Bookkeeping is a great home-based business that’s easy to start with very little cash. Whether you are looking to make extra money or want to grow a business to support you and your family, our guide on how to start a bookkeeping business will help you achieve your goal. We’ll walk you through the process, from creating a business plan and registering the business to getting the right software and marketing.

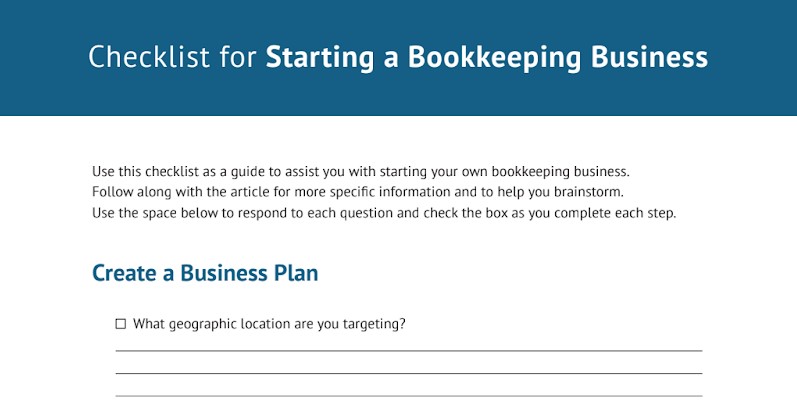

Download your free checklist for starting a bookkeeping business.

Step 1: Create a Business Plan

Writing a business plan is something that everyone should do before starting a business. While it can be used to obtain funding for your business, the real value is the thought that goes into the process of writing a plan.

During the writing process, you should think about every aspect of your business—such as what products and services you will sell, how to market those products and services, and who your competition is. You will also create a financial plan that should include a 12-month profit and loss projection, a projected balance sheet, and the projected cash flow.

Here are the key items that should be included in every business plan:

- Cover page: The cover page of your business plan is your first impression, so it should be professional and informative. If you have a company logo, include it at the top to enhance brand recognition. The document title should include “Business Plan,” and a concise and catchy tagline can introduce your business proposition. It’s also important to include your contact information and a completion date to show that your information is current.

- Executive summary: This is a concise overview of your entire business plan, highlighting the company’s purpose, products or services, target market, and financial projections. It’s essentially an elevator pitch in written form, so it is important to be clear and compelling to attract the reader’s attention.

- Company overview: Dive deeper into the details of your business by explaining what you do, your mission statement, and what makes your company unique.

- Competitive analysis: Demonstrate your understanding of the competitive landscape. This section should identify your target market, its size and demographics, and any trends that might affect your business. Also, take an impartial look at your competitors to determine what sets your business apart from them.

- Marketing plan: Outline how you plan to reach your target market and convert them into customers. This includes your marketing channels, pricing strategy, and sales strategy.

- Financial projections: This section lays out the financial health of your business. It should include your startup costs, projected revenue, expenses, profits, and losses over a specific period. You may also need to include funding requests if you’re seeking an investment.

- Management team: Briefly introduce the key members of your management team. Highlight their experience, skills, and qualifications that demonstrate their ability to lead the business to success.

Our related resources:

- How to Write a Business Plan

- How to Create a Marketing Plan (+ Free Template))

First, decide whether your target market will be limited to your surrounding area or if you’ll offer online services. While it’s tempting to offer your services online to a worldwide audience, it adds a lot of complexity to your operations. You should plan on paying for help with online advertising, web design, search engine optimization (SEO), and website content management.

The next decision is whether to focus on a particular small business niche or to offer services to all small businesses. It’s much easier to become an expert in accounting for a particular business niche than for all businesses in general.

The best niches to consider are those with unique bookkeeping challenges. For example:

- Construction companies compute their profit by project

- Truck drivers have special tax rules for computing travel expenses

- Restaurants have a very high volume of relatively low-value inventory items to track

You should decide what services your bookkeeping business will initially offer. You might add more later, but knowing your initial offerings is important so that you can choose the right certifications and software.

Here are some of the common services offered by bookkeeping businesses:

- Basic bookkeeping: Basic bookkeeping usually includes entering banking transactions, classifying payments, and reconciling bank statements. The result is typically a basic set of financial statements at the end of each month.

- Invoicing: Some bookkeeping businesses will prepare and mail invoices to their client’s customers. Even if you don’t prepare and mail the invoices, you can collect, deposit, and track customer payments.

- Bill payment: You can provide value to your clients by tracking their unpaid bills. You can submit payments to their vendors or simply provide a list of bills that need to be paid.

- Payroll: If your bookkeeping business provides payroll services, you’ll need to not only issue payments to your client’s employees but also track and pay payroll taxes. Be sure to pick a client software package that can easily be expanded to include payroll.

- Tax returns: Only provide tax return preparation to your clients if you have tax expertise. It’s not difficult to learn how to fill out tax forms, but there’s much more to know to adequately advise your clients. If you do decide to prepare tax returns, be sure to get professional liability insurance.

Our related resources:

- What Is Bookkeeping and What Does a Bookkeeper Do?

- Accounting vs Bookkeeping

- What Is Payroll? Everything Business Owners Need to Know

Define your service packages and pricing structure so that you can easily communicate this information to your clients. Create tiered service packages with increasing levels of complexity and features.

Here are some common options:

- Basic package: Ideal for startups or freelancers with minimal transactions. This could include bank reconciliation, categorization, and basic reports.

- Standard package: Suitable for growing businesses with moderate transaction volume. This might include everything in the basic package, plus accounts payable/receivable management and payroll processing (if applicable).

- Advanced package: Caters to established businesses with complex bookkeeping needs. This could include everything in the standard package plus tax preparation assistance, financial analysis, and bookkeeping cleanup for neglected accounts.

There are several pricing strategies. These include

- Hourly rate: This is achieved by charging an hourly rate for your time. This is simple but requires good time management to stay profitable.

- Monthly retainer: Clients pay a fixed monthly fee for a predetermined set of services. This provides predictable income for you and budgeting ease for clients.

- Per-transaction fee: Charge a set fee per transaction processed, which can be efficient for high-volume clients but may not be suitable for all businesses.

Step 2: Earn Your Certifications

One of the fastest ways to gain credibility with potential clients is to prove that you have the knowledge necessary to do bookkeeping, payroll, and perhaps tax returns. If you’re a certified public accountant (CPA), you probably won’t benefit from becoming a certified bookkeeper, but you still might consider becoming certified in whatever accounting software you choose to use.

Even if you don’t have formal education in accounting or bookkeeping, you can become a certified bookkeeper before starting your own bookkeeping business. Unlike CPAs, these certifications aren’t regulated by the state, so be sure to choose a large, reputable organization so that the certification is meaningful and respected.

There are two professional bookkeeper organizations that we recommend you certify with. There are also other opportunities to earn a bookkeeper specialization, such as through a university like UCLA.

- American Institute of Professional Bookkeepers (AIPB): To become AIPB-certified, you must meet the 3,000-hour work experience requirement and pass a certification exam, which costs $574 for members and $734 for non-members.

This certification is ideal if you don’t have any formal education in the bookkeeping and accounting field. As an AIPB member, you’ll get access to personal help regarding bookkeeping and payroll, as well as membership discounts. Membership comes in three tiers, and a longer membership plan has added benefits compared to a shorter membership plan.

-

- $60 for one year

- $120 for two years

- $180 for three years

Once certified, you’ll earn the right to put the letters CB (stands for Certified Bookkeeper) behind your name and display this on your resume and business cards, which will give you an edge with potential clients.

- National Association of Certified Public Bookkeepers (NACPB): To earn certification through the NACPB, you must take courses in bookkeeping, payroll, QuickBooks Online, and accounting principles and pass an exam for each course. NACPB Annual membership is $200 for Members and $250 for Pro Members.

You’ll also need one year of experience before applying for the license. If you’ve had college accounting courses, you might be able to substitute them for required courses, but you’ll still need to pass each exam.

Once certified, you’ll earn the credentials CPB (stands for Certified Professional Bookkeeper). You can put these letters after your name on resumes, business cards, and other materials to display your accomplishments to future clients.

- UCLA Extension: The Bookkeeping Specialization program consists of four courses and offers classes both online or in person if you are located in the Los Angeles area. The program costs $3,260 and includes the following courses:

-

- Bookkeeping and Accounting Essentials (I and II)

- Cloud Based QuickBooks

- Payroll Tax and Accounting

If you maintain a GPA of 2.5 or higher in each course, you’ll receive a certificate upon completion. This option is best for experienced bookkeepers or individuals who are looking to make the transition to a career in bookkeeping or accounting.

Some of the best small business accounting software offer a certification program so that bookkeepers can demonstrate they’re proficient with the solution. Most of the certifications are free and even come with free accounting software for your firm.

Here are a few of the most popular accounting software and their certification programs:

- QuickBooks ProAdvisor: QuickBooks is by far the most popular small business accounting software in the US, and you’ll very likely have clients using it. QuickBooks offers ProAdvisor certifications for both QuickBooks Online and QuickBooks Desktop. You earn your certification by completing self-paced lessons and taking exams.

The Online certification is free, but the Desktop certification requires the purchase of QuickBooks Desktop Accountant software, which starts at $499.99 per year.

- FreshBooks Partner Program: FreshBooks is a popular accounting software for service-based businesses requiring exceptional invoicing features. It offers a partnership program with accountants that includes FreshBooks certification and skills training.

It’s free to join, and there’s no cost to use the FreshBooks software for accounting professionals. FreshBooks offers a 30% discount for accountants and bookkeepers on the first six months of their clients’ paid subscription to FreshBooks.

- Xero Partner Program: Xero, while not as popular as QuickBooks in the US, is a comparable program at a lower cost. Similar to FreshBooks, Xero offers a partnership program that includes Xero certification. There are three levels to the program:

-

- Basic is free

- Xero Partner + Payroll costs $5 per month

- Xero Partner + Tax is $29 per month

- Zoho Consulting Partner: Zoho offers a suite of products that include software for accounting, CRM, and inventory tracking. It also provides marketing materials and co-branding opportunities to help you attract more clients. Its Consulting Partner program allows businesses to help clients implement and leverage Zoho’s suite of products.

The Zoho Books Consulting Partner program is free to join and gives you access to Zoho training resources and certifications. You’ll receive a dedicated account manager and free access to the Premium plan when you become a Zoho Advisor.

No certification is required for a paid preparer to sign a client’s tax return, but I highly recommend not preparing returns unless you’re a tax professional or willing to put in the work to become one. Many bookkeeping firms prepare financial statements that their clients take to CPAs or other tax pros to prepare a return. You may find yourself working closely with their tax preparer, and together, you can provide outstanding service to your mutual clients.

If you are not a CPA and want to prepare tax returns, I recommend becoming an Enrolled Agent (EA) through the IRS. EAs must initially pass an examination and then complete annual continuing education to renew their certification every three years. While no formal education or classes are required, the examinations are difficult and will prove you have the knowledge to serve tax clients properly.

Non-accounting degree holders who would like to pursue a bookkeeping career can take bookkeeping courses online. It’s significantly shorter than a full accounting college course. We recommend choosing courses that provide a certificate so that you can include it on your resume.

You can sign up for online bookkeeping courses from the following providers:

- Accounting Coach: This is a popular website that offers online learning materials related to accounting and bookkeeping. For a one-time fee that ranges from $99 to $159, you’ll receive lifetime access to resources for beginner to advanced learners.

Topics like basic bookkeeping, financial accounting, cost accounting, and financial management are covered. Learning tools include quizzes, flashcards, visual tutorials, and cheat sheets.

- Coursera: This offers a variety of online bookkeeping courses that cater to different needs and experience levels. The Intuit Academy Bookkeeping Professional Certificate is a specialization offered by Intuit. It covers the fundamentals of bookkeeping, including a double-entry system, financial statements, and using accounting software.

Coursera also curates lists of popular courses for beginners. These might include options from various providers alongside Intuit’s offerings.

- LinkedIn Learning: This is a valuable resource for both beginners and those looking to sharpen their skills. It offers courses that cater to different experience levels, from foundational bookkeeping principles to software-specific training.

You’ll find courses on topics like financial statements, journal entries, and analyzing transactions. The Accounting Foundations: Bookkeeping course allows you to earn continuing education units and a certificate upon completion.

Step 3: Register & Organize Your Bookkeeping Business

This step is important because it establishes your business as legitimate and may help to limit your personal liability if your company is ever sued. Whether you’re doing this part-time or full-time, you don’t want to skip this step.

You need to do the following to establish your business at the local, state, and federal levels:

Naming your business can be both a fun and stressful exercise. Your name must convey your brand since that is what a potential customer will see before they sit down with you for that initial consultation. Ensure your business name says exactly what you do; this is not the time to be cute—unless you can also be clear about what it is that you do.

Here are some great tips on how to name your business:

- Aim for clarity: Your name needs to tell people what you do. If you’re focusing your bookkeeping business on a niche, include the niche in your name.

- Use a term with an established brand: For example, you could use the name of the city where you are located, such as Scranton Bookkeeping.

- Get input from others: Ask family and friends for their input. Make it fun, and put it out on your social media that you are looking for suggestions on what to name your business. You could even offer a prize to the winner.

- Test it out: Try your potential business name out on potential customers to see what they think. Compare your name to competitors’ names to see if it stands out enough, but not too much.

There are four common business structures: sole proprietorship, partnership, limited liability company (LLC), and corporation. The structure that you choose will determine your personal liability if the company is ever sued, your tax liability, and your ability to raise capital.

To assist you with this decision, I recommend that you get an introduction to the four common business structures by reading our small business structure guide.

Most people operating a part-time bookkeeping business without employees will operate as a sole proprietorship, which works fine. However, if your business grows to the point of hiring employees, you need to consider becoming an LLC or corporation.

In addition to tax consequences, your personal liability in the event of a lawsuit can vary dramatically by business structure, so be sure to consult with an attorney.

Before your business begins operating, it is important to get an employer identification number (EIN), a unique nine-digit number that identifies your business. You’ll obtain an EIN from the IRS to identify your business for tax purposes.

This is also typically required to open a business bank account or apply for a business loan. There is no cost to obtain an EIN, and the process involves filling out an application and sending it via mail, fax, or online.

Once you have received your EIN and have chosen a business structure, it’s now time to register your business with your state. Our guide on how to register a business gives more detailed information and a checklist, but it will involve either doing it yourself through the state’s website or using an online legal service. If you prefer the latter, we recommend that you visit LegalZoom.

It is also a good idea to choose a registered agent, or someone who you choose to represent your business and who will serve as the point of contact if there are legal actions against your business.

Step 4: Set Up Business Operations for Your Bookkeeping Business

Now that you’ve organized your business, you can start setting up operations. For instance, you’ll want to check out one of the best small business insurance companies.

Getting a unique phone number for your business is incredibly easy and often free. You can get a free Google Voice number, which includes a local area code, voicemail, texts, and unlimited calling. You can learn more through our guide on VoIP phone systems.

As a one-person operation, you may find it hard to get back to clients right away, especially during tax season. Sending prospective customers to voicemail when they need your services can cost you business. For our recommendations, see our top-recommended answering services.

It’s important to separate your business and personal finances. While most think they should wait until the business starts to generate cash flow, it’s important to track expenses immediately so that they can be deducted as startup costs. Our list of the leading small business checking accounts will help you find a provider that fits the bill.

If you plan to lease office space, then your mailing address will be wherever your office is located. However, if you plan to set up a home office, you’ll need to obtain a business mailing address so that you don’t have to use your home address. This will make your business appear more professional and maintain your privacy.

There are a couple of options.

- Rent a post office box from your local post office: On average, you will pay $60 for six months or $120 for the year. Of course, the price will vary based on your location.

- Rent a UPS mailbox: The UPS Store will give you a real street address to use. A benefit to using a UPS mailbox is some merchants won’t deliver to P.O. boxes and require a street address.

As a bookkeeper, you should have liability protection in case you get sued for a mistake on your client’s books. Insurance can cover both the cost of settling a lawsuit and the lawyer fees to defend against a lawsuit.

Step 5: Get the Right Accounting Software

Determining which software to use to manage all of the various aspects of your business can be an overwhelming task. To get you started, the following is a list of the areas of your business for which you’ll need to decide which software tool to use:

You need to decide what accounting program you would like your clients to use. This doesn’t necessarily have to be the same platform that you use to manage your bookkeeping business.

A few things to consider when selecting software to recommend to your clients are:

- Can you access the client’s books remotely?

- How much will it cost each client for basic bookkeeping?

- How much will it cost to add client payroll?

- Is it easy for your client to learn to use?

- Does the software offer a certification program or partnership program for bookkeeping firms to help attract clients?

You’ll also need to choose a bookkeeping software for your bookkeeping business. Some accounting solutions offer a bookkeeper or accountant edition specifically designed for bookkeeping companies to use both for their books and as a portal to their client’s books.

My recommendation is that you use QuickBooks Online, which we rated as the overall best small business accounting software. You can get QuickBooks Online Accountant for free when you join the QuickBooks Online ProAdvisor program, which is also free.

Depending on the bookkeeping/accounting software you choose, there generally will be a payroll processing option you can turn on when you’re ready to hire employees. If you decide to go with QuickBooks, it offers a variety of payroll options from which to choose. You can learn more about the solution in our in-depth QuickBooks Payroll review.

Another tool that will make your life easier is practice management software. This can help you organize and track the progress of client work and, in some cases, provide a portal to access your client’s books. QuickBooks and Xero offer the best accounting practice management software that’s integrated with their accountant software.

A document-sharing program will allow you to share information—such as bank statements, copies of receipts, invoices, and accounting files—with your clients no matter where you’re working. Dropbox is a popular document-sharing program to consider.

You can create a Dropbox for each client, and they can start submitting their information. This system is much more secure than sending files via email or flash drive. To access the information in the document-sharing program, you need a user ID and password. And more importantly, there’s no need for physical backup because files are in the cloud.

Step 6: Fund Your Bookkeeping Business

After completing your business plan, you’ll have a good idea of what your estimated costs will be. In general, the startup costs for a bookkeeping business can be low if you work out of a home office as opposed to leasing office space, which we’ll discuss in the next section.

Experts say that you should always have at least six months’ worth of expenses in the bank. Also, even though your business is brand new and hasn’t generated any revenue, you may still qualify for business financing.

You’ll also want to open a business credit card account soon. It will likely be the first form of financing you’ll qualify for and can be a great financial tool to help you with cash flow or necessary expenses early on in your business. It can also be a great way to track your business expenses easily—this will go a long way toward making tax time a breeze. New bookkeeping businesses will typically use a credit card to float working capital expenses, earn rewards, and manage employees.

Our related resources:

Step 7: Set Up a Home Office for Your Bookkeeping Business

When starting out, keep your costs low by setting up a home office. If possible, plan to meet your clients at their offices or virtually. I don’t recommend inviting clients to your home office unless you know them very well and have a private room where you can work.

Also, don’t forget to take the home office tax deduction. You can deduct repairs and maintenance to the area used for business and a portion of utilities, real estate taxes, and insurance on your home.

If you can’t make a home office work, look into the top virtual office companies or office sharing. Typically, these spaces include a mailing address, a local telephone number, a receptionist to answer calls, a physical office space, and access to a conference room that you can rent by the hour.

Step 8: Market Your Bookkeeping Business

Marketing is one of the most difficult things for accountants and bookkeepers to master. Whether this is your side gig or full-time business, you can get a website customized for your business with a company that offers specialized marketing services.

Our related resources:

In addition to a website, there are many ways to market your bookkeeping business:

- Become a business advisor with the Small Business Development Center (SBDC).

- Be an adjunct instructor.

- Get certified in accounting software.

- Sign up with bookkeeper websites for freelancers.

- Join a local meetup group of bookkeepers and accountants.

- Establish a client referral program.

- Establish professional social media accounts.

- Target a niche industry and join their industry association.

Bonus Tip: Stay on Top of Industry Trends for Bookkeepers

It’s tough to stay on top of new trends and changes in the industry. For example, one of the most popular trends in the software industry is that installed desktop software is becoming a thing of the past and is being replaced with subscription-based cloud software, also known as software-as-a-service (SaaS). This is a trend that’s changing how bookkeepers and accountants do business, so you must understand how it works since it’ll have a direct impact on your business.

Here’s how you can “stay in the loop” on what’s going on in the bookkeeping/accounting industry.

1. Attend Accounting/Bookkeeping Conferences

Investing the time to attend a conference will give you those continuing education credits you need to keep your bookkeeper or CPA certification. It’ll also enable you to learn what the hottest trends in the industry are and what’s becoming obsolete.

A great conference to attend is Intuit Connect. In 2024, the conference will take place in Las Vegas from October 28 to 30.

2. Sign Up for Blogs & Newsletters

You may be surprised by how much valuable information you can get from monthly blogs and newsletters. You may not want to sign up for every accounting/bookkeeping blog that you come across, but here are a few worth checking out:

- IRS’s e-News subscriptions

- Journal of Accountancy

- Insightful Accountant

- The QuickBooks Blog

- Xero Blog

- American Institute of Professional Bookkeepers

3. Join a Professional Bookkeeper Association

You should be a member of at least one professional bookkeeper association, and the AIPB and the NACPB are the top two. Professional associations often promote or host seminars and training. Sometimes, members can get discounted rates on these events as membership perks. Being part of these associations can also help you build your network with other bookkeepers, CPAs, and tax experts.

Frequently Asked Questions (FAQs)

Because of the relatively low overhead costs, bookkeeping businesses can be profitable if they have a steady flow of clients and can manage their expenses effectively. The profitability of the business also depends on its size, the number of clients, the level of competition in the market, and the pricing strategy.

No, bookkeepers don’t need any licenses or certifications—unlike other finance professionals, such as accountants and financial planners. Some bookkeepers may decide to earn optional credentials, such as the certified public bookkeeper (CPB) designation.

To determine how much to charge as a bookkeeper, it’s important to first evaluate your level of experience, your location, the services you offer, the frequency and complexity of the work, and whether you want to charge an hourly or fixed rate for your services. See our guide on How Much Bookkeepers Charge for an up-to-date review of bookkeeping rates by state.

A bookkeeper is responsible for maintaining a company’s financial records, including recording financial transactions, reconciling accounts, paying bills and issuing invoices to clients, generating financial reports, and monitoring cash flow. They may also assist with the preparation of tax returns and other regulatory filings. The specific tasks and responsibilities of a bookkeeper may vary depending on the company they work for and the nature of their role.

Yes, running a bookkeeping business from home is a great option for many entrepreneurs. It offers several advantages, including lower overhead costs, flexibility with scheduling, and overall convenience.

Bottom Line

Now that we’ve provided you with a roadmap to get your bookkeeping business started, I want to challenge you to pick a date for when you would like to be ready to take that first client. Then, take this guide and create a weekly to-do list based on the steps we have shared with you.