Paylocity is a highly rated human resources (HR) and payroll software. Designed to automate employee management processes, its integrated suite of cloud-based solutions can help simplify basic to advanced HR tasks—from hiring and pay processing to performance management and training tracking. Because of its pricing and payroll solutions, it’s better suited for medium and larger businesses.

Therefore, if Paylocity is too expensive for you or does not quite meet your needs, there are many high-quality Paylocity alternatives to choose from. These are our top six Paylocity competitors:

- ADP: Best overall Paylocity alternative

- Paychex: Best for growing businesses

- TriNet: Best for budget-conscious businesses in highly regulated industries

- Rippling: Best for tech-dependent businesses wanting modular solutions

- Papaya Global: Best for businesses requiring international payroll and EoR services

- Gusto: Best for small businesses needing inexpensive and simple payroll

How Paylocity Compares With Top Alternatives

Starter Monthly Pricing | Payroll Included in Plan | Global Solutions | Advanced HR Tools | |

|---|---|---|---|---|

✓ | Global payroll (via Blue Marble) |

| ||

| Custom priced | ✓ | Global payroll |

|

✓ | Global payroll (via FMP Global) |

| ||

| $10 per employee | ✕ |

| |

| ✓ | Global payroll and EoR services |

| |

| $15 per employee for global payroll $599 per employee for EoR | ✓ | Global payroll and EoR services |

|

| $49 per month + $6 per person per month | ✓ | Global contractor payments |

|

Unsure how to choose? Check out our guide on how to choose payroll software for suggestions.

When Paylocity Is the Right Choice

Paylocity is one of the pricier HR and payroll services we reviewed, but it offers a lot of excellent features. Its system can take your employee from hiring to retiring, providing you with integrated solutions for handling payroll, performance reviews, compensation planning, and training tracking with ease. It can serve companies with fewer than 25 employees but is better for midsize and larger businesses.

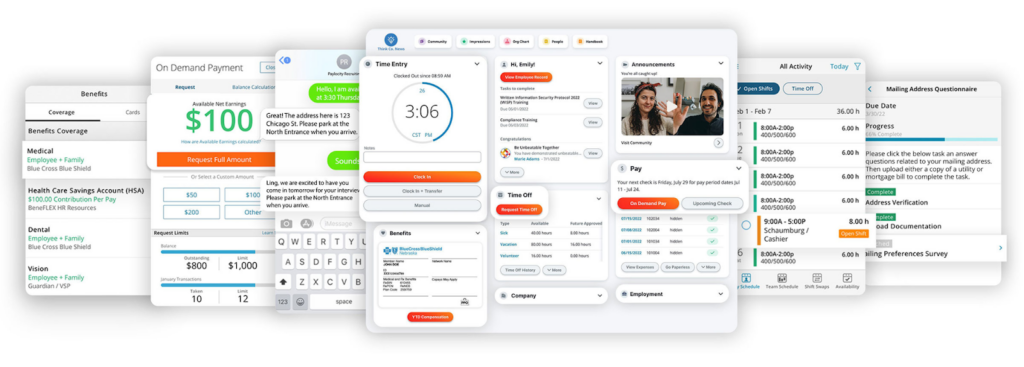

Some of its standout features include automatic expense reimbursement, pay-on-demand functions (for pay advances), flexible benefits management for all 50 states, scheduling and time tracking, and hiring tools. The learning module comes with an online course builder if you want to create your own program, although Paylocity has 600-plus prebuilt courses that you can access. Robust third-party integrations are also available—allowing you to connect its platform to more than 300 software. However, because of its price and focus on larger businesses, it rarely makes it into our small business best-of lists.

Paylocity offers an array of products and services built for large companies. (Source: Paylocity)

For more information about Paylocity and if it’s right for your business, check out our Paylocity review.

ADP: Best Overall Paylocity Competitor

Pros

- Offers pay card as well as direct deposit and check options for payroll

- Has an excellent range of integrations

- Has a wide suite of HR and payroll products, such as ADP Run for payroll, ADP Workforce Now for HR, and ADP TotalSource for PEO services

Cons

- Has setup fees

- Needs custom quotes; many things cost extra (like per payroll)

- Has long hold times when calling support

ADP Overview

Who should use it:

For midsize businesses, ADP Workforce Now offers plans from basic payroll to complete HR management with performance and learning tools. Meanwhile, ADP TotalSource is a professional employer organization (PEO) that offers competitive benefit plans.

Why we like it:

ADP is probably the priciest Paylocity competitor on our list. However, we also consider it the best because of the wide range of features it offers, its decades of experience, overall user-friendliness, and the fact that it can work with both small companies and huge international corporations.

It has a robust product list with services and solutions for managing local and global HR processes. ADP Run for small businesses offers four plans, from simple payroll to payroll plus HR tools.

Plus, ADP Run and ADP’s other HR products appear in many of our buyer’s guides, such as:

- You are on a tight budget: ADP is one of the most expensive solutions on our list. If you are a small business that needs payroll and simple HR, Gusto or Rippling may provide a better alternative.

- You don’t need payroll: If you are only interested in HR tools, then consider TriNet. All of ADP’s plans (like most of the services on our list) include payroll with HR.

- You want unlimited payroll options: ADP prices its plans depending on how many pay runs you do in a month (although it does allow you to print checks, such as for termination, without incurring extra fees). If you pay different employees on different schedules, this can get pricey. Consider Gusto, TriNet, Papaya Global, or Rippling for unlimited pay runs.

ADP has custom pricing, depending on the services you need and the plans you choose.

Here are the quotes we received for some of ADP’s products:

- ADP Run (starter Essential plan): $40 per weekly pay run plus $3 per employee monthly

- Essential Payroll: For start-ups and established businesses that need basic payroll

- Enhanced Payroll: Basic payroll, plus ZipRecruiter, state unemployment insurance, and background checks

- Complete Payroll & HR Plus: Everything in Enhanced package, plus basic HR support

- HR Pro Payroll & HR: Everything in Complete package, plus enhanced HR support and perks for employees

- ADP TotalSource: $85 per employee monthly

- A PEO service that includes hiring, onboarding, compensation, development, retention, and benefits

- ADP Workforce Now: custom-priced

- Select: all-in-one payroll and HR suite

- Plus: everything in Select, plus benefits administration

- Premium: everything in Plus, plus automated time tracking with Time and Attendance

- Payroll: With ADP, you can approve payroll as late as 4:30 p.m. Eastern time the day before and have employees paid the next day (Paychex’s recent changes make it equally fast, but most services take two to four days to post.) It also calculates and files taxes with a liability guarantee.

- Hiring tools: ADP Run’s plans offer excellent HR tools that include two revolving postings on ZipRecruiter, onboarding tools, online courses, and electronic forms and signatures. Some of the other services on our list offer job posting tools (like Gusto) and applicant tracking solutions, such as Rippling, but for an additional fee.

- HR support: ADP has ready-made documents, a handbook wizard, and access to HR experts in each state where you have employees. Its learning management module includes courses for getting and retaining certifications, including instructor-led classroom courses, something we did not see in other HR systems on our list.

- PEO: ADP has over 30 years of experience as a PEO and is one of the biggest in the industry. As a PEO, it acts as the employer in terms of HR, benefits, and payroll processing. You only need to be concerned about tasking your employees and paying for their salaries.

Paychex: Best for Growing Businesses

Pros

- Offers a suite of integrated HR solutions that you can add as your business grows

- Has an excellent benefits selection, especially for financial wellness tools

- Provides dedicated payroll specialist with 24/7 US-based customer support

Cons

- Has nontransparent pricing

- Requires extra fees for payroll tax administration and W2/1099 year-end reporting

- Doesn’t offer unlimited pay runs

Paychex Overview

Who should use it:

Paychex works with all sizes of businesses. It even added a solopreneur plan—something you won’t find with any of the other services on our list (except ADP). While its basic plans for small businesses are great, many of its customers are companies with more than 1,000 employees, which is a sign that it’s a good service to grow with.

Why we like it:

Paychex is a well-known and versatile payroll service with a multitude of HR tools. While it offers basic plans, it lets you add items (like PEO services), meaning that as your needs change, you can add or subtract tools accordingly.

Additionally, Paychex, Paychex Flex, and Paychex PEO appear in many of our other buyer’s guides, such as the following:

- You’re looking for transparent pricing: Although its basic Paychex Flex Essentials plan lists a starting price, you still need to call for a custom quote. Also, many tools and add-ons can cost extra, from 1099 filing to learning management. If you prefer transparent pricing, check Gusto or TriNet.

- You need international payroll: While it has some international customers, Paychex recommends its partner FMP Global to handle international payroll. On our list, ADP, Rippling, and Papaya Global are the best choices.

- You need unlimited pay runs: Like ADP, Paychex charges by pay run, which can be limiting if you want to pay differently for different segments of your team.

Paychex’s HR solutions require you to contact the provider to request a quote.

For its payroll tool, Paychex Flex, only starter fees ($8 per employee per month) are posted on its website. You are still required to contact Paychex for a custom quote.

Paychex payroll packages include the following:

- Paychex Flex Select: One-on-one support, employee training and development system, online payroll processing and tax filing, and dedicated support available 24/7

- Paychex Flex Pro: Full-service setup, payroll, tax filing, robust HR software and handbook tools, and dedicated specialist

- Paychex Flex Enterprise: All-in-one payroll and HR, custom analytics, hiring and onboarding employees, and dedicated support 24/7

Paychex also has several HR solutions:

- HR Partner Plus: HR guidance and resources

- HR Pro: Full-service HR solution

- HR PEO: All-in-one PEO

- Paying employees: Paychex has a real-time payments option that lets employers approve payroll and fund direct deposits in less than 15 seconds with near-instant access to pay for employees. No other payroll system does this. It also allows employees to request advances of up to $500 (only Gusto offers a similar service).

- Benefits: In addition to the usual employee benefits you find with most payroll systems, Paychex offers free financial wellness programs. An employee assistance program is also available to help your workers find solutions to personal problems affecting their work life, including limited access to counseling for mental health and financial issues.

- HR functions: Paychex has more than 300 functions for payroll and HR management that you can choose from to create a custom solution. These include time tracking and a learning module that lets you build your own courses. No other HR system on our list (aside from Paylocity) had course creation, although several offer course libraries.

TriNet: Best for Businesses on a Tight Budget in Highly Regulated Industries

Pros

- Offers unlimited pay runs

- Tailors your plan to your industry

- Lowers fees when Social Security or unemployment rate maximums are reached

- Has an affordable starter Essentials plan (with basic HR tools)

Cons

- Requires extra fees for payroll tool and HR/payroll expert advising

- Has no health insurance available in Hawaii

- Provides dedicated reps for larger businesses only

TriNet Overview

Who should use it:

TriNet offers inexpensive, HR-first solutions, costing you as little as $10 per employee monthly—making it best for businesses on a tight budget. Its robust compliance solutions and compliance status tracking tool also make it great for companies in highly regulated industries.

TriNet has a PEO we also recommend for highly regulated industries because it can adapt its services to your industry, meeting your needs for insurance, compliance, and benefits, as well as for safety regulations.

Why we like it:

Its platform is relatively simple to learn and comes with self-service tools that allow employees to access their basic information, payslips, and tax forms online easily. It also handles onboarding, PTO tracking, performance reviews, and more.

TriNet HR platform (formerly TriNet Zenefits) is featured in the following buyer’s guides:

- You hire only or mostly contractors: TriNet does not have a contractor-only payroll plan like Gusto or Rippling does.

- You need international payroll: If you have a multinational business, we recommend Papaya Global, Rippling, or ADP. Meanwhile, you can go for Gusto if you only have international contractors.

- You have employees in Hawaii: TriNet does not offer health benefits in Hawaii. The others on our list do, except for Gusto.

HR Platform Plans Discounts available when paid annually :

- Essentials: $10 per employee monthly, includes automated onboarding, employee management, time off tracking, scheduling, integrations, mobile app, and analytics dashboard

- Growth: $20 per employee monthly, includes everything in Essentials plan, plus configurable people analytics, compensation management, and performance management

- Zen: $33 per employee monthly, includes everything in Growth plan, plus employee engagement surveys, people hub, and payroll

Contingent workers: $6 per worker monthly with any plan

HR Plus Plans Requires purchase of a base HR Software plan. Pricing for plus plans is additional. :

- Payroll tax compliance manager: Starting at $20 per employee monthly

- Payroll manager: Starting at $30 per employee monthly

- HR manager: Starting at $50 per employee monthly

Add-ons

- Payroll Payroll is included with the Zen plan at no additional charge. : $6 per employee monthly

- HR advisory services: $8 per employee monthly

- Benefits administration if you have your own broker: $5 per employee monthly

- Recruiting: Starting at $35 per month

- Payroll tax compliance audit: $1,000 per audit

- HR operations audit: $2,500 per audit

All plans and add-ons require at least five employees.

- Inexpensive HR: If you only need HR services, TriNet offers three plans with excellent HR tools. These include onboarding, scheduling, PTO tracking, performance management, and employee well-being and engagement tools (Rippling also offers an HR-only option). Plus, payroll is included with its Zen plan.

- Marketing opportunity: Like Paychex and ADP, TriNet also offers an employee discount program. However, it invites its customers who have online businesses to offer other TriNet users discounts in exchange for being part of the program. It’s an easy way to expand your market base.

- Compensation management: One thing TriNet offers with its Growth and Zen plans is compensation management, which analyzes salaries and provides benchmarks. You can get this with Paylocity and some of its competitors, but usually as an add-on.

Rippling: Best for Tech-reliant Businesses That Need Modular HR, Payroll & IT Tools

Pros

- Provides modular HR, payroll, and IT solutions to build your own system

- Is easy to switch PEO option on and off

- Has over 500 third-party integrations

- Has global payroll and EoR services

Cons

- Requires purchase of core Workforce Management solution first

- Has limited employee payment options

- Gets pricey as you add features

Rippling Overview

Who should use it:

Rippling’s IT modules allow you to onboard software and hardware easily, or Rippling can handle it for you, making it the top choice for companies that depend heavily on software applications to run their business. Rippling also has the tools to manage a global workforce, so it is a great platform for businesses with remote and international employees.

In terms of company size (based on the number of employees), almost half of Rippling’s user base are large businesses. However, Rippling is flexible enough to manage small company needs as well.

Why we like it:

Rippling is a favorite provider for us and among real-world users. The interface is one of the most intuitive we’ve seen, especially when it comes to third-party integrations. The modular approach can take you from simple HR administration, through payroll, and up to a full-service PEO.

Even more, the PEO option can be turned on and off at will. Modules are individually priced, but you need to call for a quote.

Rippling’s global payroll and EoR services are featured in the following buyer’s guides:

- You want a provider with straightforward pricing: Rippling charges for each module, making prices add up quickly, although it sometimes offers discounts if you choose multiple modules. You need to call for a quote. This is similar to others on our list, but if you want completely transparent pricing, check out Gusto or TriNet.

- You want multiple employee payment options: Rippling only pays employees through direct deposits and manual paychecks. For payments via pay cards, consider ADP, Paychex, or Gusto.

- You need HR assistance without breaking the bank: Unlike the others on our list, which include access to HR experts in many of their plans, Rippling charges extra for its HR help desk.

Rippling’s pricing starts at $8 per employee per month. However, to get true pricing, you must contact a rep for a custom quote.

Rippling offers the following plans:

- Core: Global employee graph, workflows and automation, role-based permission management, role-based policy management, and autolocalization

- Pro: All Core features, plus workflow studio, 10 custom workflows, 10 formula fields, and 10 advanced reports

- Unlimited: All Pro features, plus unlimited workflows, fields, reports, and webhooks

- Enterprise: All Unlimited features, plus Rippling API

After purchasing one of the above subscriptions, you can add on any of the following:

- Rippling HCM: HR management, workforce management, talent, global EoR, PEO, benefits, and more

- Rippling Payroll: Global and US payroll

- Rippling IT: Identity, device, and inventory management

- Rippling Spend: Expense management, corporate cards, bill pay, and global spend

- Global Payroll: Rippling offers complete payroll management, including tax filing services and benefits administration. Processing global contractor payments and paying international employees are also easier with Rippling’s global payroll solution, which covers more than 185 countries.

- HR tools: Rippling offers an ATS, 90-second employee onboarding, learning and talent management, and more. It has strong tools for compliance with payroll, safety, and labor laws.

- Tech and computer management: Rippling stands out from the rest on our list with its excellent management of computer technology, where you can easily assign computers and applications. Additionally, Rippling can handle the entire process for you by providing preloaded computers and helping get computers back upon termination.

- PEO on/off: While many of the services on our list offer PEO, Rippling is the only one that lets you turn it off and on at will. This is a great tool for seasonal businesses if you plan on building an HR department but aren’t there yet.

- Integrations: Rippling is the most integration-friendly HR payroll service we’ve seen. It works with more than 500 apps for accounting, expense management, HR, sales, communication, and productivity. You access them right from Rippling’s dashboard.

Papaya Global: Best for Multinational Businesses

Pros

- Has transparent pricing

- Offers payroll, contractor management, and EoR services in 160-plus countries

- Has compliance support that includes worker classification checks for contractors

Cons

- EoR can get expensive; high starting price

- Lacks performance and learning management

- Doesn’t provide 24/7 support

Papaya Global Overview

Who should use it:

We suggest Papaya Global as an alternative to Paylocity for multinational companies that want to jump to a complete global employer organization, also called employer of record (EoR), or seek a payroll company to handle paying all its international employees.

Why we like it:

Papaya Global has a workforce platform that scales with your business. Depending on your needs, it will handle payroll in the US and globally, plus it offers employer of record and agent of record solutions for international handles.

It has three plans with transparent pricing, and each of these includes payroll, local tax filing, full benefits management, and HR support. You can choose from payroll-only, complete Global EoR, or a contractor-only plan that includes HR support.

Papaya Global’s payroll services are featured in the following buyer’s guides:

- You don’t need international payroll services: Papaya Global has a lot to offer but is not meant for use in a single country. If you only need US-based payroll services, then any of the other providers on this list will suffice.

- You’re looking for PEO services: The steep price of Papaya can be daunting for those that don’t need international services. It’s best to approach Rippling, Paychex, or ADP for this.

Papaya Global has several options for your business:

- Payroll Plus: All plans include global workforce platform, API connectors and integrations, employee experience, and dedicated support

- Grow Global (101-500 employees): Starting from $25 per employee per month

- Scale Global (501-1,000 employees): Starting from $20 per employee per month

- Enterprise Global (over 1,000 employees): Starting from $15 per employee per month

- Enterprise grade EoR: Starting from $599 per employee monthly

- Contractor payments and management: Starting from $30 per contractor per month

- Global workforce payments: Starting from $2.50 per transaction

- Agent of record: Starting from $200 per contractor per month

- International payroll: Papaya Global works through in-country partners to provide payroll for your employees wherever they work. It supports payment in local currencies, handles local tax filings, and ensures payroll compliance for more than 160 countries.

- EoR: Papaya Global takes full HR and payroll responsibility for your employee; all you need to concentrate on is task management.

- Contractor management: If you only work with contractors, Papaya Global can handle the payroll and Independent Contractor Compliance administration for you. ADP is a close competitor to Papaya Global but does not have a contractor-only plan.

- Immigration services: Papaya Global sets itself apart not just from those on our list but also from other EOR services in that it offers immigration services. It helps you get work permits for expatriates and employees on short-term international assignments. It can also help you get permits for your employee’s immediate family.

Gusto: Best for Small Businesses That Need Inexpensive & Simple Payroll

Pros

- Offers contractor-only plan that works for international contractors too

- Is easy to use

- Has unlimited pay runs

- Offers HR solutions that include hiring, onboarding, and performance tools

Cons

- Is not good for larger businesses

- Does not offer PEO services

- Only includes time tracking and PTO management in premium plans

Gusto Overview

Who should use it:

Gusto makes our list because it’s consistently a top choice for us for small business payroll. If you have fewer than 100 employees, you’ll find Gusto offers excellent services at a great price. Plus, it has a contractor-only plan that is affordable for small businesses with both stateside and international contracting needs.

Why we like it:

Gusto offers an all-inclusive platform that includes unlimited payroll, HR solutions for hiring and onboarding, and benefits like health, vision, dental, flexible spending account (FSA)/HSA, and 401(k) insurance. Its platform is easy to navigate and uses smart technology to allow payroll in just a few clicks.

You can find Gusto as a top provider in the following buyer’s guides:

- You are not a small business: The others on our list are better choices, especially if you go past 100 employees.

- You need a PEO: If this is something on your wish list, consider ADP, Paychex, or Rippling. Gusto does not offer PEO services.

- Simple: $49 base fee plus $6 per employee monthly, includes full-service single-state payroll with W2 and 1099 processing, full support, employee profiles and self-service, basic hiring and onboarding tools, Gusto-brokered health insurance administration, employee financial benefits, payroll and time off reports, custom admin permissions, and integrations for accounting, time tracking, expense management, and more

- Plus: $80 base fee plus $12 per employee monthly

Save 25% for the first 3 months. Create an account by January 31, 2025 and run payroll by February 28, 2025 to apply this discount.

, includes everything in Simple plan, plus multistate payroll, next-day direct deposit, advanced hiring and onboarding tools, PTO management and policies, time tracking and project tracking, time kiosk, workforce costing and reports, team management tools, performance reviews, and employee surveys and insights

- Add-on to Plus plan: Priority support and HR resources: $8 per employee monthly

- Premium: $180 base fee plus $22 per employee monthly Save 25% for the first 3 months. Create an account by January 31, 2025 and run payroll by February 28, 2025 to apply this discount. , includes everything in Plus plan, plus dedicated customer success manager, HR resource center, compliance alerts, access to certified HR experts, full-service payroll migration and account setup, health insurance broker integration, R&D tax credit discount, priority support, and special pricing for eligible companies

- Contractor-only payroll plan: $35 base fee plus $6 per contractor monthly, includes unlimited contractor payments across all 50 states, 4-day direct deposit, 1099-NECs at the end of the year, new hire reporting,

- Add-on to Contractor plan: Global contractor payments: custom priced

Add-ons

- State payroll tax registration: Pricing varies per state

- Gusto global (EoR services): $699 Pricing discounted to $599 through December 31, 2024 per employee monthly

- Health insurance broker integration: $6 per eligible employee

- International contractor payments across 120-plus countries: Custom priced

- Tax advantaged benefits: $200 per year

- Health savings accounts (HSAs): $2.50 per participant per month

- Flexible spending accounts (FSAs): $4.00 per participant per month ($20 minimum required)

- Dependent care FSAs: $4.00 per participant per month ($20 minimum required)

- Commuter benefits: $4.00 per participant per month ($20 minimum required)

- Ease of use: Gusto is very easy to set up and use. You don’t need a specialized setup like with Paylocity or ADP, and if you’re familiar with running payroll, you can jump in right away. Gusto leads you through your first payroll, and there are how-to guides and phone, chat, or email support.

- Payroll: Unlike Paychex, you get unlimited payroll runs, making it very cost-effective, and you can automate different pay schedules, such as for hourly or salary workers. Gusto handles new hire reporting and tax filing, even for local taxes. It also files end-of-year forms, which some services like ADP may charge extra for.

- Payment options: Gusto offers direct deposit or you can print your own checks; consider ADP or Paychex if you want check stuffing and sending. It does offer a pay card through Gusto Wallet, which also gives your employees financial benefits, like the ability to get an advance on pay. Paylocity offers something similar as does Paychex.

- HR tools: All of Gusto’s packages (except the Contractor Plan) include tools for hiring and onboarding, such as offer letters, onboarding checklists, and document storage. You need the Complete Plan or higher for electronic signatures, org charts, and employee surveys. The highest plan also includes HR reps.

Methodology: How We Chose the Top Paylocity Competitors

When looking for companies like Paylocity, we naturally chose top-rated HRMS payroll software, many of which you can find in our other reviews. Therefore, the question is not which is best, but which is best for your needs.

Since Paylocity primarily serves medium and larger businesses, most of the products on this list do so as well—Gusto being the exception, in case you’re a small business needing a smaller alternative. The rest cover the gamut and can grow as your business does.

We looked at how these other providers compared with Paylocity in terms of cost, payroll processing features, HR tools, and international payroll and HR capabilities.

Frequently Asked Questions (FAQs)

Paylocity is similar to other HRMS software that provide HR and payroll processing options for midsize to large companies. Large companies like ADP offer global payroll and EoR services, like Paylocity. And, pricing with ADP is comparable to Paylocity, making it a great alternative choice.

Paychex is different from Paylocity in a lot of ways. Depending on your specific business needs, Paychex may be a better option. Paychex works better for small- to medium-sized businesses, whereas Paylocity is more geared toward larger companies. If you are a solopreneur, Paychex offers a plan just for you. And, while Paychex’s pricing is not fully transparent, it may be cheaper in the long run.

ADP is a top alternative to Paylocity because their offerings are very aligned. ADP has excellent tools for managing HR and payroll for large companies. Plus, pricing is similar, making it an easy swap. Like Paylocity, ADP has multistate and global payroll capabilities. But where ADP is a better choice is that it offers freelance and contract management.

Bottom Line

There are many worthy Paylocity alternatives out there. We looked at six of the best for different use cases. All of them have earned high marks from us in this and other reviews. However, we think ADP is the top competitor. While pricier, it offers a huge feature set, an abundance of payroll and HR tools, and plans to fit you no matter what your business size.