Square is a mobile payment company that offers a suite of business software, point-of-sale (POS) systems, payment hardware products, and small business services like marketing tools and loyalty programs. The Square payment and POS app has been downloaded over 33 million times and has more than 4 million merchant clients.

Key takeaways:

- Unlike most payment processors, Square is available to businesses of all sizes and offers the most comprehensive free POS system on the market.

- Square’s most popular product is its feature-rich, free, all-in-one POS system that allows users to set up an entire POS with zero upfront cost and only transaction fees to pay every month.

- In addition to its small business POS services, Square’s products now include customizable POS setups for enterprise-level businesses.

- According to the Financial Technology Report, Square processes an average of $210 billion in transactions every year.

Should you use Square?

We’ll get into more detail on Square’s specific products below. But, generally, for any small business processing less than $10,000 per month, Square is the best POS and payment processing solution because it comes with no fixed monthly costs and offers incredible value with the free POS system. Visit Square to create your free account.

Square’s services: Why small businesses love it

Square is the original mobile payment processing app and card reader. It had high adoption rates when it first launched because it allowed businesses to accept card payments anywhere instead of relying on cash or peer-to-peer payment apps. It also did away with the complex contracts and long-term commitments required by many merchant services.

Unlike most credit card processing companies, Square does not require an application or approval process and has no monthly fees or minimum requirements. Every free Square account has three main functions: payments, POS software, and online ordering.

How does Square work?

Square starts with simple, flat-rate payment processing that includes credit cards, contactless payments, and ACH transfers. Then, it offers various products within its ecosystem that all work together to form a complete small business management solution. However, some solutions, like Payroll, can stand alone.

Square continues to add to its offerings for small businesses, from improvements to the software to new systems. More on what’s new below, but first, let’s dive into Square’s core features.

Easy, flat-rate payment processing

You can use Square to complete credit card transactions online, in your brick-and-mortar store, and on your mobile device when you’re on the go.

Square charges a flat rate price per credit card transaction. This means that the credit card company, customer’s bank, and merchant account processor fees are all wrapped up into one flat-rate fee. This is regardless of the type of card you are processing. The only difference in rates is whether you have to key in the numbers.

Square payment processing fees

Payment Type | Transaction Fee |

|---|---|

In-person, mobile, and gift card payments | 2.6% + 15 cents per transaction |

Online payments | 2.9% + 30 cents per transaction |

Recurring billing and card-on-file transactions | 3.5% + 15 cents per transaction |

Keyed-in payments (virtual terminal) transactions | |

ACH Bank Transfers | 1% with a $1 minimum transaction |

Invoiced payments | 3.3% + 30 cents per transaction |

The advantage of this pricing model is its simplicity. You don’t have to worry about figuring out how much you are paying in credit card processing fees because you know in advance exactly how much you will pay. It’s the same flat rate, no matter what type of card your customer uses.

See a full breakdown of Square’s pricing and fees.

Top-rated merchant services

Square’s affordable and user-friendly payment processing is one of the best merchant services available for small businesses. In addition to mobile and in-store payments, every free Square account has a virtual terminal, invoicing, online payments, and tools to monitor and dispute chargebacks.

- Learn more about merchant accounts.

- Read our full Square Payments review to see if it’s right for you.

- Or, if you’re ready to start using Square, read our step-by-step guide on how to use Square to process payments.

Free and low-cost POS software

In addition to excellent merchant services, Square offers free POS apps that can be downloaded onto iOS and Android smartphones and tablets or used with one of Square’s proprietary hardware products. The free, user-friendly app has an offline mode, making it suitable for both mobile and in-store sales.

On top of the standard free Square POS app, Square offers free and paid POS software subscriptions for retail, restaurant, and appointment-based businesses.

Each POS software product includes payment processing, inventory management, basic employee management, customer relationship management (CRM), reporting, analytics, and industry-specific functions.

Square POS: $0/mo

Square POS is a free, general-purpose POS system that allows you to process sales, track inventory, manage customers, and view reports. It works on any iPad, iPhone, Android device, and Square hardware. It’s best for individuals and small businesses on a budget.

Read our full Square POS review to learn more.

Square for Retail: $0–$89/mo

Square for Retail lets retailers scan barcodes to ring transactions, manage orders, and track inventory easily. You can assign and scan SKUs to each product, and Square’s inventory system will automatically track product levels, locations, and more. It also syncs seamlessly with Square Online for ecommerce and pickup orders.

There is a forever-free plan and a Plus plan with advanced inventory tracking, analytics, and team management.

Read our Square for Retail review to learn more.

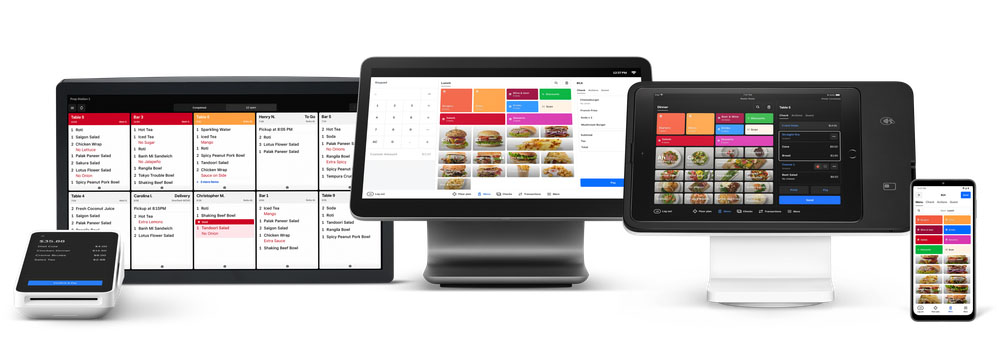

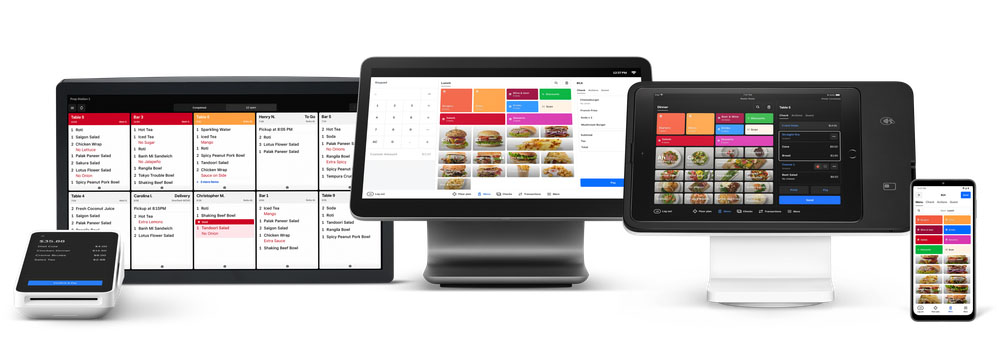

Square for Restaurants: $0–$165/mo

Square for Restaurants allows businesses to manage front-of-house and back-of-house operations, including menus, floor plans, in-house customer orders, online orders, and kitchen displays. There is a forever-free plan and a Plus plan with better front-of-house tools and team management.

Read our Square for Restaurants review to learn more.

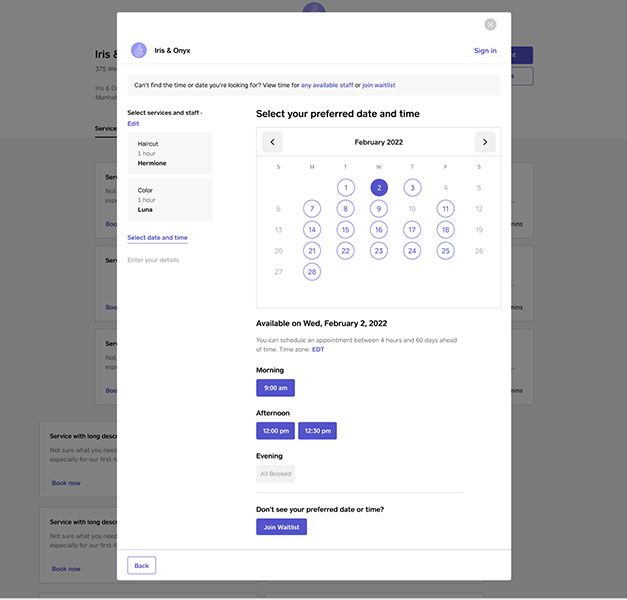

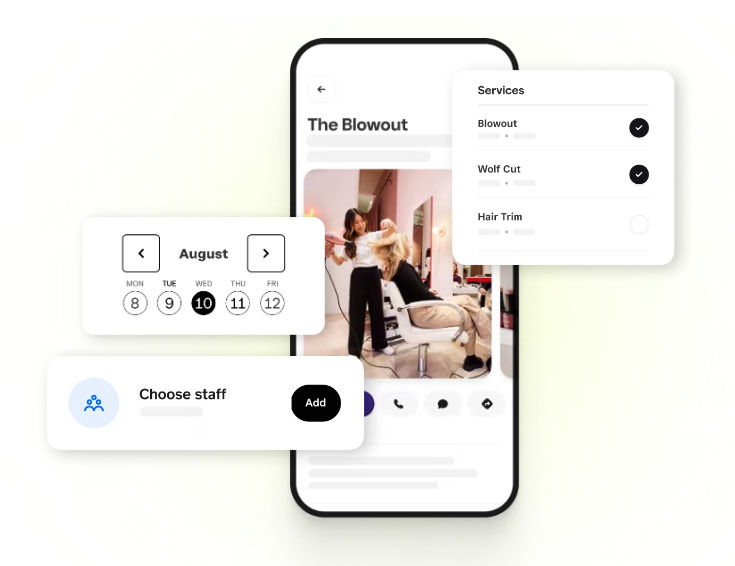

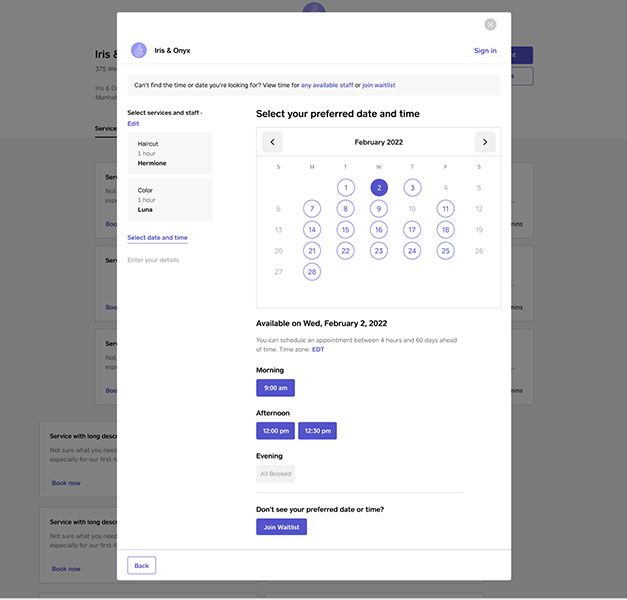

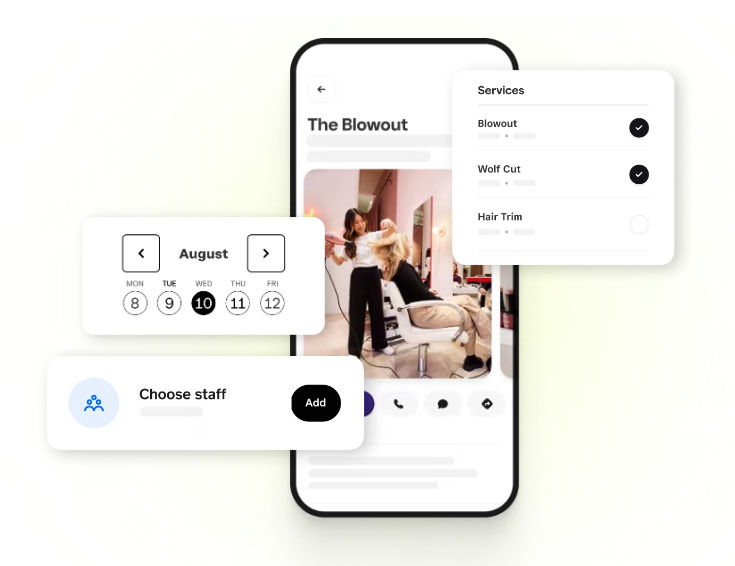

Square Appointments: $0–$69/mo

Square Appointments is similar to Square POS but with the added functionality of a full-fledged appointment management tool. Manage client booking for you or your employees, allow customers to book online, and automatically send email or text confirmations. Integrated payment processing means you can require a card on file for every client.

Read our Square Appointments review to learn more.

Accept payments anywhere customers are: In-person, Online, Remote, Buy Now Pay Later |

|

Affordable card readers and registers

Square offers a range of POS hardware and equipment designed to facilitate point-of-sale (POS) transactions for businesses of all sizes. For smaller businesses, there are card reader options to securely accommodate magstripe, chip cards, and contactless payments anywhere.

On the other hand, Square’s advanced registers provide a complete point-of-sale solution, combining sleek hardware with easy-to-use software for streamlined operations. These registers come equipped with features such as touch-screen interfaces, integrated receipt printers, customer displays, and compatibility with peripherals like barcode scanners and cash drawers.

All of Square’s hardware and equipment come with data encryption and comply with industry security standards.

Square Reader for magstripe: Free

| Square offers the first Square Reader for magstripe for free to users, and additional ones for $10 each. It connects to a mobile phone via the headset jack or the lightning connector to accept swipe payments using the free Square POS app. Best for: Businesses looking for a free POS setup. |

Square Reader for contactless and chip: $49–$59

| Square offers a first generation ($49) with a micro USB charging port and a second generation ($59) with a USB-C charging port. Both card readers can come with an optional dock for $15. The Square Reader for contactless and chip payments connects to a mobile phone via Bluetooth and accepts payments using the Square POS app Best for: Businesses selling on the go |

Square Stand: $149

| The Square Stand is an all-in-one dock for iPads with Square POS software. The hardware comes with a built-in contactless reader and a USB-C port for connecting a Square Magstripe Reader. The base swivels 180°, allowing customers to add a tip or confirm their payment. Financing is available for qualified merchants at $14 per month. Best for: Small, independent businesses such as convenience stores, food trucks, and mom-and-pop shops |

Square Kiosk: $149

| The Square Kiosk is an all-in-one dock for iPads with Square Kiosk POS software (+ $50/month). Merchants can choose between an unmanned counter or a freestanding setup. Financing is available for qualified merchants at $14 per month—optional Bosstab Floor Stand at $299. Best for: Small, independent fast food and quick service restaurants. |

Square Terminal: $299

| The Square Terminal is a standalone, all-in-one credit card terminal with a built-in Square POS app. It accepts swipe, dip, and tap payments and prints receipts. Financing is available for qualified merchants at $27 per month. Best for: Food trucks, tableside ordering, and trade shows. |

Read our full Square Terminal review or try it for yourself.

Square Register: $799

| The Square Register is a fully integrated POS system with a customer-facing display equipped with a card reader. It accepts swipe, chip, and contactless payments, including Cash App. It easily connects with other Square hardware such as a cash drawer, receipt printer, kitchen printer, or barcode scanner. Financing is available for qualified merchants at $39 per month. Best for: Businesses needing a complete POS setup. |

See our full Square Register review, or try it for yourself.

What’s New With Square

Square posts all of its product updates publicly in its community forum. Here are some of our favorite recent developments:

Square’s restaurant POS redesign is deployed across its mobile, tablet, kitchen display system (KDS), Square Terminal, and Square Register hardware as of March 5th, 2024. (Source: Square)

The redesigned Restaurant POS allows for greater customization with item pictures and tile colors. Plus, businesses have more granular control over item modifiers and can more easily access features and actions from more screens.

Square now offers Waitlist, which is available for users with a Square Appointments Plus or Premium subscription. This feature allows merchants to offer waitlists for appointment slots and services. (Source: Square)

Square has steadily made improvements to its appointments software, including recently adding waitlisting capabilities, and the ability to drag-and-drop appointments to reschedule them within the iOS and Android apps.

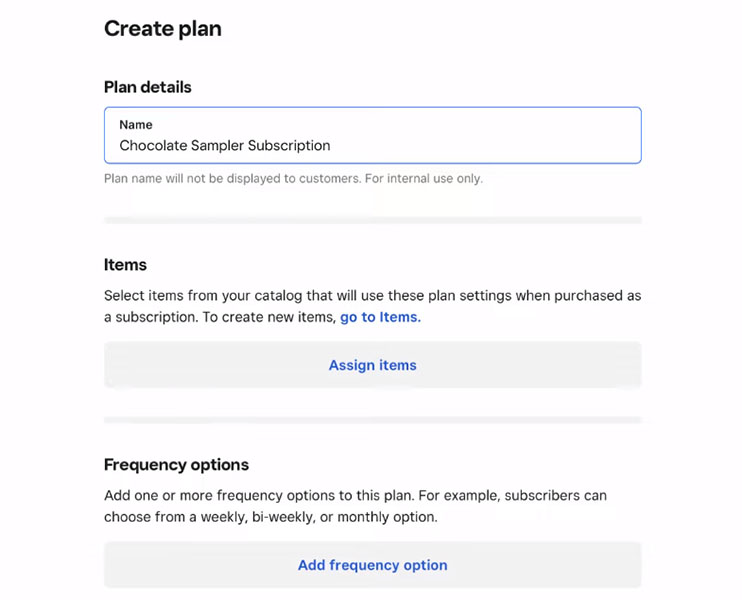

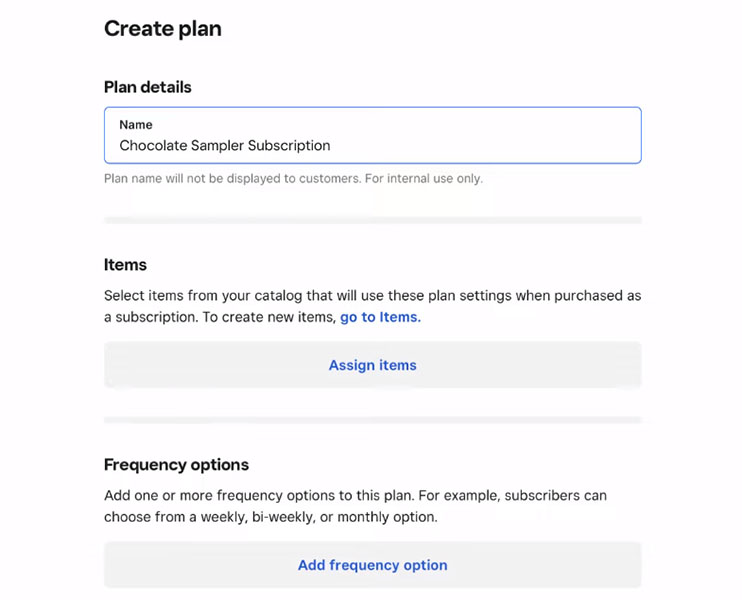

Square has launched Square Subscriptions for Square Online users. This feature allows merchants to create subscription plans for their products or services. (Source: Square)

Square’s newer subscription tool includes customizable billing, free trial options for your customers, multiple kinds of checkout and payment links, and the ability to adjust, pause, or resume billing cycles easily. Square’s subscription tools come with no monthly fee—just regular payment processing costs.

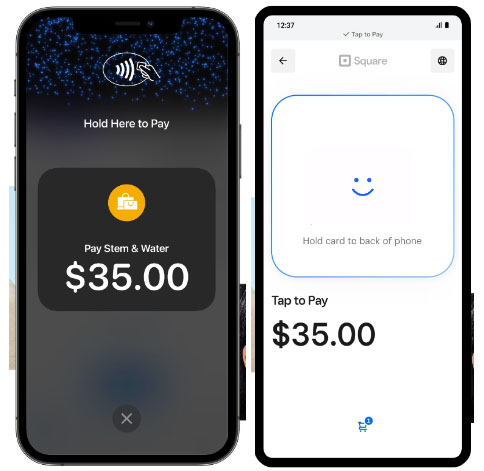

Square launched Tap to Pay on iPhone in September 2022 and Tap to Pay on Android in April 2023, which allows merchants to accept contactless payments using a compatible mobile device as a card reader. (Source: Square)

While Square’s tap-to-pay functionality has been available for some time now, the feature is finally gaining some traction and hitting the mainstream. It is an easy way to accept payments for the lower in-person rates without needing any specific hardware or card reader.

Square has launched Square Go, its new booking app, that connects seamlessly with Square Appointments, allowing consumers access to beauty and personal care businesses. (Source: Square)

Square Go sends customers push notification reminders and makes it easy for them to manage accounts, re-book or reschedule, and discover other local businesses. This customer-facing app currently has a 4.9 out of 5 rating on the App Store with over 56,700 reviews.

What is Cash App?

Cash App is a peer-to-peer (PSP) payment app owned by Square’s parent company, Block. This free mobile payment service allows individuals to send, receive, request, spend, save, and invest money. Because Square and Cash App are both owned by Block, Cash App can be accepted as a payment option on both Square Online and Square POS.

Free online ordering website builder

Square Online is the third free solution with every Square account. It’s a user-friendly site builder that can be used to create a business website or a basic ecommerce site or to add online ordering or order-ahead functionality to your business. You can also use Square Online for online appointment booking.

Compared to Shopify, Square’s advantage is that its system is compatible with all business types. Square Online includes a range of templates for retail, restaurant, event, appointment, and other business types. It automatically syncs orders, inventory, and customers with your POS, which you can also use to process curbside pickup, shipping, or local delivery orders.

Learn more in our Square Online review, or how to create a free Square Online Store in minutes with our step-by-step guide.

Native add-on business tools

In addition to Square’s three free business tools — payments, POS, and online store — it offers an array of business management solutions that can be used as a standalone tool or in conjunction with any of Square’s other products. One of the advantages of using Square for business is that merchants can mix and match the solutions they need to create the best setup for their needs.

Some popular solutions include:

- Square Marketing: Square offers email and SMS text message marketing including automations, segmentations, and personalization options.

- Square Loyalty: Customizable loyalty program that customers can enroll in right from the checkout screen or POS with automated rewards and messaging.

- Square Payroll: Track time, pay employees, manage benefits, and automatically file tax forms.

- Square Capital: Square offers small business loans of up to $100,000. This is only available for Square sellers but has fast approval and fast funding without a hard credit check.

- Square Banking: Business checking and savings accounts plus small business loans available right from Square Dashboard. No opening, minimum, overdraft, or account fees.

Square also has paid add-ons for team management, invoicing, gift cards, and advanced online sales. Check out our review of Square’s invoicing feature.

What’s new with Square

Redesigned Restaurant POS

Square publicly posts all of its product updates in its community forum. Here are some of our favorite recent developments:

Square’s restaurant POS redesign is deployed across its mobile, tablet, kitchen display system (KDS), Square Terminal, and Square Register hardware as of March 5th, 2024. (Source: Square)

The redesigned Restaurant POS allows for greater customization with item pictures and tile colors. Plus, businesses have more granular control over item modifiers and can more easily access features and actions from more screens.

Waitlisting and drag-and-drop appointments

Square has steadily made improvements to its appointments software, including recently adding waitlisting capabilities and the ability to drag-and-drop appointments to reschedule them within the iOS and Android apps.

Square Subscriptions

Square’s newer subscription tool includes customizable billing, free trial options for your customers, multiple kinds of checkout and payment links, and the ability to adjust, pause, or resume billing cycles easily. Square’s subscription tools come with no monthly fee — just regular payment processing costs.

Square Go

Square Go sends customers push notification reminders and makes it easy for them to manage accounts, re-book or reschedule, and discover other local businesses. This customer-facing app currently has a 4.9 out of 5 rating on the App Store with over 56,700 reviews.

Square as the best all-in-one solution

As you can see from its merchant services, POS software, card readers, and add-ons, Square offers a full suite of tools to power most business types. Because of its price point, ease of use, and breadth of offerings, we highly recommend Square, and it has consistently performed well in our evaluations for many of our guides:

- Best Merchant Services

- Best Virtual Terminal

- Best Credit Card Payment Apps

- Best Credit Card Readers

- Best Retail POS Systems

- Best Free Inventory Software

- Best Kitchen Display Systems

- Best Restaurant POS Systems

- Best Payroll Software

- Best Free Appointment Software

Best Free Appointment Software

That said, the payments, point-of-sale, and ecommerce software space is full of competition, and there are several other products we also highly recommend.

Best for | Monthly Fee From | |

|---|---|---|

$5 | ||

| Businesses needing a simple online and international mobile payment app | $0 |

Businesses needing an all-in-one solution with a dedicated merchant account | $0 | |

See our additional head-to-head comparisons:

Or, check out our full list of the top Square competitors.

Square drawbacks

While Square has a lot to offer, it is not perfect. Here are the biggest drawbacks of using Square and the most common reasons businesses choose to use an alternative:

- Limited support hours: For certain plans, Square only offers phone support from 6 a.m.–6 p.m. PST, Monday–Friday. If you operate outside of these hours, you may need to wait to get support.

- Inconsistent support quality: The level of support you receive and general product knowledge highly depends on the representative you come into contact with, which we have experienced first-hand in our calls to Square support.

- Payment processing fees: While Square’s fees are transparent and average, they aren’t the lowest on the market. As you can see in our alternatives above, PayPal and Clover offer lower rates, as do some other payment processors.

Frequently Asked Questions (FAQs)

These are some of the most common questions we get about Square.

Square offers a complete point-of-sale system solution. It provides POS software with built-in payments and an ecommerce platform that makes it easy for merchants to set up a business platform and start selling in minutes. Square also provides an array of POS hardware to fit any type of budget.

Yes, Square has no monthly fees and offers a month-to-month contract, so you can use Square even if you only sell occasionally, are a solopreneur, or are a member of an organization. The application process will allow you to specify that you are an individual using Square, and you can also choose a business type to specify the type of product or service you offer.

Once your Square POS is up and running, you will need to pay for the monthly use of the system. If you stay with the free POS software without any add-on services, you only have to pay for the transaction fees that would cost roughly around $250 per month for businesses that process below $10,000 in monthly credit card sales.

Both Square and PayPal offer POS software. However, Square is considered one of the top POS systems in the industry. Both also provide payment processing services, but Square supports more features for in-person and mobile payments. PayPal, on the other hand, offers stronger online payments and is better for international transactions.

The Square POS system comes with its built-in payment processing service, Square Payments. It allows Square businesses to accept credit and debit card transactions, as well as ACH. The beauty of Square Payments is that merchants do not need to apply for the service separately.

Bottom Line

Square has become the go-to solution for pay-as-you-go flat-rate payment processing. Every year, Square continues to enhance the features of its free POS software, including solutions specifically designed for retail, restaurants, and appointment-based businesses like salons, in addition to its generic small business POS. Even more, it offers business tools from payroll and marketing to banking. Overall, we highly recommend Square for small businesses. Visit Square to create a free account.