Looking for houses to buy, fix, and flip is a different process than looking for a primary home or a long-term investment property. Houses for flipping are typically distressed or worn down and in need of a wide range of repairs or renovations, which flippers can leverage to make a profit once the property is fixed. Finding houses to flip in this condition can be challenging, but there are many ways to do it, like going to online listing websites, manually searching through public records, and implementing marketing and advertising strategies.

1. Visit Online Real Estate Listing Sites

One of the most popular and best ways to buy houses to flip is through real estate listing websites. They are generally easy to use and provide you with extensive property and local market data that help you learn how to find good houses to flip.

While popular listing websites are useful, those wanting to start a house flipping business will particularly benefit from websites that offer preforeclosures, for sale by owner (FSBO) sales, and auctions. These properties are often listed at lower prices than other properties of similar size and are frequently sold “as is.”

A few of the top real estate flipping websites include:

Listing Site | About the Site & Who It’s Best For | Learn More |

|---|---|---|

Zillow is the top real estate website, so it’s an ideal resource for finding homes to flip. It provides extensive search filters like price, square footage, location, type of property, and home features. It allows you to search for keywords like “as is” and “opportunity.” | ||

Realtor.com is another listing site that gets millions of users every month and provides detailed property and neighborhood information on every listing. | ||

Trulia is one of the most user-friendly real estate listing sites, with a powerful mobile app that makes it easy to search and filter properties from your phone. Its listings also uniquely provide “comparable sales,” so you can evaluate each property’s comps before running a complete comparative market analysis (CMA). | ||

This listing platform is specifically for commercial properties. LoopNet makes it easy to search for properties for lease, for sale, auctions, and even businesses for sale. Listings include extensive property and location details, like demographics, population details, and nearby businesses. | ||

This listing website specializes in foreclosures and preforeclosures, which helps you find houses before they hit the market. It also allows you to search bankruptcies, tax liens, as-is deals, and short sales all over the country. | ||

| FSBO.com is the top listing site for homeowners who are selling their properties without an agent. You can search through active listings in your state with property filters or look at foreclosures by state. | |

Auction.com stands out because it provides exclusive listing information for in-person and online auctions. You can look for foreclosures, bank-owned properties, and short sales, and use their calendar to attend in-person property auctions. | ||

| Craigslist is a well-known platform for buying and selling, but often forgotten as a source for finding houses to flip. Many homeowners post their homes for sale or for rent, but they don’t always include many details. However, when learning how flippers find houses, it’s a great source of leads. | |

This real estate listing platform for investors provides foreclosures, preforeclosures, bank-owned properties, and auctions. It also provides a selection of investment tools, like market trend reports, a long-term rental calculator, and a wholesale calculator. |

To search specifically for properties in the midst of foreclosure, check out Foreclosure.com or start using the widget below. Foreclosure.com has over 1.3 million listings in various stages of the foreclosure process, including fixer-uppers and as-is deals. Search for homes in your location and get property data for only $39.80 per month. This can help you learn how to find cheap houses to flip and increase your profitability and return on investment (ROI).

Powered by Foreclosure.com |

To get even more details on the best online property listing sites, visit our guide on How to Find Investment Properties for Sale in 5 Ways.

2. Meet With Real Estate Professionals

Local real estate professionals are valuable resources for any new or aspiring flipper learning how to find properties to sell. These professionals can include real estate agents, brokers, wholesalers, or mortgage brokers. They can provide you with firsthand insight into the local real estate market, ideal neighborhoods for finding houses to flip, and real-time updates on potential properties.

For example, here are a few ways each type of real estate professional can help you find properties to flip:

Real Estate Agents or Brokers | Wholesalers | Mortgage Brokers |

|---|---|---|

Agents and brokers are two of the best sources of information, properties, and connections you have available. They have access to the multiple listing service (MLS), a large pool of buyer and seller connections, and spend time in a variety of neighborhoods. They can pinpoint distressed properties or get in touch with distressed sellers more quickly than any other platform or lead source. | Wholesalers focus on finding distressed properties, but don’t have to also manage the purchase, renovation, and sale of each property. This means that they are more focused on finding deals and may be an incredible source of how to find houses to flip. In addition, their success depends on finding an investor like you to purchase the home. | Mortgage professionals may have inside information about homeowners struggling financially and looking for a way out of their homes. By being connected with a finance professional, you may be able to find a property before it’s even in preforeclosure and simultaneously help someone out of a bad situation. |

Once you’re ready to sell your fix and flip property, hire a real estate agent to help you—unless you decide to become a real estate agent yourself. Getting a real estate license can help you immerse yourself in the real estate world and maximize your profits. Learn the specific steps to get a real estate license in our complete guide on How to Get a Real Estate License in Every State.

3. Manually Search for Potential Properties

Even though most real estate transactions start with online listings, this isn’t the only way to find cheap houses to flip. And while offline strategies take more time and effort than searching online or speaking with real estate professionals, they can be a lucrative way to find properties to flip.

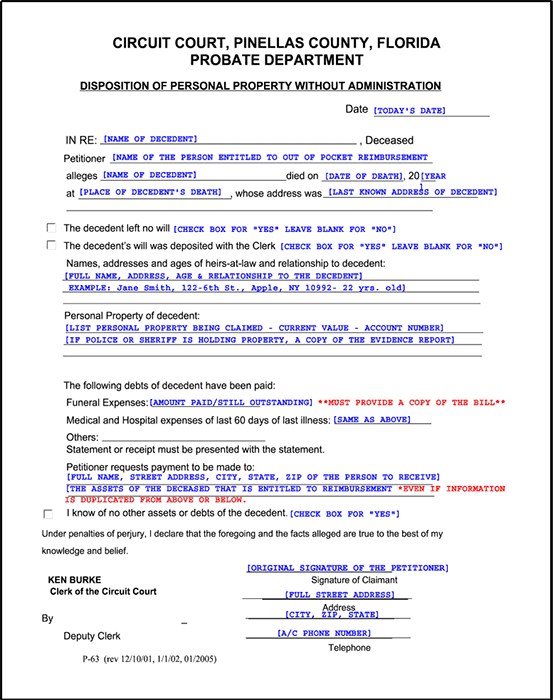

Sample probate document (Source: pdfFiller)

These are the primary offline strategies that real estate investors use to find potential flip properties:

- Public records: Search public records for properties with delinquent mortgage payments. This indicates that the homeowners may be in financial trouble, which means they may be open to receiving an offer to buy their home. Public records can be found at your local government office, but most agencies have an online presence where you can view and request records.

- Tax records: This is another way to find homeowners who haven’t paid their mortgages, which may make them motivated to sell their homes. Check your state’s Secretary of State website for details about how to view or access this information.

- Probate court: Probate properties are usually neglected homes because they’ve been left to someone who doesn’t want the responsibility. Attending probate court can put you in direct contact with someone who has a home they want to get rid of without the hassle of listing it on the market.

- Driving for dollars: This means actively driving through local neighborhoods and searching for distressed properties that could be flipped. It can be time-consuming and challenging, but it’s a great strategy to find off-market properties and essentially eliminate a competing investor from making an offer.

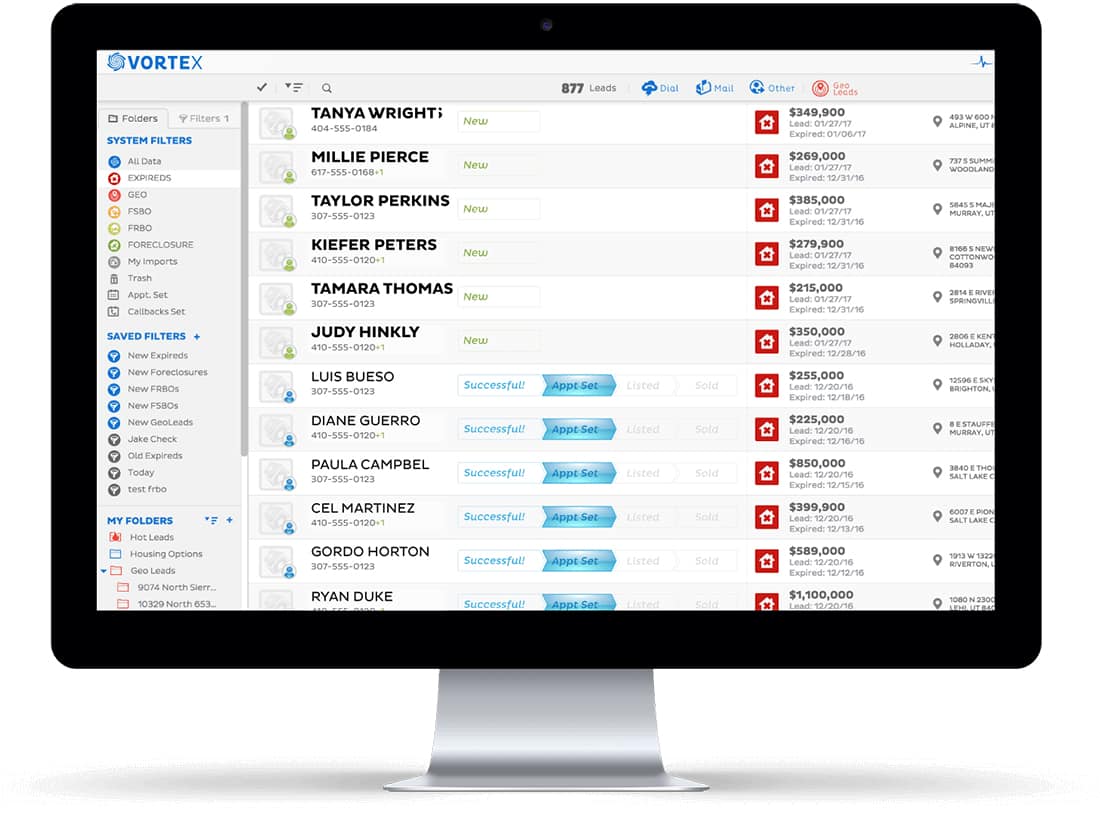

Contact information from REDX (Source: REDX)

As you continue to learn how to find homes to flip, you’ll find that these methods are effective, but time-consuming. An ideal way to find these leads without spending hours on manual searches is by using REDX, a prospecting platform that searches through thousands of databases. It provides the most updated and accurate information on FSBO properties, preforeclosures, and expired listings. It even includes an easy-to-use contact management system to stay on top of all communications and potential deals.

4. Engage in Networking

Building a network is a core element of any successful real estate investing business. The more connected you are with your network, the more likely they are to send you potential properties. For example, other local real estate investors are the most likely people to find distressed properties, and it may not be the right fit for their current financial or business goals.

A few simple ways to connect with other flippers and investors include:

- Associations: The Real Estate Investors Association (REIA) has local chapters in most states and cities, like the REIA of Washington. On the other hand, there are many standalone state-specific groups for flippers, like Brooklyn Flippers and Funders or Fix & Flip Real Estate Investors of Denver.

- Local events: Do a simple search for fix and flip groups and events on Google or Meetup.

- Real estate networking platforms: Websites like Flipper Force and REIClub have searchable directories to help you find local groups and events.

- Social media: Search for Facebook groups for investors and flippers, or search for social media profiles that talk about renovations and home flipping.

Example Facebook group for investors (Source: Facebook)

To successfully make money flipping houses, you need a variety of connections that include other real estate investors, real estate professionals, financial professionals, home improvement professionals, and active members of the community. These connections will not only help you learn how to buy cheap houses to flip, but also build awareness about your business. The more people who know that you are a flipper and want to buy worn-down properties to renovate, the more easily you’ll be able to find and contact home sellers.

Another reason to intentionally network with other investors is to find mentors who can help guide your decisions and minimize the learning curves of investing.

5. Implement Marketing & Advertising Strategies

While you’re learning how to find houses to flip and going through your first fix-and-flip, building a brand and developing authority in the community will help you build long-term success. A comprehensive marketing strategy and plan will be an essential step in continuing to find properties to flip.

Learning how to advertise your business and target distressed properties can be challenging for new investors, but there are various methods that can work for you. In fact, marketing and advertising as a home flipper is not much different from marketing as a real estate agent. Both methods involve pinpointing your audience and implementing a plan to reach them and bring awareness to your business.

Here are some of the most effective ways to market yourself and find properties to flip, as well as tools that can streamline your efforts:

Create a Website

A real estate website is like having a home base, where potential partners, sellers, or team members can learn more about you and decide whether to reach out to you. Even a one-page website with simple yet professional information about who you are and what you do can help you find houses to fix and flip.

Sample real estate template from GoDaddy (Source: GoDaddy)

If you choose the right tools, creating a website can be simple. GoDaddy makes it easy to choose a domain, purchase your domain and hosting, and use a template to set up a beautiful website in a matter of hours. It even includes options to have your website managed for you, so you can focus on your business.

Social Media

You don’t have to become an influencer or a professional marketer to use social media effectively. Approximately 4.8 billion people use social media, and they often use it to evaluate whether a business or person is worthy of their trust. By creating a simple yet consistent social media strategy and being active online, you can more easily build brand recognition, make connections, and become an authority figure for flipping houses in your area.

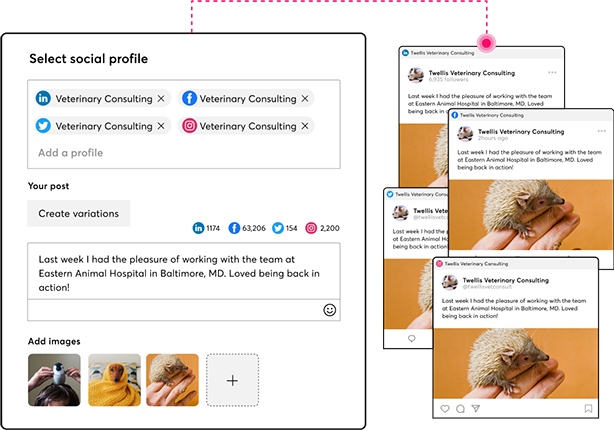

Social media post planner (Source: Constant Contact)

Plus, the right social media tools can make this process even easier and more effective. For example, Constant Contact is a marketing software that helps with email marketing, tracking leads, and optimizing social media content. It includes a built-in social media post planner to schedule content ahead of time, automatically share posts to multiple platforms, and optimize them with the right keywords and hashtags. It also includes easy-to-understand analytics to help you continually improve.

Read about other social media companies in our article 10 Best Real Estate Social Media Marketing Companies in 2023.

Online Advertising

In addition to your ongoing marketing strategies, advertising can help you reach thousands of people at a relatively affordable cost. Online advertising platforms like Google and Facebook also provide very detailed targeting options, so you are more likely to reach the exact audience you’re looking for, like people with distressed properties, FSBOs, or other investors. When you’re considering how to find houses before they hit the market, advertising is arguably the most direct way to find them.

Real estate Facebook ad freelancers (Source: Fiverr)

If advertising is a strategy that you’re interested in using but don’t have experience with, it’s wise to work with an expert. Although advertising can be learned, you can waste your time and money with the wrong ad strategy. Luckily, Fiverr makes it easy to find a variety of ad management professionals. Find freelancers to help you with almost any need, including real estate Facebook ads. It’s also easy to view each freelancer’s past work and testimonials, as well as establish the right budget.

Direct Mail

Mailers are seen as a more traditional method of marketing, but they’re still extremely effective for investors. In fact, some recent studies show that direct mail gets an average response rate of 5.3%, which is significantly higher than the rate for other marketing channels like email, which averages only 0.6%.

Direct mail can include:

MapMyMail builder for ProspectsPLUS! mailing list (Source: ProspectsPLUS!)

Plus, using a real estate direct mail service like ProspectsPLUS! automates the process, so you can send comprehensive mail campaigns without wasting time. It offers hundreds of different campaign types, each with various templates, so you don’t have to waste time on copywriting or design. ProspectsPLUS! also provides Every Door Direct Mail (EDDM) and mailing lists by geographic location, demographics, or lifestyle. It could be the solution you need to build awareness in your community.

Bandit Signs

You’ve probably seen real estate signs on street corners saying, “we buy houses.” These are called bandit signs and can be an affordable and effective way to capture the attention of homeowners in financial trouble. With VistaPrint, these signs are easy to design, customize, and order. You can even order unique and affordable yard signs in varying shapes, like an arrow or circle. There are also VistaPrint design professionals who can design signs for you.

Custom yard sign example (Source: VistaPrint)

6. Look Into Auctions

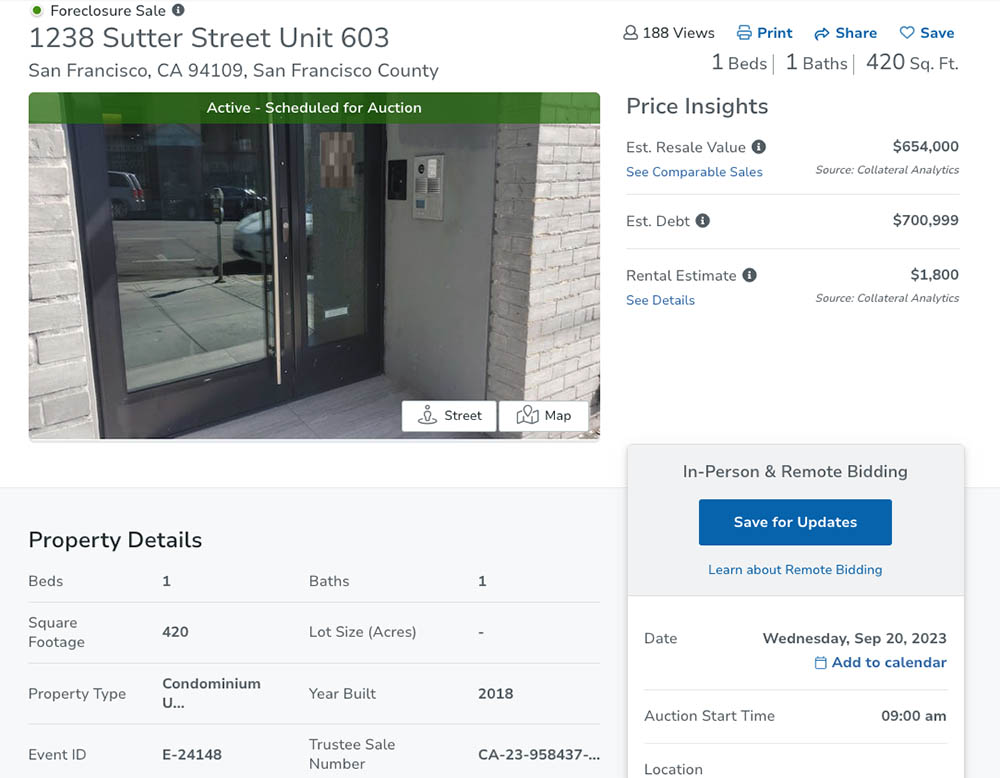

Most real estate auctions sell houses that are bank-owned, foreclosed, short sales, or in preforeclosure. This makes them an ideal place to find homes to flip because starting bids are usually well below market value, and the final sale amount only depends on your budget and your competition. Real estate auctions can happen in-person or online through platforms like Auction.com, RealtyTrac, or the government’s website for HUD Homes. You can also search for local auction houses near your location to attend a live auction.

Auction.com foreclosure listing (Source: Auction.com)

With online auctions, the due diligence paperwork and financial estimations are often included in the property listing. This makes it easy for investors to thoroughly evaluate the property before participating in the auction and increases the chances of getting a profitable deal. For example, Auction.com provides local comps, rental estimates, sales history, tax history, and neighborhood analyses on every listing.

7. Monitor Change of Life Circumstances

Another time when properties in good locations can be offered below market value is when major events happen, like divorce, death, an inheritance, or changes in the executor of an estate. Although this is an unfortunate situation, it creates an opportunity for home flippers to find profitable properties.

The ownership of a property is often automatically changed, and the person who inherits the house may not be able to pay for the mortgage or property taxes. If you can connect with these leads at the right time, you are more likely to get a great deal on a home and reduce the costs of flipping a house.

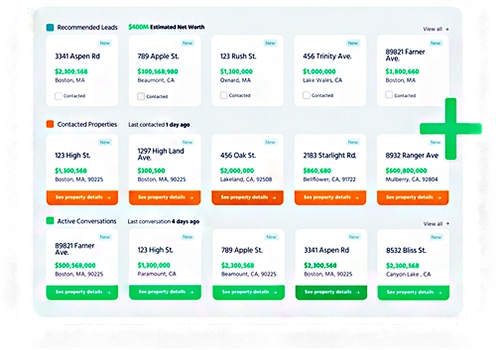

Catalyze AI lead dashboard (Source: Catalyze AI)

Instead of searching specifically for distressed properties, pay attention to changes in life circumstances in local neighborhoods to target potential deals. This is easy to do with Catalyze AI, an event-driven predictive analytics tool. It accurately predicts the buying cycles of consumers and homeowners by analyzing hundreds of millions of data points, therefore providing property leads that are more likely to need an investor’s help.

Frequently Asked Questions (FAQs)

When you’re figuring out how to find houses to flip, listing sites for niche properties will be more useful. For example, Foreclosure.com, Auction.com, and RealtyTrac specialize in listing preforeclosures, foreclosures, bank-owned homes, and short sales. However, the more popular and well-known listing sites like Zillow and Realtor.com are useful for gathering information about individual properties and comparable properties.

Although flipping houses is glamorized on television, investors know that the process is challenging and can be risky. However, ATTOM reports that home flippers generate an average profit margin of 22.5%, which is an approximate average of about $56,000. As long as you thoroughly and accurately evaluate potential properties and make wise financial decisions, flipping houses is still extremely profitable.

The most important part of buying a house to flip is choosing the right property. Make sure you start with a clear budget and evaluate potential properties thoroughly. Use the 70% rule and search for a property that costs no more than 70% of its after-repair value.

Bottom Line

One of the most common questions asked by aspiring house flippers is, “How do you find houses to flip?” Learning how to buy a cheap house and fix it up is challenging because there is plenty of competition for low-priced homes. However, by using the methods above, you’ll be able to effectively find off-market properties and grow your house-flipping business.