With predictable fees and lots of free tools, Square offers excellent value for all kinds of small businesses.

Square Fees: Is Square Worth It? (+ Calculator)

This article is part of a larger series on POS Systems.

Square is a payments, point-of-sale (POS), and business management tool for small businesses. It has no contracts, minimum requirements, or upfront costs for its software or payment processing tools. The basic software is free, and any upgrades are billed monthly. Square deducts a flat fee on successful payment transactions, and you get low-cost hardware, with interest-free installment plans for qualified purchases.

Square Payment Processing Fees

Payment Type | Transaction Fee |

|---|---|

In-person, mobile, and gift card payments | 2.6% + 15 cents per transaction |

Online payments | 2.9% + 30 cents per transaction |

Recurring billing and card-on-file transactions | 3.5% + 15 cents per transaction |

Keyed-in payments (virtual terminal) transactions | |

ACH Bank Transfers | 1% with a $1 minimum transaction |

Invoiced payments | 3.3% + 30 cents per transaction |

Square processing fees are lower for businesses that purchase Square Register or Square Terminal hardware or Square for Retail or Square for Restaurants software.

Lower rates are also available for businesses processing over $250,000 annually.

Square Fee Calculator

Enter your monthly card processing information to find out how much you would pay with Square.

How Square Fees Work

Overall, Square offers some of the best merchant services tools for new and small businesses. You’ll get the same core features and services for whatever payment methods you use—in-store, online, or virtual terminal.

- No monthly fee to accept and process credit cards

- All payments and sales are tracked together in your Square dashboard

- Accept Visa, Mastercard, Discover, and American Express, plus contactless payments

- Same Square transaction fees for all cards and card types: debit, credit, prepaid, rewards, and corporate

- Deposits made within one to two business days

- Instant deposit available for an additional fee of 1.75%

- Chargeback protection free for sellers and covers disputes up to $250 per month

- Custom Square pricing for sellers with annual revenue over $250,000 and average ticket size over $15

What You Get With a Free Square Account

Standard Square POS software | Invoicing |

Square payments processing | Virtual terminal |

Mobile POS app | Customer directory |

Ecommerce plan (Square Online) | Starter team management plan |

Payment Links | First magstripe mobile card reader |

Without a doubt, Square’s free merchant account is the best option for new and small businesses, particularly if you need a POS. There is no approval required to set up an account. Square allows you to start running your business with little to no setup cost, and charges no monthly fees.

Square POS Fees

Square offers a free POS system with every free Square Payments account. When you sign up with Square, you’ll instantly have access to inventory, order, sales, and customer management tools through the free basic POS. However, Square also offers specific POS software for retail, restaurant, and appointment-based businesses. These business-specific Square POS systems offer different plans with slightly different fees, while the basic free Square POS uses the standard Square pricing.

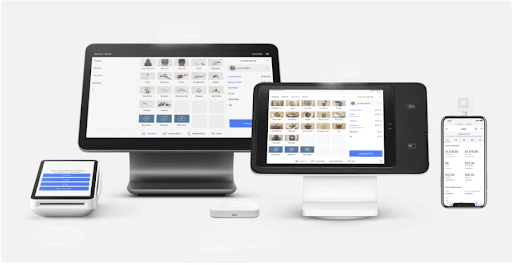

The basic Square POS software is a simple but versatile system designed for startup retail, service, and restaurant businesses with simple inventory management needs. It conveniently integrates inventory, checkout, payments, CRM, ecommerce, and analytics into your point of sale. You can add more features as your business grows, but the best part of this software is no monthly subscription fee.

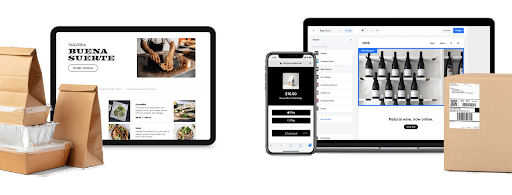

Square’s basic POS system is free to use and can be designed to support different types of startup businesses. (Source: Square)

Features you get with the free POS system:

- Inventory management

- Cash, mobile, debit, credit, and gift card payments processing

- Invoicing

- Website builder

- Virtual terminal

- CRM

- Offline credit card payment processing

- Returns and refunds processing

- Tip management

- Digital and printed receipts

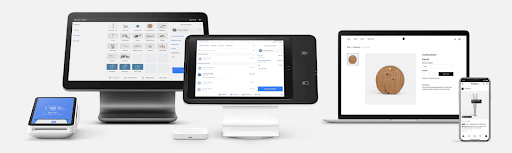

Square for Retail is a POS system designed specifically for retail businesses of all sizes, such as boutiques and gift shops. It has advanced inventory, online sales, checkout tools, and reporting.

Square for Retail includes advanced reporting and inventory management tools for omnichannel selling. (Source: Square)

Square for Retail Pricing Plans

Square for Retail offers a free option, a Plus tier that contains all of the advanced retail functions, and a Premium plan that provides access to Square’s other business tools like Marketing and Payroll. All options provide unlimited products, transactions, employee logins, and a free online store.

Free | Plus | Premium | |

|---|---|---|---|

Monthly software fee | $0 | $89 per location | Custom rate |

In-person processing rate | 2.6% + 10 cents | 2.5% + 10 cents | Custom rate |

Online processing rate | 2.9% + 30 cents | 2.9% + 30 cents | Custom rate |

Manually entered/ Card-on-file | 3.5% + 15 cents | 3.5% + 15 cents | Custom rate |

Afterpay | 6% + 30 cents | 6% + 30 cents | Custom rate |

Online store features | Basic | Basic | Advanced |

Inventory management | Basic | Advanced | Advanced |

Reporting | Basic | Advanced | Advanced |

Team management | Basic | Basic | Advanced + Payroll |

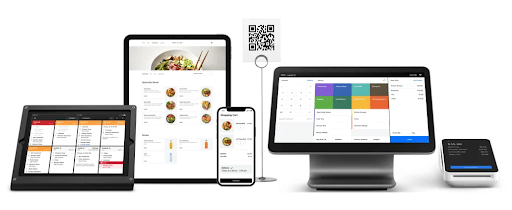

Square for Restaurants is POS software designed for quick-service, full-service, fast-casual, bar, and multi-concept restaurants. It offers restaurant-specific features, such as floor management, kitchen management, customizable and intuitive order entry, and flexible payment options.

Square for Restaurants allows businesses to manage online, tableside, and at-the-counter orders centrally. (Source: Square)

Square for Restaurants Pricing Plans

Free | Plus | Premium | |

|---|---|---|---|

Monthly software fee | $0 | $60 per location; $40 per additional countertop device; $50 per location for mobile POS | Custom rate |

In-person payments | 2.6% + 10 cents | 2.6% + 10 cents | Custom rate |

Online payments | 2.9% + 30 cents | 2.9% + 30 cents | Custom rate |

Invoice payments | 3.3% + 30 cents | 3.3% + 30 cents | Custom rate |

Manual key-in and card-on file | 3.5% + 15 cents | 3.5% + 15 cents | Custom rate |

Customer support | Monday to Friday, 6 a.m. to 6 p.m. Pacific time | 24/7 | 24/7 |

Front-of-house | Menu and table management | Menu, table, seat, and course management | Menu, table, seat, and course management |

Kitchen Display System | $20/month/device | Included/Unlimited | Included/Unlimited |

Online ordering | Basic | Basic | Advanced |

Team management | Basic | Advanced | Advanced |

Reporting | Basic | Advanced | Advanced |

All plans include fast order entry with conversational modifiers, menu and order management, table management, open checks, auto-gratuity options, multi-location management, and remote device management.

The Plus tier has 24/7 support and more sophisticated restaurant features like auto-86ing, coursing, and options to set closing procedures. Premium has everything in Plus and comes with discounts on Square Payroll, Marketing, Loyalty, and Online Store. All paid Square for Restaurant plans have a free 30-day trial.

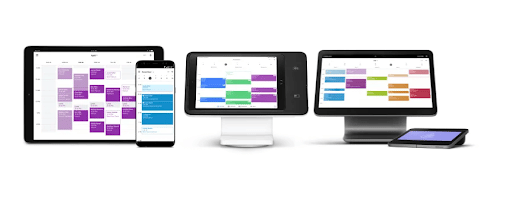

Square Appointments is designed for service-based businesses and professionals. These include spas, salons, hairdressers, personal trainers, massage therapists, makeup artists, photographers, appointment-based retail, and consulting.

Square Appointments makes it easy to manage multiple appointment calendars from anywhere. (Source: Square)

Square Appointments Pricing Plans

Like Square for Retail, Square Appointments offers discounted in-person payment processing rates if you subscribe to a paid plan. However, Square Appointments offers a second paid plan that includes access to advanced team management features. Custom Square pricing is also available.

Free | Plus | Premium | |

|---|---|---|---|

Monthly software fee | $0 | $29 per location | $69 per location |

In-person processing rate | 2.6% + 10 cents | 2.5% + 10 cents | 2.5% + 10 cents |

Online processing rate | 2.9% + 30 cents | 2.9% + 30 cents | 2.9% + 30 cents |

Manual key-in, card-on-file, payment links | 3.5% + 15 cents | 3.5% + 15 cents | 3.5% + 15 cents |

Afterpay | 6% + 30 cents | 6% + 30 cents | 6% + 30 cents |

Scheduling | Basic | Advanced | Advanced + Resource management |

Online booking | Advanced | Advanced | Advanced |

Team management | Basic | Basic | Advanced |

Client management | Advanced | Advanced | Advanced |

Inventory and reporting | Advanced | Advanced | Advanced |

Feature-wise, Square is the undisputed leader in startup and small business POS software. Even with its paid plans, Square offers the most value for money, providing merchants with industry-specific POS, and a range of free tools to run a business.

On the other hand, Square’s inventory management tools are not the most robust. You will need to use third-party integration for customization tools to handle complex inventory management for establishments like convenience stores and specialty restaurants.

Did you know?

- In addition to the best overall POS for small businesses, Square POS is a consistent pick for leading retail POS systems, multichannel POS systems, and POS inventory systems.

- To learn more about Square’s free POS system, read our full Square POS review.

- To learn how to set up Square POS, read our Square POS setup guide.

Square Online Fees

Every free Square account comes with basic POS software, payment processing, invoicing, and a Square Online store. The online store ties into the rest of the Square ecosystem and can be managed through your Square Dashboard, where you can sync products, orders, and customers across your in-person and online sales channels.

The Square Online store is a free drag-and-drop web builder for selling goods and services online.

(Source: Square)

You can upgrade to a paid online store to get a custom domain, remove Square branding, and receive discounts on integrated shipping labels and real-time shipping calculations. Paid plans also come with advanced features like customer product reviews, abandoned cart recovery, and the ability to accept PayPal payments.

Square Online Pricing Plans

Free | Plus | Premium | |

|---|---|---|---|

Monthly fee* | $0 | $29 | $79 |

Processing fee | 2.9% + 30 cents | 2.9% + 30 cents | 2.6% + 30 cents |

Website builder + SEO tools | ✓ | ✓ | ✓ |

Pickup, local delivery, and shipping | ✓ | ✓ | ✓ |

Sell on social | ✓ | ✓ | ✓ |

Expanded site customization | ✕ | ✓ | ✓ |

QR code ordering | ✕ | ✓ | ✓ |

Customer accounts | ✕ | ✓ | ✓ |

Personalized ordering | ✕ | ✓ | ✓ |

Advanced item settings | ✓ | ✓ | |

Accept PayPal | ✕ | ✓ | ✓ |

Free 1-year domain | ✕ | ✓ | ✓ |

Real-time shipping calculator | ✕ | ✕ | ✓ |

When talking about online POS platforms, it’s hard not to compare any provider with Shopify. Overall, Shopify is the better option in terms of features, customization, and scalability. However, Shopify does not have a free version, and its monthly fees are more expensive even if merchants subscribe to a Square Online paid plan. So if you are primarily a merchant with a storefront looking to expand with an online presence, Square is the more cost-effective choice.

Square Hardware Fees

To get a complete idea of Square POS system cost, you also need to consider hardware. Mobile payments and in-store sales require credit card readers to accept payments, and Square has a variety of hardware options that let you swipe, insert, or tap cards to complete a sale. Each works on smartphones and iPads using Square’s free POS app.

The beauty of Square’s range of hardware is that it offers setup for every stage of your business. You can start with zero upfront cost, and invest only as needed.

Consider the following examples:

Business Size | Square Hardware Setup | Square Hardware Cost |

|---|---|---|

Home-based, Seasonal, Startups | Your computer or mobile device + Square Virtual Terminal | $0 |

Small startups, on-the-go | Your mobile device + Square Mobile Card Reader | $0–$49 |

Startup, single checkout storefronts | Your iPad + Square Stand | From $14 per month for 12 months ($149) |

Remote businesses that accept swiped payments | Your computer or mobile device + Square Terminal | From $27 per month for 12 months ($299) |

Storefronts that accept swiped payments | Square Register (+ optional Square Terminal) | From $39 per month for 24 months ($799) |

Growing storefronts | Square Stand/Register Kit (+ optional Square Terminal) | From $739 |

Accessories such as cash drawers, barcode scanners, kitchen printers, and thermal printers are also available and can be bought separately or bundled into a POS hardware kit.

Device | Description | Cost |

Square Mobile Card Readers | ||

Square Reader for Magstripe |

| First free, additional $10 |

Square Reader for Contactless and Chip (1st generation) |

| $49 |

Square Reader for Contactless and Chip (2nd generation) |

| $59 |

Square In-store POS | ||

Square Stand for Contactless and Chip |

| $149 or $14 per month for 12 months |

Square Terminal |

| $299 or $27 per month for 12 months |

Square Register |

| $799 or $39 per month for 24 months |

Square Stand Mount |

| $149 or $14 per month for 12 months |

Square Hardware Kits | ||

Square Stand Kit |

| $668 |

Square Register Kit |

| $1,358 |

Square Stand Restaurant Kit |

| $1,089 |

Square Stand Restaurant Kit and Terminal |

| $1,389 |

Square Mobile Card Readers | |

Square Reader for Magstripe | |

| First free, additional $10 |

Buy Magstripe Reader | |

Square Reader for Contactless and Chip (1st generation) | |

| $49 |

Buy 1st Generation Contactless and Chip Reader | |

Square Reader for Contactless and Chip (2nd generation) | |

| $59 |

Buy 2nd Generation Contactless and Chip Reader | |

Square In-store POS | |

Square Stand for Contactless and Chip | |

| $149 or $14 per month for 12 months |

Buy Square Stand | |

Square Terminal | |

| $299 or $27 per month for 12 months |

Buy Square Terminal | |

Square Register | |

| $799 or $39 per month for 24 months |

Buy Square Register | |

Square Stand Mount | |

| $149 or $14 per month for 12 months |

Buy Square Stand Mount | |

Square Hardware Kits | |

Square Stand Kit | |

| $668 |

Buy Square Stand Kit | |

Square Register Kit | |

| $1,358 |

Buy Square Register Kit | |

Square Stand Restaurant Kit | |

| $1,089 |

Buy Square Stand Restaurant Kit | |

Square Stand Restaurant Kit and Terminal | |

| $1,389 |

Square Stand Restaurant Kit and Terminal | |

What we like about Square is that it offers scalable hardware options. You’ll find that Square has more hardware variety compared to Clover and has better setup flexibility than Lightspeed.

Granted you’ll end up spending a significant amount depending on your business needs, but the range of choices and the availability of installment payment plans makes it easier for merchants on a budget.

Square Fees for Add-on Software & Other Services

Square’s core products are POS, payments, and ecommerce, though the company offers a variety of other supplemental products, including invoicing, payroll, and marketing that you can use alongside other solutions or individually.

Square Invoicing can be a good fit for client service businesses like consulting firms, field service businesses like contractors, made-to-order retailers, and freelance professionals that want to easily request payment from customers.

Square Invoices are free to create and send. (Source: Square)

Square Invoicing Pricing

Square Invoicing now offers both a free and an advanced plan. While both charge the same Square processing fees, you get customization tools with the paid plan.

Free Plan | Plus Plan |

|---|---|

$0 per month | $30 per month |

|

|

Square fee structure for invoiced payments are as follows:

- In-person: 2.6% + 10 cents per transaction

- Online: 2.9% + 30 cents per transaction

- Card on file: 3.5% + 15 cents per transaction

- Online ACH payment: 1% with minimum fee of $1

- With Afterpay: 6% + 30 cents per card payment

You can create, send, and manage invoices through your web-based Square Dashboard or the Square Invoicing app for iOS and Android. Learn how to send a Square Invoice.

Square Payroll is subscription-based, full-service payroll software that automatically calculates payments and taxes. This service can be used independently or in tandem with Square’s other products like POS or Team Management.

Calculate and process payroll straight from your mobile phone. (Source: Square)

Square Payroll Pricing

Employees and Contractors | Contractors Only | |

|---|---|---|

Monthly fee | $35 + $6 per person paid | $6 per person paid |

Unlimited monthly pay periods | ✓ | ✓ |

1099-MISC forms | ✓ | ✓ |

W-2s | ✓ | ✕ |

Pay by check, direct deposit, or Cash App | ✓ | ✓ |

Tips and Commissions tracking | ✓ | ✕ |

Multistate payroll | ✓ | ✕ |

Automatic payroll tax calculations | ✓ | ✕ |

Time cards and employee app | ✓ | ✕ |

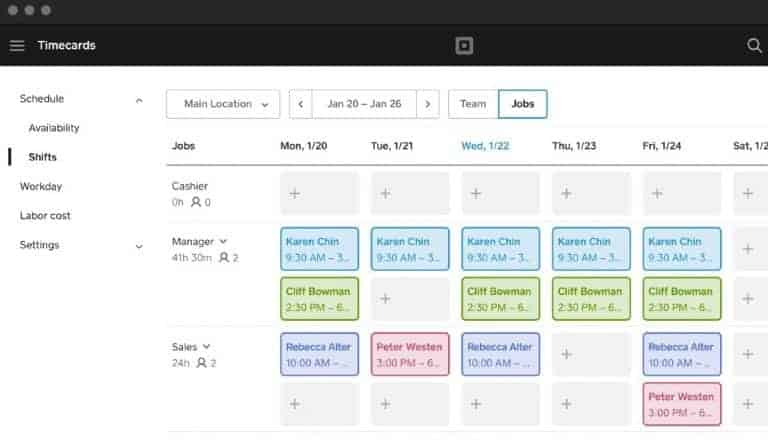

Square Team Management is included with every free Square account. Some paid POS plans include Team Plus features, although they can also be purchased separately. Advanced features include setting wage rates, timecard notes, multiple permission levels, and detailed labor reports. Team Plus has a 30-day free trial.

View all planned shifts by week to assign a job or an employee. A shift can be viewed weekly or daily to make changes. (Source: Square)

Square Team Management Pricing

Team Management | Team Plus | |

|---|---|---|

Monthly fee | $0 | $35 per location |

Time clock and time card with break tracking | ✓ | ✓ |

Unscheduled log in prevention | ✕ | ✓ |

Payroll exports | ✓ | ✓ |

Permission levels | One | Unlimited |

Multiple wage rates | ✕ | ✓ |

Overtime reporting | ✕ | ✓ |

Activity logs | ✕ | ✓ |

Labor reports | ✕ | ✓ |

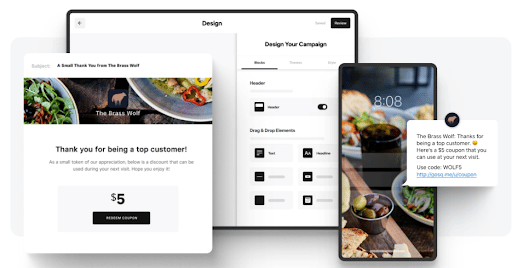

Square Marketing allows businesses to create, send, and track email and social campaigns. Every plan includes automation features, customer coupon options, automatic email collection, and unlimited email sends. Plus, it has a Square Marketing Assistant, an automated chat that sends you suggestions, opportunities, and reports to stay on top of campaigns. It also uses your email lists to suggest campaigns you can launch from your phone.

Square allows you to customize your customer engagement methods, including fully-branded campaigns and two-way text messaging options. (Source: Square)

Square Marketing plans depend on the communication type and number of customer contacts. Email marketing costs start at $15 per month, while SMS marketing costs at $10 per month.

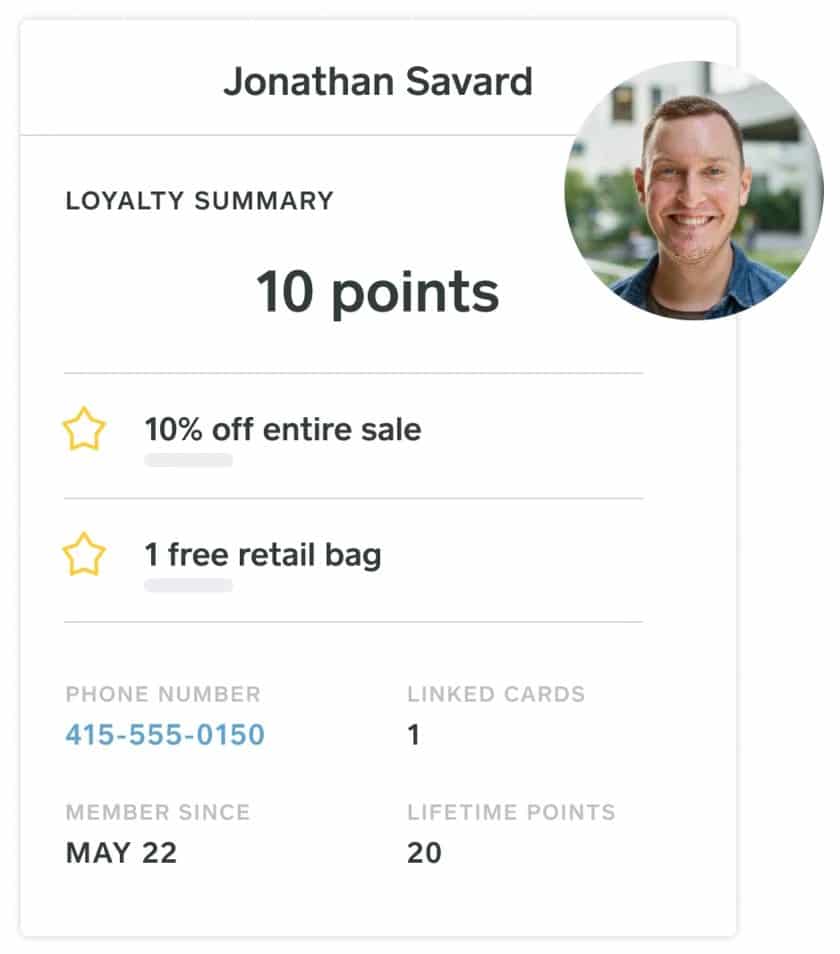

Square Loyalty is a mobile-app-based digital rewards program that provides customers with points based on their activity. It integrates seamlessly with Square POS and Square Online and tracks customers based on their payment and/or method once they enroll. Businesses can customize whether shoppers are rewarded per visit or per dollar spent. To apply rewards, just enter the customer’s phone number online or at in-store checkout.

View returning customers’ points and reward history in a quick glance. (Source: Square)

Like Square Marketing, Loyalty pricing is based on the number of times a customer enrolls or completes a transaction where loyalty points are earned or redeemed. The features are identical for each plan.

Square Loyalty Pricing

Monthly | $45 | $75 | $105 |

|---|---|---|---|

Loyalty Visits | 0–500 | 501–1,500 | 1,501–10,000 |

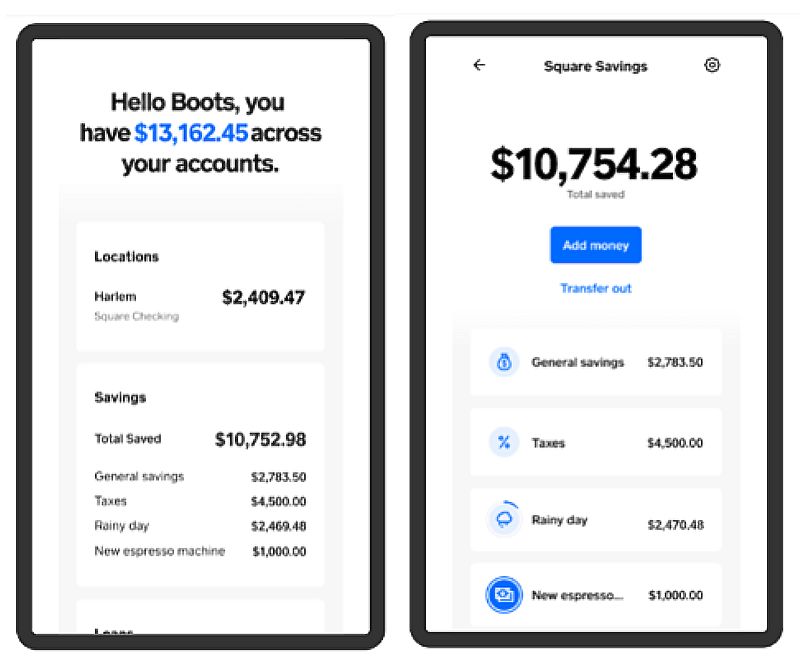

Square Banking is a service that offers businesses integrated banking solutions with traditional checking and savings accounts, as well as options for setting up investments and taking out loans. Signing up is easy as there is no lengthy application process or credit checks. There is also no monthly fee, and you don’t need to maintain a minimum balance.

Square Banking Products

- Square Checking: A checking account integrated with your Square merchant account. It comes with a debit card that provides access to your sales and loan proceeds.

- Square Savings: Integrated with Square Payments so merchants can automatically set money aside for savings, paying bills, sales tax, and more. Earns 1.75% annual percent yield (APY).

- Square Business Loans: Open to individuals who process with Square Payments with loans ranging from $300–$250,000 based on card sales through Square. Repayment is set up automatically as a portion of your total monthly sales.

Your Square Savings account allows you to set aside a percentage of your daily sales into a high-yield investment. Apply for a Square Debit Card and immediately get access to your funds.

(Source: Square)

Square Business Banking Fees

Opening a bank account with Square is absolutely free; there is no minimum opening deposit and maintaining balance, and you don’t get charged for maintenance fees or overdrafts. For qualified customers, you can apply for business loans ranging from $500 to $250,000, and Square automatically deducts a fixed percentage of your daily sales to repay the loan over time, or you can prepay the loan amount.

- Opening Deposit: $0

- Monthly Fee: $0

- Minimum Balance: $0

- Credit Checks: None

- Overdraft Fee: $0

Ways to Lower Square Fees

With Square, merchants can launch their business with very minimal (even free, if you prefer to accept payments without a card reader) upfront cost. Your monthly Square fees can be limited to transaction rates if you use the standard POS software.

If you wish to keep your Square transaction fees, consider the following:

- Accept more in-person payments: Transaction rates for accepting in-person payments are much lower than remote payment methods.

- Refrain from manually keying in your customer card information: Manually keyed-in and card-on-file transaction rates are charged above 3%.

- Avoid buy-now-pay-later (BNPL) transactions: Square’s BNPL app, Afterpay charges expensive transaction fees compared to other top BNPL apps.

- Avoid same-day fund deposits: If possible, wait for Square’s standard 2-business day funding speed. Square charges 1.75% for same-day deposits.

Cheaper Alternatives to Square Fees

Square fees are small-business friendly, but if you are looking to save more, here are some Square alternatives to consider:

For omnichannel payment processing

Helcim is a suitable cheaper alternative to Square when it comes to payment processing fees. It uses an interchange-plus-plus pricing model which means it charges the interchange rate plus a small add-on rate and a flat amount for every transaction.

Helcim’s pricing schedule is designed to charge lower fees as the monthly sales volume increases. Interchange-plus pricing models usually come out cheaper than Square’s flat-rate pricing model.

Read our Helcim review to learn more.

If you have high-volume transactions, an even cheaper option is Payment Depot which only charges the interchange rate plus a flat amount for every transaction. However, it comes with a $79 monthly fee. If you have a lot of transactions in a month, Payment Depot may still come out cheaper even with the monthly fee.

Read our Payment Depot review to learn more.

For in-store payment processing

If you only need to process payments in-store, PayPal Zettle is a cheaper option. The PayPal Zettle POS app is also free to use like Square’s and its all-in-one terminal costs $199–cheaper than Square’s $299. Additionally, its processing fee is 2.29% + 9 cents per transaction, which is also lower than Square’s 2.6% + 10 cents per transaction.

Read our PayPal Zettle review to learn more.

For online payment processing

All the best ecommerce platforms we’ve evaluated offer the same payment processing fee. However, some charge monthly fees. One of the best free ecommerce platforms to consider is Shift4Shop. It costs the same as Square and has features similar to Shopify, one of the best and most popular ecommerce platforms.

Read our Shift4Shop review to learn more.

Frequently Asked Questions (FAQs)

Here are some of the questions we commonly get about Square fees.

Square charges a flat fee per credit card transaction as it is processed. Most of Square’s software, including the point-of-sale app, online store, invoicing, inventory tracking, and virtual terminal, are free to use.

However, Square also has paid software you can add on at any time on a month-to-month basis, including Plus plans for retail, restaurants, and appointment point-of-sale, advanced ecommerce, marketing tools, team management, payroll processing, and more.

Square fees for merchants are flat-rate so it’s easy to manage costs. For card-present transactions, including swipe, tap, and chip payments, Square charges 2.6% + 10 cents. Online and invoice transactions cost 2.9% + 30 cents with Square pricing, and it’s 3.5% + 15 cents for keyed-in or card-on-file transactions.

If you process over $250,000 annually, you may be eligible for lower rates through Square’s custom pricing program.

Square credit card fees are fairly standard for mobile and online payments, especially for new and small businesses. However, there are cheaper options available, especially if you have an established business. See our guide to the cheapest credit card processing to calculate the best option for you.

No, basic Square accounts have zero monthly fees.

You can choose to add on additional software upgrades like marketing, loyalty programs, payroll processing, advanced team management, or Plus POS plans, which do have monthly fees.

Bottom Line

Square is best known for its square-shaped mobile card reader and payment processing service. However, it has grown into a platform that supports your entire business, including, business management, online selling, and marketing.

Its strongest advantage is that you can easily craft a full sales and business management solution on any budget. Square pricing is set up so that the core features are free, and you only pay the Square fees for credit card processing, certain processing equipment, and optional advanced features. So, with Square, you only pay for what you actually need. Head over to Square to sign up for a free account.