A personnel file is a paper or electronic folder kept for each employee—new, existing, and past—that contains HR and payroll documents. The documents within an employee personnel file should cover the entire employment lifecycle, from offer letters and W-4 forms to performance reviews and termination paperwork.

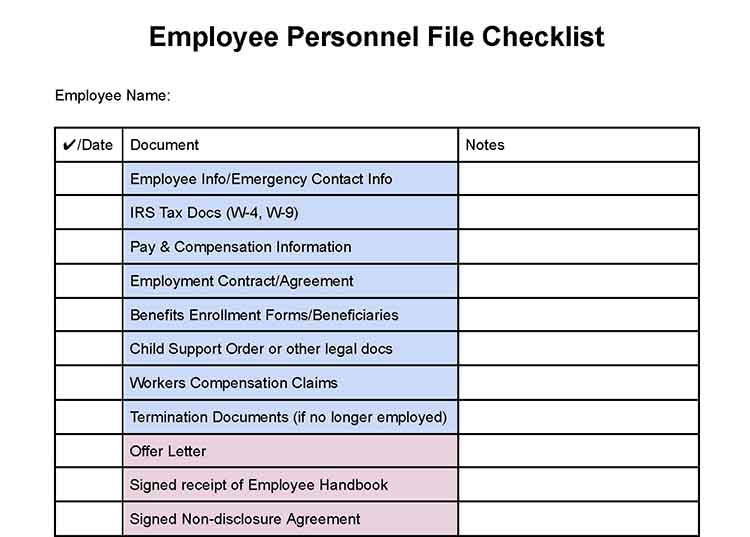

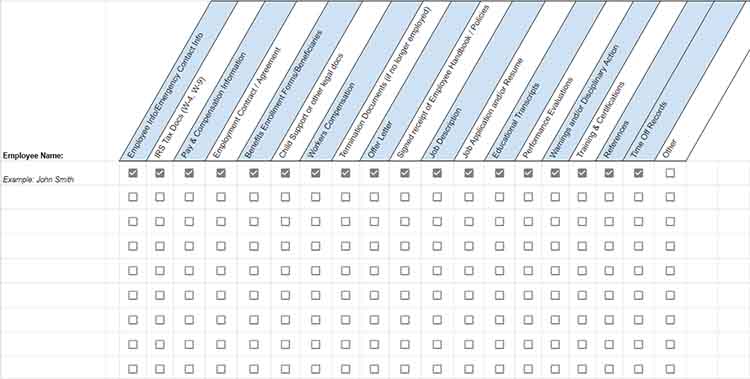

Download our free checklists to help you keep track of what employee personnel file records to store; these can be edited to add documents specific to your company.

What Should Be Included in a Personnel File?

As repositories of important information related to individual employees, employee personnel files should include legal documents, company documents, and employee documents.

What Should Not Be Included in Personnel Files?

There are also documents that you should not include in the employee’s personnel folder, primarily because of confidentiality. These include the following:

Document | Reason |

|---|---|

Pre-employment Records:

| Can expose sensitive information about an applicant that may not be relevant to their employment and violate privacy laws, such as the Fair Credit Reporting Act (FCRA), which requires employers to obtain explicit consent from applicants before conducting background checks. |

Worker Eligibility Documents:

| Contains personal information, like Social Security number, date of birth, and immigration status, which is a violation of employee privacy, according to the Privacy Act of 1974. |

Equal Employment Opportunity (EEO) Records:

| Can expose protected characteristics, like race, gender, or religion; which can result in a discrimination claim or violation of privacy laws if accessed by unauthorized personnel, including managers |

Medical/Health Information:

| Violates employee privacy laws, particularly the Americans with Disabilities Act (ADA), which prohibits employers from including medical information in an employee's general personnel file, as it could lead to discrimination based on health conditions. May also be protected by the Health Insurance Portability and Accountability Act (HIPAA), also referred to as health information privacy. |

Private Employee Data:

| May contain private and personal details of the employee, which is a violation of privacy laws. Additionally, it could lead to discrimination claims against protected classes. |

Best Practices to Maintain Employee Personnel Files

Business owners don’t always realize the importance of setting up personnel files until they’re audited or served with a lawsuit. If you are operating in hindsight and nervous about getting everything set up for employees that already exist, don’t stress.

Take Inventory

First, you need to take an inventory of what you already have for each employee. Ideally, create a personnel file for each employee on the date of hire. However, if you forget to do so, you can find personnel-related documents—like performance reviews and tax forms—in your email or online storage. Make sure you also have I-9s for each employee as well, but they should be kept in a separate file.

Use an employee personnel file checklist to make sure everything is in order. Each person might require their own list.

If there are documents on your list that you cannot find in your files, you can request these documents from your employees. Give each employee a copy of their checklist to show what they need to submit to update their personnel file. Set a due date for all employee documents to be in and completed.

Follow up with each employee you requested additional documents from before the deadline so that everyone has time to submit the missing documents.

Jump to Employee Personnel File Checklist Download

Limit Access to Sensitive Information

Only authorized personnel, including HR and relevant managers, should have access to employee personnel files. No other employee in the company should be allowed to access these records, as they contain sensitive information about the employee, such as disciplinary actions and tax and benefits forms.

The best way to ensure sensitive information does not end up in the wrong hands is to securely store documents, either in a locked cabinet or an encrypted online data storage—methods that reduce the number of people who can easily access the records.

Securely Store Documents

You can choose to manage the employee personnel files electronically or use a paper-based system; either way, it’s important to include basic employee reports and adhere to the appropriate federal and state laws.

You will want to store your personnel-related documents in a file folder marked specifically for each employee by name. Access to employee files should be limited to an authorized individual or department whose permission is needed to view the files, such as HR.

Personnel File Maintenance and Storage Options

Documents can also be stored online with an encrypted service. Many of the best payroll software and HR outsourcing services offer secure online document storage, including copies of employee contracts, policies, and a copy of your employee handbook.

With Rippling, you can create, distribute, and store all your HR documents in one place—plus gain access to modular HR, payroll, and IT solutions that connect seamlessly with each other. | ||

| Gusto has an all-in-one platform where your employee database is integrated with other features, like payroll, benefits, automated tax filing, and more. | |

Paychex offers a variety of services, from payroll processing and HR document management to full PEO services. Plus, it offers multiple plans and features designed to grow with your business. | ||

Bambee provides you with an HR Manager and an online platform to store HR documents, keeping your files in one central location and ensuring labor law compliance. | ||

Train Employees on Record-keeping Practices

Don’t assume that your human resources employees and managers know how to handle personnel files. They should be properly trained in what to do and what not to do. This involves setting clear expectations and establishing policies for creating, maintaining, and disposing of employee records.

If you are using digitized online storage for your personnel files, I recommend that you assign specific roles for record management, regularly audit records, and incorporate ongoing feedback and coaching to ensure compliance.

Establish a Regular Personnel File Audit

Schedule a periodic review of each employee’s personnel file as part of your HR compliance. This can be done when you conduct their annual performance evaluation. Ensure that the files are accurate, up-to-date, and complete. If not, you can ask the employee to provide you with the updated files or information. Your business should verify that files are in order before any audits, such as payroll or labor.

You can use a personnel file audit checklist to help keep track. Please note that personnel files can be viewed during a government audit or subpoenaed in the event of a wrongful termination lawsuit. Maintaining accurate, up-to-date files will help you avoid liability.

Jump to Employee Personnel File Checklist Download

Federal & State Laws About Personnel Files

As an employer, maintaining employee data and personnel files is part of maintaining compliance with federal and state law. Here are the best practices, as well as what is required, at the federal and state levels.

Federal Law

Federal labor laws apply to all employers covered by federal anti-discrimination laws, which is typically any employer with 15 or more full-time employees. However, the following laws apply to all businesses, and each agency has its own document retention requirements and guidelines.

- Recordkeeping Requirements (EEOC): requires that employers keep all personnel or employment records for at least one year. If an employee is fired, their personnel records must be retained for at least one year from the date of termination.

- Age Discrimination in Employment Act (ADEA): employers must keep payroll records for a minimum of three years. Additionally, employers must keep on file any employee benefit plan (such as pension and insurance plans) and any written seniority or merit system for the full period the plan or system is in effect and for at least one year after its termination.

- Fair Labor Standards Act (FLSA): employers must keep payroll records for at least three years. Also, employers must keep for at least two years all records that explain the basis for paying different wages to employees of all genders in the same establishment (including pay rates, performance reviews, seniority and merit systems, and collective bargaining agreements).

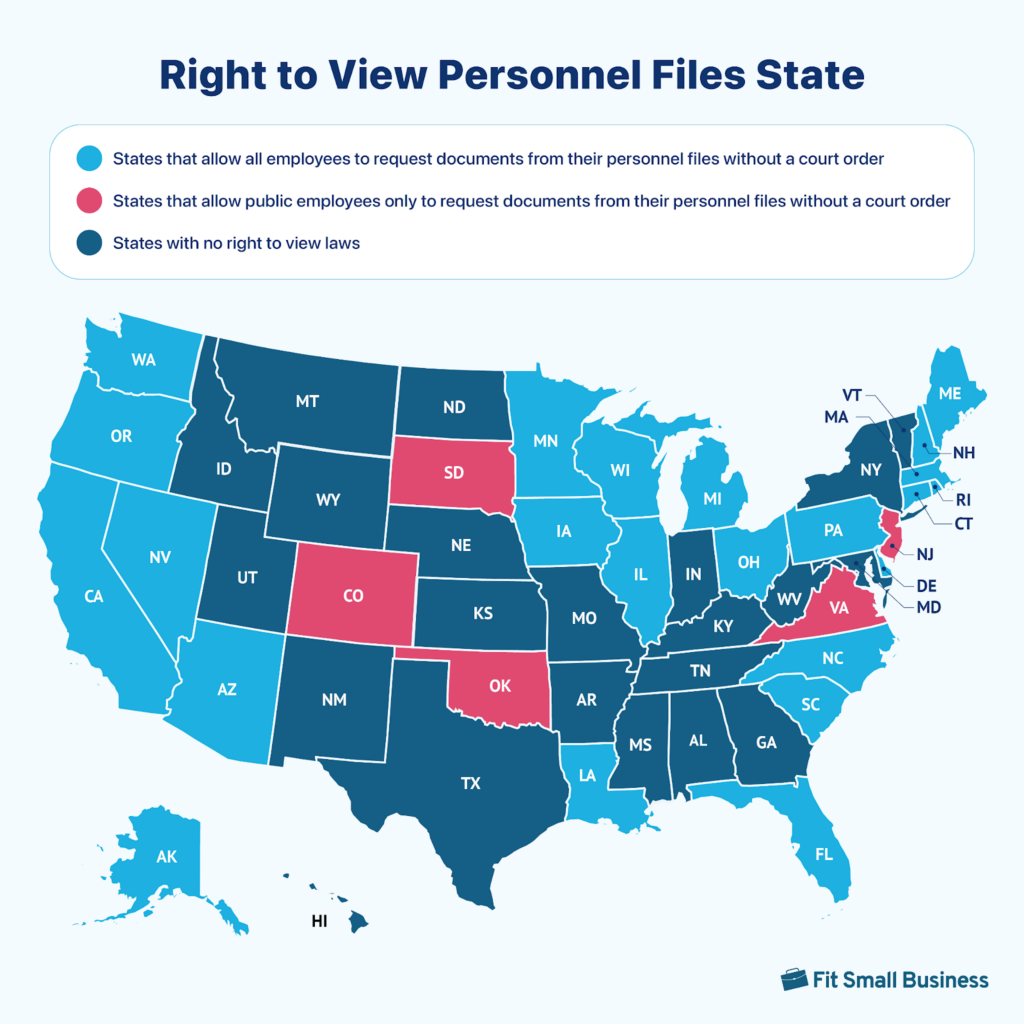

State Laws

State laws on personnel files revolve around whether or not an employee has a right to look at their personnel file. Many states have a provision that allows employees to request copies of personnel-related documents in their files. In other states, employees may have to file a lawsuit to see their personnel file.

Right to View States

The following states allow employees to see some or all of the documents in their personnel folder; many states are quite specific about what exactly employees are allowed to view. Others allow the employer to charge reasonable fees for document copies. For example, in Arizona, payroll records can only be viewed.

Please see your state’s Department of Labor (DOL) website for more specific details.

Current “right to view personnel file” states include Alaska, Arizona, California, Colorado, Connecticut, Delaware, Florida, Illinois, Iowa, Louisiana, Maine, Massachusetts, Michigan, Minnesota, Nevada, New Hampshire, New Jersey, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Virginia, Washington, and Wisconsin.

Personnel File Frequently Asked Questions (FAQs)

A personnel file contains documents that cover the entire employee lifecycle, from candidate status to termination. Some common items to keep in a personnel file include tax documents, employment applications, contracts, disciplinary action items, and termination paperwork (if applicable).

The employee may just want to see what personal information the company has on file and/or any disciplinary action notices. Former employees may also request their personnel files to see what information may be passed to their new employers, or if they intend to bring a lawsuit against their former employer. Some states require an employer to let their employees view their files.

Depending on the employment law, how long you keep certain records in employee personnel files differs. For example, the EEOC requires that employers keep all personnel or employment records for one year for all employees who are involuntarily terminated, while the IRS requires that you keep all employee payroll taxes-related documents for at least four years. I recommend keeping records for at least four years following the termination of an employee to remain in compliance.