Point-of-sale (POS) system costs vary by industry; expect to pay $0 to $400 per month for software, and $60 to over $3,000 upfront for devices, registers, and hardware kits—depending on your POS hardware preferences. This comes to a total of around $4,000–$10,000 per year, without factoring in additional costs for payment processing.

That price range is incredibly wide, so let’s break down the costs by type and industry to help you budget for the tools you need, and let you know if you are getting a good deal on a POS.

POS Costs at a Glance

Typical POS Costs | ||

|---|---|---|

Software | $0–$400+ per month | Some POS brands offer free baseline software subscriptions. Higher-level subscriptions with increased functionality will cost more. |

Hardware |

| Many cloud POS systems run on iPads or consumer-grade tablets. Devices such as card readers and receipt printers are available. |

Installation | $0–$600+ | You can self-install many POS systems, but complex systems might require on-site networking and installation. These fees are typically custom-quoted and can range from $250 to more than $1,000. |

Payment processing | Varies by processor; usually around 3% per credit card transaction | Some POS systems offer built-in payment processing, while others integrate with payment processors with different rates. Read our guide to payment processing fees to learn more. |

Add-on modules and integrations | $0–$100+ per month | Many systems offer expanded features for payroll, loyalty, online ordering, inventory, and more. If you opt into these tools, your costs may be higher. |

Average Annual Overall Costs: $4,000–$10,000 (payment processing not yet included) | ||

Cost of Popular POS Systems

Monthly software fees | Hardware costs | Installation fee | In-person processing fees | Contract length | |

|---|---|---|---|---|---|

$0–$60+ |

| $0 | 2.6% + 10 cents | Month-to-month | |

$39–$399 | $49–$399+ | $0 | 2.4% - 2.7% | Month-to-month | |

$89–$269 | $199+ for individual devices (Custom quotes may apply) | $0 | 2.6% + 10 cents | 1–3 years | |

$0–$165+ (Custom pricing available) | $0–$799 | $0–$299+ | 2.49% + 15 cents - 2.99% + 15 cents | 2 years | |

$59–$89 (Custom pricing available) | $300–$3,400 (Custom quotes may apply) | $0 | Varies by processor | Month-to-month | |

$99+ per terminal | $400–$1,000 (Custom quotes may apply) | $674+ | Varies by processor | 3 years |

Breakdown of POS Costs

Let’s take a look at the type of costs involved to get a POS system up and running for your small business, including software, hardware, and payment processing costs.

POS Software Costs

POS system software costs run from $0 to around $400 per month, the latter reserved for high-end subscriptions with advanced features.

For example, Square has a free plan that includes an online store, good inventory and customer management tools, and basic reporting functions. On the other end of the scale, Shopify’s Advanced Plan ($399 per month) gives you additional staff accounts, advanced reporting, ecommerce automations, and lower processing fees.

Learn more about Square, Shopify, and their similarities and difference with the following resources:

POS Hardware Costs

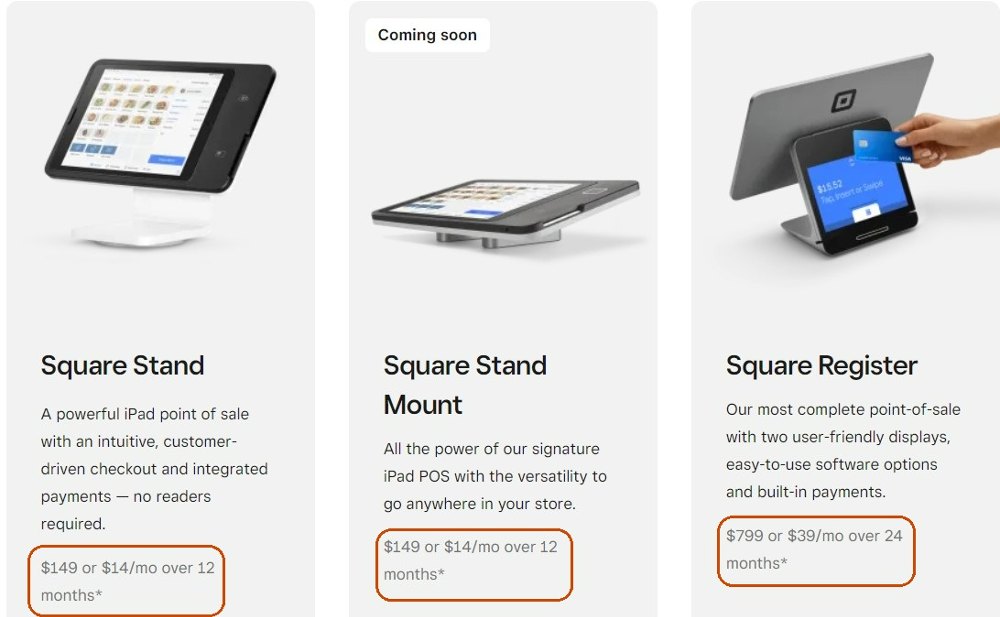

Individual devices designed to work with POS systems go for around $50 to $800. In some cases, you might be able to get free options: Square stands out for offering one free card reader per account. On the higher end, a Square Register system will run you around $800 but gets you all the software and hardware you need in a POS, including a customer display that accepts various payment types and an offline processing mode.

Learn more about the best POS hardware options for small businesses.

POS Payment Processing Costs

Credit card processing fees vary by provider—some are flat-fee percentages, while others use interchange-plus pricing, for example. Which you choose will depend a lot on your sales volume, credit score, and business type. As with POS in general, shops selling high-risk products will have limited options for payment processing. And, this is one area where those high-risk businesses will likely pay higher prices.

Typical payment processing rates look like the following:

- In-person card rates: Up to around 2.99% plus 10–15 cents per transaction

- Manually keyed-in rates: Up to around 3.5% plus 15 cents per transaction

- Online processing rates: Up to around 2.9% plus 30 cents per transaction

POS System Costs by Industry

Many sales-based industries have specific POS needs, and there are many different POS brands designed to meet them. Costs can vary considerably between small independent retailers and service businesses, or between food trucks and full-service restaurants. Expand the sections below to see average POS costs by industry.

Independent retailers can often set up a simple retail POS system for free. However, high-volume or multilocation shops may have more demanding configurations that require a professional installation fee. These businesses might also be better served by a POS like Revel, which is designed to work with several locations but does not have a free plan.

If you’re running a multilocation retail chain or are a retail franchise, you may run a proprietary POS system. Instead of using services like Square or Lightspeed, your company builds and maintains its system. The costs of this can be astronomical if you’re the business owner. However, if you’re a franchisee, it removes all of the guesswork of picking a POS system.

In addition to your POS costs, you’ll need to consider the costs of payment processing. Retailers can expect to pay 2% to 3% on in-person transactions, which adds up to $5,000 to $7,500 annually for a shop that processes $250,000.

Retail POS Cost Breakdown

Retail POS software subscription price: $0–$400 per month | ||

x 12 months = $0–$4,800 per year | ||

Retail POS hardware | ||

Hardware type | Necessary/Optional | Average price range |

Stationary terminal | Necessary | $300–$800 |

Customer-facing displays | Optional | $125–$350 |

Handheld terminal | Optional | $300–$500 |

Barcode scanner | Necessary | $120–$200 |

Tap, dip, and swipe card reader | Necessary | $50–$125 |

Receipt printer | Necessary | $290–$400 |

Barcode label printer | Optional (but very useful) | $120–$500 |

Cash drawers | Necessary if you accept cash | $130–$300 |

Integrated scales | Necessary if you sell items by weight | $500–$1,500 |

Inventory management devices | Optional (but useful for high volume) | $75–$300 |

Average hardware cost: $755–$5,600 | ||

Average overall retail POS cost: $755–$8,500 | ||

Restaurant POS systems can be very complex, but these providers are also well-versed in training business owners to use their systems. Many modern restaurant POS systems are self-installable with a little virtual guidance. But if you need hardware that is spill-proof and can withstand a high volume of use, you’ll likely pay more than retailers or service businesses do.

In addition to your POS costs, you’ll need to anticipate card processing fees. Restaurants should expect to pay at least 2% to 3% in processing fees, though if you accept online payments for takeout and delivery orders, rates are closer to 3.5% to 5%. For a restaurant that processes $1,000 per day in in-person transactions, the fees range from $7,300 to $10,950 annually.

Restaurant POS Cost Breakdown

Restaurant POS software subscription price: $0–$300 per month | ||

x 12 months = $0–$3,600 per year | ||

Restaurant POS hardware | ||

Hardware type | Necessary/Optional | Average price range |

Stationary terminal | Necessary; usually multiple | $300–$800 |

Handheld terminals | Optional, but increasingly popular | $300–$500 |

Barcode label printer | Optional | $120–$500 |

Customer-facing displays | Optional | $125–$350 |

Receipt printer | Necessary | $290–$400 |

Tap, dip, and swipe card reader | Necessary | $50–$125 |

Kitchen printer | Necessary; usually multiple | $200–$400 |

Kitchen Display System (KDS) | Optional (useful for high volume and quick service) | $500–$2,500 |

Barcode scanner | Optional | $120–$200 |

Cash drawers | Necessary if you accept cash | $130–$300 |

Digital menu board | Optional (but useful for high volume) | $200+ |

Wireless Routers (Cloud-based POS) | Necessary (for most cloud-based systems) | $30–$200 |

Server (Legacy POS) | Necessary (for legacy systems) | $400–$1,000+ |

Average hardware cost: $2,160–$7,770 | ||

Average overall restaurant POS cost: $2,160–$11,300 | ||

Note on Handheld Terminals: Handheld terminals are technically optional for restaurants. But since they easily support tableside payments, they have become increasingly popular as they help restaurants remain EMV-compliant. If your restaurant is not EMV-compliant—accepting chip and tap payments without the card leaving the customers’ sight—you will lose many chargeback disputes, which can get costly.

Café POS systems are something of a hybrid between restaurant and retail systems. Since cafes generally have a small kitchen (if they have one at all), they’re much less complicated and expensive. And, since they sell smaller, inventory-based food items, their POS functions more like a retail system, with a couple of tablet POS terminals at a central counter. If your cafe offers drive-thru service, however, you may need a slightly more complex system to manage that channel.

Cafes should also anticipate paying 2% to 3% per in-person digital payment. In the unlikely case that your cafe accepts online orders with online payments, the fees are closer to 3.5% to 5% per transaction. So, if your cafe processes $1,500 per day, you’d be looking at $10,950 to $16,425 in annual processing fees. Many cafe-focused POS systems like TouchBistro offer cash-discount settings that help you offset these costs.

Cafe POS Cost Breakdown

Cafe POS software subscription price: $0–$300 per month | ||

x 12 months = $0–$3,600 per year | ||

Cafe POS hardware | ||

Hardware type | Necessary/Optional | Average price range |

Stationary terminal | Necessary; sometimes multiple | $300–$800 |

Customer-facing displays | Optional, but popular | $125–$350 |

Handheld terminal | Optional | $300–$500 |

Barcode scanner | Necessary | $120–$200 |

Tap, dip, and swipe card reader | Necessary | $50–$125 |

Receipt printer | Necessary | $290–$400 |

Barcode label printer | Optional (but very useful) | $120–$500 |

Cash drawers | Necessary; sometimes multiple | $130–$300 |

Kitchen printer | Necessary of you have a kitchen | $200–$400 |

Kitchen display system (KDS) | Option if you have a kitchen | $500–$2,500 |

Average hardware cost: $1,350–$4,775 | ||

Average overall cafe POS cost: $1,350–$8,375 | ||

Systems that cater to spas, salons, and wellness businesses usually include a combination of appointment scheduling, invoicing, and retail features. They may also include features for charging recurring membership fees (as for a gym) or weekly booth rental fees (as in a salon). Examples include Square Appointments, Fresha, Vagaro, and Acuity Scheduling, some of which offer free baseline software.

Since most health and wellness businesses are appointment-based, they don’t require much in the way of hardware. But it is common for spas and wellness businesses to invest in customer-facing tablets for intake forms, and tablets for each service provider to record client notes. Payment processing fees generally run from 2.5% to 4%, depending on your sales volume and business type. So, a salon that processes $245,000 annually can expect to pay $6,125 to $9,800 in yearly processing fees.

Health and Wellness POS Cost Breakdown

Health and Wellness POS software subscription price: $0–$90 per month | ||

x 12 months = $0–$1,080 per year | ||

Health and Wellness POS hardware | ||

Hardware type | Necessary/Optional | Average price range |

Stationary terminal | Necessary | $300–$800 |

Customer-facing displays/ tablets | Optional (though necessary for some businesses) | $125–$350 |

Handheld terminal | Optional; increasingly popular for beauty services | $300–$500 |

Barcode scanner | Necessary | $120–$200 |

Tap, dip, and swipe card reader | Necessary | $50–$125 |

Receipt printer | Necessary | $290–$400 |

Cash drawers | Necessary if you accept cash | $130–$300 |

Average hardware cost: $815–$2,695 | ||

Average overall health and wellness POS cost: $815–$3,775 | ||

A food truck POS must be mobile, wirelessly connected to the internet or cellular signal, and take up as little space as possible. Most trucks get by with a single terminal and card reader, but if your truck is popular (and we hope it is!), you’ll want some handheld terminals to quickly bust through long lines. With limited menus, most trucks can also use free POS software for the long term. In fact, the baseline version of our top-ranking food truck POS, Square for Restaurants, is entirely free to use; all you’ll pay are processing and hardware fees.

Food trucks tend to be lower-volume businesses than others on this list, so processing fees may be higher, in the 3% to 4% range. If you accept online payments for mobile orders, you’ll pay fees closer to 5% on those transactions. A food truck that processes $100,000 per year should expect to pay $3,000 to $5,000 in processing fees; though you may be able to offset these fees by offering a discount to customers who pay with cash.

Food Truck POS Cost Breakdown

Food Truck POS software subscription price: $0–$60 per month | ||

x 12 months = $0–$720 per year | ||

Food Truck POS Hardware | ||

Hardware type | Necessary/Optional | Average price range |

Tablet terminal | Necessary | $200–$500 |

Customer-facing displays | Optional | $125–$350 |

Handheld terminal | Optional; popular for high-volume trucks | $300–$500 |

Tap, dip, and swipe card reader | Necessary | $50–$125 |

Receipt printer | Necessary | $290–$400 |

Cash drawer | Necessary if you accept cash | $130–$300 |

Kitchen printer | Necessary | $200–$400 |

Kitchen display system (KDS) | Optional (but useful for high volume) | $500–$2,500 |

Secure, cellular-enabled wireless router | Necessary | $30–$200 |

Average hardware cost: $1,115–$3,655 | ||

Average overall food truck POS cost: $1,115–$4,375 | ||

Factors That Impact the Cost of Your POS System

Several factors influence the overall cost you will incur for your POS system. The biggest factor will be the type of POS you need. A mobile business, such as selling at a craft fair, is going to need minimal hardware and software compared to a large brick-and-mortar retail shop or a restaurant. The type of POS is just one of the reasons POS costs can vary so widely.

Here are some other factors that influence how much you will pay for your POS:

- Business size: Solo ventures, startups, small and midsize businesses, large enterprises, and corporate giants each need different types of hardware and software. The smaller your business’s footprint, the less you can expect to spend on your POS.

- Industry: Retail clothing shops have different needs compared to restaurants, and therefore have a wide difference in their POS setups. The POS system you choose should be tailor-made to the type of business you run. Software that handles complex analytics or ingredient-level inventory tracking (which a restaurant might want) will be more expensive than basic software that simply tracks payments.

- Product type: Products for which sales are regulated by law (like tobacco, CBD, and cannabis) are considered high-risk. Many POS brands do not support high-risk businesses, so your POS options may be limited from the beginning. There are systems that support high-risk businesses, and they are not always more expensive. The size of your business and the number of terminals you need will likely have more of an impact on the price you pay.

- Hardware needs: Tablet-based POS systems are very popular with bars, restaurants, retail stores, mobile businesses, and any seller wanting high sales mobility. Retailers typically need a mix of stationary countertop POS systems and mobile-based POS systems. Stationary hardware typically contains more comprehensive features and also costs more.

- Software: A small retail shop needs software that handles simple inventory, payments, basic reports, and possibly time-tracking and employee management. Larger businesses may need more advanced inventory and reporting, ecommerce integrations, full-spectrum employee management, and multi-location rewards programs. The more functions you need, the pricier your POS will be.

- Payment processing: Some POS systems require businesses to use a third-party payment processor to collect sales, but many POS systems come with built-in POS processing with set rates. These set rates typically fall within a range of about 2% to 3%, with online payments reaching 3.5% or so.

Need tools for a high-risk business? See our guide to the best merchant services providers for high-risk businesses and our ranking of the top vape shop POS systems.

How to Budget for a POS System

While your POS system should be one of your business’ top-budgeted priorities, you should explore all available cost-saving options before you commit to the full cost of a POS. There are a lot of different ways to bring down the costs of a POS: paying your software fees annually, using the brand’s preferred payment processor, and more.

Many POS systems allow you to choose whether you want to pay month-by-month or for a whole year or more upfront. Businesses that don’t have much cash on hand might find monthly billing better for their cash flow, while more established businesses will find the discounts offered by annual plans to be more attractive. Monthly contracts also make it easier to switch POS software if you are not satisfied and could be beneficial for new businesses that have not yet settled on a program.

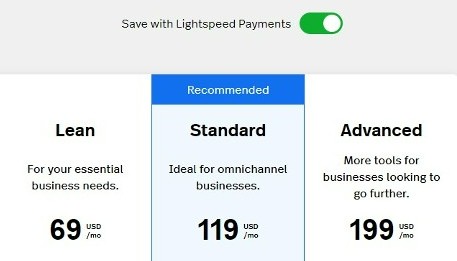

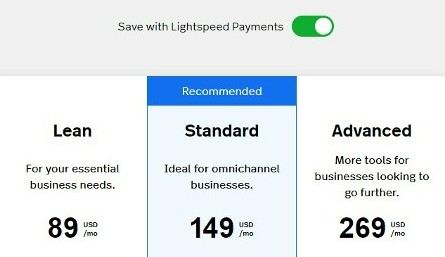

Paying software fees annually versus monthly saves Lightspeed Retail POS users $250 to $928 per year. (Source: Lightspeed)

Many POS systems offer integrated payment processing for credit, debit, and digital payments. In many cases—especially with cloud POS systems—this means the brand’s own built-in payment processor. If you opt to use a POS brand’s built-in processor, you’ll usually get a break on monthly software fees. Lightspeed, Revel, and TouchBistro are all examples of POS brands that offer both built-in and integrated processors.

If you are a high-volume retailer or restaurant with a proven sales history, you may get lower processing rates by shopping around with multiple payment processors. It pays to do the math and see which arrangement will save you the most money in the long run. And, if you get several estimates for payment processing, let your preferred POS brand know the rates you were quoted. In most cases, the POS brand will try to match or beat the lowest quoted rate (as long as you back it up with documentation). It’s also worth noting that if you run a successful business with a high sales volume (more than $250,000 processed per year), many providers will offer you special POS packages with tailored features and custom pricing.

Sometimes, however, built-in processing is your only option. Popular POS systems Square and Toast only offer their built-in processors. But both also offer volume discounts and tend to quote lower processing rates to high-volume businesses.

Like all things tech, POS systems are constantly improving—adding new features and becoming faster and more durable. If you purchase your equipment outright, it’s a one-time cost, and you won’t have to worry about monthly or yearly payments. If you lease equipment, you have the option to upgrade every few years.

However, leasing tends to come with extra monthly or yearly payments, and may require a lengthier service contract. For most small businesses like retailers and other brick-and-mortar storefronts with a few terminals, purchasing POS equipment outright is still the most economical option, even if you upgrade equipment every few years.

If you don’t have the cash on hand to pay for POS hardware upfront, many POS providers allow you to make payments on their systems. For example, Square discloses its interest-free installments clearly on its hardware online store. Many others offer extended financing options so you can pay for hardware over the course of a year or more. If hardware costs are the only thing preventing you from purchasing your preferred POS, you should always ask a sales representative about financing options. The POS market is competitive, and most brands will do what it takes to earn your business.

Square clearly lists installment pricing on its hardware website. (Source: Square)

In recent years, several POS brands have started offering their baseline POS software—and sometimes hardware—for no upfront cost. In most cases, these free or pay-as-you-go systems also offer more comprehensive software options for higher monthly fees, so you can expand your software as your business grows. Some brands—like the restaurant POS Toast—even offer free hardware to business owners that are willing to pay higher payment processing fees. The table below showcases a few popular POS brands that offer free baseline subscriptions.

Best for: Retailers, restaurants, and service businesses looking for versatility and transparency plus a mobile POS | Best for: Small bars and restaurants that only need 1-2 terminals | Best for: Specialty retailers like wine shops, vape shops, and independent grocers; or businesses with ticketing sales |

Free POS plan is $0 per month with no long-term contract | Starter POS is $0 per month with a 2-year contract; users can purchase 2 terminals at no upfront cost and 2.99% + 15 cents per transaction | Offers a free POS for up to 30 transactions per day without long-term contracts |

Read our review of Toast | Read our review of KORONA | |

POS System Costs Frequently Asked Questions (FAQ)

Square is your best bet. Its baseline POS is free and has impressive functionality and versatility. You’ll also get one free card reader. These tools alone may be enough to run a small business for the first few months.

All business types will need inventory management, staff management, marketing, and desktop terminals or mobile POS devices. Developed retail businesses will eventually want ecommerce options and an online store, while restaurants can go for online ordering and delivery.

Open-source systems like Odoo may have free plans. However, you won’t get the full spectrum of functionality unless you add modules or integrations, which often carry price tags. Open-source systems will also require maintenance and upgrading on your end.

Bottom Line

When everything is calculated, paid for, and processed, you can generally expect to spend $4,000 to $10,000 a year for your business’s POS system. That’s a huge range and varies depending on your industry, business size, revenue stream, and hardware needs. Mobile businesses and occasional sellers will have minimal costs, while brick-and-mortar businesses will need to pay higher rates for more sophisticated hardware and software setups. For a more specific cost estimate, find the best POS system for your business and request a direct quote.