QuickBooks is the most popular accounting software suite widely used by small businesses to manage their financial transactions. It lets you invoice customers, pay bills, generate reports, and print reports to be used to prepare taxes. The QuickBooks product line includes several solutions to support different business needs, including QuickBooks Online, QuickBooks Payroll, QuickBooks Time, QuickBooks Payments, and QuickBooks Checking.

QuickBooks Products

Not only is QuickBooks the dominant small business accounting software on the market today, but it also offers supplementary products to augment your overall QuickBooks experience. In addition to its accounting products—QuickBooks Online and QuickBooks Desktop—these are the other solutions that can help you manage the other aspects of your business.

- QuickBooks Checking: You can open a business checking account for free and enjoy no monthly fees or account minimums. Instant deposit is also available at no extra cost. You can apply for free via QuickBooks Online or sign up through QuickBooks Money, which doesn’t have the excellent features of QuickBooks Online.

- QuickBooks Payroll: With this, you can manage payroll easily. What’s more, you can track employee hours and billable time effortlessly with QuickBooks Payroll and QuickBooks Online.

- QuickBooks Payments: Formerly known as Intuit Merchant Services, this product lets you integrate payments seamlessly on QuickBooks Online. Get paid easily and process online payments effortlessly.

- QuickBooks Bill Pay: This new solution allows you to automate your accounts payable (A/P) workflows in QuickBooks Online.

- QuickBooks Time: QuickBooks Time, formerly TSheets, offers time-tracking features for employees to track client or project billable hours.

- QuickBooks Live: This is an online bookkeeping service wherein you can get a ProAdvisor to work with your bookkeeping needs.

- QuickBooks Capital: You can get additional financing options up to $150,000 with this product.

Fit Small Business’ Recommended QuickBooks Products

QuickBooks offers a suite of products that can enhance your experience and streamline operations. Here are our recommended product combinations within the QuickBooks ecosystem, categorized by your business size.

QuickBooks Pricing

To learn more about each product in greater detail, check out our in-depth reviews.

Product | Pricing starts at | Our reviews |

|---|---|---|

QuickBooks Online | $35 per month | |

QuickBooks Enterprise | $142 per month | |

QuickBooks Checking | Free with no minimum balance | |

QuickBooks Payroll | $50 plus $6 per employee, per month | |

QuickBooks Time | $20 plus $8 per employee, per month | |

QuickBooks Payments | $0; charges a fee per transaction | |

QuickBooks Bill Pay | $0 for five payments per month | |

QuickBooks Live | $300 per month | |

QuickBooks Capital | Contact QuickBooks |

What Does QuickBooks Do in Terms of Bookkeeping?

- Invoicing

- Bill and expense management

- Online payments

- Time tracking and billing

- Reporting

- Project management

- Payroll management

- Inventory management

- Tax preparation

- Read our QuickBooks Online review for details on the platform.

- If you need help deciding which subscription is right for you, check out our QuickBooks Online plans comparison.

- To stay updated on the latest features, check out our article on what’s new in QuickBooks Online.

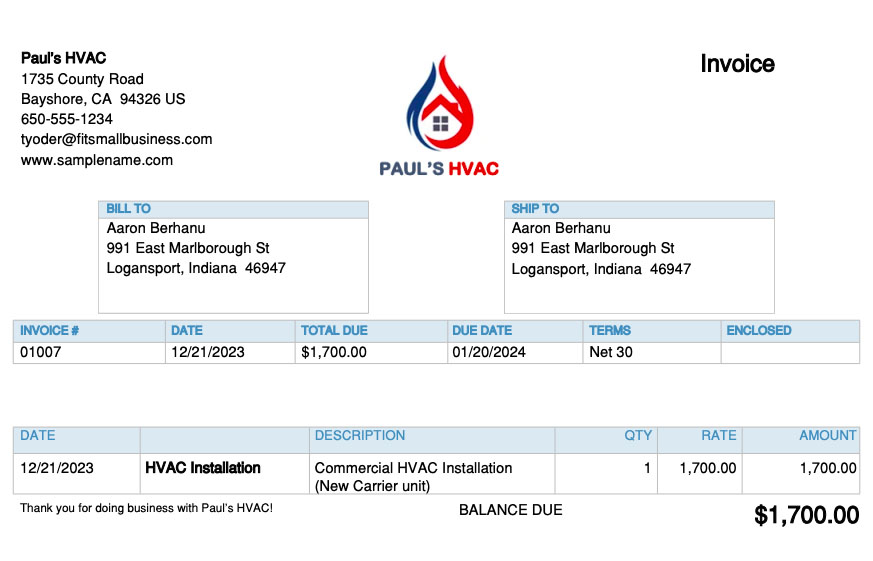

Invoicing

QuickBooks Online allows you to create invoices and either print them or email them to customers. You can create a new invoice from scratch or by converting an existing estimate into an invoice. The program is known for its customizable invoices—making it our overall best invoicing software. You can upload your company logo, select from different templates, change the invoice colors, edit invoice fields, and add personalized messages for customers.

Sample invoice in QuickBooks Online

Bill and Expense Management

QuickBooks allows you to enter new bills and expenses and keep track of them automatically by connecting your bank and credit card accounts to the platform. By doing so, all your expenses are downloaded and categorized automatically.

If you need to track a check or cash transaction manually, you can record it directly in QuickBooks in a few minutes. You can also add bills in QuickBooks when you receive them so that QuickBooks can help you track upcoming payments.

What’s more, you can set up scheduled bill payments in QuickBooks using QuickBooks Bill Pay, a new built-in feature that replaced the Bill Pay powered by Melio integration. Available in QuickBooks Online Essentials and higher plans, QuickBooks Bill Pay allows you to pay bills via bank transfer or check directly from QuickBooks in a few seconds and pay several bills at once.

Online Payments

You can add QuickBooks Payments so that customers can pay online directly from their emailed invoice. It is similar to other merchant services. However, because it’s integrated completely within QuickBooks, the sale, credit card fee, and cash deposit are all recorded automatically as they occur.

Time Tracking & Billing

Employees or subcontractors can enter their own time as they progress through the day, or a bookkeeper can enter their weekly time if the employee submits a manual timesheet. Time entered and assigned to a customer will be available to add to the customer’s next invoice.

Also, any expense entered can be marked as billable and assigned to a customer. As with time, these billable expenses will be available to add to the customer’s next invoice. You don’t need the payroll add-on to track employee time for billing purposes—you need at least the QuickBooks Online Essentials plan to track billable hours and the Plus subscription to track billable expenses.

Reporting

By managing all of your cash inflow and outflow activities in QuickBooks, you can print financial statements that provide useful information about how your business is performing. Lenders often require financial statements when you apply for a small business loan or line of credit.

You can run basic reports, like profit and loss, balance sheets, and statements of cash flows, and more advanced reports, such as A/P and A/R aging reports and profit and loss by class.

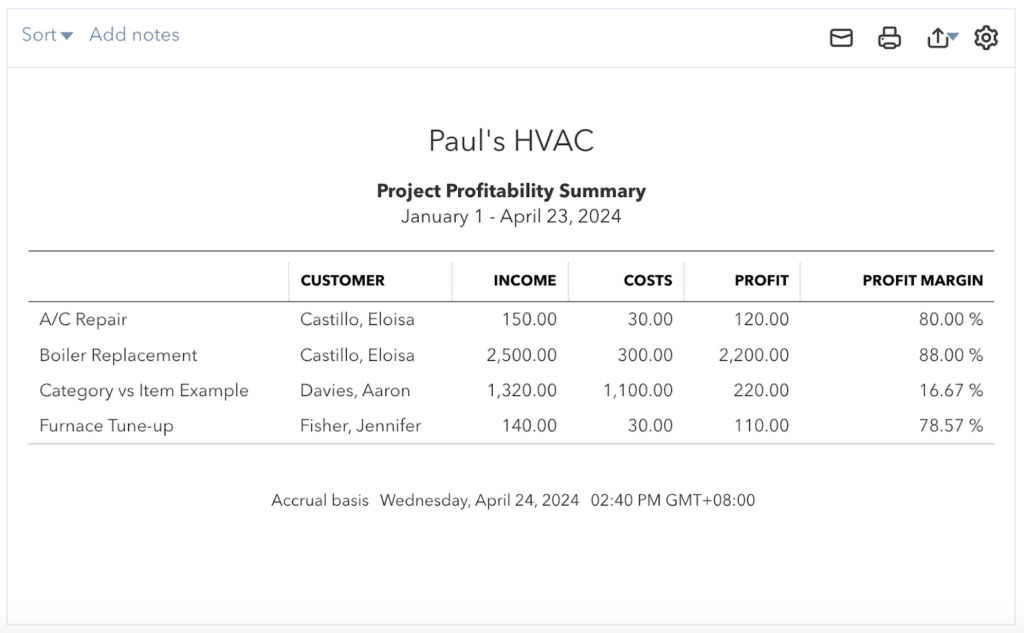

Project Management

You can use QuickBooks Online Plus or Advanced to create and manage projects, assign income and wages to a project, and track expenses associated with labor and materials. QuickBooks Online’s project accounting module also allows you to generate project estimates and include inventories, labor, and sales taxes. You can monitor the profitability of each project you’re working on by generating a project profitability summary report.

Sample Project Profitability Summary report in QuickBooks Online

Payroll Management

Payroll is an area that you don’t want to skimp on and try to do manually. Mistakes made in calculating paychecks can result in steep penalties and unhappy employees.

QuickBooks has its own payroll function that can automatically calculate and run payroll as often as you need. The best thing about using it is that it’s integrated with QuickBooks, so your financial statements are always up to date as of the latest payroll run. You have to purchase a QuickBooks Payroll subscription to run payroll, but you have several levels of service to choose from to fit your needs.

Running your payroll through QuickBooks will allow you to:

- Pay employees with a check or direct deposit

- Calculate federal and state payroll taxes automatically

- Have QuickBooks fill in the payroll tax forms for you

- E-pay your payroll taxes directly from QuickBooks

See Intuit’s video on how small businesses use QuickBooks Payroll.

Inventory Management

Available in QuickBooks Online Plus and Advanced plans, the inventory management feature helps you track the quantity and cost of your inventory. As you sell inventory, QuickBooks will allocate a portion of your inventory to the cost of goods sold (COGS) automatically, which is an expense account that reduces your income.

This allocation is a requirement for calculating taxable income and is very cumbersome to do by hand. QuickBooks can also remind you to order inventory automatically when quantities are low.

Tax Preparation

By far, the largest headache in preparing a tax return is compiling your income and expenses. If you use QuickBooks during the year, all you need to do at tax time is print your financial statements. Better yet, with QuickBooks Online, you can invite your tax preparer to access your account directly so that they can review your numbers and print whatever information they need to prepare your return.

If you’re using QuickBooks Online, you or your accountant can easily transfer all the needed tax information through a tax preparation program like TurboTax. Bookkeepers and accounting professionals using QuickBooks Accountant can simplify tax preparation through ProConnect, a professional tax management solution.

Our related resources:

Other Things You Can Do With QuickBooks

Depending on your QuickBooks product and plan, you may access additional features, including:

- Receipt scanning: QuickBooks allows you to take a picture of a receipt through the mobile app and upload it to QuickBooks Online in a few minutes. You can upload unlimited receipts to QuickBooks as the receipts are stored in the cloud along with your data.

- Mileage tracking: For employees and individuals who use their personal vehicles for business purposes, QuickBooks allows them to keep a record of the date, miles, and purpose of their trips.

- Integration: If you’re using QuickBooks Online, then you have access to a wide array of third-party integrations. In addition to some native QuickBooks Online integrations—such as QuickBooks Payroll, QuickBooks Time, and QuickBooks Payments—QuickBooks Online connects with popular apps. These include PayPal, Melio, HubSpot, Expensify, LeanLaw, Square Payroll, and Expensify. See the best QuickBooks Online integrations for small businesses and the best Shopify integrations for QuickBooks.

- Sales tax management: QuickBooks can help small businesses manage their sales tax obligations by calculating sales tax, preparing sales tax returns, and generating reports on sales tax liability. It can calculate sales tax for transactions automatically based on the tax rates and rules for the customer’s location.

- Mobile accounting: Available for Android and iOS devices, the QuickBooks Online mobile app lets you create and send invoices, accept payments online, and assign expenses to projects or customers. You can also track your business mileage and view financial reports from your smartphone

- Assisted bookkeeping: You can seek assisted bookkeeping support through the QuickBooks Live add-on or in the form of a QuickBooks ProAdvisor. Check out our QuickBooks Live review for more information on this bookkeeping add-on. We also suggest reading our article on how to find a QuickBooks ProAdvisor for step-by-step guidance.

- Fixed asset management: Available exclusively in QuickBooks Online Advanced and QuickBooks Enterprise, the fixed asset accounting tool allows you to add, manage, and track fixed assets, like buildings, vehicles, machinery, and equipment. QuickBooks automatically calculates depreciation expenses based on the depreciation method you choose, such as straight line and double declining. For this, we prepared a guide on how to use the QuickBooks Online Fixed Asset Manager.

- Business checking: QuickBooks Checking is a free business account with no monthly fees and balance requirements. Available for QuickBooks Online users, this online-only banking solution lets you process instant deposit payments (requires QuickBooks Payments), use the free Visa debit card called the QuickBooks Debit Card, generate business balance projections, and more. You can learn more about this solution through our QuickBooks business checking review.

- Lending: QuickBooks Capital is a lending service by QuickBooks that allows users to borrow loan amounts from $1,500 to $200,000 with terms from six to 24 months. It’s available exclusively for businesses that have earned over $50,000 within the past 12 months.

Other QuickBooks Bookkeeping Options

- QuickBooks Solopreneur: QuickBooks Solopreneur is new, replacing QuickBooks Self-Employed. It is designed for one-person businesses and has very basic features, including invoicing, expense tracking, and mileage tracking. It also includes features for filing Schedule C with Form 1040, making it suitable for solo proprietors and single-member LLCs. For more information, check out our review of QuickBooks Solopreneur.

- QuickBooks Ledger: This product is another new version of QuickBooks Online, but it’s built exclusively for QuickBooks ProAdvisors and accounting professionals using QuickBooks Online Accountant. It’s great for accountants who serve after-the-fact and tax-only clients without the need for typical financial management features like invoicing and bill management. Read our QuickBooks Ledger review for more details.

- QuickBooks Desktop: QuickBooks Desktop comes in three versions: Pro, Premier, and Enterprise (Pro and Premier have been unavailable to new users since August 1, 2024). Prices for Enterprise start at $1,410 per year for one user, and its higher version, Diamond, can accommodate up to 40 users. QuickBooks Enterprise is for large operations with complicated pricing and heavy inventory. Learn more about its features in our review of QuickBooks Enterprise.

- QuickBooks Accountant Desktop: This is another version of QuickBooks Desktop, but it’s built specifically for bookkeepers and accounting professionals serving QuickBooks Desktop clients. The program is available with the purchase of a QuickBooks Desktop ProAdvisor membership, with prices starting at $799 per year for each ProAdvisor. Our QuickBooks Accountant Desktop review discusses its features, pricing, and more.

Frequently Asked Questions (FAQs)

QuickBooks is used to manage a business’s financial transactions. Depending on your product and plan, you can use QuickBooks to create and send invoices, manage and track unpaid bills, handle inventory, keep track of project profitability, view financial reports, and more.

QuickBooks Online is cloud-based software that can be accessed anytime and anywhere from any internet-enabled device and has monthly subscription options. Meanwhile, QuickBooks Desktop is an on-premise software that needs to be installed on the computer where you’ll use it and is available as an annual subscription. For more about the differences between the two programs, read our comparison of QuickBooks Online vs QuickBooks Desktop.

No, there’s no free version of QuickBooks for businesses, but there’s a 30-day free trial for new users. However, QuickBooks Online Accountant is free for professional bookkeepers. For accounting software with free options, check out our top-recommended free accounting software.

Excel and QuickBooks are drastically different programs. QuickBooks is by far the most popular small business bookkeeping program in the US, whereas Excel is a spreadsheet program that advanced users may use to create their own custom bookkeeping program. While we don’t recommend using Excel as your base bookkeeping program, we do have a guide on how to use Excel for accounting. Our comparison of QuickBooks Online vs Excel will help you better understand the differences between the two programs.

The best QuickBooks product depends on your needs and the size of your business. SMBs needing remote access to their account files should choose QuickBooks Online. If you want the speed and usability of desktop software, then QuickBooks Desktop is preferable. If you’re a one-person business owner, consider QuickBooks Solopreneur.

It’s quite easy to learn QuickBooks given its user-friendly interface. All QuickBooks Online products have the same interface, and so do all the QuickBooks Desktop products. There are also available free online training resources that you can use to get up to speed quickly. To get started, check out our free QuickBooks Online tutorials.

Bottom Line

QuickBooks is the most popular small business accounting software suite. It comes in a variety of editions and has web-based and desktop programs. QuickBooks includes features that allow you to keep track of your income and expenses, pay your employees, track your inventory, and simplify your taxes.