The best payroll services—such as online payroll software, professional employer organizations (PEOs), and human resources (HR) systems—help businesses pay employees correctly, manage tax withholdings, and ensure deductions are withheld (for benefit premiums, retirement savings, and more). In this guide, I compiled a list of the nine best payroll services for small businesses.

- Gusto: Best small business payroll service

- ADP Run: Best for fast-growing businesses

- Rippling: Best all-in-one HR, payroll, and IT solution

- QuickBooks Payroll: Best for accountants and paying contractors

- Paychex: Best for solopreneurs and startups

- Square Payroll: Best for small restaurants and retail shops

- Papaya Global: Best for global payroll services

- TimeTrex: Best free payroll service

- Justworks: Best low-cost PEO to outsource HR and payroll

Featured Partner |

|---|

Run Payroll Confidently with QuickBooks Payroll |

|

Top Online Payroll Services Compared

All the providers in this guide have tools to calculate wages and taxes, process direct deposit payments, generate payroll reports, and manage basic employee data. They also offer online self-service portals for employees to view payslips, documents, and personal information. Here are some of the standout features and pricing details.

Starter Monthly Pricing | Global Payroll Functionality | |||

|---|---|---|---|---|

| $49 per month + $6 per person per month | ✓ (paid add-on) |

| |

| Three months free payroll | ✓ (paid add-on) |

| |

| First month free | ✓ (paid add-on) |

| |

Choose a 30-day free trial or discounted base fees for three months | $6 per employee + $50 base fee | ✕ | ✕ | |

Three months free payroll | ✓ (via third-party partner) |

| ||

| ✕ | $6 per employee + $35 base fee | ✕ | ✕ |

| ✕ | $25 per employee for global payroll | ✓ |

|

| 30-day free trial | $0 (for the Community edition) | ✕ |

|

✕ | ✓ (paid add-on) |

| ||

*A Professional Employer Organization (PEO) is a co-employment service that helps manage your day-to-day HR, payroll, and benefits processes. Meanwhile, an Employer of Record (EOR) is an HR service that allows you to hire and pay workers in countries outside of the US. Learn more about the two solutions in our PEO guide and What is an EOR article. | ||||

The above payroll solutions often appear in numerous buyer’s guides across our site. These have been evaluated using a 5-star scale with criteria specific to the type of payroll services they provide and the businesses they cater to.

To view the general evaluation criteria, check out the methodology section. I also added the specific buyer’s guides where these products are featured in the provider sections below. You can refer to those guides to help you find a payroll services provider that fits your needs.

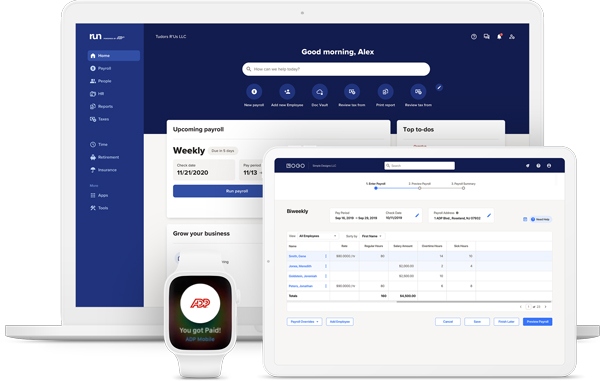

Gusto: Best Small Business Payroll Service

Pros

- Full-service payroll with tax payments/filings included in all plans

- Unlimited and automatic pay runs

- Multiple direct deposit options

- Offers hiring, job posting, and performance review tools

- Reasonably priced plans

Cons

- Basic support includes limited live support hours; priority support reserved for the Premium plan

- Time tracking, multi-state payroll, and paid time off (PTO) management included only in higher plans

- No dedicated payroll specialist

Overview

Who should use it:

Gusto ranks well among our payroll buyer’s guides, earning the title of “best overall” in seven guides and ranking high in many others. It’s a great payroll service for small businesses because it’s reasonably priced and its features are very well-rounded—you can run payroll an unlimited number of times, automate tax payments and filings (federal, state, and local taxes), post job ads, track applicants, and receive HR support.

Why I like it:

While its core platform is payroll, Gusto has expanded its online tools to include HR features and global hiring and payroll services. I appreciate that it can manage nearly all HR processes, from hiring to time tracking and performance reviews. It even handles COBRA administration and child-support garnishments Gusto automatically pays child-support garnishments in all states except South Carolina. for you.

Gusto also offers health insurance but the coverage is limited (unavailable in Alabama, Alaska, Hawaii, Louisiana, Mississippi, Montana, Nebraska, North Dakota, Rhode Island, South Dakota, West Virginia, and Wyoming). For health benefits that are available in all US states, consider other payroll providers, like Paychex and Square Payroll.

- Plans

- Simple: $49 per month + $6 per person per month

- Plus: $80 base fee + $12 per employee monthly

- Premium: $180 base fee + $22 per employee monthly

- Contractor-only payroll: $35 base fee + $6 per contractor monthly; for companies without W-2 employees

- Add-ons*

- State payroll tax registration: Pricing varies per state

- R&D tax credits: 15% of identified tax credits

- Health insurance and other benefits: Pricing varies by benefit

- Global contractor payments: Custom-priced; available in over 120 countries

- Gusto Global: $699 per employee monthly; EOR services for international hiring and payroll Gusto Global is available in Australia, Brazil, Canada, India, Ireland, Mexico, Spain, the Philippines, and the United Kingdom (as of this writing).

*Note that the above are just some of the Gusto add-ons. Visit the provider’s website to see all of its pricing information.

- Robust payroll tools: Running payroll with Gusto is easy, given its intuitive interface and automatic pay runs. All plans include tax filing services and unlimited payroll processing. It also handles garnishment deductions and sends child support payments to all states except South Carolina. This is unlike QuickBooks Payroll and Square Payroll, which only deduct the garnishment amounts from employee payroll.

- Multiple payment options: Employees receive pay via manual checks you print yourself, pay cards, and direct deposits. The standard direct deposit timelines are four and two days, with a next-day option included in the higher tiers. If you prefer same-day payments, QuickBooks Payroll is a great alternative—provided you get at least its Premium plan. Square Payroll also offers instant payments via its Cash App but you have to be a Square Payments user.

- Hiring and onboarding tools: Aside from offer letters, new hire state reporting, and a self-onboarding portal, you can manage employee access to business software (such as Slack, Zoom, and Asana) and company email accounts (Gmail and Microsoft 360). However, its job posting tools aren’t as robust as ADP’s, which can post jobs to 25,000-plus job boards (Gusto distributes job listings to only 1,000 job sites).

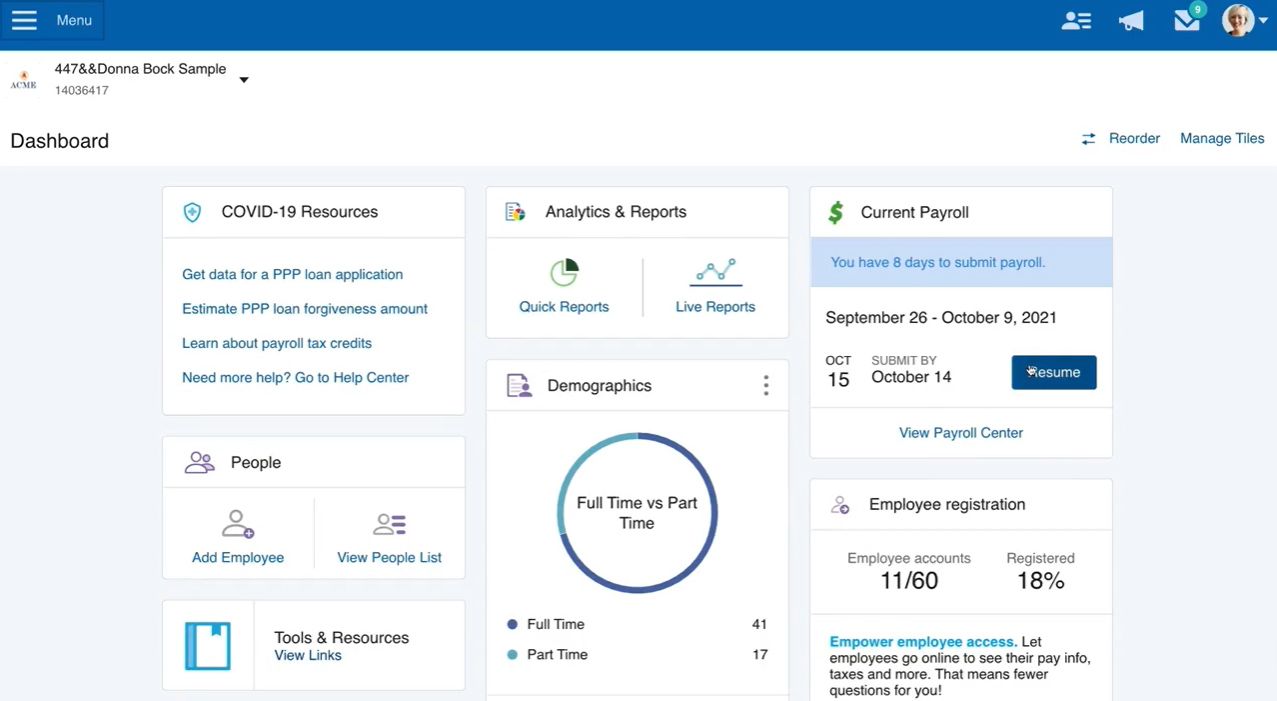

Gusto payroll dashboard (Source: Gusto)

Gusto’s average online rating on third-party review sites like G2 and Capterra is 4.57 out of 5 (as of this writing). Many reviewers like its user-friendly interface and efficient payroll tools that make paying employees easy for them. They also commended its support team for being helpful and generally responsive.

However, some users wished for better benefits, integrations, and additional time off policy customizations. A few reviewers also said it can get pricey, especially for small businesses with plans to expand their workforce.

Gusto Is Featured In

- Best Payroll for Small Businesses

- Best Cheap Payroll Services

- Best Restaurant Payroll Software

- Best HR Payroll Software

- Best Payroll Software for Mac

- Best Church Payroll Services

- Best Payroll Software for Nonprofits

- Best Payroll for Trucking Companies

- Best HRIS/HRMS Software

- Best Construction Payroll Software

- Best Payroll Software for Accountants

- Best Payroll Software for Paying Contractors

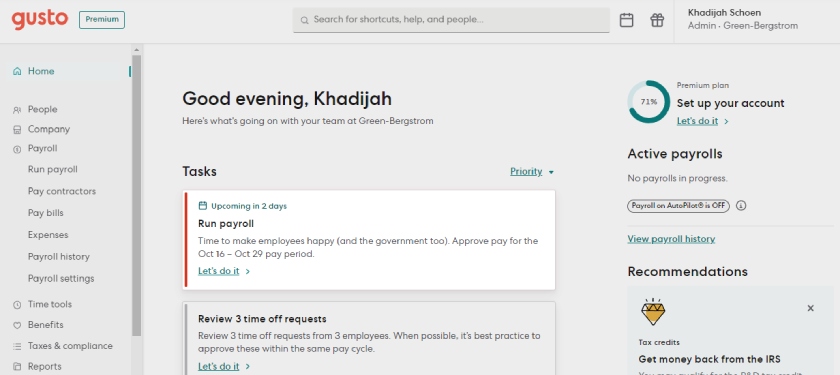

ADP Run: Best for Fast-growing Businesses

Pros

- Offers secure paychecks with advanced fraud protection

- Feature-rich platform includes hiring, talent management, and learning tools; offers PEO services

- Benefits plans include standard and nonstandard options, such as employee discounts

Cons

- Pricing isn’t transparent

- Time tracking, health insurance, and workers’ compensation are paid add-ons

- W-2/1099 form delivery and filing are available for an additional fee

- Lacks unlimited pay runs

Overview

Who should use it:

ADP offers payroll packages and HR tools designed to handle the needs of growing businesses. You can start with ADP Run to pay up to 49 workers and then switch to its ADP Workforce tool to handle the HR and payroll requirements of 50 or more employees. Similar to Rippling and Justworks, ADP provides PEO services with its ADP TotalSource product if you want expert assistance in managing your day-to-day HR and payroll tasks.

Why I like it:

With ADP Run, you get more than payroll features. It provides tools to automate time tracking, new hire reporting, and onboarding, which helps you save time from doing these yourself while reducing potential errors from manual data inputs. I also like that it offers salary benchmark reports, allowing you to assess whether your employee compensation package is competitive with market rates.

Of the providers in this list of best payroll for small businesses, Paychex’s features are similar to ADP’s. However, ADP’s job postings are more robust—it can post to over 25,000 job boards, while Paychex only has a dozen. It also has in-house global payroll tools, whereas Paychex provides this via third-party software integrations.

- ADP Run Plans

- Essential: Custom priced

- Enhanced: $81.66 per weekly pay run to pay 25 workers + $1.89 per additional worker*

- Complete: Custom priced

- HR Pro: Custom priced

- Add-ons

- Mobile timekeeping (via smartphones): $6 per employee monthly*

- Time clock kiosk: $62.50 base fee + $6 per employee monthly*

- Health insurance, retirement, and workers’ compensation: Pricing varies by benefit

*Pricing is based on a quote we received for a business with 25 weekly-paid employees

- Flexible pay processing: Similar to Paychex, ADP Run lets you start processing payroll through its mobile apps (for iOS and Android devices) and then continue it on a computer. It even has a separate payroll app product, Roll by ADP, that allows you to pay employees through chat-based commands.

- Multiple payment options: Apart from direct deposits, ADP offers a Wisely Direct debit card to provide your unbanked employees another option to receive payments. It also provides paper checks (with 10 advanced fraud protection features) and check signing, stuffing, and delivery services, but this option is available only in ADP Run’s higher tiers.

- Employee benefits: While this is a paid add-on, ADP’s benefits options cover all 50 states. It also provides employee discounts with partner retailers and businesses but doesn’t have the health and wellness perks that Justworks offers.

ADP Run’s cloud-based platform allows you to run payroll from anywhere and any device, provided there’s an available internet connection. (Source: ADP Run)

Scoring an average rating of 4.5 out of 5 on G2 and Capterra (as of this writing), ADP Run received many positive reviews in which users praised its user-friendly solutions that make payroll easy to run. However, some noted that it can be expensive for small businesses, and contacting support can be difficult because of the occasional long wait times.

ADP Is Featured In

While ADP Run ranked in several of our best payroll lists, ADP’s other products also made it to some of our payroll and HR buyer’s guides. Roll by ADP and ADP TotalSource are on our list of the best payroll apps and best PEO companies, respectively.

- Best Construction Payroll Software

- Best Payroll Software for Small Businesses

- Best Restaurant Payroll Software

- Best HR Payroll Software

- Best Payroll Software for Mac

- Best Payroll for Trucking Companies

- Best Payroll Apps

- Best PEO Companies

- Best HRIS/HRMS Software

Rippling: Best All-in-One HR, Payroll, and IT Software

Pros

- Integration with more than 600 business software

- Modular HR, payroll, and IT solutions; you can choose the modules you want

- PEO option can easily be switched on and off

- Offers global payroll and EOR solutions

Cons

- You can’t buy its payroll solution (and other modules) without purchasing its core workforce management platform first

- Gets pricey as you add features

- One-on-one HR help desk with phone and email support is a paid add-on

Overview

Who should use it:

Rippling can help you manage employees with its feature-rich platform that can run payroll and handle basic to advanced HR tasks—from hiring to compensation planning and performance reviews. This makes it a great option for small to large businesses looking for an all-in-one HR software. It’s also a good option for tech-heavy companies, given the IT solutions that allow you to manage the devices and work-related apps that are usually provided to employees.

Why I like it:

Rippling appears in a lot of our HR and payroll buyer’s guides, primarily due to its efficient and modular HR, payroll, and IT products that you can integrate—provided you get its core workforce management platform. I’m impressed with its customizable workflow tools, which allow you to trigger actions across Rippling’s various modules. Let’s say you hired an employee through its recruiting module, its workflows automatically start onboarding processes, grant software access, assign mandatory learning courses, and issue a corporate card if the new hire is eligible for it.

Similar to Justworks, it offers a PEO service and an EOR solution if you need to hire and pay international workers. The platform also integrates with 600-plus third-party software, such as accounting, HR, sales, expense management, and productivity tools.

Rippling lets you add tools like applicant tracking and payroll to its core platform. While its pricing page shows a starter monthly fee of $8 per user, you have to contact the provider so it can create a custom package for you.

For a Rippling plan that includes full-service payroll, time tracking, and its core workforce management platform, I was given a quote of $35 plus $8 per employee monthly. This also includes access to onboarding and offboarding tools, as well as software integration options.

Add-ons

- App, device, and computer inventory management: $8 per employee monthly*

- Benefits administration: Pricing varies, depending on your insurance broker

- HR help desk: Custom-priced

- PEO services: Custom-priced

- Global payroll: $20 per employee or contractor monthly*

- EOR services: $599 per employee monthly*

*Pricing is based on a quote we received

- Robust product portfolio: Similar to ADP, Rippling’s product line covers a wide range of HR functionalities—from hiring and time tracking to PEO services and international payroll. What also sets Rippling apart from the software in this guide is the finance and IT solutions that it offers, allowing you to manage expenses and business apps in one HR platform.

- IT support: Rippling’s app and device management modules allow you to set up, manage, and disable employee apps (like Slack and Office 365) and company computer devices. The provider can even help store your computers in an offsite warehouse and ship/retrieve the units to/from your remote team. Further, Rippling has robust integration options with more than 600 software. None of the providers on our list of best small business payroll companies offer similar IT solutions.

- PEO on/off switch: Rippling’s PEO service has a convenient on-and-off switch that allows you to transition smoothly from its PEO to using its software again. This differs from all the others on our list, which don’t have an easy on/off option and a seamless transition to HR software.

Rippling can run payroll with just a few clicks. (Source: Rippling)

Rippling earned an average online rating of 4.85 out of 5 on third-party review sites like G2 and Capterra (as of this writing). The features that many reviewers are happy about include its ease of use, intuitive interface, solid onboarding and payroll tools, integration options, and extensive solution suite.

However, some complained about occasional login errors, slow-loading pages, and software glitches. Others said that learning to navigate through its features can take time given its many functionalities.

Rippling Is Featured In

- Best HRIS/HRMS Software

- Best HR Payroll Software

- Best Payroll for Small Businesses

- Best Payroll Software for Mac

- Best PEO Companies

- Best Cheap Payroll Services

- Best International Payroll Services

- Best Payroll Software for Accountants

- Best Payroll Software for Paying Contractors

- Best Church Payroll Services

- Best Employer of Record

QuickBooks Payroll: Best for Accountants & Paying Contractors

Pros

- Unlimited payroll runs with a low-cost contractor payments plan

- Next- and same-day direct deposit options

- Seamless integration with QuickBooks Accounting

- Tax penalty protection program covers penalties (up to $25,000 per year) regardless of who makes the mistake

- Partner program for accountants includes discounts that can also be passed to clients

Cons

- Automated local tax filings available only in its higher tiers

- Tax penalty protection is included in the Elite plan only; other plans are covered by a basic program that covers mistakes that its representatives make

- Payroll product with special discounts for accountants requires you to use QuickBooks Accounting

- Basic HR features

Overview

Who should use it:

QuickBooks Payroll helps users manage their payroll entirely online and has pay processing products for specific niches like accounting firms. Its solid tools and reasonably-priced plans are just some of the reasons why it ranks well in our payroll buyer’s guides—currently holding the top spot in our lists of best payroll for accountants, contractors, and trucking companies.

Why I like it:

What I and many users like about QuickBooks is the variety of products it offers. Its online payroll solutions are part of a larger set of Intuit products that integrate seamlessly. Since many small businesses start out using QuickBooks for accounting, adding payroll is usually the logical next step. Plus, it offers a contractor payment plan that’s more affordable ($15 monthly for up to 20 workers) than Square Payroll and Gusto (monthly fees of $6 per contractor and $35 + $6 per worker, respectively).

- QuickBooks Payroll Plans

- Core: $50 + $6 per employee monthly

- Premium: $85 + $9 per employee monthly

- Elite: $130 + $11 per employee monthly

- Contractor payments package: $15 monthly for 20 workers; plus $2 for each additional contractor

- QuickBooks Payroll Partner Accountant Program

- Accountant perk: Free access to QuickBooks Payroll Elite with QuickBooks Online Accountant

- Discounts: 30% off the monthly base fees and 15% off the per-employee fees, with the option to pass the discount to new clients

- Efficient payroll processing: In addition to full-service payroll, it offers next-day direct deposits as part of its basic Core plan—but upgrading to its higher tiers will grant you access to a same-day option. You also get automated calculations, payments, and filings for federal and state taxes, including year-end reporting. However, for local payroll tax filings, you have to upgrade to at least its Premium package.

- Low-cost contractor payments: If you only employ contract workers, QuickBooks will process your contractor payments at a lesser cost than the other providers on our list. It even comes with next-day direct deposits (Gusto offers a four-day option). However, if you only have two contract workers at any given time, Square is more affordable than QuickBooks—costing only $12 monthly for two persons (vs $15 monthly).

- Tax accuracy guarantee and penalty protection: QuickBooks offers a tax filing and payment accuracy guarantee, which covers all penalties resulting from late or inaccurate tax submissions of its representatives, provided that it received the correct details on time. However, if you’re on the Elite tier, QuickBooks will cover all penalties (up to $25,000 a year), regardless of who made the mistake. No other providers in this guide have a plan that covers errors you make.

QuickBooks Payroll allows you to change payment methods and add employee time data while processing payroll. (Source: QuickBooks Payroll)

Users who left QuickBooks Payroll reviews on G2 and Capterra gave it an average rating of 4.36 out of 5 (as of this writing). Reviewers like its user-friendly tools that streamline pay processing, from calculating payroll to filing taxes and remitting payments to workers. However, some users said its customer service quality is less than ideal, adding that its support team can be difficult to reach at times. A few reviewers also said that it is pricier than similar payroll software.

QuickBooks Payroll Is Featured In

- Best Payroll Software for Accountants

- Best Payroll for Trucking Companies

- Best Payroll Software for Paying Contractors

- Best Payroll for Small Businesses

- Best Restaurant Payroll Software

- Best HR Payroll Software

- Best Church Payroll Services

- Best Construction Payroll Software

- Best Payroll Software for Mac

- Best Payroll Software for Nonprofits

Find out more about what it can do for your business by checking out our What Is QuickBooks article.

Paychex: Best for Solopreneurs & Startups

Pros

- Special package for solopreneurs includes payroll, incorporation support, and access to a 401(k) plan

- Multiple pay options (eg., check, direct deposit, and pay cards)

- Offers a dedicated payroll specialist

- Flexible payroll and HR plans

Cons

- Pricing isn’t all transparent

- Time tracking, benefits, recruiting, onboarding, performance reviews, and learning management tools are paid add-ons

- Has a bit of a learning curve (due to robust features)

- Third-party software integrations cost extra

Overview

Who should use it:

Paychex offers a suite of HR and payroll solutions, including PEO services, that make it a great option for businesses of all sizes. Solopreneurs can start with its Paychex Solo tier, which includes access to payroll, a self-employed 401(k) plan, and incorporation services to help establish and protect their business. Once their companies start to expand, they can transition to Paychex Flex, which is great for growing businesses that need payroll and HR tools.

Why I like it:

The provider appears in several of our buyer’s guides, even ranking high on our best HR payroll list and best payroll apps guide. I like that it offers the option to submit payroll via phone to a dedicated payroll specialist. I also appreciate its secure “Voice Assist” solution for hands-off pay processing. However, you have to pay extra or sign up for a premium plan to access many of its HR solutions, such as new hire onboarding, benefits administration, SUI management, garnishment payment services, and time tracking.

- For businesses with 1-19 employees: Monthly fees start at $39 + $5 per employee

- Paychex Flex Plans

- Select: Custom priced

- Pro: Custom priced

- Enterprise: Custom priced

- Paychex Plan for Solopreneurs and the Self-employed

- Paychex Solo: Custom priced; includes payroll, self-employed 401(k), and incorporation services

- Add-ons

- Recruiting and applicant tracking: Custom priced

- Employee onboarding: Custom priced

- Learning management: Custom priced

- Time tracking: Custom priced

- Health insurance, retirement, and workers’ compensation: Pricing varies by benefit

- Voice-assisted payroll: Paychex is the only provider on this list that offers “Voice Assist,” a voice-enabled solution for processing, reviewing, updating, and submitting payroll. You can start a new pay period, make adjustments, or continue a pay run that’s already in progress—without having to manually log in to your Paychex Flex account. It works on Siri and Google Assistant-compatible devices and comes with built-in verification and artificial intelligence (AI) solutions for user authentication.

- Employee benefits: Paychex’s benefits options include health insurance, dental and vision, HSA, FSA, and retirement plans. What also sets it apart from other providers in this list is its financial wellness program. However, if you want to offer employee discounts or wellness perks, then try either ADP or Justworks.

- Dedicated payroll support: Paychex grants you access to a dedicated payroll specialist who serves as your point of contact for all of your payroll and tax questions.

Paychex Flex’s dashboard provides easy access to run reports, start and resume payroll, and add employees. (Source: Paychex)

Users who left Paychex Flex reviews online said that it is generally easy to use and has a wide range of solutions that simplify HR management. However, others complained of occasional software glitches and log-in issues. Some reviewers also wished for additional customization options and a more responsive support team. Overall, its average user rating on G2 and Capterra is 4.2 out of 5 (as of this writing).

Paychex Is Featured In

- Best HR Payroll Software

- Best Payroll Apps

- Best Nanny Payroll Service

- Best Payroll Software for Mac

- Best Payroll for Small Businesses

- Best PEO Companies

- Best Cheap Payroll Services

- Best HRIS/HRMS Software

- Best Restaurant Payroll Software

Square Payroll: Best for Small Restaurants & Retail Shops

Pros

- Affordability

- Low-cost contractor-only plan

- Seamless integration with Square products

- Offers next-day direct deposits and instant payment options

Cons

- Next-day direct deposits and instant payments require a Square Payments account

- Standard direct deposit timeline is four days

- Limited HR features

Overview

Who should use it:

The software ranks well in our payroll buyer’s guides, appearing in many of our lists given its affordability and efficient pay processing tools. Square Payroll is even our top-recommended payroll app for small businesses. Its seamless integration with Square’s POS and payments products makes it a great option for bars, restaurants, and retail shops because you can have employees clock in/out via the POS terminal and transfer data, such as attendance and tip info, to its payroll solution for pay processing.

Why I like it:

Square Payroll comes with several essential solutions that make managing employee payments easy for administrators. In addition to full-service payroll, it has basic time tracking, tips and commissions tracking, employee benefits, and team management tools. If you only employ and pay contractors, Square Payroll has a low-cost contractor-only plan, which is cheaper than Gusto’s contractor payroll tier.

- Plans

- Full-service payroll: $35 base fee + $6 per employee monthly

- Contractor-only payroll: $6 per worker monthly

- Add-ons

- Employee handbook builder: Custom priced

- Direct access to HR experts: Custom priced

- Mail paper copies of W-2s/1099s: $3 per mailed form annually (Square also offers digital W-2s/1099s at no cost)

- Health insurance, retirement, and workers’ compensation: Pricing varies by benefit

- Affordability: Square Payroll offers one of the lowest-priced contractor-only plans in this guide. Even if you need to pay both employees and contractors, it charges a monthly rate that is cheaper than most payroll companies. While Rippling also offers reasonably priced plans, you have to purchase its payroll, benefits, time tracking, and HR help desk solutions separately on top of its core workforce management solution.

- Instant payment option: Square Payroll’s direct deposits typically take four days, but if you have a Square Payments account, you can pay employees the next business day or instantly via its Cash App.

- Time tracking through Square POS: Employees can use a four-digit passcode to clock in and out through the Square POS app. The system will collate all time entries into online employee time cards that you can review and import into Square Payroll for pay processing.

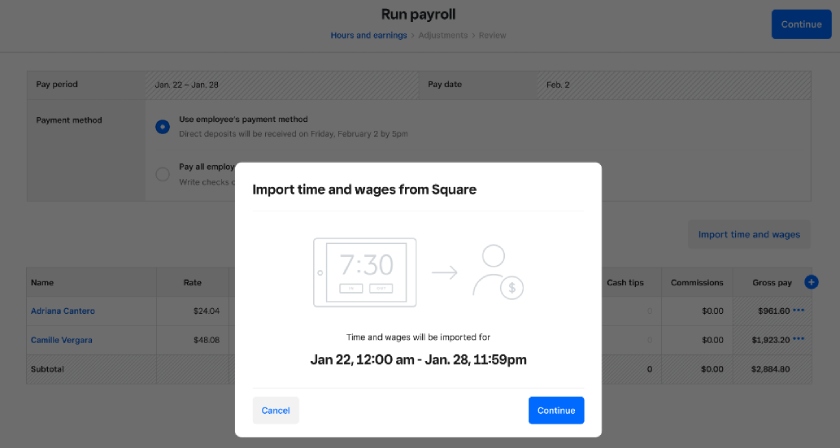

With one click, Square Payroll lets you import tips and employee attendance data from Square POS. (Source: Square Payroll)

Most of the Square Payroll reviews online are positive, with users highlighting its ease of use, affordability, and integration between Square products as its best features. However, others dislike the support team’s slow response times and the limited customization and report options. Overall, Square Payroll earned an average rating of 4.68 out of 5 on G2 and Capterra (as of this writing).

Square Payroll Is Featured In

- Best Payroll Apps

- Best Payroll for Small Businesses

- Best Restaurant Payroll Software

- Best Cheap Payroll Services

- Best HR Payroll Software

- Best Payroll Software for Mac

- Best Payroll Software for Paying Contractors

Papaya Global: Best for Global Payroll Services

Pros

- Transparent pricing

- Handles payroll, HR, and compliances across several nations and localities

- EOR in more than 160 countries; lets you hire without assistance from a local entity

- Cross-border payroll payments in as fast as 72 hours

Cons

- Can get expensive depending on the services you require

- Charges a setup fee and requires a refundable deposit

- No local entities; only has partners in countries that it services

Overview

Who should use it:

Papaya Global’s services and tools are designed for global businesses. It handles both employee and contractor payments and automates payroll in more than 160 countries, making it our top choice for international payroll services. It also provides EOR services, offering a suite of solutions that includes full benefits management, legal and compliance support, and hiring services.

Why I like it:

In addition to its efficient payroll and HR tools, I like that it has transparent pricing. Similar international payroll providers, such as ADP and Rippling, typically require you to request a quote. Further, Papaya Global integrates with HRIS, time tracking, expense management, and enterprise resource planning (ERP) software. However, its partner systems aren’t as robust as Rippling’s 600-plus options.

- PayrollPlus Plans

- Grow Global: Starts at $25 per employee monthly for businesses with up to four entities and 101 to 500 employees

- Scale Global: Starts at $20 per employee monthly for businesses with up to 10 entities and 501 to 1,000 employees

- Enterprise Global: Starts at $15 per employee monthly for businesses with over 10 entities and more than 1,000 employees

- EOR: Starts at $599 per employee monthly

- Contractor Payments and Management: Starts at $30 per worker monthly; includes payroll, compliance, and contractor management

- Agent of Record: Starts at $200 per worker monthly; includes contractor management, payroll, compliance, and contractor classification

- Payments: Starts at $2.5 per transaction; includes tools to facilitate ad hoc workforce payments (e.g., split payroll payments and statutory payouts to local authorities)

- Payroll and tax filings: Papaya Global pays your employees in their local currency with pay stubs in their own language. Payments are through direct deposits and bank transfers, with cross-border payouts that take hours instead of days. Plus, it also does tax filings and year-end reporting, as well as provides local tax filing assistance.

- Extensive immigration services: Papaya Global can help secure work permits for your expatriates and employees on short-term assignments so you don’t handle these yourself. Its immigration services also include obtaining the necessary residence and spouse/family permits.

- Compliance support: In addition to helping you stay compliant with local employment regulations, Papaya Global tracks global tax laws to ensure you’re up-to-date with the latest rulings. However, it lacks phone support and only offers 24/7 chat assistance via WhatsApp.

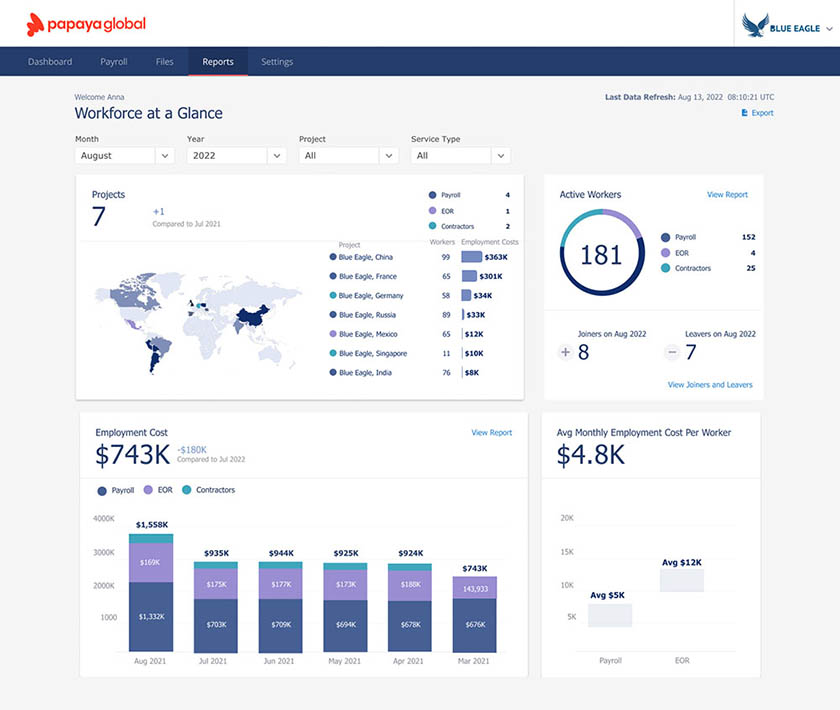

Papaya Global’s dashboard shows a comprehensive view of your international workforce and payroll expenses.

(Source: Papaya Global)

Papaya Global earned an average online review rating of 4.5 out of 5 (as of this writing). It doesn’t have a lot of reviews on G2 and Capterra, but those who left positive feedback like that they can manage payroll and a global workforce from a single platform. They also said that its support team is helpful and responsive. However, some users said that its solutions can get pricey, while others wished for more report customization options.

Papaya Global Is Featured In

TimeTrex: Best Free Payroll Service

Pros

- Feature-rich free tier

- Automatic payroll runs

- Integrates with accounting, hiring, and HR software

- Has recruiting, invoicing, and expense tracking tools

Cons

- User dashboard looks cluttered

- Free tier only includes basic payroll, scheduling, and time tracking tools

- Doesn’t handle payroll tax filings

- You have to upgrade to its paid plans to access its mobile apps and technical support

Overview

Who should use it:

TimeTrex is great for small businesses looking for a payroll service that’s feature-rich and free to use. With its platform’s Community Edition, you get all the basic tools to manage payroll, staff attendance, PTO, schedules, and employee information. If you upgrade to its paid tiers, TimeTrex offers recruiting, onboarding, and advanced time tracking with facial recognition and geofencing features.

Why I like it:

Aside from payroll and HR tools, it offers online time clock apps that work on web browsers and mobile iOS/Android devices. Its facial recognition feature comes with high-precision scanning that recognizes facial hair, hats, and glasses, which makes clocking in/out easy for your employees while helping prevent buddy punching.

However, its interface looks outdated and its Community Edition is an open-sourced platform that needs to be downloaded—although a cloud-hosted option is available only to paid plan holders. Plus, its payroll tax functionalities don’t include automated tax filings.

- Plans

- Community Edition: Free

- Professional Edition: Starts at $30 per month

- Corporate Edition: Starts at $50 per month

- Enterprise Edition: Starts at $80 per month

Note that all paid plans cover up to 10 employees, but special rates are available for larger teams. Contact TimeTrex for a quote.

- Feature-rich free tier: TimeTrex’s Community Edition comes with features that most providers typically charge extra for. Aside from employee data management and payroll, its online tools can help you time track and schedule employees.

- Efficient pay processing: TimeTrex offers automatic pay runs, payroll tax calculations, custom deductions, electronic pay stubs, and free direct deposits. However, it doesn’t handle payroll tax filings. For full-service payroll that includes federal, state, and local tax payments and filings, consider Gusto, Rippling, or Square Payroll.

- Touchless time clocks: With TimeTrex’s time clock apps for iOS and Android devices, you can turn a tablet into a touchless time clock. Employees don’t have to touch the device since it supports clock ins/outs via facial recognition. TimeTrex will automatically scan, identify, and verify a person by comparing his/her facial features from the saved image in its database.

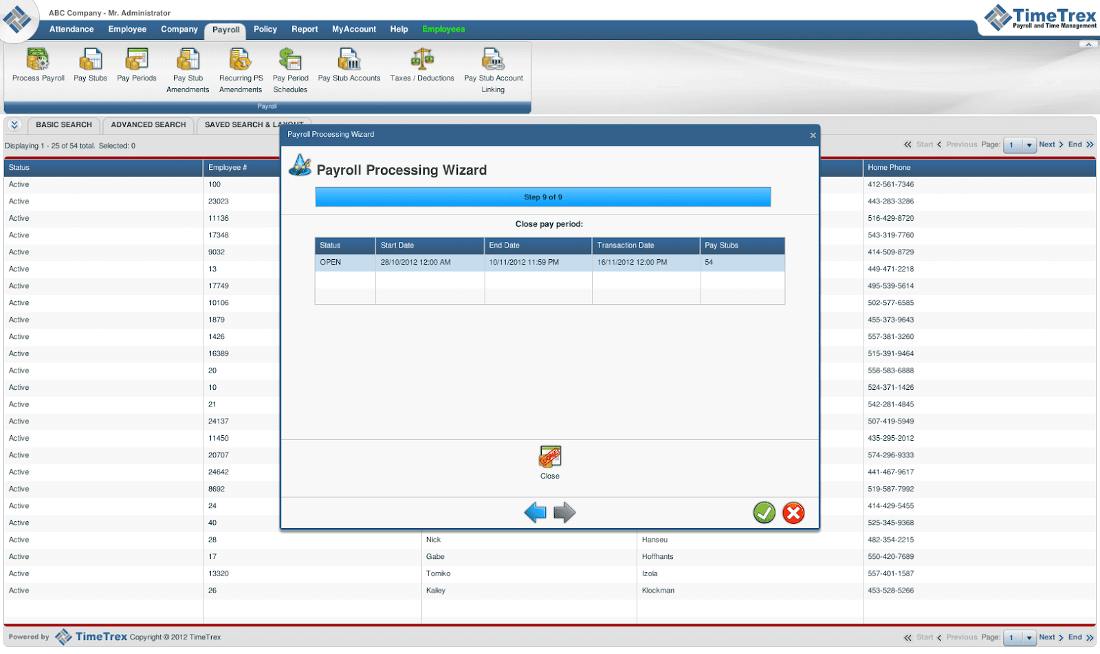

TimeTrex has an online wizard to guide you through the payroll process. (Source: TimeTrex)

Users gave TimeTrex average ratings of 4.23 out of 5 on third-party sites like Capterra and G2 (as of this writing). What they like most about it is its user-friendly tools and how it helps automate time tracking and payroll management. Others said it is difficult to set up, and some of its features aren’t intuitive.

TimeTrex Is Featured In

Justworks: Best Low-cost PEO to Outsource HR & Payroll

Pros

- Intuitive interface

- Transparent pricing with affordable PEO plans

- Enterprise-level benefits from major insurance companies plus 401(k) plans; offers health and wellness perks

- Offers standalone payroll and EOR solutions

Cons

- Time tracking is a paid add-on

- Medical, dental, vision, health savings account (HSA), and flexible savings account (FSA) are available only in the Plus plan

- Has pre-set payout schedules for hourly and non-exempt salaried employees (set every other Friday)

- EOR service only covers 11 countries Justworks EOR is available in Brazil, Canada, Chile, Colombia, Costa Rica, Ireland, Mexico, the Netherlands, Portugal, Spain, and the United Kingdom. (as of this writing)

Overview

Who should use it:

Justworks didn’t show up in a lot of our buyer’s guides mainly because of the type of service it provides. It’s a PEO that acts as a co-employer that handles your day-to-day HR, payroll, and benefits administration tasks. It isn’t ideal for those looking for a no-frills payroll solution, as its PEO service comes at a much higher cost than other straight payroll providers.

Why I like it:

What’s great about Justworks is its transparent pricing. Most PEO providers, such as ADP, Rippling, and Paychex, will require you to contact their sales team to request a quote. Its PEO plans also include a wide range of features—from automated direct deposits and off-cycle payments to online employee onboarding and HR consulting. Plus, Justworks offers standalone solutions for managing only payroll and EOR.

- Plans

- PEO Basic: $59 per employee monthly

- PEO Plus: $109 per employee monthly

- Payroll only: $50 base fee + $8 per employee monthly

- Add-ons

- Time tracking: $8 per employee monthly; available in Payroll, PEO Basic, and PEO Plus plans

- International contractor payments: $39 per worker monthly; available in PEO Basic and PEO Plus plans

- EOR: $599 per employee monthly; available in PEO Basic and PEO Plus plans

- Health insurance add-on for Payroll plan: $8 per benefits-eligible employee monthly (this is included in the PEO plans)

- Efficient payroll tools: With Justworks, you can pay salaried and hourly employees, contractors, and even vendors. It can handle federal, state, and local payroll tax filings for you, including end-of-year reporting (W-2s/1099s). However, it only supports direct deposits and paychecks, so if you need multiple payment options, ADP and Paychex are great PEO alternatives. You must also adhere to its pay schedule (payments are made on Fridays).

- Employee benefits: Justworks offers a variety of traditional and nontraditional benefits. Apart from the typical health insurance, 401(k) plans, and HSA/FSA accounts, it has fertility benefits, mental health services, and fitness memberships. None of the providers in this list offer options that go beyond the standard benefits, except for ADP (which provides access to employee discounts) and Paychex (which has a financial wellness program).

- Compliance support: Included in all Justworks PEO plans are HR consulting services and compliance support to help ensure you’re following federal, state, and local employment regulations. You’re also granted access to online learning sessions that include sexual harassment prevention and inclusion training.

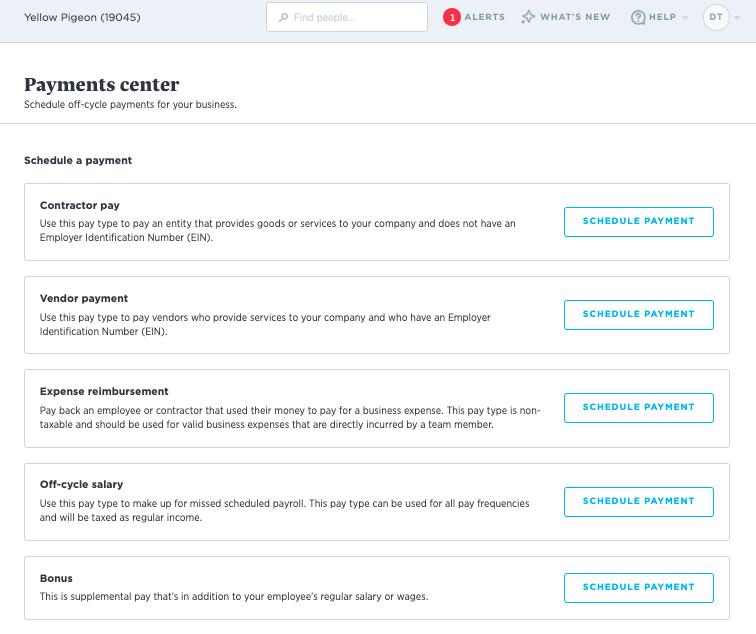

Justworks can handle different types of payments, from regular payroll to bonus payouts. (Source: Justworks)

Justworks earned an average user rating of over 4.6 out of 5 on third-party review sites like G2 and Capterra (as of this writing). Many users appreciate its ease of use and good customer support. On the other hand, some reviewers said that it has limited customizations, report filtering options, and mobile app features.

Justworks Is Featured In

How to Choose a Payroll Service

In selecting the best option for your business, consider the following factors:

- Features: Take a look at your business’ payroll needs and identify the essential features that will help you compliantly and accurately pay workers. Some of the must-have tools include automatic pay runs, payroll tax payment, and filing services, and payroll compliance solutions to help you stay on top of changing labor laws and regulations.

- Ease of use and accessibility: Check if the system is intuitive and simple to use. You can do this by requesting a free demo or taking advantage of free trial offers. You should also look for mobile apps that can be used on either Android or iOS devices.

- Support: Live phone support is important, including access to an online help center with easy-to-understand how-to guides. This way, you or your HR team can focus more on business-building strategies and spend less time answering employees’ questions on how to use the software. Don’t forget to check for add-on fees if a premium support plan is offered.

- Security: Verify if the software complies with data protection rules and offers access controls.

- Your budget: Identify how much you’re willing to pay for payroll services. Most providers charge a monthly base fee on top of per-employee costs, so look at your current and planned headcount to calculate potential costs. Note that you may also need to upgrade to higher tiers if you want access to more advanced payroll and/or HR features.

- Scalability: Think about your organization’s growth. Will the software be able to scale with your business as it expands? Scalability is crucial to avoid outgrowing your software in the future.

Methodology: How We Evaluated the Best Payroll Services for Small Businesses

To find the best small business payroll companies, I looked at our payroll-related buyer’s guides and compiled a list of providers that often appear in those guides. I also included those that offer specific payroll services, such as PEO and international pay processing.

Note that our buyer’s guides use a five-star scale that covers several criteria, such as essential pay processing functionalities, basic HR features (like onboarding), customer support options, and ease of use. Pricing is also an important factor, as well as feedback that users leave on popular review sites (such as G2 and Capterra).

Frequently Asked Questions (FAQs)

The ideal payroll service for small businesses provides all the tools you need to pay your employees accurately and compliantly. Payroll tax payment and filing services should be included so you don’t have to worry about handling these yourself. Access to basic HR solutions is also important to help you manage employee data, new hire onboarding, and benefits with ease.

Paying employees can be challenging, especially for employers who don’t know how to handle payroll, and partnering with a reliable payroll service eliminates the need for manual pay calculations. Plus, there are legal obligations and laws you need to follow when paying employees. Payroll companies can help you manage compliance requirements—from state new hire reporting to payroll tax computations and tax form filings.

For standard payroll services, which include automatic pay calculations and tax filing services (including basic payroll compliance tools), you should expect to pay anywhere from $40 to $60 per employee monthly. The cost will go up if you need other solutions like time tracking and employee benefits.

If you know the basics of doing payroll, then yes, you can process this yourself. You can manually compute payroll either by hand, with a calculator, or by using Excel. However, this is only advisable for businesses with very small teams―fewer than 10 workers―as it can be confusing and stressful to keep track of payments, deductions, benefits, and tax reports if you have a large workforce.

Bottom Line

Choosing the best payroll service for a small business can be a bit challenging and overwhelming given the range of payroll solutions available in the market. If you are looking for the best option or are switching payroll providers, consider your company’s immediate HR and payroll needs, including your growth plans.

You can also check our buyer’s guides where we compare many of these providers side by side. You could even choose to hire a local bookkeeping or accounting service to do your payroll; it’ll likely be more expensive than some of the options we reviewed, but if you value face-to-face service, it could be worth it.