Square Payments is Square’s built-in payment solution that provides mobile payment processing and aggregated merchant services. Its features include instant setup with no application or approval process, free invoicing software and mobile payment app, next-day deposits, and chargeback management.

In our review of merchant service providers, Square earned an overall score of 4.42 out of 5, consistently taking the top spot for its free payment processing, point of sale (POS), and competitive transaction fees. We find Square best for new and occasional sellers processing under $10,000 monthly.

Square Payments Overview

Among different merchant accounts and payment providers, Square Payments offers the most convenient way for new and small businesses to start accepting payments. It has no monthly, cancelation, or chargeback fees and does not require application or approval to sign up. To top it off, the free POS app and online payment solution offer excellent value, and the entire system is incredibly easy to use.

Square also offers the best POS software for small businesses, which comes free with every Square Payments account. It is also one of our top picks for best multichannel POS systems. To learn more, read our Square POS review.

When to Use Square Payments Alternatives

However, Square Payments’ flat fee of 2.6% + 10 cents per transaction may not be the ideal solution for large-volume businesses. Merchants with over $250,000 in annual revenue may apply for custom pricing, while other cheaper credit card processing companies with an interchange-plus model may be a better option. Square also charges for instant deposits but merchants can have this for free with a Square Business Checking account.

Additionally, it has limited ACH and digital check payment processing features, making it less suitable for B2B payment processing. Consider other B2B payment solutions if your business handles a lot of B2B transactions. Square also does not support high-risk businesses. Instead, look to alternative high-risk merchant services providers.

Compare Square with other alternatives in our guides:

- Square vs Shopify

- Square vs PayPal

- Square vs Payanywhere

- Square vs Wave

- Square vs Stripe

- Square vs Helcim

- Square vs Stripe vs PayPal

Overall, Square Payments is an outstanding choice for small merchants and startups looking for simple payment processing. And while it is only available for merchants using the Square payment app, the free POS features for in-store, online, and mobile create a powerful platform to launch any type of small business in minutes.

What’s New With Square

Square recently launched House Accounts, a feature that lets customers charge their purchases to their accounts. The merchant may collect payment for purchases charged to house accounts by sending recurring invoices. Learn more about Square House Accounts.

Square Fee Calculator

Square Fee Calculator

Enter your current in-store and/or online sales volumes and average order values for an estimate on the monthly fees you would pay using Square.

Square Payments comes built into every Square POS software, so there are no monthly fees and no lengthy application process. It also comes with a free magstripe card reader and virtual terminal so new businesses can start accepting payments in minutes and without any upfront cost.

Square Payments’ pricing guide shows transaction fees that start at 2.6% + 10 cents, and actual rates depend on your customers’ payment type: card-present or card-not-present (your free account enables you to accept both). The main difference between the two is the need for additional hardware. There are no monthly fees, processing requirements, or payment card industry (PCI) fees.

Flat-rate transaction fee

Square Online Free Plan | Square Online Plus Plan | Square Online Premium Plan | Square for Retail Plus Plan | |

|---|---|---|---|---|

Monthly Fee | $0 | $29 | $79 | $60 |

In-person Transaction Fee | 2.6% + 10 cents | 2.6% + 10 cents | 2.6% + 10 cents | 2.5% + 10 cents |

Keyed-in Transaction Fee | 3.5% + 15 cents | 3.5% + 15 cents | 3.5% + 15 cents | 3.5% + 15 cents |

Online Transaction Fee | 2.9% + 30 cents | 2.9% + 30 cents | 2.6% + 30 cents | 2.9% + 30 cents |

*Volume discounts: Square will create custom pricing packages for any business processing over $250,000 in credit card sales.

The Free plan for Square Online includes the following:

- Use of Square POS app

- Basic website builder with SEO tools

- Pickup, local delivery, and shipping

- Sell on Facebook and Instagram

- Square Risk Manager for fraud protection

Invoices

Square Invoices Free | Square Invoices Plus | ||

|---|---|---|---|

Monthly Fee | $0 | $20 | |

In-person Transaction Fee | 2.6% + 10 cents | 2.6% + 10 cents | |

Keyed-in Transaction Fee | 3.5% + 15 cents | 3.5% + 15 cents | |

Online Transaction Fee | 3.3% + 30 cents |

|

Other Fees

- ACH Payments: 1%, minimum $1

- Afterpay: 6% + 30 cents

- Instant Transfer: 1.75%

For a breakdown of Square’s software pricing, see our Square pricing guide.

Square Card Readers

Square Reader for Magstripe | Square Reader for Contactless and Chip |

|---|---|

|  |

First free, additional $10 | $59 |

Accepts payments via magstripe (swiped), available in jack or lightning connector | Bluetooth reader that accepts EMV (chip), and NFC (Apple Pay, Google Pay) payments |

Since our last update:

Square released the 2nd generation of its Square Reader for contactless and chip in May 2023. Among the improvements made in its 2nd generation readers are longer battery life, stronger connectivity and NFC performance, enhanced security, and a USB-C port.

Square POS Systems

Square Terminal | Square Register | Square Stand |

|---|---|---|

|  |  |

$299 or $27 per month for 12 months | $799 or $39 per month for 24 months | $149 or $14 per month for 12 months |

Stand-alone mobile POS that can take orders, accept card payments and issue receipts. | Full POS with touch-screen monitor, detachable customer-facing display, and credit card machine | All-in-one credit card machine with POS, and built-in card reader |

Square does not require any long-term contract. It offers a month-to-month contract for both its free and paid versions. Square is also an aggregator, which means it does not provide individual merchant accounts—instead, it aggregates multiple similar clients and signs up for a single merchant account with a direct processor or acquiring bank.

While this is ideal for small businesses, note that the TOS specifies a limit of the allowed volume of card sales per month, and any Square account that exceeds that limit will be required to sign up directly for a merchant account with the acquiring bank.

Other stipulations within Square’s Payment TOS are:

- List of businesses not supported by Square under Section 3.

- Note that there is a separate fee schedule for Afterpay, Pay with ACH, and Cash App Pay transactions, which you can find on your Square Dashboard.

- Payments taken in offline mode that are not validated online expire after 24 hours. Square is also not liable for the additional risk when accepting payments offline.

- A reserve account may be required for businesses with a certain degree of risk—the value of which can be adjusted at any time.

Square lists additional agreements to detail its other products such as ACH, POS, Square Checking and Savings, and hardware terms, among others. You can find Square’s other Terms of Service here.

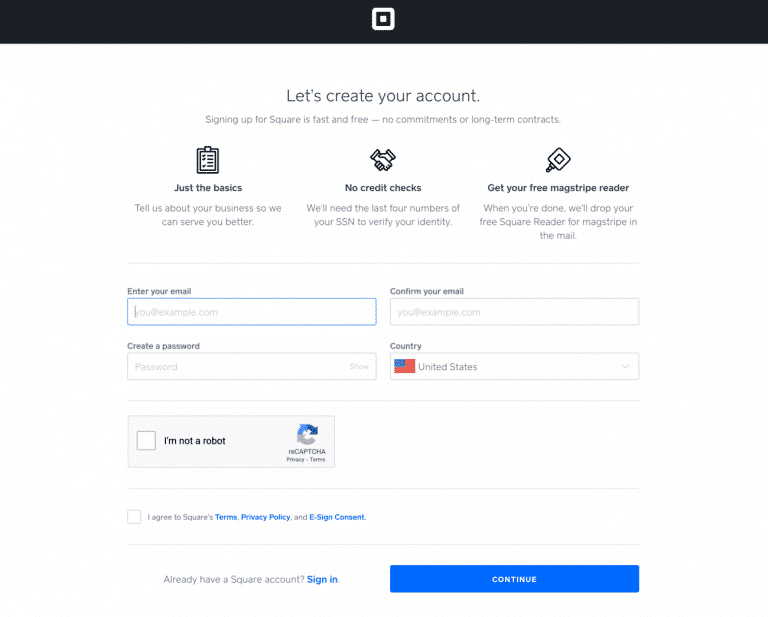

Square Payments offers an easy sign-up process and does not require any approval process to start accepting payments. When you sign up for your free Square account, it automatically gives you access to Square Payments. You get a setup guide that will take you through the necessary steps, which only take minutes to complete. Once done, you can start setting up your store and accept payments right away.

Click on any “Get Started” button on the Square website and provide your name, email address, and a secure password. (Source: Square)

Ready to get started? Learn more about Square. Visit our complete step-by-step guide to setting up your Square account and find more details on how to use Square to process payments.

Square supports almost every payment type and with minimal service fees compared to other popular competitors. Instead of eCheck payments, Square allows merchants to process ACH transactions. And while it does not have level 2 and 3 processing, Square can offer volume discounts for businesses that process sales above $250,000 per month.

The Square payment app for mobile is compatible with Android and iOS devices and comes with a free magstripe reader that can be mailed immediately to the user after successfully signing up for an account. It also allows you to manually enter the transaction amount or select items from your Library if you’ve set up your inventory.

Square’s Mobile App provides a wide range of payment tools, including the ability to process invoice transactions in-person. (Source: Square)

Since Our Last Update:

After launching Tap to Pay on iPhone in September 2022, Square has expanded its Tap to Pay features by launching its Tap to Pay on Android in April 2023 for US merchants and in September 2023 for merchants in Canada. If you have a compatible Android device, you can now start accepting payments using your Android device.

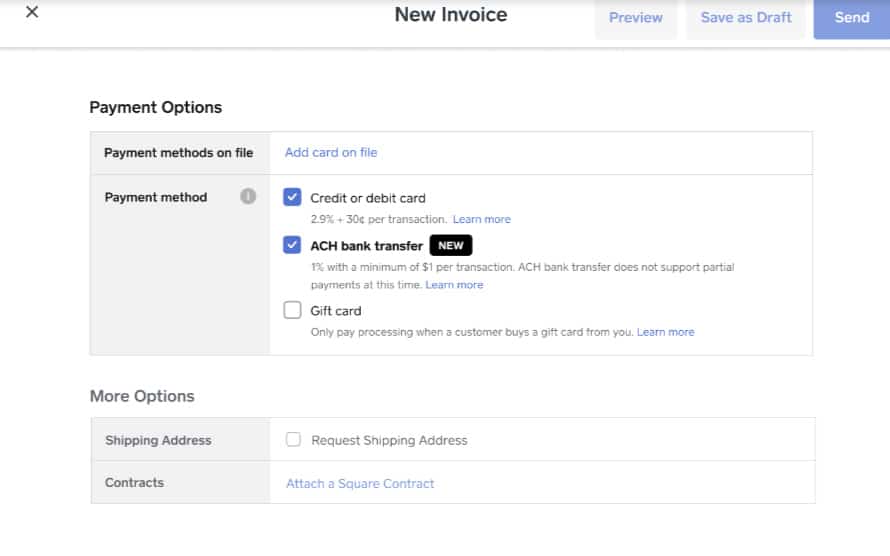

Square’s invoicing feature allows you to request payment through invoices and accept payments through different payment methods, such as card and ACH transactions. You can create, send, and track invoices online or via Square Payments’ iOS and Android apps. Additionally, you can use automatic payment reminders, advanced reporting, and recurring billing. Advanced invoicing features are also available for those wanting a more customized look, plus additional tools like multi-package estimates and milestone-based payment schedules.

Square Payments offers simple and advanced invoicing tools to match businesses that require functions such as recurring payment, estimates, and custom payment schedules. (Source: Square)

Learn more in our ultimate Square Invoice guide.

Square Payments allows you to process transactions automatically with its card-on-file feature. This is ideal for recurring payments, open tickets, and customers for subscription-based businesses. Aside from their card details, you can also use your customer’s email address to send digital receipts for both online and in-person transactions. Square is also PCI-compliant, so there is no need to worry about handling your customer’s sensitive information. Learn more about PCI compliance.

Square allows merchants to accept ACH payments as an option for completing invoice transactions. It requires a $1 minimum and charges a low 1% fee for each transaction. However, while this payment method is significantly cheaper, note that it takes three to five business days to process an ACH bank transfer. It also does not support partial payments.

You can add ACH bank transfer as a payment method on your invoice transactions from both the mobile app and on your desktop. (Source: Square)

Square users are able to offer BNPL payment options to their customers with Afterpay. This means your customer can choose to pay for their items in four interest-free installments over six weeks, while you immediately get the full value of your sales.

There are no monthly or setup fees to enable Afterpay with Square. The transaction fee is slightly higher than regular transactions at 6% + 30 cents. Afterpay is available with Square for both online and in-person payments—a feature that is not often available with other processors.

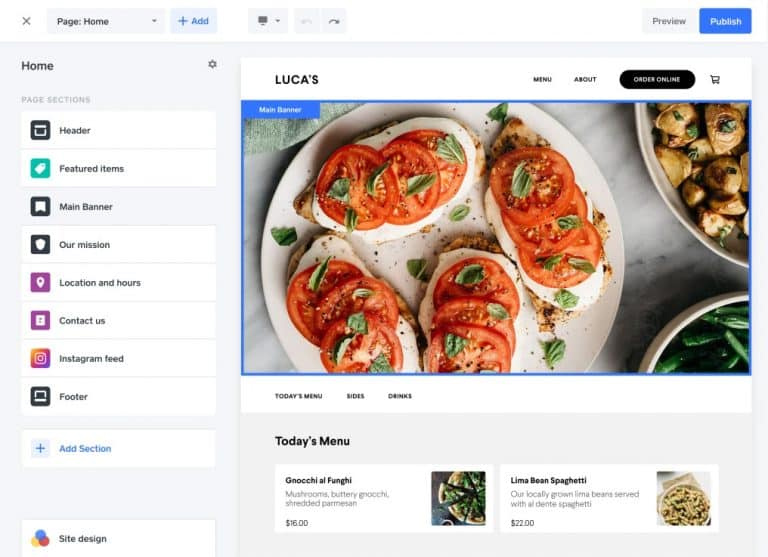

Square Payments enables you to sell your products online (on social media and ecommerce stores), manage shipping and delivery, offer curbside pickup, and set up discounts and gift cards. If you’re an online merchant, you can build and publish an online store—even without coding knowledge—by accessing Square Payments’ drag-and-drop site builder. It also integrates with popular web builders, such as WordPress and Wix.

Square’s website builder is an easy drag-and-drop function that comes free with every Square account. (Source: Square)

Square is easy to use but doesn’t offer many customization options. If you want a more flexible ecommerce payment solution or one that integrates with more software, consider Stripe. See how Square compares to Stripe.

Square offers a wide range of business management and software tools and integrations—most of them free. It even offers proprietary, industry-grade hardware in affordable installments, and we find this accessibility a huge plus for small businesses and startups working on a budget. However, you’ll need to pay an additional fee if you want same-day transfer of funds. Square’s customer service is also limited to extended business hours.

Square Payments is exclusive to merchants using the Square POS software. The basic plan starts at zero and with the option to upgrade to industry-specific paid plans priced at $60 per month. There are also optional add-ons and advanced tools for building out your POS as your business grows.

Square Software Pricing

Square POS | Square for Retail | Square for Restaurants | Square Appointments | |

|---|---|---|---|---|

Basic Plan | $0 | $0 | $0 | $0 |

Plus Plan | N/A | $60 /location | $60 /location | $29 /location |

Premium Plan | N/A | Custom | Custom | $69 /location |

Businesses that sell CBD products, including oil, flower, seeds, lotions, topicals, and wax can sign up for a Square account through its CBD Program. It allows users to accept payments for hemp and hemp-derived CBD products that have less than, or equal to, 0.3% THC in most states within the US. However, expect sign-up requirements and transaction fees to be slightly different, with higher payment processing due to the risk involved.

Payment Method | Fees |

|---|---|

Card-present (tap, dip, swipe) | 3.5% + 10 cents |

Card-not-present | 4.4% + 15 cents |

Card-on-file | 4.4% + 15 cents |

Square invoices | 3.8% + 30 cents |

Square online payments | 3.8% + 30 cents |

ACH payments | 1% |

Unlike other software that offer CRM as an add-on, the Square customer management tools come built-in. You are given access to the customer directory, where you’ll find all customer information for use in marketing, analytics, and more. This is where you store email addresses used for sending digital receipts and marketing campaign materials, and credit card details for customers who opt to sign up for automatic payments. Customers also have a platform for leaving feedback whenever needed.

Square makes it easy to manage your customer data, including the ability to bulk upload your customer list from a CSV file. (Source: Square)

Money is credited to your bank account as soon as the next business day, while ACH payments are processed in three to five business days. For an extra fee of 1.75%, you may opt for same-day or instant transfers to your bank account, similar to PayPal.

Another way to get instant access to your funds is with a Square Checking account. Merchants with a Square Business Checking account get a debit card and instant access to their funds. which also comes with a debit card.

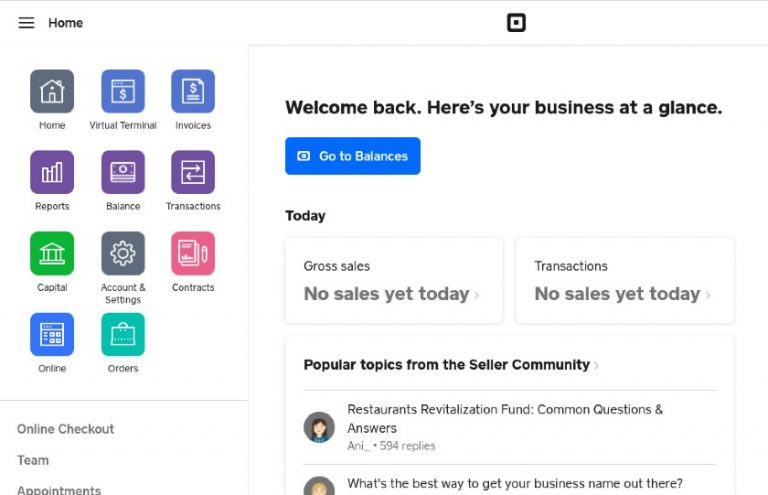

This all-in-one management platform lets you manage your invoices, finances, inventory, and multichannel sales all in one place. Square Payments users can manage all their business processes, sync inventory, and track sales through Square Dashboard. It also enables you to track your team and view detailed reports, among others.

Square’s dashboard is adaptable, allowing you to customize shortcuts, so you always see what’s most important to your business once you log on. (Source: Square)

Need free inventory management tools? Square’s inventory management feature is also easily accessible from the Square dashboard or through the Square POS app. Among its capabilities are downloadable reports, stock alerts, and multilocation inventory management. Learn more about Square inventory management in our guide.

Ensuring the safety and integrity of payment transactions is a top priority at Square, and it shows in the comprehensive payment security measures it offers. These measures are designed to protect both merchants and their customers throughout the payment process.

Fraud Protection

Square monitors transactions with the use of machine learning and human experts to catch anything that might be suspicious and fraudulent. You get notified about any unusual transactions.

Chargeback & Dispute Management

You can easily manage chargebacks and disputes from the Square Dashboard. When a dispute comes up, Square sends a notification to inform you. You get to decide whether to accept the dispute as valid or to challenge it. If you choose to challenge the dispute, you will need to provide Square with the documentation related to the transaction. The bank will then make a decision on whether the transaction was fraudulent or legitimate. Best of all, Square does not charge any fees for disputes filed by customers.

Data & Hardware Security

Square Payments keeps your customers’ data safe and secure, and it is PCI-compliant. Aside from this, all data that goes through Square’s hardware and software are encrypted from end to end.

Customer support is one of the few downsides to using Square Payments. Only active accounts are given access to phone support, and even then, you will require a customer code when calling. You will need to log in to your account to get a “Call Support” option, including your own customer code.

However, if your account is active, you can also access support through chat in the Square POS app—a handy feature. Square’s phone customer support is available from 6 a.m. to 6 p.m. Pacific time, Monday through Friday.

Square has always done well in our evaluations because it allows new merchants to start their business with the least (even zero) upfront cost. It offers very competitive pricing as an all-in-one solution for flexible POS software, extensive business management tools, affordable, industry-grade hardware, and versatile payment processing. To top it off, the system is stable and reliable, making it a popular choice for small businesses.

If there’s anything Square can improve upon, it’s to expand its features to meet the needs of larger businesses. Unfortunately, Square Payments is only available exclusively within Square’s ecosystem. This means merchants won’t be able to use it without subscribing to a Square POS account. And while Square’s POS works great, higher-volume businesses needing management tools or businesses seeking more customization options beyond what’s available in the free Square plans might find it somewhat limited without upgrading to the higher plans.

Other than that, we find Square Payments an outstanding payment processing solution.

What Users Say in Square Payments Reviews

Square Payments users have mostly positive things to say about the platform. Overall, they agree that it is convenient and easy to use since they can take payments, create invoices, and manage their business operations all in one place.

- Capterra: More than 2,000 users rated Square Payments an average of 4.7 out of 5 stars.

- G2: Over 140 users rated Square Payments an average of 4.6 out of 5 stars.

On the other hand, there is a handful of negative feedback about the platform. The most common downsides mentioned by users are the need for better customer service and additional customizations, and that transaction fees can be quite expensive.

| Users Like | Users Don’t Like |

|---|---|

| Easy-to-use platform | Lacks ideal customization in the free plan |

| All-in-one Square Dashboard | Can be expensive for businesses with high transaction volumes |

| Good value, reasonable fees | No integrations with other POS |

| Convenient mobile payment processing | Hard-to-reach customer phone support |

Methodology—How We Evaluated Square Payments

We test each merchant account service provider ourselves to ensure an extensive review of the products. We compare pricing methods, identifying providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. We then further evaluate according to a range of payment processing features, scalability, and ease of use.

The result is our list of the best overall merchant services. However, we adjust the criteria when looking at specific use cases, such as for different business types and merchant categories. This is why every merchant services provider has multiple scores across our site, depending on the use case you are looking for.

Click through the tabs below for our overall merchant services evaluation criteria:

25% of Overall Score

We awarded points to merchant account providers that don’t require contracts and offer month-to-month or pay-as-you-go billing. Additionally, we prioritized providers that don’t charge hefty monthly fees, cancellation fees, or chargeback fees and only included providers that offer competitive and predictable flat-rate or interchange-plus pricing. We also awarded points to processors that offer volume discounts and extra points if those discounts are transparent or automated.

Square Payments received a near-perfect score in this section, only missing the mark for automated volume discounts.

30% of Overall Score

- The best merchant accounts can accept various payment types—including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and echeck payments—and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

Again, a near-perfect score for this Square Payments review sub-criteria. However, we were also looking for Level 2 and 3 payment processing, which Square does not support.

25% of Overall Score

We prioritized merchant accounts with free 24/7 phone and email support. Small businesses also need fast deposits, so payment processors offering free same- or next-day funding earned bonus points. Finally, we considered whether each system has affordable and flexible hardware options and offers any business management tools, like dispute and chargeback management, reporting, or customer management.

Square Payments again earned high scores for this section. Limited customer support hours and add-on fees for same-day deposits prevented it from earning a perfect score.

20% of Overall Score

- We judged each system based on its overall pricing and advertising transparency, ease of use (including account stability), popularity, and reputation among business owners and sites like Better Business Bureau. Finally, we considered how well each system works with other popular small business software, like accounting, point-of-sale, and ecommerce solutions.

Square Payments did well in this category, only missing partial points for ease of use and integrations.

Frequently Asked Questions (FAQs)

Here are some of the most common questions we get about Square Payments. Expand the sections below for more.

Yes, aside from being an all-in-one POS and payment solution, Square Payments is a great option for small businesses because it does not require a long application process, and setup is so easy that you can complete your application and start accepting payments in minutes.

Square is a household name in POS software and payment processing for small businesses. It’s easy to use and offers flexible POS and payment features. User reviews from different sites give Square an above-average overall score.

Payments accepted through Square are processed instantly, and even work without an internet connection. Funds are deposited into your bank account on the next business day, same-day with an additional fee, or instantly to your Square Checking account, if you have one.

Larger businesses may find Square’s POS and payment features limited. For one, it does not have level 2 and 3 processing available for B2Bs. It also does not work with other POS systems and does not support high-risk merchants.

Square Payments is often compared to Stripe and PayPal because it supports similar business sizes and offers similar payment services.

Bottom Line

Square Payments is a free, membership-based payment platform that works with the Square POS system. It is perfect for small businesses selling online, in-store, and on the go because it doesn’t require an approval process, allowing users to start accepting payments immediately after setting up their merchant accounts.

Aside from zero monthly fees, Square Payments also come bundled with key features you’ll find in most paid payment processing alternatives. This makes Square Payments one of our highly recommended providers for merchants looking for a quick and no-fuss solution to get their business up and running in no time. Visit Square to create a free account to test it out.