The best human resources payroll software makes managing the entire employee lifecycle (from hiring to retiring) easier for users. Here are our top picks for small businesses.

8 Best Human Resources Payroll Software

This article is part of a larger series on Payroll Services.

Human resources payroll software combines both HR and payroll features in one platform. By sharing information between the two functions, you can save time and increase accuracy. The best human resources payroll software not only offer solutions that integrate well with each other but have reasonably priced plans and online tools that are easy to learn and use.

In this guide, we researched and compared 16 popular options and narrowed the list down to our top eight recommendations.

- Gusto: Best overall human resource payroll system for small businesses

- Paychex Flex: Best for startups and small companies wanting dedicated payroll support

- Rippling: Best all-in-one human and resource payroll software for small to midsize businesses (SMBs)

- ADP Run: Best for growing companies looking for scalable payroll and HR management tools

- QuickBooks Payroll: Best for QuickBooks accounting users and paying contractors

- Square Payroll: Best for small retail shops and restaurants needing a basic HR payroll solution

- OnPay: Best HR and payroll management system with robust system permissions

- TriNet HR Platform (formerly TriNet Zenefits): Best human resources payroll for businesses in highly regulated industries

Top Human Resource Payroll Software Compared

Starter Monthly Pricing | Full-service Payroll | Time Tracking | |||

|---|---|---|---|---|---|

$49 per month + $6 per person per month | ✓ | Included in higher tiers | |||

Three months free payroll | $5 per employee + $39 base fee | ✓ | Paid add-on |

| |

First month is free |

| ||||

| Three months free payroll | ✓ | Paid add-on |

| |

30-day free trial or 50% off base fees for three months | $6 per employee + $50 base fee | ✓ | Included in higher tiers |

| |

✕ | $6 per employee + $35 base fee | ✓ | ✓ |

| |

30-day free trial | $6 per employee + $40 base fee | ✓ | Via integrations |

| |

✕ | ✓ |

| |||

*PEO stands for Professional Employer Organization, which is a co-employer service to help you manage day-to-day HR payroll tasks. EOR stands for Employer of Record, which is also a co-employer solution but for hiring and paying international workers. | |||||

Pricing Calculator: Do You Want to Compare Costs?

Use our online calculator to compute the estimated monthly and annual costs of our top recommended human resource and payroll software.

Gusto: Best Overall HR Payroll Software

Pros

- Full-service payroll with tax payments and filings included in all plans

- Reasonably priced contractor-only payroll option

- Employee benefits include non-standard options like financial management tools

- Unlimited and automated payroll

Cons

- Time tracking, hiring, and performance reviews included in higher tiers

- Lacks payroll mobile app

- Multistate pay processing isn’t available in the starter plan

Gusto is a highly rated and popular small business payroll software with HR functions for hiring employees, tracking attendance and projects, and managing performance reviews. It processes both employee and contractor payroll, files the applicable payroll taxes and year-end W-2/1099 reports, and even handles tip credits. An EOR service for hiring and paying international employees is also available in Canada and India, as well as a global payments option for paying global contractors in over 120 countries.

Scoring 4.72 out of 5, Gusto earned the highest overall rating in our evaluation due to its intuitive interface, efficient payroll tools, reasonably priced plans, and reporting capabilities. Many users also love its user-friendly platform that makes processing employee payments easy for them.

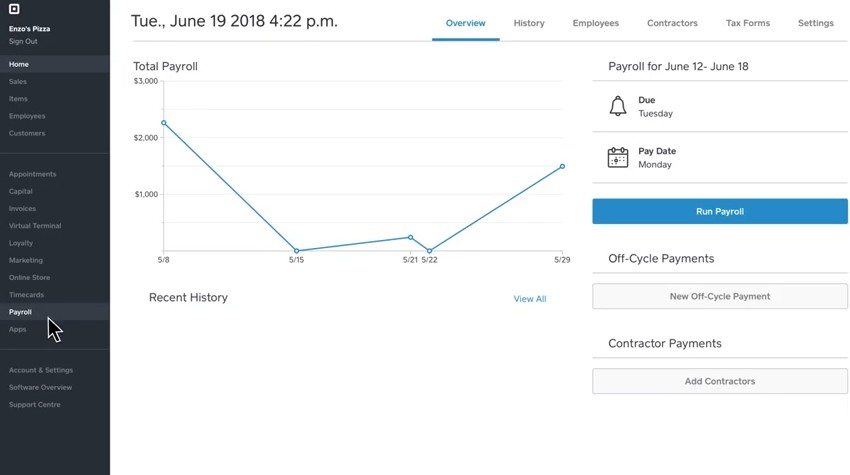

Gusto’s payroll tool (Source: Gusto)

Gusto Overview

See how Gusto compares with some of its competitors:

Paychex Flex: Best for Startups & Small Businesses Needing Dedicated Payroll Support

Pros

- Reasonably priced starter plan

- Has multiple HR and payroll plans

- Dedicated payroll specialist

- Offers a wide range of HR solutions, including PEO services

- Special package for solopreneurs includes payroll, incorporation support, and access to a 401(k) plan

Cons

- Pricing isn’t all transparent

- Year-end payroll tax filings cost extra

- Learning management tools and state unemployment insurance (SUI) services are included in higher tiers

- Time tracking, performance reviews, recruiting, and benefits are paid add-ons

Paychex Flex is a feature-rich human resource and payroll software. It has a wide range of tools and services that help you manage the entire employee lifecycle. What’s great about Paychex is that apart from providing 24/7 customer support, it assigns a dedicated payroll specialist to its clients. Plus, it has small business tiers that are perfect for startups and solopreneurs. The other providers in this guide don’t offer dedicated payroll support unless you leverage their PEO services.

In our evaluation, Paychex earned a 4.35 out of 5 with high marks (4 and up) in nearly all criteria. Many like its efficient payroll, onboarding, and employee self-service tools. However, it scored the lowest in pricing because most of its products and plans are custom-priced (except for Paychex Flex’s starter tier).

Paychex Flex’s “People View” tool lets you add new employees and invite them to accomplish onboarding tasks, such as filling up forms and updating their personal info.

(Source: Paychex)

Paychex Flex Overview

For a direct comparison of Paychex Flex with other HR software for payroll, see our articles:

Rippling: Best All-in-One HRM Payroll Software for SMBs

Pros

- Offers modular HR, payroll, benefits, and IT solutions that integrate seamlessly; you can choose the modules that you need

- IT tools streamline computer and app provisioning and deprovisioning processes

- Integrates with 500+ third-party software and apps

- Unlimited and automated payroll

- PEO and EOR services

Cons

- You must purchase its core Rippling platform to access other modules, including payroll

- Can get pricey as you add more solutions/modules

- HR help desk option with phone and email support costs extra

- Lacks live phone support (you have to go through its chat tool to contact customer reps)

Rippling Unity, Rippling’s base platform that all subscribers must purchase, is now called Rippling Platform.

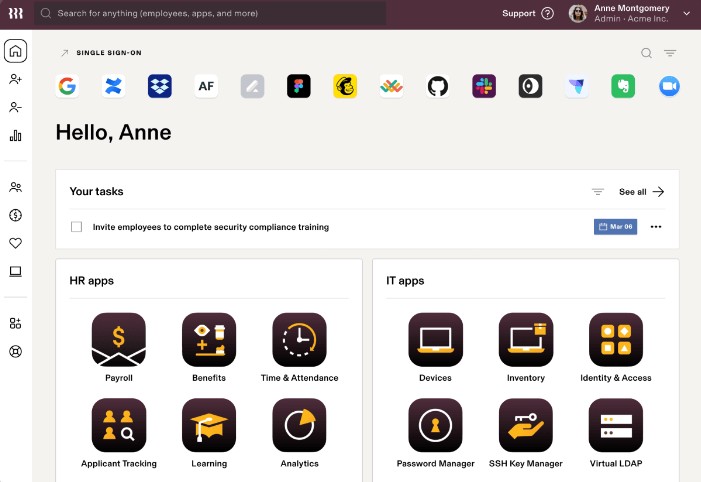

Rippling’s highly adaptable HR payroll system makes it a good option for SMBs that want simple to advanced HR features. Its core Rippling platform includes onboarding tools, system permissions, customizable workflows, and a unified database. Depending on your HR needs, you can add modules for payroll, benefits, hiring, expense reporting, and headcount planning. It has IT tools for tracking computers and controlling access to more than 500 business software.

Scoring 4.26 out of 5, Rippling earned top marks for reporting, user popularity, HR functions, and payroll features. It lost points because pricing isn’t all transparent and live phone support with an HR expert costs extra. It also doesn’t provide a dedicated payroll specialist as Paychex does. Nonetheless, users on review sites like G2 and Capterra praise its intuitive platform, wide range of HR functions, and seamless third-party software integrations.

Rippling’s feature-rich platform not only manages HR and payroll, but also helps you track business apps, passwords, and computer devices. (Source: Rippling)

Rippling Overview

For a direct comparison of Rippling with the other providers on our list, see our guides:

ADP Run: Best for Growing Companies Looking for Scalable Plans

Pros

- Feature-rich platform that comes with job posting, background checks, new hire onboarding, payroll, benefits, and training solutions

- Has multiple products and flexible plans that cater to different business sizes

- Offers secure paychecks with advanced fraud protection

- Offers secure paychecks with advanced fraud protection

Cons

- Non-transparent pricing

- Charges fees on a per-pay run basis; year-end tax reporting and form delivery cost extra

- Time tracking, workers' compensation, and benefits plans are add-on products

- Advanced HR tools like learning management, applicant tracking, job postings, and salary benchmarks are limited to higher tiers

ADP Run is optimal for those needing a human resource and payroll software for managing a wide range of functions. It has a comprehensive solution suite with flexible plans that can handle basic to complex HR and payroll processes. This makes ADP a good choice for growing businesses that don’t want to deal with the hassle of switching companies because they’ve outgrown the one they’re with.

Scoring 4.23 out of 5 in our evaluation, ADP’s HR solution suite which includes payroll, employee benefits, onboarding, online training, and hiring tools contributed to its high scores. Users also appreciate its ease of use and how its payroll solution helps them save time and simplify processes. However, it lost points due to its non-transparent pricing.

Aside from letting you run payroll, ADP Run’s dashboard shows your to-do list and details of your last pay run. (Source: ADP)

ADP Run Overview

Read our ADP vs Paychex vs Gusto and ADP Run vs QuickBooks Payroll comparison articles to see how ADP stacks up against other human and resource payroll software.

QuickBooks Payroll: Best for QuickBooks Users and Paying Contractors

Pros

- Offers next- and same-day direct deposits

- Unlimited and automated payroll

- Tax penalty protection program; QuickBooks to cover tax penalties (up to $25,000/year) regardless of who makes the mistake Note that this is separate from QuickBooks Payroll's tax accuracy guarantee, which is included in all plans and covers penalties from tax filing errors made by its representatives.

- regardless of who makes the mistake

- Seamless integration with QuickBooks Accounting

- Affordable contractor payments package

Cons

- Time tracking and local tax filings limited to its premium tiers

- Tax penalty protection available only in highest plan

- Integrates mostly with QuickBooks products; you need its accounting platform to access third-party software integrations

- Has few HR capabilities outside of payroll, time-tracking, and benefits administration

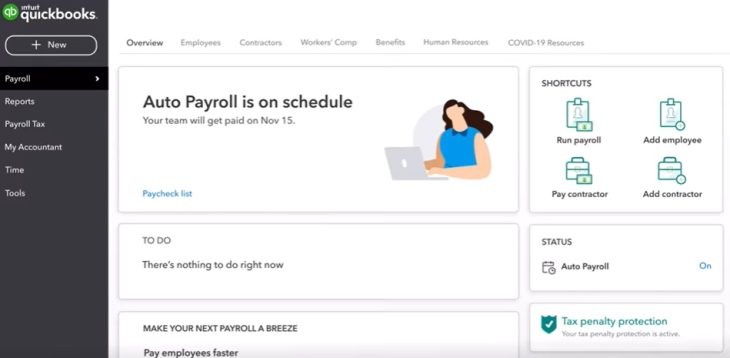

If you already use QuickBooks accounting, you can easily add on QuickBooks Payroll to consolidate all your accounting, payroll, and core HR processes in one place. QuickBooks Payroll allows unlimited pay runs with automated payroll tax payments and filings. Compared to other software in this guide, its low-cost contractor payments plan particularly stands out for small businesses that only hire and pay contract workers.

QuickBooks Payroll earned 4.16 out of 5 in our evaluation, with high ratings (4 and above) in reporting, payroll functionalities, pricing, and ease of use. While its average number of reviews on G2 and Capterra is below 500, most of the feedback is positive, with users raving over its efficient payroll tools and fast payment options. However, it didn’t rank higher on our list because it lacks advanced HR tools like TriNet HR Platform’s compensation planning module, Rippling’s and Paychex’s online learning programs, and ADP’s talent acquisition features.

QuickBooks Payroll’s main dashboard (Source: QuickBooks Payroll)

QuickBooks Payroll Overview

See how QuickBooks Payroll stacks against the other HRM payroll software on our list:

- QuickBooks Payroll vs Gusto

- QuickBooks Payroll vs Paychex

- QuickBooks Payroll vs ADP Run

- QuickBooks Payroll vs Square Payroll

Square Payroll: Best for Small Retail Shops & Restaurants Needing Basic HR

Pros

- Affordable contractor-only plan

- Seamless integration with Square POS

- Offers fast direct deposits, including an instant payment option

- Unlimited and automated payroll

Cons

- Standard direct deposit has a four-day processing timeline

- A Square Payments account is needed for next-day direct deposits and instant payments

- Limited HR solutions; doesn’t offer hiring, job posting, and learning management tools

Square is popular for its POS and payment processing, but it also handles payroll and time tracking through its Square Payroll solution. It connects seamlessly with Square POS and offers four-day direct deposits with an instant payment option, which is particularly attractive to small retail and restaurant businesses. Similar to QuickBooks Payroll, it has a low-cost plan for paying only contractors—although, QuickBooks’ contractor package is more affordable if you have more than two contract workers.

With an overall score of 4.11 out of 5, Square Payroll didn’t rank higher on our list because it lacks expert HR advisers on staff and has limited HR functions. That said, its payroll features are strong, with multiple payment options, automatic and unlimited pay runs, year-end W-2/1099 reporting, and payroll tax filings. Users who left reviews on third-party sites like G2 and Capterra also rated it positively for ease of use, affordability, and payroll functionalities.

Square Payroll’s main dashboard contains helpful links for running different types of payroll (such as contractor pay runs and off-cycle payments). (Source: Square Payroll)

Square Payroll Overview

Check out our Square Payroll vs QuickBooks Payroll guide to see how one compares against the other.

OnPay: Best HR Payroll Software with Strong System Permissions

Pros

- Has an affordably priced plan

- Offers full-service payroll with automatic tax filings and unlimited pay runs

- Niche payroll services for churches, nonprofits, farms, and agriculture companies

- Good customer support; with free account migration services for new clients

Cons

- Lacks multiple subscription tiers that cater to varying payroll and HR needs

- Eligibility for either two- or four-day direct deposits is based on OnPay’s risk assessment

- Limited third-party software integrations

- Lacks time tracking and performance review tools

Unlike the other software in this guide, OnPay only has one plan (priced at $40 + $6 per employee monthly), which comes with all of its features—from multistate payroll to PTO tracking and full customer support. This means that you don’t need to upgrade to higher plans to unlock features as you would with other providers like Gusto; its starter tier only covers payroll for one state, but costs the same as OnPay. OnPay’s extensive permission settings (six levels) also come with pre-defined roles for controlling system access and delegating HR payroll tasks, providing you with a faster way of setting up user roles.

Scoring 4.08 out of 5 in our evaluation, OnPay received high ratings (4 and up) in nearly all criteria. It lost points because its direct deposits take longer than two days. Plus, it has limited integration options and HR functionalities (such as learning management and performance reviews). However, users still like its affordability and intuitive interface that’s easy to navigate.

OnPay’s intuitive interface allows you to easily toggle between employee PTO view options and approve/disapprove requests. (Source: OnPay)

OnPay Overview

Read our OnPay vs Gusto guide to see how this provider compares with one of its competitors.

TriNet HR Platform (formerly TriNet Zenefits): Best for Highly Regulated Businesses

Pros

- Reasonably priced plans with multiple options

- Strong compliance tools with HR advisory services

- Time tracking and employee scheduling included in all plans

- Unlimited pay runs

Cons

- Payroll and advisory services are paid add-ons

- Advanced HR tools (such as compensation and performance management) are available only in higher tiers

- All plans and add-ons have a minimum five-employee requirement

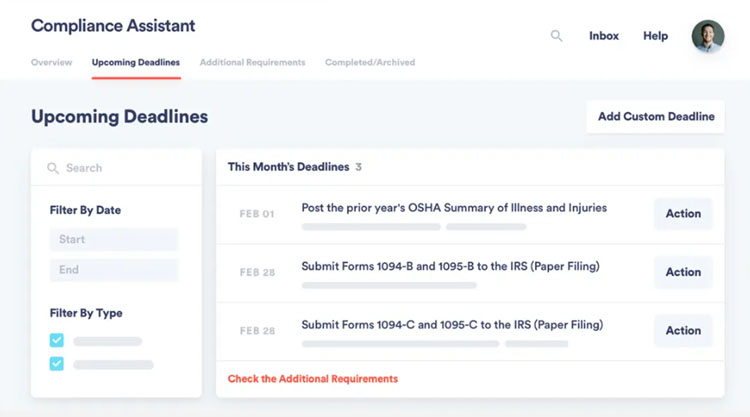

Although TriNet HR Platform’s (formerly TriNet Zenefits) payroll module is included in its highest tiers (available as a paid add-on for lower plans), it offers powerful compliance features. Its most basic plan comes with solutions, like time tracking and scheduling, that some of the providers on our list offer in only their higher tiers. We found TriNet HR Platform optimal for businesses in highly regulated industries because it automates and monitors your HR and benefits compliance.

Earning an overall rating of 4.06 out of 5, TriNet HR Platform scored well (4 and up) in most of our criteria because of its transparent pricing, efficient HR, and reporting functionalities. Users also like its user-friendly interface and how well its solutions integrate with each other. However, it didn’t rank higher on our list since it doesn’t offer automatic pay runs and dedicated support. It can also get pricey, depending on the number of employees you have.

TriNet HR Platform’s “Compliance Assistant” tool allows you to track federal compliance requirements and even create custom deadlines.

(Source: TriNet)

TriNet HR Platform Overview

Check out our TriNet HR Platform vs Rippling guide to see how this provider compares with two of its competitors.

HR vs Payroll Software: What’s the Difference?

While some of the systems we considered have basic HR features along with payroll, others have advanced core HR products that allow you to add on payroll services. To help you find the right solution for your business, it’s useful to see the differences in the software types and when each might be your best fit.

How We Chose the Best Human Resources Payroll Software

We selected human resources payroll software that processed paychecks for hourly, salaried, and contract workers and can handle direct deposits and checks. We also looked for solutions that can calculate deductions and tax withholdings, file tax reports, and provide basic payroll reports. Lastly, all the companies we reviewed either include HR tools in their payroll system or have HR products that work with their payroll module.

Click through the tabs below for a more detailed breakdown of our evaluation criteria.

35% of Overall Score

I looked for HR services and functions like online onboarding, state new hire reporting, self-service portals, and a staff of expert advisors. I also gave additional points to software providers offering health insurance available in all 50 states and advanced HR solutions like hiring, compensation, learning, and performance management.

20% of Overall Score

I gave the most credit to solutions that process direct deposits in two days or fewer, have multiple payment options, handle year-end tax reporting, manage tax payments and filings―federal, state, and local taxes―and offer a penalty-free guarantee.

20% of Overall Score

I looked for features that make the software easy to use, such as having an interface that’s intuitive and customizable. Extra points were given to providers that offer integration options, set-up assistance, live phone support, and a dedicated representative.

15% of Overall Score

I checked to see if the provider has transparent pricing, zero setup fees, and multiple plan options with unlimited pay runs. I also gave additional points to those with plans that cost $50 per employee.

5% of Overall Score

Preference was given to software with built-in basic payroll reports and customization options.

5% of Overall Score

I considered online user reviews on popular third-party sites like G2 and Capterra, based on a 5-star scale, wherein any option with an average of 4-plus stars is ideal. Also, software with 1,000 or more reviews on third-party sites is preferred.

Bottom Line

A platform that has a combination of HR and payroll functions streamlines processes and provides a unified database to store employee information. It can make tasks like onboarding, benefits administration, and performance reviews easier to handle since you don’t have to use separate systems to manage critical HR functions.

We found that Gusto offers the essential human resources and payroll features that small businesses need. While its health insurance is not available in all states, businesses located in areas where it does offer health plans can take advantage of its affordable pricing and intuitive interface with full-service payroll and core HR tools. Sign up for a Gusto plan today.