Not every business needs a complex point-of-sale (POS) system to accept customer payments. You can download credit card payment apps to your smartphone or tablet; these let you take payments on the go via digital wallets, payment links, QR codes, and tap-to-pay features—all from your mobile device.

Most payment apps are free, and some include additional tools for point of sale, ecommerce, and offline functionality. I evaluated over a dozen options to give you my top recommendations.

The best credit card payment apps for small businesses are as follows:

- Square: Best overall

- PayPal: Best for occasional sales

- Chase: Best for fast and free same-day funding

- Shopify: Best for multichannel sales

- SimplyPayMe: Best for mobile payments without card readers

- SumUp: Best for low-volume and low-ticket sales

- Payanywhere: Best for restaurants and bars

Best Credit Card Payment Apps Compared

Our Score (out of 5) | Monthly Account Fee | In-person/Contactless Fee | App Payment Methods | |

|---|---|---|---|---|

| 4.63 | $0-$165+ | 2.6% + 10 cents | Digital wallets Payment links QR codes Tap to pay |

| 4.31 | $0-$40 | 2.29% + 9 cents | Digital wallets Payment links QR codes Tap to pay |

| 4.13 | $0-$15 | 2.6% + 10 cents | Digital wallets Payment links QR codes |

| 4.11 | $39-$399 (Ecommerce plan) | 2.4% + 10 cents to 2.6% + 10 cents | Digital wallets Payment links QR codes Tap to pay |

| 3.97 | $1.99-$9.99 | 2.9% + 30 cents | Digital wallets Payment links QR codes Tap to pay Scan to pay |

| 3.88 | POS Plan: $99-$289 Payment app: $0 | 2.6% + 10 cents | Digital wallets Payment links QR codes Tap to pay |

| 3.86 | $0 | 2.69% | Digital wallets Payment links QR codes |

Square: Best Overall Credit Card Payment App

Pros

- Free card reader and account subscription

- Wide range of integrations, features, and payment methods

- Up to $250/month chargeback fees waivable

Cons

- Locked into Square Payments

- Limited support hours

- No interchange-plus rates

Overview

Who should use it:

Businesses wanting a free, easy-to-use payment app with general-purpose POS features.

Why I like Square:

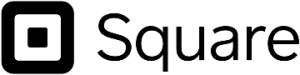

Square offers a free POS and credit card payment app that works seamlessly on iOS and Android mobile devices. It has one of the most intuitive interfaces I’ve ever seen on a POS system. Square consistently makes our list of top mobile credit card processors. The POS software includes inventory management, ecommerce, and checkout features, not to mention add-ons and integrations that allow the system to grow, making it a great choice for nearly any small business or startup.

In addition to an all-purpose credit card payment app, Square also has free POS apps for retail, restaurant, and appointment-based businesses.

- Monthly fees: $0-$165+

- In-person: 2.6% + 10 cents per transaction

- Keyed-in: 3.5% + 15 cents per transaction

- Online: 2.9% + 30 cents per transaction

- Buy-now-pay-later: 6% + 30 cents with AfterPay

- Volume discounts: Custom pricing for businesses processing over $250,000 in credit card sales.

- Mobile card reader:

- Magstripe reader (for swiped payments): $10 (first is free)

- Contactless reader: $59

- Multidevice register app: Square has a fully functioning POS register app that works on smartphones, tablets, and Square’s POS hardware and includes inventory tracking, taxes, and discounts. Square also has an integrated online store and can process card payments offline.

- Free mobile card reader: You’ll get one free smartphone-compatible magstripe reader when you sign up for a Square account, and affordable contactless readers are also available.

- Highly rated mobile app: Square ranks number one on our lists of best credit card readers for iPhones and card readers for Android and also leads our list of leading mobile credit card processors. In the Apple App Store, it has a 4.8 rating out of 5 based on more than 503,000 ratings. For Android, it has 4.7 stars and more than 234,000 reviews.

- Chargeback protection: Square is unique among the credit card processors on our list because it waives up to $250 a month in chargeback fees. This should be sufficient for a small business or solopreneur.

Square’s POS software is easy to set up and use and works well on mobile devices. (Source: Square)

Square is a well-known and highly regarded software and app, and its user reviews reflect this with an average of about 4.8 out of 5.

PayPal: Best for Occasional Sales

Pros

- Reasonable transaction rates

- International payment processing

- Trusted by consumers

Cons

- No offline mode

- Reputation for account freezes

- Relatively few POS features and tools

Overview

Who should use it:

Small businesses and seasonal sellers that process casual in-person sales, or cater to international tourists.

Why we like it:

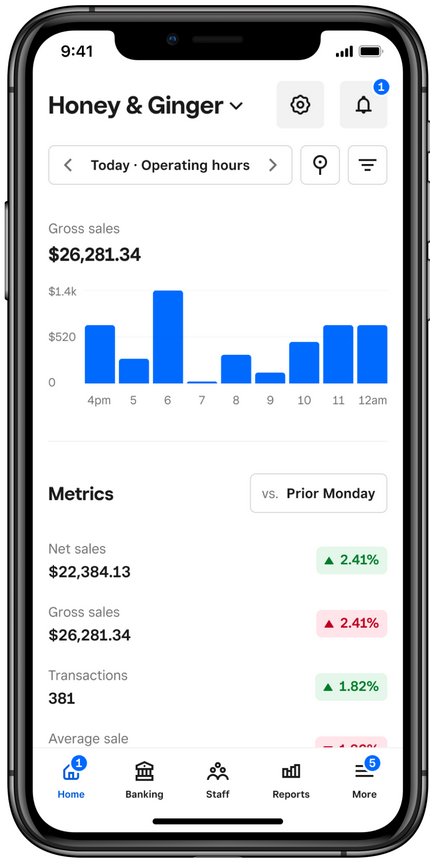

PayPal is one of the most popular credit card payment apps in the industry. Not only does its payment app help merchants manage all credit cards in one place, but it can also directly accept payments via QR codes and contactless methods. PayPal is also popular for its easy-to-use payment links, invoicing, crypto payment management tools, and exclusive PayPal user checkout options.

The POS is simpler than Square, easy to use, and free. It has discounted 3-in-1 card readers and cheaper in-person rates; the processing rates are also cheaper. Learn how PayPal stacks up against Square.

- Monthly fee: $0-$40

- Card-present fee: 2.29% + 9 cents

- Keyed-in fee: 3.49% + 9 cents

- QR code payments: 2.29% + 9 cents

- Chargeback fee: $20

- Mobile Card reader: $79, first one $29

PayPal’s in-person transaction fees are the cheapest on our list of apps for credit card processing. However, its rates vary for online sales, virtual terminal sales, donations, and country. Learn more about PayPal pros and cons.

Zettle’s entire POS system is free with the use of PayPal’s payment processing. Unlike Square, PayPal has no premium plans.

- PayPal Zettle: The Zettle mobile POS app is free for merchants accepting payments in person but requires pairing with the Zettle card reader to start accepting card payments. You can also manually enter your customer’s payment details on the app, but the fees are higher.

- Cryptocurrency payments: PayPal is among the first of the major payment processors to accept cryptocurrency payments. Each PayPal account (personal and business) comes with a digital crypto wallet. This is integrated with PayPal’s Zettle payment app, so your customers can opt to pay with cryptocurrency such as Bitcoin, Ethereum, and more.

- Social selling: PayPal lets you include links for social selling, and you can create payment buttons and payment links directly from the mobile app. Adding a PayPal option to your sales increases your chance of making a sale. It also offers direct integration with popular peer-to-peer payment app Venmo. Learn how to create a Venmo account for your business.

PayPal is highly versatile, allowing for multiple payment methods as well as usage on multiple device types. (Source: PayPal)

PayPal is a highly popular credit card payment app that makes it easy for customers to pay. Users gave this software an average score of about 4.5 out of 5.

Chase Payment Solutions: Best for Fast & Free Same-day Funding

Pros

- Free merchant account

- Same-day funding with a Chase bank account

- Advanced report analytics

Cons

- Expensive hardware

- Minimum maintaining balance of $15/month required for a Chase bank account

- Reports of account closures without notice

Overview

Who should use it:

Businesses wanting payment processing features without creating an account, or those preferring same-day funding options

Why I like Chase Payment Solutions:

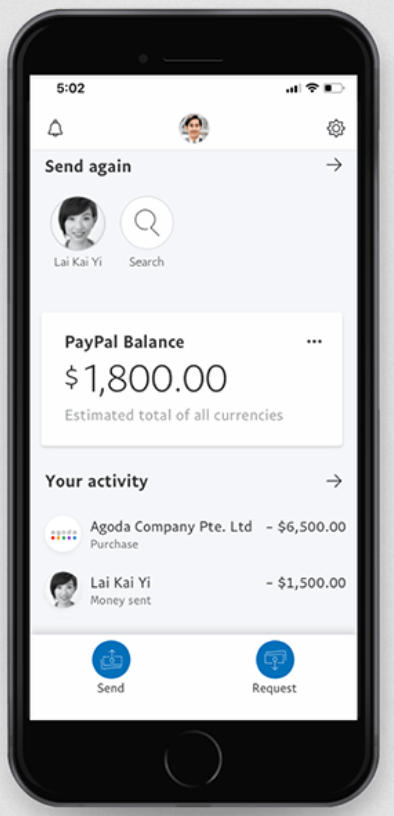

Chase is one of the biggest banks in the world, but one of the rare few that directly works with small businesses. Merchants with or without a Chase bank account can sign up with Chase Payment Solutions, but you will need one if you want access to free same-day funding.

Chase Mobile Checkout (for non-Chase bank account holders) and Chase Quick Accept (for merchants with a Chase bank account) both support a range of swipe, chip, and contactless credit card payment methods. There’s also a separate Chase mobile POS app with built-in payment processing tools.

- Monthly account fee:

- Merchant services: $0

- Chase business bank account: $0-$15 (monthly fee waived with $2,000 monthly maintaining balance)

- Transaction fees:

- In-person transaction fee: 2.6% + 10 cents

- Online transaction fee: 2.9% + 25 cents

- Keyed-in transaction fee: 3.5% + 10 cents

- Custom rates available for larger transactions

- Chargeback fee: $25-$100 per transaction depending on dispute volume

- Same-day funding: Free (for Chase business bank account holders), otherwise free next-day funding

- Mobile card reader: $99 ($129 for reader + base)

- Mobile checkout: Chase Mobile Checkout is available for merchants without a Chase bank account. It comes with an image-based product catalog and a range of credit card payment methods supported by Chase 3-in-1 mobile credit card reader (sold separately for $99). Free next-day funding is available for deposited funds.

- Chase QuickAccept: Chase QuickAccept is like Chase Mobile Checkout except that it offers same-day funding and is only available for merchants with a Chase bank account. It also works with the same 3-in-1 card reader that you can get for free with QuickAccept.

- Free same-day funding: Free same-day funding is available for merchants with a Chase bank account. Merchants without a Chase bank account have access to next-day deposits at no extra cost.

- Customer Insights: Every Chase merchant account comes with a business intelligence platform that provides analytics for key metrics such as daily sales and trends. On top of that, it also provides robust customer data profiles and peer benchmarking based on Chase’s rich merchant-acquiring and card-issuing data.

Chase Payment Solutions offers same-day or next-day funding, plus mobile checkout options. (Source: Chase)

Chase offers mobility and options to users; they can choose whether or not to sign up for a Chase bank account and can use the app regardless. However, you’ll have more tools at your disposal if you do create an account. App users gave it an average score of about 4.6 out of 5.

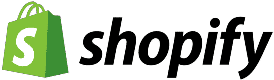

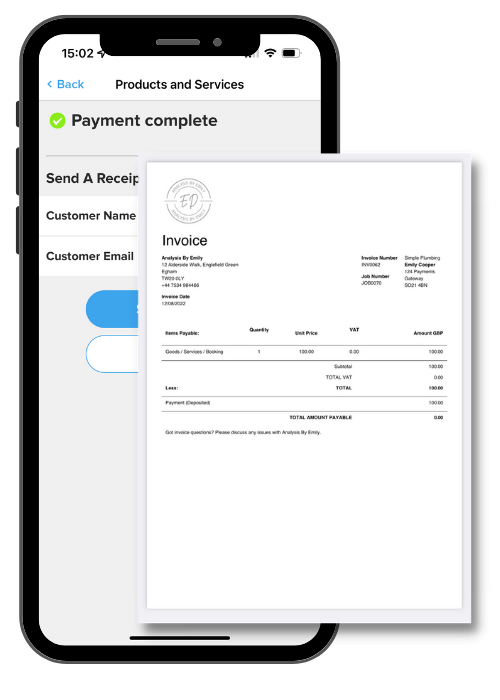

Shopify: Best for Multichannel Sales

Pros

- Extensive inventory tools

- Ecommerce-focused

- POS hardware available for purchase or rent

Cons

- More compatible with iOS than Android

- Additional fees for third-party processors

- No free plan or free card reader

Overview

Who should use it:

Multichannel businesses or businesses focusing on ecommerce sales

Why I like Shopify:

I love Shopify’s checkout features and multichannel sales tools. It is on our list of the leading ecommerce solutions today and made our list of the best POS systems, especially for multichannel retailers.

The app comes free with every ecommerce account and can be used on iPhone and Android devices. However, you can rent full POS systems for special occasions, something none of the others on our list do.

To use Shopify’s credit card processing, you must purchase a software plan. The $5 a month Starter plan allows you to sell only on social sites and messaging. Annual pricing is also available. Shopify’s mobile card reader can be purchased at $49.

Your transaction fees depend on the plan you purchase—the more expensive plans have lower rates. You can use your own payment processor, but Shopify adds a fee to do this, which could negate the advantage. Only Shopify offers discounts on shipping.

- Starter: $5

- In-person transactions: 5%

- Domestic online transactions: 5% + 30 cents

- Basic: $39 (Annual pricing $29)

- In-person transactions: 2.6% + 10 cents

- Domestic online transactions: 2.9% + 30 cents

- Shopify: $105 (Annual pricing $79)

- In-person transactions: 2.5% + 10 cents

- Domestic online transactions: 2.7% + 30 cents

- Advanced: $399 (Annual pricing $299)

- In-person transactions: 2.4% + 10 cents

- Domestic online transactions: 2.5% + 30 cents

- Multichannel sales: Integrate with channels like eBay, Facebook, and other social or online venues. The credit card app itself allows you to create payment buttons and links to send via email or add to a social media post.

- Shipping discounts: The Shopify payment app also gives you access to logistics management (shipping and delivery). If you process mail orders, sell on eBay, or ship a lot of your products, then Shopify is worth considering for the shipping discounts alone—you can save up to 88%.

- POS hardware rental: Shopify allows you to rent a system by the day. This is a great tool for those times when you may need to up your game, such as for a big convention with high-traffic sales.

Offer multichannel sales, track metrics, and monitor payments from anywhere with the Shopify app. (Source: Shopify)

Shopify is a great software for multichannel or ecommerce-focused sales and is a top-shelf online selling solution. App users gave it an average score of about 4.5 out of 5.

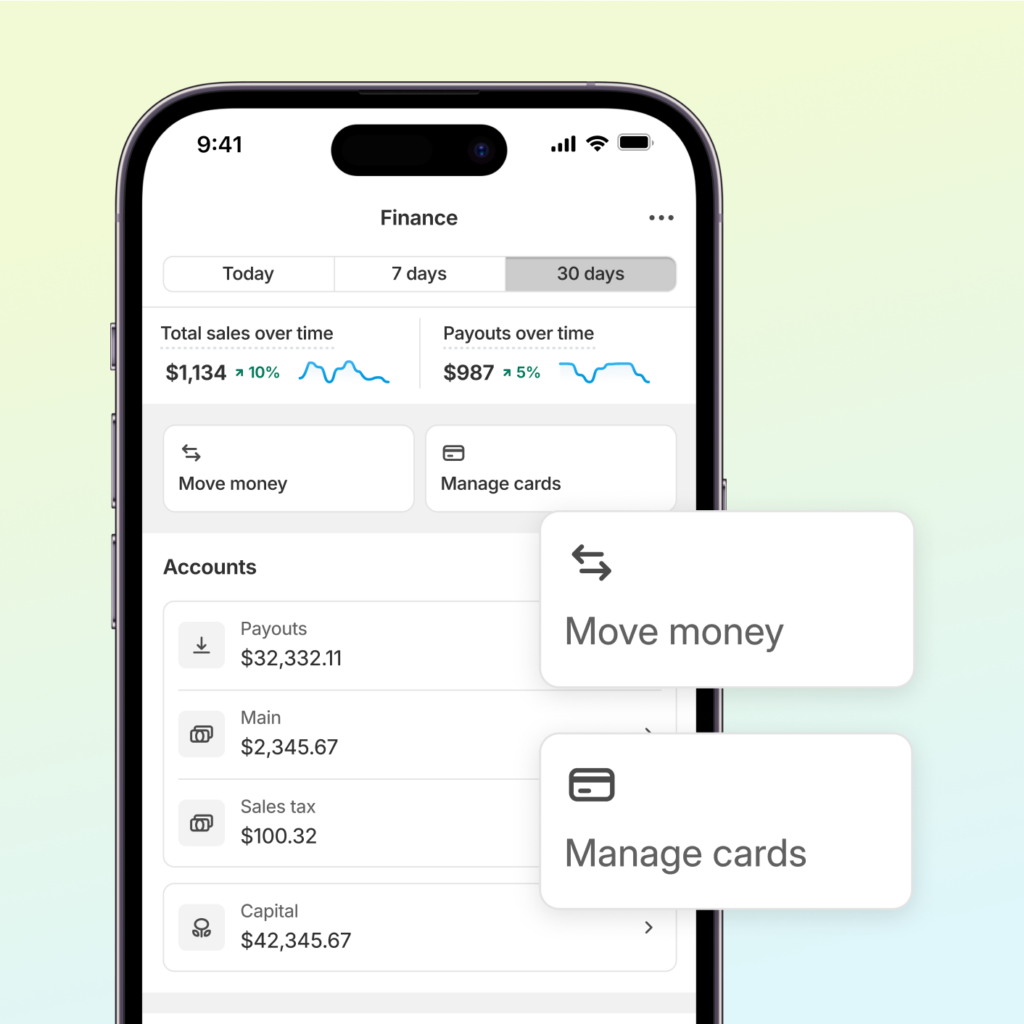

SimplyPayMe: Best for Service Professionals Without Credit Card Readers

Pros

- Card reader not required

- Built-in POS and job scheduling software

- Offline payments processing

Cons

- Slow payouts (3-7 business days)

- Chargeback fees not disclosed

- Some features not available to US merchants

Overview

Who should use it:

Businesses that don’t plan to obtain credit card readers or prefer to process payments via mobile app; businesses that don’t depend on quick payouts

Why I like SimplyPayMe:

SimplyPayMe is a payment service provider offering hardware-free payment processing to merchants through the latest advancements in mobile payment technology. It is one of only a few providers that are equipped with card scanning tools that don’t need external hardware.

Because SimplyPayMe can accept card payments directly from the mobile app, it’s a great option if you are a service professional who prefers not to invest in credit card reader hardware. SimplyPayMe also comes with a POS, a very strong suite of invoicing features, plus a job scheduling software ideal for mobile service-based businesses such as landscaping, home-cleaning, HVAC, and more.

- Monthly Fees (US): Terms and Conditions indicate that US-based merchants are automatically subscribed to its Invoicing Plus Plan (the pricing page shows entirely different plans).

- Essential: $1.99

- Manage: $4.99

- Grow: $9.99

- Payment processing:

- In-person: 2.9% + 30 cents

- Online (for payment links): Not specified

- Mobile card reader: Not required

- Chargeback fee: Not disclosed

- Free trial: 30 days

Note that while it does away with the need to invest in additional hardware, SimplyPayMe’s in-person rates are like online rates for most of the providers on our list, like Square, PayPal, and Chase, so there are no significant transaction fee savings involved.

- Hardware-free payments: SimplyPayMe uses card scanner technology built into its mobile payment app; merchants can accept payments without a physical mobile card reader. Customers can confirm the transaction by entering their three-digit CVC for in-person payments. Remote customers can pay through payment links and digital invoices.

- Built-in POS software: The SimplyPayMe mobile app includes POS software that allows merchants to manage their products or services, invoices, customer lists, and sales on their smartphones. It also comes with job scheduling software for managing and tracking job statuses and employee performance.

- Invoicing: Every SimplyPayMe plan comes with an invoicing feature that allows businesses to manage transactions from start to finish right on their smartphones. The software allows you to create, copy existing, send, and remotely get approved quotes with an “accept quote” button. It can also generate status reports, send detailed invoices with payment links, and send digital receipts.

- Team management: Most popular credit card apps for small businesses carry full-featured invoicing software, but team management is often an add-on. SimplyPayMe makes both available on its mobile app without extra fees, which makes it, in part, stand out among its competitors.

Accept various payment methods, create invoices, and manage your teams with SimplyPayMe. (Source: SimplyPayMe)

SimplyPayMe doesn’t use hardware at all, opting for payment processing entirely via mobile app. Various business management tools are included as well. Average user scores are at 4.5 out of 5.

SumUp: Best for Low-volume & Low-ticket Sales

Pros

- Zero monthly fees

- Offline payment processing

- Low chargeback fee ($10 per transaction)

Cons

- Payout speed relatively slow

- Separate paid subscription for POS

- Limited support

Overview

Who should use it:

Small businesses or solopreneurs wanting low fees and who process mostly low-ticket sales or few sales overall

Why I like SumUp:

SumUp is a reliable, straightforward credit card processor that takes swipe, chip, and contactless payments. You will need the mobile payments app that comes with it to process transactions. Zero monthly fees and zero per-transaction markup make SumUp a competitive option for businesses with low-volume and low-ticket sales. There is also a relatively low chargeback fee of $10; strictly speaking, this fee is paid not to SumUp itself but to its provider partners.

The app itself comes with an inventory management function that’s easy to set up, or you can simply process charges manually with notes. In addition to card processing with a basic POS system, you can send links, create QR codes, set up an online store for free (Shopify charges for this), and even create digital gift cards.

However, you must pay an extra monthly fee of at least $99 for POS functions. SumUp also has no same-day funding option and no interchange-plus pricing.

- Monthly costs:

- POS plan: $99-$289 (Optional)

- Payment app: $0

- In-person transaction: 2.6% + 10 cents

- Online and manually keyed-in transaction: 3.5% + 15 cents

- Virtual terminal processing: 3.25% + 15 cents

- Gift card processing: 3.25% + 15 cents

- Invoice processing: 2.9% + 15 cents

- Chargeback fee: $10 payment provider fee

- Mobile card reader: From $54

- Cheaper for low-ticket sales: Like Payanywhere, SumUp offers good rates for low-ticket sales. Compared with Square and Zettle, your low-ticket transactions will be cheaper with SumUp.

- POS system: SumUp offers its own POS system; however, unlike Square, this is a separate add-on service that will cost you up to $289 per month. Payment processing fees are slightly lower than when using the mobile card readers. It’s 2.6% + 10 cents for in-person and 3.5% + 15 cents for online and keyed-in transactions.

- Basic in-app invoicing: SumUp also offers a free invoicing tool with customizable invoices, embedded payment links, and automatic reconciliation between payments and open invoices. You can create and monitor invoices right from the app, including resending overdue invoices.

SumUp gives you a free invoicing tool and tap-to-pay functions. (Source: SumUp)

Average user scores come in at around 4.7 out of 5.

Payanywhere: Best for Restaurants & Bars

Pros

- Low fees on small transactions

- Free restaurant-specific tools

- Same-day payouts

Cons

- Complaints about hidden fees

- $3.99/month inactivity fee

- No free hardware

Overview

Who should use it:

Food and beverage-based small businesses wanting lots of mobile hardware options and industry-specific features

Why I like Payanywhere:

Payanywhere is a mobile-first solution with free built-in payment processing and a POS app designed for restaurants, bars, and food trucks. It rivals Square in features (see more details in our Payanywhere vs Square comparison). It also offers a range of card readers and mobile smart terminals with competitive processing fees, especially for small-ticket items. Like Square, Payanywhere works offline and can manage different payment options like open tickets, tipping, split payments, and even signature capture.

Overall, Payanywhere has a robust and easy-to-use credit card payment app with a mobile POS system. It offers a free same-day payout, something many other processors don’t do. However, some of Payanywhere’s hardware is quite expensive, you must pay extra for some POS functions, and chargeback fees are not transparent.

- Monthly fees: $0 (mobile POS)

- Payanywhere software used on POS hardware: Up to $39.95 per month

- Card-present fee: 2.69%

- Keyed-in fee: 3.49% + 19 cents

- Mobile card reader: $59.95 (3-in-1)

- Inactivity fee: $3.99/month after 12 months of inactivity

- Fast payouts: Payanywhere has next-day funding with a 10 p.m. cutoff time. However, if you have later hours, you can get a “same-day” funding option with a 10:30 a.m. cutoff time, so your transactions from overnight will be deposited later that day. (Saturday and Sunday deposits will appear on Mondays.) This is the fastest turnaround of the systems on our list and, even better, comes with no added fees.

- Restaurant features: Payanywhere offers open tabs, split payments, and tip functions that make it a good choice for restaurants—and a good alternative to Square for Restaurants. If your tickets are smaller, like in food trucks, you may save money with Payanywhere. An offline mode is available as well.

- Employee management: Unlike most of the apps for credit card payments on our list, Payanywhere includes employee management tools through Homebase at no extra charge. This includes hiring tools, time clocks, scheduling, and tracking employee sales. See our full Homebase review for more details.

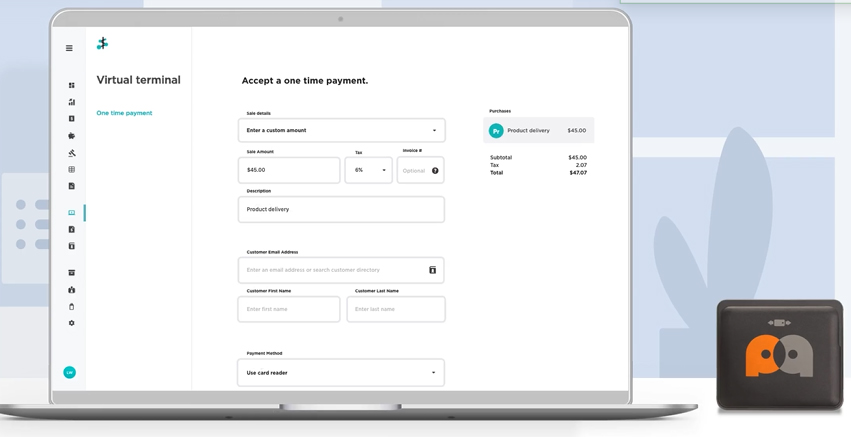

Payanywhere gives you a mobile virtual terminal plus tools for restaurants and staff management. (Source: Payanywhere)

Designed for both mobility and richness of features, Payanywhere is a good solution for restaurants and bars. App users gave it an average score of about 3.8 out of 5.

How to Choose the Best Credit Card Payment Apps

To choose the best app for credit card payments, consider the following:

- Versatility: Payment app that’s compatible with iOS and Android devices

- Payment convenience: Can accept payments straight from the mobile device

- With a card reader via swipe or tap and dip (through EMV chip)

- Without a card reader via digital wallets such as Apple Pay, QR codes, tap-to-pay, manual entry, and credit card scanning

- Scalability: Can grow with your business with add-ons and POS hardware

- Flexible pricing: Monthly fees for merchant accounts are affordable (or free) and transaction rates (including the pricing method) can match the budgets of small businesses and startups. Learn more about merchant accounts.

- Reliability: Works offline, with minimal downtime, and great user reviews.

Not sure where to start? If you are a first-time business owner or just simply looking for a better merchant or payments service provider alternative, check out our list of best merchant services and cheapest credit card processing companies for small businesses.

How I Evaluated the Best Credit Card Payment Apps

Testing each credit card payment app is at the core of providing the best recommendations for small businesses. We took that expertise and combined it with reviews from real-world businesses to find the easiest to use, then looked at other important factors for small businesses: price, versatility, and primary functions.

Square is the best app for taking credit card payments because of its ease of use and free POS. It’s also on our lists of best mobile POS apps and top-recommended payment processors in general. It’s a highly flexible program that works for the hobbyist or the full-time retailer with a store and ecommerce website.

Click through the tabs below for our full evaluation criteria:

25% of Overall Score

The best credit card payment applications have low transaction fees with no monthly subscriptions, either for use or for a POS system. They can be used both with or without a card reader.

25% of Overall Score

This criterion considered a payment app’s overall simplicity and range of payment features. We also evaluated real-life iOS and Android user reviews of each payment app.

25% of Overall Score

We considered each payment processor’s overall merchant services features—how fast you get paid, the chargeback policy and fees, ease of merchant account application and setup, and available business management tools.

25% of Overall Score

Frequently Asked Questions (FAQs)

Click through the sections below to learn more about credit card payment apps, how to use them, and how much they cost.

Credit card processing apps are convenient for offering cashless transactions. They allow merchants to accept credit card payments on the go, whether around the store, out for deliveries, or during client visits. Credit card payment apps are also often automatically synced to POS systems, so they update sales, inventory, and cost data in real time.

To accept card payments, a business will need at minimum a POS system and a card reader device. This device can be a standalone mobile device, part of a countertop POS kit, or even a small device that attaches to a smartphone.

We consider Square the best credit card payment app. It has a free plan, gives you one free mobile card reader, offers reasonable fixed processing rates, and provides strong chargeback protection. Square is reliable, versatile, and highly popular among users.

Credit card payment apps are usually free to download and use. The only fees you will pay are the cost of transactions and the monthly fee for your merchant account (if any).

Some payment processors allow for surcharging, which lets merchants avoid credit card processing fees by passing these fees onto customers. If you want to avoid paying these fees (at the cost of making your customers pay them instead), look for a processor that allows for surcharging.

Bottom Line

Whether you have a brick-and-mortar business with an online store or an artist who sells their creations at the local flea market, credit card processing apps for small businesses can make taking payments easy while helping you keep track of your sales. Some, like SumUp, offer simple POS systems for the smartphone, while others are more complex, like Square, which has extra programs for employee management, reservations, and even payroll.

Square is our choice for the best credit card payment app because while it can handle a multitude of business functions beyond credit card processing, it is also simple enough for the hobbyist or solopreneur. The system is free, and you’re only charged for processing transactions, so sign up for Square today.