When reconciling payroll, many QuickBooks Payroll users are concerned with aligning their payroll records to their bank statements. There are, however, important related tasks, like learning how to reconcile payroll liabilities in QuickBooks. This consists of researching outstanding payroll debts, like payroll taxes or benefit premiums, that haven’t cleared your general ledger accounts in a reasonable time frame. You may do this annually, but doing it monthly saves more time in the long run.

Whether you're focused on paying invoices, allocating budgets, or managing employee spend, BILL simplifies the entire process. And, of course, it integrates with QuickBooks. |

|

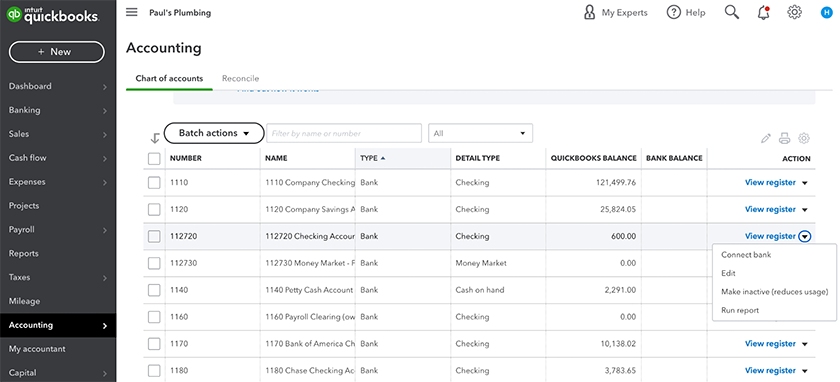

Step 1: Make a List of Your Liability Accounts

The first thing you need to do is make a list of all your payroll liability accounts. If you still need to set them up, use our tutorial on setting up a chart of accounts in QuickBooks.

Here’s a list of the payroll liability accounts you may need to reconcile. Keep in mind that you can create additional accounts as needed, depending on how specific your accounts need to be.

- Federal Income Tax Withholdings Payable: Federal income tax you deducted from employee paychecks but haven’t paid to the IRS.

- State Income Tax Withholdings Payable: State tax you deducted from employee paychecks but haven’t paid to applicable state tax agencies; local income taxes may fall under this category or you can create a similar account to house only that.

- FICA Tax Payable: This includes both employee and employer Social Security and Medicare taxes that are outstanding; half is deducted from employee pay, and the other half is a business expense.

- 401(k) or Retirement Benefit Premiums Payable: This account consists of deposits employees make to their 401(k) accounts; you can also deposit any contribution your business is matching into this account.

- Health Insurance Payable: This account should hold any employee insurance premiums plus health insurance premiums that have been recorded as an expense to the business but are still waiting to be paid.

Remember, since you’re reconciling liability accounts, the funds should remain in the account until you pay them out. Any funds that aren’t routinely cleared from your payroll accounts, like retirement benefit premiums that are paid out monthly, indicate there may be a problem. For instance, a bill payment may be late, or a transaction could be booked to the wrong account(s).

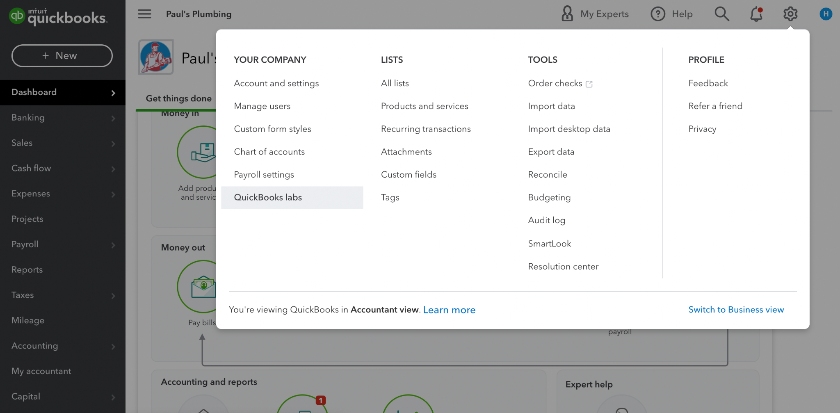

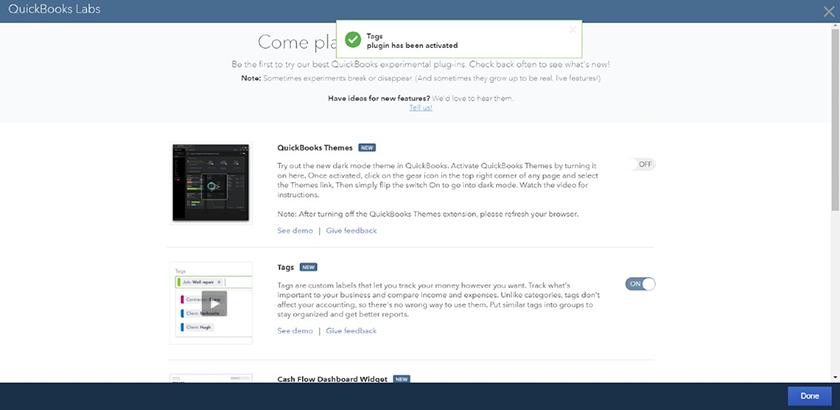

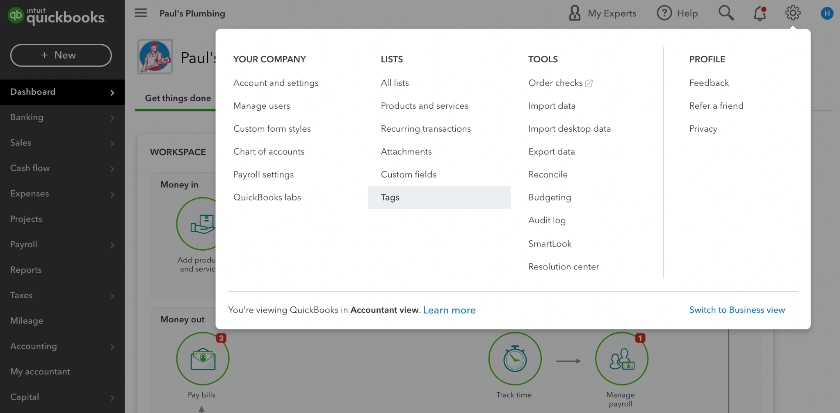

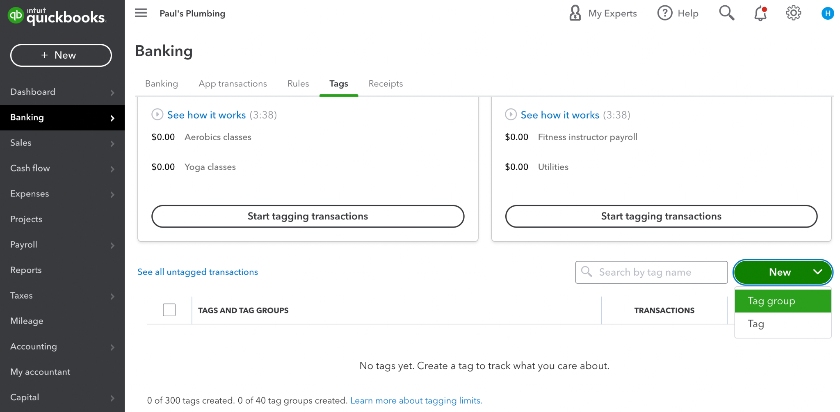

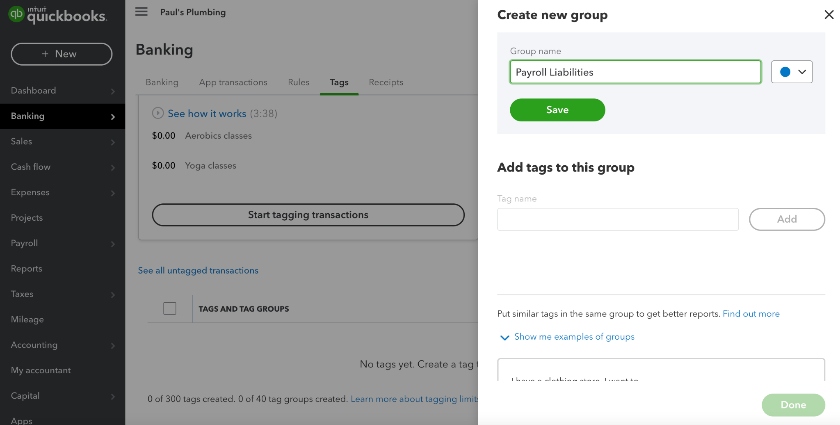

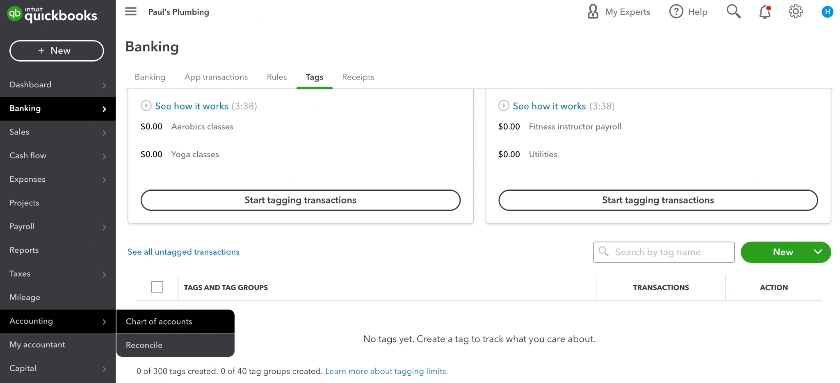

Step 2: Create Transaction Labels to Separate Employee & Employer Payroll Liability Transactions

QuickBooks allows you to assign transaction labels, so you should consider identifying employee and employer funds (EE can be short for employee, and ER can represent employer contributions). This will help you organize data much faster when you need to research payroll liabilities.

Step 3: Set Up Payroll Liability Reconciliation Sheets

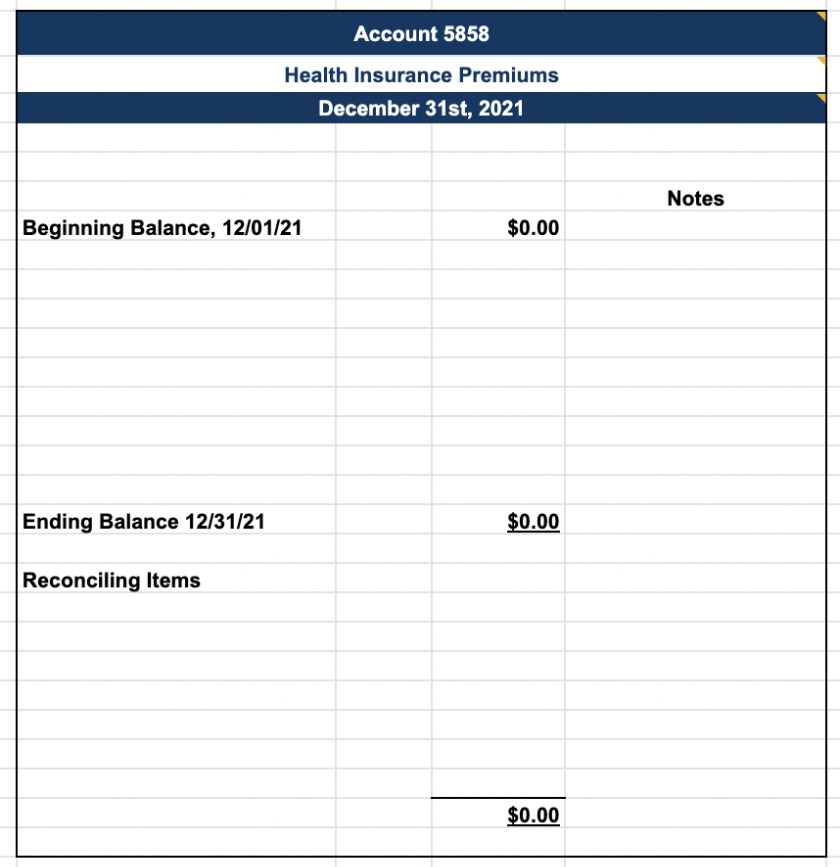

We recommend downloading our payroll reconciliation spreadsheet to help document the activity in your accounts. Make copies for each payroll liability account and create a new copy at the end of each period, depending on how often you intend to perform the reconciliations—remember, monthly is ideal. Enter the liability account name at the top of the spreadsheet along with the beginning and ending balance for each that ties to the general ledger balance records. Leave space for reconciling items.

Download our Payroll Reconciliation Spreadsheet in Excel | Google Sheet

Reconciling Items: These are transactions that may not be showing in the general ledger correctly or at all. You’ll recognize reconciling items because they won’t clear out of the account smoothly or in a timely manner.

This is an example of a payroll reconciliation report.

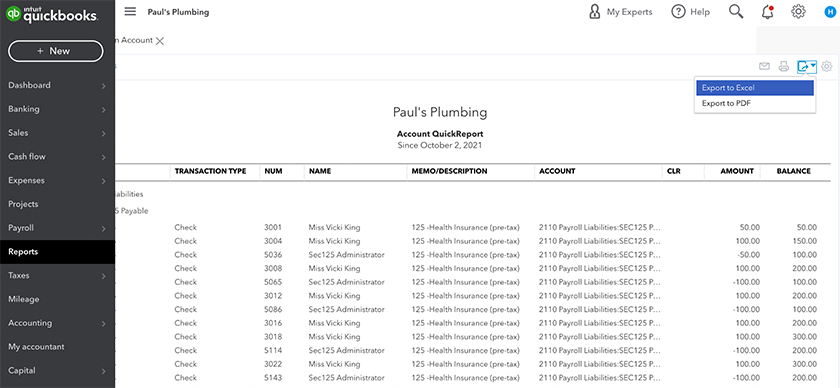

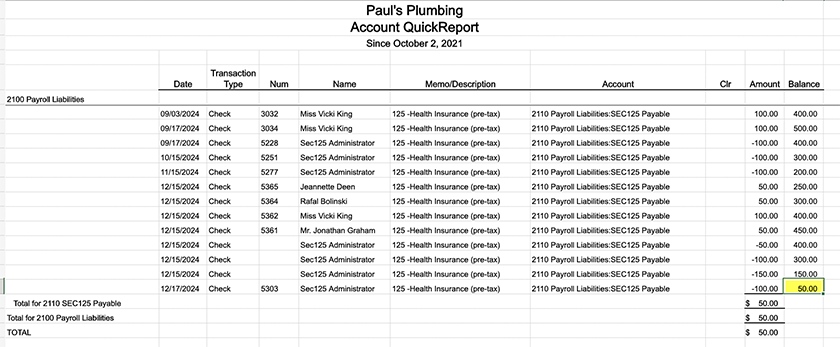

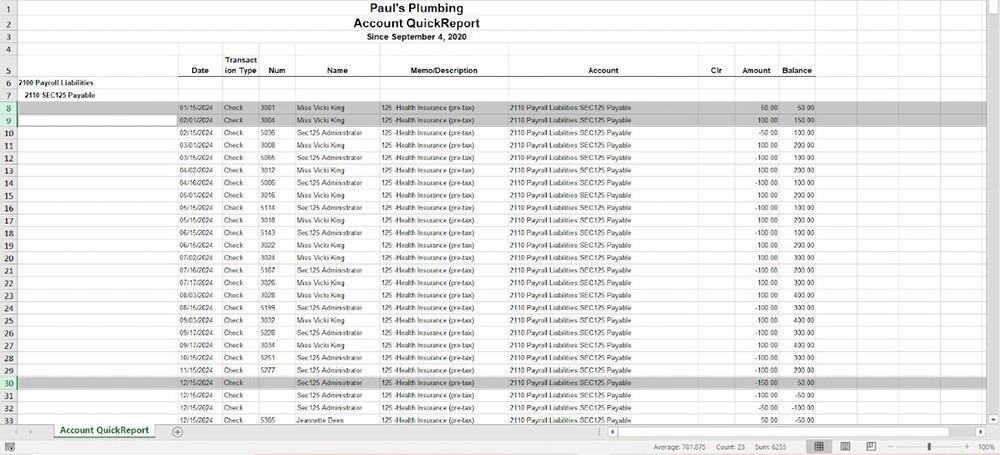

Step 4: Print Reports From Your QuickBooks Payroll Software & General Ledger

The great thing about using QuickBooks is that it makes it easy to reconcile your payroll liability accounts. You can print payroll reports using its payroll feature and make any adjustments to the general ledger within the same software. To get started, you’ll need reports from both the general ledger and the payroll software.

If you’re reconciling payroll liabilities in QuickBooks on a monthly basis, you’ll need a monthly transaction report for each payroll liability account. It should show both the beginning and ending balances for the time period.

Repeat this process for each payroll liability account you need to reconcile.

Reports you may need to gather from your payroll software are a payroll register, payroll tax report, payroll deduction report, etc. You might also need to print payroll cash reports or itemized invoices from your benefit vendors if the issue requires more in-depth research.

For more guidance, check out our guide on how to run and print QuickBooks Payroll reports.

Step 5: Review Each Payroll Liability Transaction & Reconcile Outstanding Items

After printing your reports, it’s a good idea to download the transactions from QuickBooks into an Excel spreadsheet. It makes it easier to organize the transactions so it’s clear which amounts cleared and which did not.

Pro Tip: Since you’ll be deleting transactions to find what you’re looking for, I recommend maintaining a separate tab that shows all of the transactions, whether they cleared or not. This ensures you always have all of the original data in your reconciliation report.

Step 6: Fix Payroll Liability Reconciling Items

Once you determine the transactions that make up the final balance of each payroll liability account, you should assess whether or not the transaction amounts should be there. If it’s a Quarter 1 tax deposit you withheld from an employee’s paycheck and it’s now Quarter 3, there’s probably an issue you need to resolve. At this point, you would pull your Quarter 1 tax payment reports, preferably itemized, so you can figure out why and/or if this payment was inadvertently left out.

When dealing with benefit premiums, you might need to pull the related invoice to see who you were charged for and how much. You’ll also need to take a deep dive into the payroll deductions you received for the period. Assess whether they align with what you were charged and what was paid out.

Depending on the answers your research uncovers, you may need to reverse a transaction and give an employee a refund, work with your benefits provider to determine if an invoice needs to be corrected, or keep the money to pay on your next month’s bill.

The most common reconciliation items you may encounter are:

- A voided check that was never cleared from the general ledger (using QuickBooks for both accounting and payroll helps prevent this since they’re seamlessly integrated)

- An error on the invoice your benefits provider billed you

- Employees were terminated, but you’re still expensing employer match funds for retirement and other benefits for them

- You expensed amounts to the business that employees were responsible for

When learning how to reconcile your payroll liabilities in QuickBooks, take your time and dive deep. You may need to review several months of records, call providers to get itemized invoices, request revised invoices, and even work with your bank and tax agencies. If you have a good payroll accounting system in place and do your payroll reconciliations monthly, the time you spend reconciling payroll liabilities in QuickBooks should be minimized.

If you’re not yet using QuickBooks Online to manage your small business accounting, check out our 2021 guide to the best small business accounting software, where QBO ranks #1. If you haven’t started using QuickBooks Payroll yet and need help setting it up, check our guide on how to set up QuickBooks Payroll.

Bottom Line

QuickBooks makes it easy to reconcile your payroll liabilities. Its payroll service and accounting features are integrated, which helps ensure that your payroll data is accurate in both systems. In addition, you get access to labeling and easy export/print reporting features that help you identify reconciling items much faster, so you can get back to the important things.

Although having payroll software makes paying your employees the right way much easier, you still need to know the basics. Check out our tips on the best payroll training to help.