Realtors and other real estate professionals can earn extra income in various creative and proven ways, from managing properties or working in a leasing office to becoming a real estate coach or contractor. These methods can help supplement income during slower seasons or add to existing income. Below, I reveal 13 ideas for how to make money as a real estate agent—and why they’re worth considering to boost your real estate business.

1. Focus on an Uncommon Niche

Most real estate agents work on buying or selling residential properties, but many other types of real estate transactions are available to licensed salespeople. For instance, a few uncommon real estate niches are short sales, auctions, and preforeclosures. These niches tend to be much less saturated by real estate agents but are still well-known and have clientele who need the help of real estate agents.

Click on each tab below to read more about these uncommon niches:

Short sales happen when a homeowner gets behind on their mortgage payments and owes more than the house is worth. Rather than fall into foreclosure, they can make a short sale, needing the expertise of a real estate agent. Many agents don’t choose short sales as their niche because the process requires communication with frustrated, overwhelmed, and sad clients, as well as the following (see below), which deters some agents but also makes it a unique way of making money in real estate:

- Communicating and negotiating extensively with lenders

- Gathering and organizing important documents

- Contacting attorneys or tax professionals

- Finding a buyer

- Writing and submitting proposals

The commission is negotiable but can range from 6% or less of the sale price and is decided by the lender. Some agents enjoy working with short sales because they can genuinely help people in need, and the agent’s paycheck isn’t coming out of the seller’s pocket. Plus, a strong negotiator may even get a higher commission split. Although short sales can be complicated, agents can learn the process, build relationships with lenders, and use their real estate expertise to help distressed homeowners in difficult times.

Auctions are a unique way to buy and sell houses. Most homes sold are foreclosures or have a tax lien, but the condition or financial part of the property doesn’t change the ways that agents can be involved with auctions, which include:

- Referring a homeseller to an auction company: Instead of working with the client to buy or sell their home, you will connect them with an auction company in exchange for a real estate referral fee.

- Helping a buyer purchase a home from an auction: Help buyers understand how different auctions work and evaluate a home before buying.

- Helping a seller register and sell their home by auction: Be the contact for the auction company and homesellers to list the house on multiple listing services (MLS), qualify potential bidders, and post-auction inspections and requirements.

One of the advantages of working with real estate auctions is that the closing process is about 30 days, so you can get a commission check in less time. Plus, as you become more familiar with the auctioneers and auction companies, you can easily streamline the process for yourself and your clients.

Preforeclosures, legally referred to as “lis pendens,” are often filed by a mortgage lender as soon as a borrower stops making mortgage payments. It’s the first notice to the public that a property is facing foreclosure. Preforeclosures present an opportunity for both real estate agents and investors. As agents, you can help homeowners sell their homes and escape a scary financial situation. On the other hand, real estate investors can buy the house from the owners, which can also help relieve their burden.

However, there may be legal restrictions around homes in preforeclosure, and the property may not be in the best condition, so it’s essential for both agents and investors to analyze each preforeclosure lead to determine if it’s an excellent opportunity to pursue.

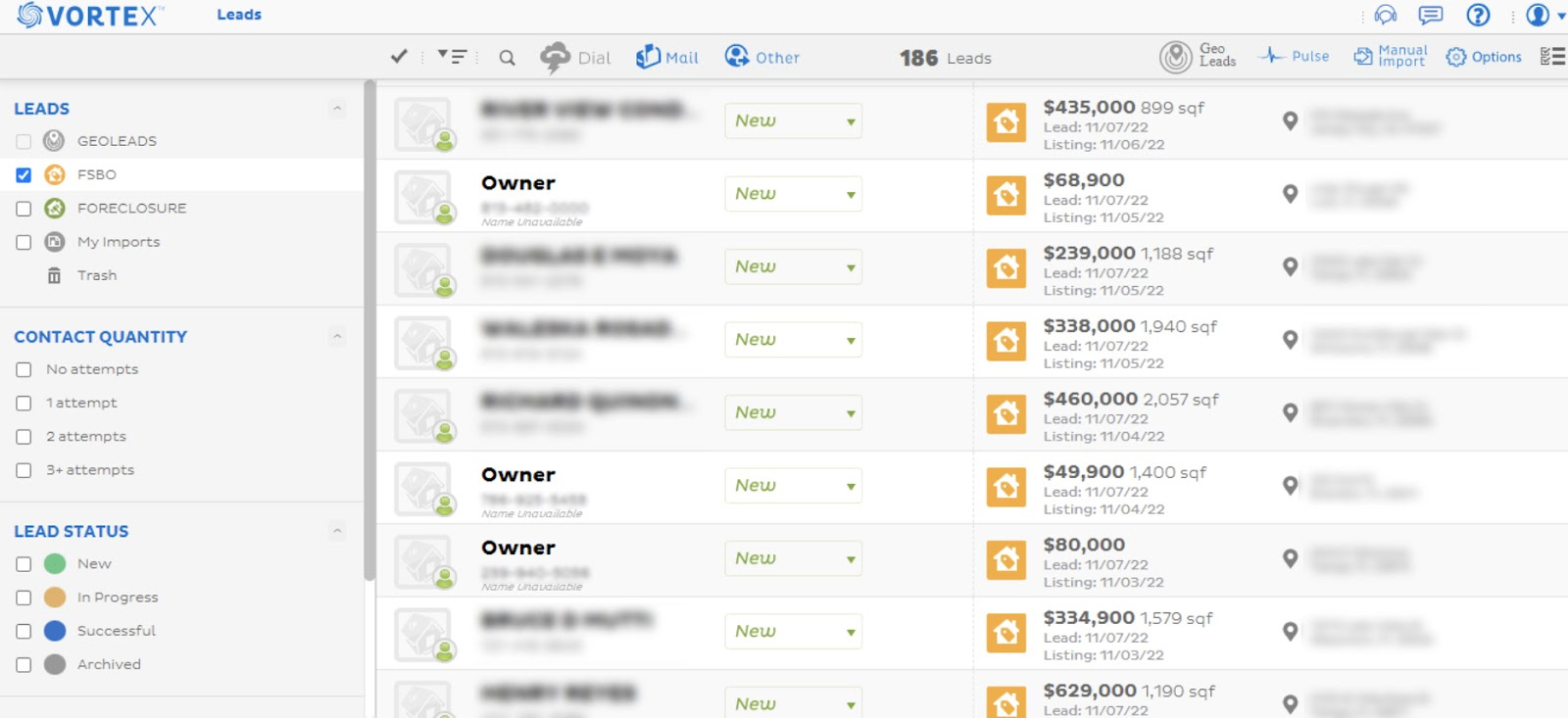

REDX Vortex dashboard

If you’re considering making money in real estate by focusing on preforeclosures, you’ll need REDX. This platform is a lead generation tool that can pinpoint preforeclosure leads and accurate contact information before the information is public, allowing you to reach the homeowner before the competition. Find out more about REDX preforeclosure listings today.

2. Become a Property Manager

One of the alternative ways to make money with a real estate license is to become a property manager. Manage the properties of your real estate investor clients, allowing you to earn about $58,335 a year as a part-time property manager. Property managers are responsible for a wide range of tasks and operations, depending on the property type.

For instance, being a property manager typically includes the following:

- Consistently marketing vacant rentals

- Scheduling and hosting property tours

- Screening applicants

- Managing documents

- Managing vendors to maintain the property

- Communicating with tenants

- Evaluating and setting rental prices

- Renewing leases

- Collecting rent

- Following up on late payments

- Enforcing late fees or evictions

- Inspecting properties

3. Work in a Leasing Office

Another way to make money in real estate is by working in a leasing office. Leasing offices are common in apartment or rental complexes but can provide services for various property types. A leasing agent typically communicates with current and prospective tenants, receives payments, and follows Fair Housing laws as well as company policies. If you’re interested in learning about real estate management and investing, a leasing office might be an ideal place to start.

Leasing office at North Highland Steel

Search for “leasing agent” or “leasing manager” jobs on Indeed for more specific details about being a leasing agent in your area. Contact local apartment complexes and property management companies if you’d like to get some training to help you in your job search. Ask about their requirements for leasing agents. You could also walk into a rental building to inquire about opportunities at that building or others the property management company might own.

4. Become a Real Estate Coach

As you actively work in the industry, you gain a lot of expertise in the real estate market, making and evaluating deals and working with clients. This knowledge and experience will naturally help you grow your skills and gain more success, but it can also be leveraged to assist other professionals. If you have a proven track record of success, consider offering your hard-earned real estate smarts as a resource. This could mean writing a book, developing a training program, or creating content on TikTok, YouTube, or a blog.

Mike Sherrard’s YouTube channel

For example, a YouTube channel or podcast would be a logical fit if you are a naturally charismatic speaker. Mike Sherrard shows precisely how to turn your strengths into a money-making system. After being ranked in the world’s top 30 real estate agents on social media, he started a YouTube channel and coaching business to teach others how to get clients and grow their businesses, specifically through social media.

For more information on creating your own YouTube content, check out our article, 11 Ways to Use YouTube for Real Estate Lead Generation.

5. Call Landlords to Get More Listings

When you want to focus more on selling listings, one of the unique ways to make money in real estate and to get listing leads is through landlords. Landlords and real estate investors generally own one, if not many, investment properties, and they may be waiting for the right opportunity to sell or rent. Of course, the best real estate sales come from genuine relationships, so reach out to your network first—or expand your network and make more connections with investors.

Find landlords to call and treat them as a potential repeat or referral business source, so don’t attempt to make a hard sale on your first cold call. Getting in touch with a busy landlord may take 10 to 20 calls or emails, but your first goal should be to schedule a meeting with them, whether over lunch, coffee, or even Zoom. Before the meeting, look up what type of properties they own, how they market and rent them, and how they’ve worked with real estate professionals in the past.

6. Train & Practice in Other Aspects of Real Estate

If you spend time as a real estate agent but realize that your skills and interests don’t perfectly suit the sales world, consider trying a different real estate specialty. Even though agents are the most common type of real estate professional, there are many real estate career paths that don’t include being an agent or salesperson.

Here are some ways how to make money in real estate, including the following:

- Real estate appraiser

- Inspector

- Land surveyor

- Contractor

- A mortgage broker or loan officer

- Notary public

Remember that some alternative career paths may require additional education or certifications. However, any experience you have in the real estate industry can help you become successful in whichever new role you choose. If you’re serious about getting another real estate-related license, research your state requirements for each career.

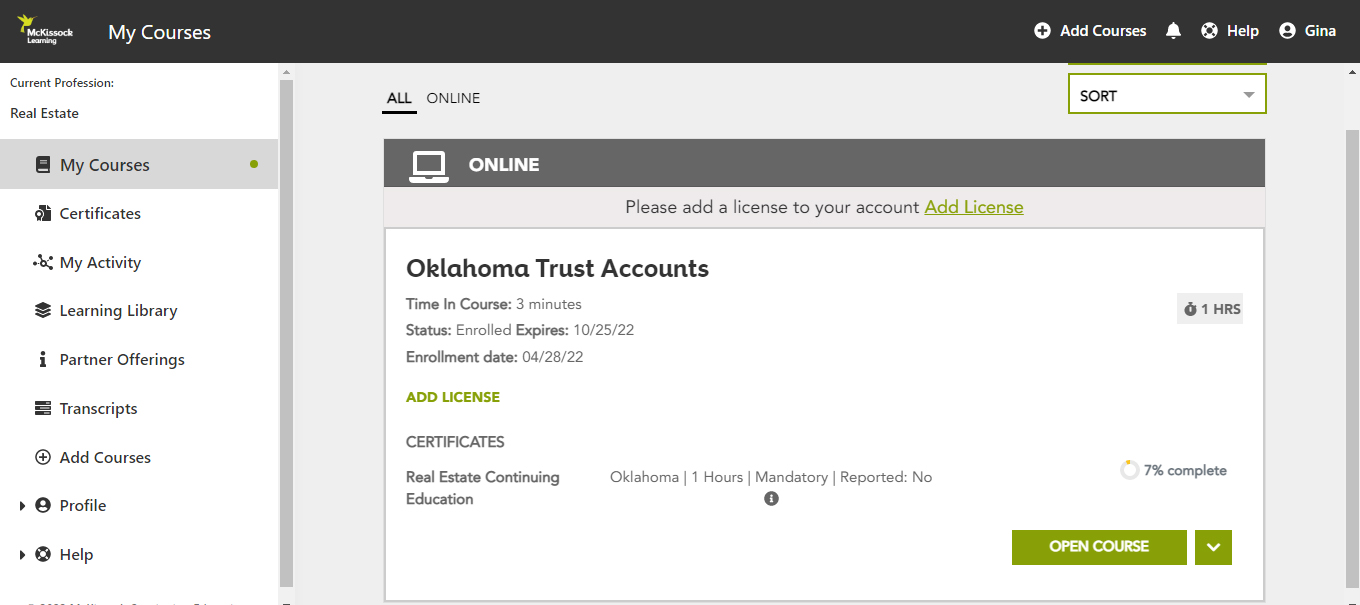

McKissock Learning course dashboard

McKissock Learning has step-by-step guides, teaching you exactly how to become an appraiser, inspector, mortgage broker, or land surveyor, as well as top-quality online courses in each industry. McKissock Learning provides a variety of licensing, continuing education, and self-paced or livestream classes in almost every state—highly rated by hundreds of thousands of students. Learn more about McKissock Learning today.

7. Become a Relocation Specialist

If you’ve ever moved across the country, you know firsthand that it is a massive undertaking. Relocation specialists are real estate professionals who take this burden off movers by helping them sell their current property and find and purchase a new one. They orchestrate details like packing, hiring movers, transporting vehicles, and processing visas.

Since relocation specialists must deal with varying laws and regulations in different states and countries, you must pass an exam and become a Certified Relocation Professional. Being a relocation specialist may be one of the ideal ways to make money in real estate—especially for real estate professionals who are passionate about traveling, seeing diverse cultures, and have strengths in organization, planning, and communicating with clients.

8. Build Relationships With Rental Clients

One way on how to make money renting homes is by working with rental clients. It is an excellent way for agents operating in and around major metropolitan areas to make more money as a real estate professional. An average rental commission is a month’s rent, which you must divide with your broker, but the work required to get a renter for a rental may often be completed in a day or less, allowing you to rack up several rentals in a week.

Renters who had a positive experience with you may recommend you to others or come back to you when they’re ready to rent again or buy. You may even demonstrate your skills to developers looking to fill new condominiums or apartments.

9. Offer Property Tax Appeals Services

If you are knowledgeable about the process for property tax appeals, you can provide your services to assist individuals in reducing their property tax charges. This is one of the excellent ways to make money in real estate or a real estate side job for agents since it allows you to use your knowledge to help others while making extra income.

As a property tax agent, you must show the county that the property is worth less than they think. Before initiating a property tax appeal, you must review the tax bill and assessment to identify errors or discrepancies. As evidence, you must complete a comparative market analysis (CMA) or gather information like independent appraisals, property condition reports, and documentation.

After this, you can present your valuation findings to the county taxing authority via email or phone call, or you’ll be invited to present your case to a hearing officer or an assessment appeals board in person.

Because many homeowners are uncomfortable appealing their property taxes on their own, they are ready to pay for professional assistance. If you succeed with a few clients, you will profit from word-of-mouth promotion, which will help you build your business.

10. Create an Online Real Estate Course

Creating a real estate course is a great way on how to make money with a real estate license and leverage your real estate expertise for passive income. Any topic related to real estate, such as investing, financing, marketing, or property management, could be a course topic. You can create stellar online courses with free and low-cost tools and software like Udemy, Camtasia, and Canva.

Real estate online courses at Udemy (Source: Udemy)

It will take some research to determine what courses are available and unavailable, but the work will be worthwhile. Although building an appealing and quality online course takes a lot of work, you only need to go through it once. After that, the course can continue to generate passive income for many years.

11. Be a Freelance Writer

Freelancing is an excellent choice if you enjoy writing but aren’t interested in launching a blog or specialized website. You might write on a wide range of real estate-related subjects, such as tips for buyers and sellers, the current condition of the housing market, or provide advice for new real estate agents. Browse for job posts online, such as LinkedIn and Indeed, contact firms and businesses directly, or collaborate with a real estate-focused content marketing agency.

As a freelance writer, fees might vary greatly; nevertheless, having experience in the field will help you draw in clients willing to pay higher rates. If you can find a few clients who require ongoing work, such as many blogs and websites, you can earn a good side income as a freelance writer. Also, post your published articles on social media and/or your personal website to gain exposure and showcase your experience to generate real estate clients. All things considered, it is one of the top pick ways to make money with a real estate license.

12. Run a Home Staging Business

Home staging is another great non-licensed real estate job agents can provide their clients. If you have an artistic eye, this is a great side job and an opportunity to make extra cash. The service is in great demand and is relatively simple to establish. Offering home staging services to your clients is a good place to start. Alternatively, you could create a company and recruit other stagers to work for you.

An empty home vs virtual home staging (Source: BoxBrownie)

Staging a house to increase its appeal to buyers is one way to assist your customers in getting their properties ready for sale and selling them faster. Staging may include changing furniture, redecorating, cleaning, choosing paint colors, and making other cosmetic modifications to make the home more desirable.

For more home staging tips for real estate agents and homeowners that guarantee a higher price and a quick sale, read our Top 9 Home Staging Tips That Guarantee a Quick Sale.

13. Take Real Estate Photography & Videography

If you’re an excellent photographer, taking pictures and videos of the property could be the perfect side job for you in real estate. This service is in great demand and is rather simple to establish. You could earn money by offering your services to real estate agents and homeowners. As your business grows, hire other photographers to work for you. To attract more clients and promote your services, create a website or portfolio, sign up for a real estate photography network, or list your services online.

Read our 11 Real Estate Photography Tips, Equipment & Mistakes to Avoid and Real Estate Photography Pricing, Types & Hiring Tips Guide articles to know more about real estate photography pricing and tips to show agents how to present your properties’ best views and features.

Bottom Line

Making money in real estate isn’t quite as straightforward as getting hired for a job, but there are so many interesting and unique ways to make money in real estate. Start by becoming a real estate agent, then try out different money-making strategies like freelancing, leasing, or working in unusual niches.