skip the Property Inspection

When real estate inventory is low and there is high demand, buyers might waive the property inspection to entice a seller to accept their offer. Real estate professionals do not recommend doing this, especially on an investment property. It’s better to miss out on a property than end up in a money pit.

Skip the inspection at your peril.

A property inspection can help you prepare for repairs, uncover damage, and deferred maintenance that can tank your profits. The inspection report helps to determine if the property is an instant liability or a gem. It also allows you to reevaluate your financial strategy to see if this property is worth your investment.

14. Know Your Marketing Strategy

It takes some skill to market vacancies. Even in a high-demand rental market, you can’t just purchase a rental property and expect qualified tenants to find you. You must understand which tenants would be most interested in your units and how to reach them.

For example, if your rental property is located a mile from a large college, your ideal tenants could be students. In this case, you can reach them through partnerships with the school’s recruiting department, a school bulletin, or online advertising. There are many ways to market rental property vacancies. Here are a few to help you get started:

- Add your listings to popular websites, like Zillow and Realtor.com

- Use landing pages that direct prospective tenants to property websites

- Create a website that showcases vacancies

- Create a social media business page and list and advertise available rentals

- Use for rent signs on the property

- Post vacancies on Craigslist and in the local newspaper

- Ask other tenants for recommendations

- Have your leasing agent post them in the multiple listing service (MLS)

15. Understand Landlord & Tenant Laws

Understanding state and federal housing and landlord-tenant laws will help to avoid litigation and ensure you aren’t unintentionally violating laws. For example, states have different requirements for landlords and tenants to give notice when making lease changes. It could be lease termination, rolling over an existing lease into the next rental period, or giving an eviction notice.

Lorman course description (Source: Lorman)

Consider taking a professional course through Lorman to build confidence in understanding your state laws. Lorman offers online, live, and on-demand courses from industry professionals on various real estate, legal, financial, and property management topics, like “Understanding Property Management Law” and “Fair Housing Act Update for Property Owners.” Sign up for Lorman today to improve your confidence and success as an investor.

16. Screen Prospective Tenants

Thorough background screening can be the difference between accepting tenants who cause headaches and choosing tenants who pay on time and take care of their units. Conducting a background check involves running multiple screens, including criminal records, terrorist alerts, sex offender registry searches, and eviction history.

To minimize the risk of non-payment of rent, verify the tenant’s income as part of your screening process. You can require specific documentation where applicable, such as:

- Pay stubs

- Tax returns

- Bank statements

- Letters of employment

- Job offer letters from employers

- Business owner profit and loss statements

- IRS Schedule C for self-employed individuals

- Social Security benefits statements

- Court-ordered alimony and child support agreements

- Landlord reference letters

To learn more about tenant screening, review our article How to Screen Tenants in 7 Steps (+ Free Checklist & Flowchart).

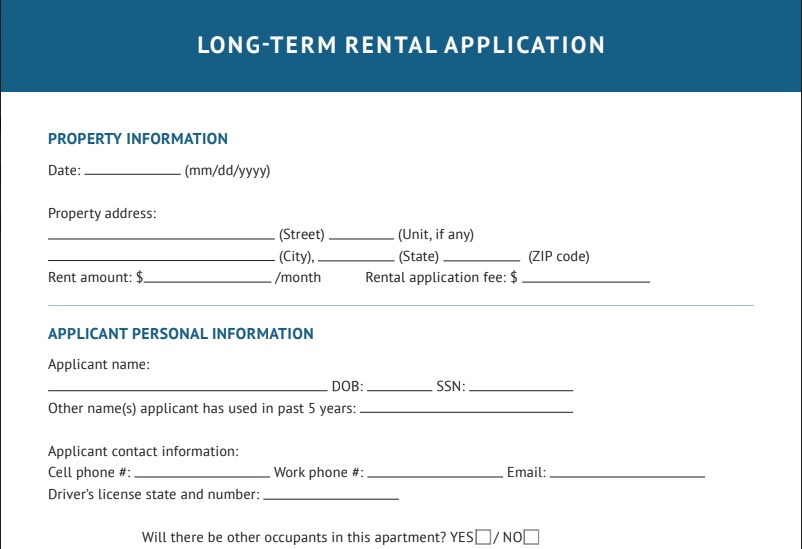

17. Prepare Rental Applications & Leases

Be ready for tenants as soon as you have a property available with a thorough rental application form and lease agreement. Start by using our free rental application form template, gathering the necessary information to run the applicant through your screening process.

In addition, you should have a very clear lease in place with expectations for the tenant and landlord laid out. This includes details about when payments are due, how the lease can be terminated, pet restrictions, and maintenance and repair responsibilities. Also, enjoy this free long-term lease application downloadable template for a year or longer rentals:

18. Set Up Online Rent Collection

Your success with these rental property investment tips depends on the income you receive from tenants’ rent payments. Therefore, if you can automate the rent collection process, you’ll avoid forgetting to collect rent, chasing tenants, or costly evictions for non-payment. There are many online rent payment systems to choose from, and you can review your options in the article 7 Best Online Rent Payment Services for Landlords 2023.

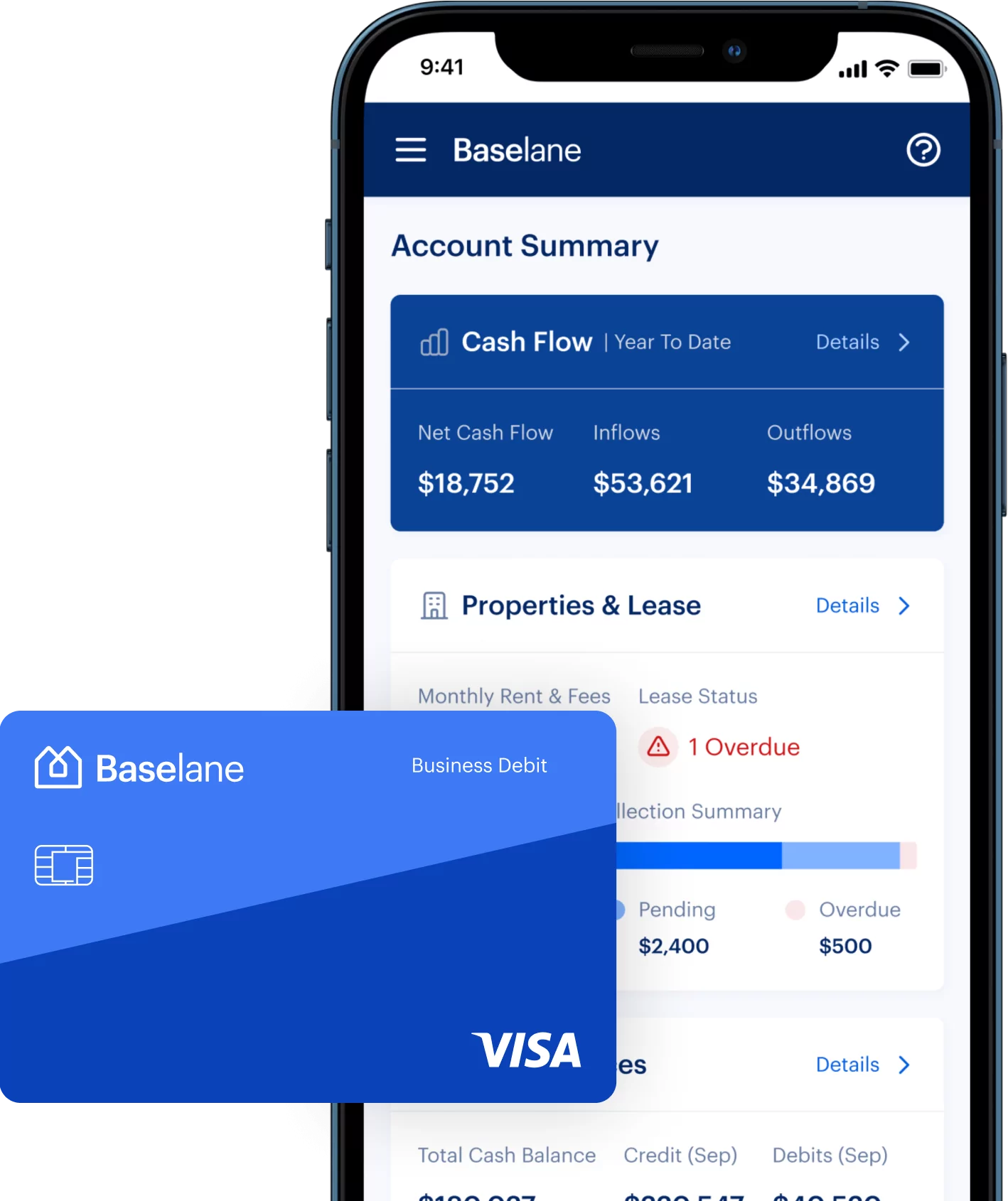

Baselane dashboard on mobile (Source: Baselane)

Baselane is a landlord-designed platform that is free, and it pays you a high-yield annual percentage yield (APY) of 4.25% on all deposits. It also offers a Visa debit card with up to 5% cashback. It’s easy for your tenants to sign up for a free account and automate and track their rent payments and incurred fees. You get notified when your tenant pays the rent in real time, and you can see all their data from your dashboard.

19. Hire a Property Management Company

Many first-time investors and landlords opt to manage and maintain the property themselves to save as much money as possible. This can be effective depending on your home maintenance experience and ability to organize maintenance requests. However, in many cases, taking the do-it-yourself route can be time-consuming and costly.

Making repairs you aren’t familiar with can lead to more significant problems and higher repair costs. Therefore, it’s worth it to consider hiring a property manager. To afford it, include hiring a property manager in your cash flow projections and operational expenses before buying the property to ensure there is enough money to cover the costs.

If you must do it yourself, online property management companies are generally more affordable and include various tools to streamline your management tasks, from screening applicants to maintenance requests and rent collection.

For more information on managing investment properties, check out our 8 Best Property Management Software for Small Business in 2023.

20. Plan a Real Estate Exit Strategy

When you write your real estate business plan, you must include an exit strategy to prepare for when you end your real estate investing business. Your “Why?” and ultimate goal may be to build wealth and generate income, but you will want to get out or retire at some point. Your exit strategy could be to pass along the properties to heirs or perpetually reinvest with an IRS 1031 exchange for like-kind properties to avoid paying capital gains.

Start planning with the end in mind.

If you’re a fix-and-flip investor, you would consider each property’s exit strategy from purchase through flipping to a buyer and also have a plan to no longer flip houses. Or, you might grow a portfolio of properties under a real estate holding company and sell it in its entirety, along with the business name and everything within it. In any case, planning with the end in mind empowers your short and long-term goals and ensures you finish solid and profitable.

Pitfalls to Avoid When Buying Your First Rental Property

While there are numerous advantages to buying rental property, there also can be downsides. This article should help lessen some risks, but sometimes circumstances beyond your control will occur. It’s good to be aware of them and an essential aspect of what to know about buying a rental property.

Consider these pitfalls and how to avoid them:

Pitfall | How to Avoid |

|---|---|

Buying based on your emotions | It’s easy to fall in love with a property, but rely on the financials and hard data. |

Skipping thorough due diligence | Don’t take shortcuts. Evaluate everything we’ve shared in these tips and talk to real estate professionals before purchasing. |

Not factoring in all costs | You must include all costs in your cash flow projections as outlined above. Don't forget vacancy rates and banking and credit card fees. |

Renting to someone based on a good vibe | If you have a good feeling about someone, great! Still, run a comprehensive background check to ensure you’re right about them. |

Slow to evict | Don’t let weeks or months go by before starting eviction proceedings since it can take time to get into court. The longer you wait, the more money and time you lose. |

Not collecting security deposits, last month’s rent, and estoppel agreements from the previous owner | When a property transfers to a new owner, the owner must transfer security deposits and last month’s paid rent to the new owner. Tenants should also sign estoppel agreements stating no money is owed from the current owner. |

Changing locks and putting tenants' belongings on the street | Most states don’t allow “self-help.” Landlords must follow laws when tenants abandon property or need to be evicted. |

Not reviewing previous rent rolls | To ensure all tenants are paid to date, the current owner should supply you with rent rolls and corresponding bank statements. This way, you’re not stuck collecting past due rent or with difficult tenants. |

Not reviewing existing leases | As part of your due diligence, review all existing leases for expiration dates, tenant and landlord responsibilities, and procedures. |

Accepting existing difficult tenants | When buying an investment property, you can sometimes put in your offer that existing tenants vacate so you can choose your own. If there is no sale clause in their lease, you will need to honor the lease terms, but a month-to-month tenant can vacate with the current landlord providing a 30-day notice. |

Bottom Line

Of all the ways to invest your money, buying and renting property is a lucrative strategy that can provide a strong return on investment (ROI) and a reliable income. After reading these tips for buying a rental property, you should be equipped with information to help you evaluate potential properties, find the right tenants, and manage your property efficiently. Staying connected with other investors and resources, you’ll learn how to make your first rental property a success.