Insurance customer relationship management (CRM) products help insurance agencies manage sales deals, track commissions, oversee insured accounts, and procure policies. The best insurance CRM software will have features for commission tracking, agency team management, reporting, and policy document storage that are both low-cost and easy to use.

Based on our evaluation, the eight best insurance CRM software products include:

- Best for sales deal management: Pipedrive

- Great insurance CRM for marketing: HubSpot CRM Suite

- Best CRM for insurance account management: Freshsales

- Excellent option for prospecting tools: Zendesk Sell

- Solid insurance sales software for multiline deals: Bitrix24

- Best CRM for insurance with tool integrations: Salesforce Sales Cloud

- Great custom CRM software for insurance agents: Zoho CRM

- Best CRM for life insurance agents: Insureio

Identifies promising leads and streamlines follow-ups for your Fintech Business |

|

Best CRM for Insurance Agents Compared

Provider | Starting Monthly Price per User* | Free Plan | Our CRM Rating Out of 5 |

|---|---|---|---|

| $14 | ✕ | 4.74 |

| $15 | ✓ | 4.68 |

| $9 | ✓ | 4.68 |

| $19 | ✕ | 4.65 |

$43 (up to 5 users) | ✓ | 4.54 | |

| $25 | ✕ | 4.39 |

| $14 | ✓ | 4.38 |

| $25 | ✕ | 4.03 |

*Based on annual billing per month. Monthly billing is also available for slightly higher rates.

Pipedrive: Best for Insurance Deal Management

Pros

- Robust deal management features to oversee large insurance sales opportunities

- Excellent proposal management features to generate, send, and track insurance quotes to leads

- Offers advanced artificial intelligence (AI) on the lowest-tiered plan

Cons

- Doesn’t offer a free plan

- Sales team management tools get expensive

- Not a specialty CRM insurance software; users cannot procure premium quotes from the system

- You manage a lot of insurance policy deals: Pipedrive is primarily a sales CRM system that comes with excellent lead and deal management features. That said, insurance agencies can give their producers a leg up in the sales process with its robust deal tracking. These features come with custom pipelines to monitor opportunities, deal activity, potential premium value of deals, and whether a deal is on pace to become cold and needs action.

- You want to deliver insurance quotes efficiently: Quote generation is often tedious in insurance sales as agents have to gather premium details from multiple carriers, put together a personalized document, and deliver to insureds. Pipedrive offers an advanced CRM feature known as SmartDocs to streamline this task. It’ll auto-pull contact data from a record into a custom quote template to create, send, track, and obtain signatures.

- You need a free CRM for insurance sales: While it’s affordable and can offer tons of value with its advanced sales features, Pipedrive does not offer any free-forever CRM for an insurance agency getting started and on a tight budget:

- Alternative: Numerous products on this list can support those who need freemium CRM solutions. HubSpot is great for its no-cost marketing capabilities to promote an agency’s brand, Freshsales has free account management tools to oversee insured clients, and Bitrix24 is solid for free e-signature tools.

- You want a more affordable CRM to manage numerous teams: The sales team management is one of the more expensive tools in Pipedrive, which starts at $49.90 per user monthly. It is useful if you need to oversee various sales territories based on a geographic region or a particular line of coverage, such as separating property and casualty insurance sales from life, health, and annuities coverage:

- Alternative: Zoho CRM’s territory and team management features begin at $40 per user monthly.

Pipedrive Monthly Pricing Plans*

*Pricing is based on annual billing on a per-user monthly breakdown. Monthly billing is available for a higher cost. Paid plans include a 14-day free trial. Pricing reflects pricing info available at the time of publishing. While we update pricing information regularly, we encourage our readers to check current pricing here.

Pipedrive deal management module in Kanban view (Source: Pipedrive)

Our Expert Opinion

Pipedrive is the ultimate insurance CRM software for producers to close large-scale policies. Its easy-to-use yet robust deal management tools allow agencies to efficiently get quotes out to leads and ensure no sales task slips through the cracks. We especially like the deal-rotting tools that will indicate if an opportunity is getting cold—promoting a producer to go in for a follow-up.

HubSpot CRM: Best CRM to Market an Insurance Agency

Pros

- Comes with blog, video, email campaign, social media, and ads management to promote an insurance brand and generate leads

- Solid free plan with quote generation, document management, and appointment scheduling tools

- Highly intuitive interface with easy-to-operate features

Cons

- Expensive sales team management features

- Getting signatures on quotes requires Profesional plan

- Only one sales pipeline allowed for free

- You want to market your agency on a large scale: The HubSpot CRM Suite is an all-in-one sales, marketing, service, and content management system (CMS). In addition to generating sales and supporting insureds with the platform, agencies can market their brand via email marketing campaigns, online ads, and social media posts. There’s even the ability to create and post blog articles and manage an on-demand video library to promote thought leadership in insurance and risk management.

- You need a solid free insurance CRM software: While many providers offer a freemium plan, HubSpot is the best free CRM system. Its free plan includes all modules necessary to create and retain clients. All for no cost, producers can store contacts, manage deals, and send quotes, while marketing teams can deploy email campaigns and host a blog. Additionally, account managers can handle client documents and service tickets for free.

- You want a more affordable way to get policy signatures: While users can obtain digital signatures on sales or policy documents using HubSpot, this feature requires the Professional CRM Suite for a whopping $1,600 per month.

- Alternative: Bitrix24 offers its new sign tool for e-signatures starting for free.

- You need to manage various sales processes at a lower cost: Since most insurance agencies sell various lines of coverage that require different tasks, they need to be able to monitor various sales processes. HubSpot, while it has multipipeline capabilities, cannot offer those features until the Starter plan for $30 per month.

- Alternative: Pipedrive is a great alternative for insurance deal management, with multi-pipeline options available for just $14.90 per user monthly.

HubSpot CRM Monthly Pricing Plans*

*Pricing is based on annual billing on a per-month breakdown. Monthly billing is available for a higher cost. Each plan offers a 14-day free trial. Pricing reflects pricing info available at the time of publishing. While we update pricing information regularly, we encourage our readers to check current pricing here.

**Pricing uses the monthly CRM Suite costs for individuals and small teams. The provider also offers Enterprise-level products for larger agencies and individual purchase options for Sales, Marketing, Customer Service, CMS, and Operations Hubs for lower costs.

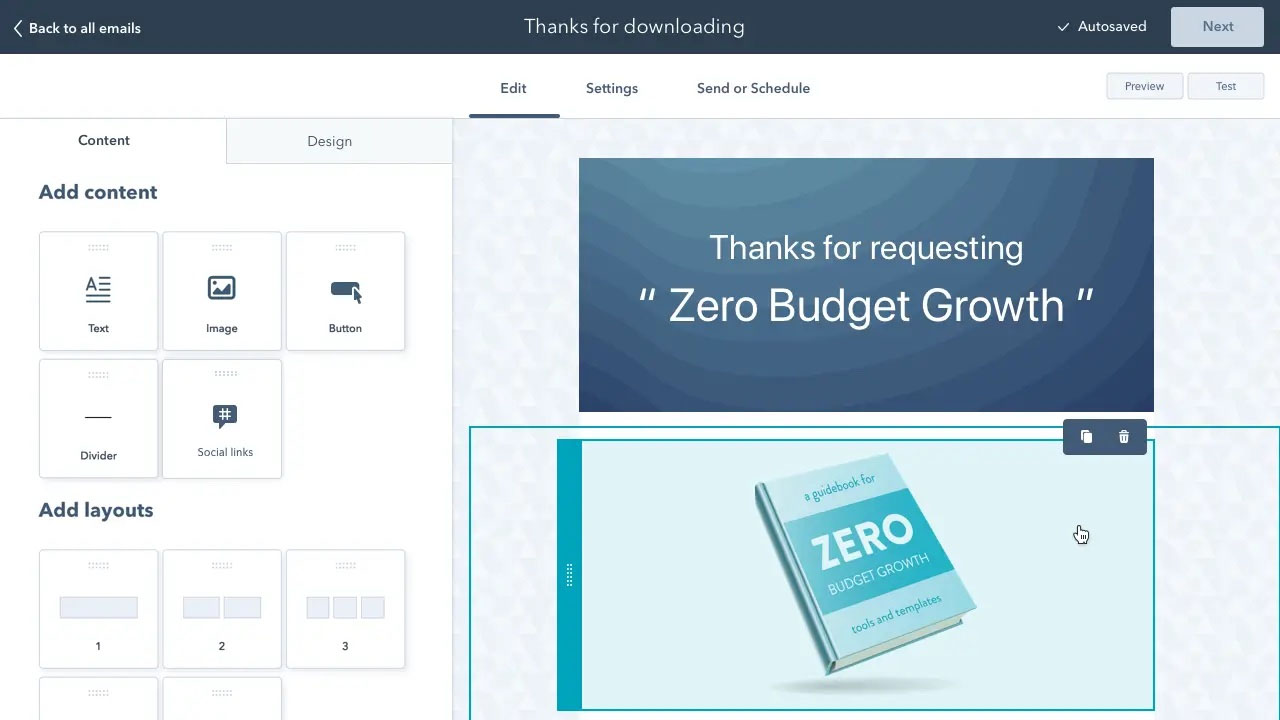

HubSpot CRM designing email campaign (Source: HubSpot)

Our Expert Opinion

HubSpot is a great solution for agency marketers to put their brand on the map. Between the email marketing tools, ad management features, and social media integrations, users can deliver multirange campaigns that engage a wide range of insured audiences. Additionally, the blog and video library hosting allows agencies to promote themselves as thought leaders by leveraging content on insurance and risk management subjects.

Freshsales: Best for Insured Account Management

Pros

- Offers a dedicated account management module to oversee insured clients and their policy documents

- Includes a free built-in telephone to engage leads and support insureds

- Solid features for premium quota tracking and managing agency teams

Cons

- Automated profile enrichment gets expensive

- Email tools not available for free

- Users can’t automate lead, deal, or account assignment until the Pro plan

- You need a solid CRM to manage insured accounts: Freshsales is particularly useful for account managers wanting to organize insured documents, track account activity, and support clients to help retain the business. The Free plan has a dedicated account management module for agencies to handle renewals. There’s even a built-in telephone, also available for free, to receive, place, and track calls from the CRM.

- You want to track premium quotas in your CRM: Sales quotas are extremely common in insurance sales to keep producers accountable for new premiums generated. Freshsales has some of the best quota management features in its platform. Whether it’s for individuals or specific sales teams, agency principals can use Freshsales to set goals, track progress, and get insights from an AI tool to see which deals can get committed to a report.

- You need free email features: Because Freshsales recently went back to its previous pricing model, which has a dedicated Free plan, users can no longer get free access to email integrations to use email tools in the CRM:

- Alternative: HubSpot CRM provides the most robust direct and bulk email marketing tools beginning in its free plan.

- You want low-cost lead assignment: Since many insurance deals are generated from inbound leads through referrals, call-ins, or online web forms, it’s useful to have an automated system that assigns contacts and accounts to producers as they’re generated. Unfortunately, the Freshsales auto assignment is relatively expensive and not available until the Pro plan, which costs $39 per user, per month:

- Alternative: Zoho CRM can provide teams workflow automation, including trigger-based lead assignment, for $14 per user monthly.

Freshsales Monthly Pricing Plans*

*Pricing is based on annual billing on a per-user monthly breakdown. Monthly billing is available for a higher cost. Freshsales offers a 21-day free trial and optional paid add-ons for additional workflow automations and phone credits starting at $5. Pricing reflects pricing info available at the time of publishing. While we update pricing information regularly, we encourage our readers to check current pricing here.

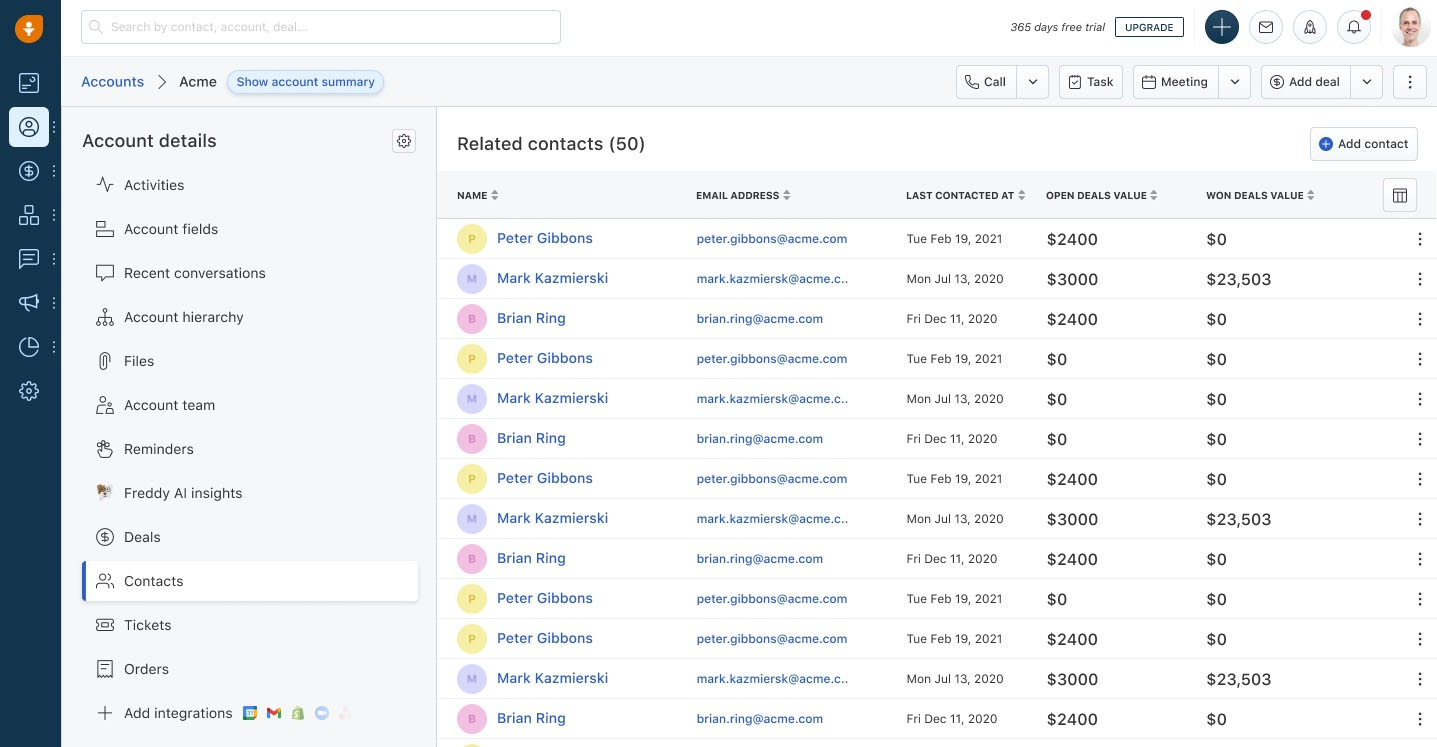

Freshsales account record contacts and details (Source: Freshworks)

Our Expert Opinion

Freshsales supports account managers who need to service their insureds after the deal is closed. We like how the account management module, built-in phone system, and appointment scheduling tools are all included for free for agencies on a tight budget. It’s also important to note how robust the account management tools are, letting you track hierarchies, store contacts, manage files, and create deals out of account records.

Zendesk Sell: Best for Prospecting Potential Clients

Pros

- Solid prospecting tool with built-in database to obtain lead data

- Multichannel outreach options via phone, text, email, or AI chatbot

- Wide reporting capabilities like generating forecasts, tracking premium goals, and getting email campaign insights

Cons

- No free plan

- Relatively expensive bulk email tools

- Doesn't have a proposal management feature to create quotes for insureds

- You want to find prospective insureds with your CRM: Zendesk Sellis unique in that it’s the only insurance CRM software on this list with a built-in database for prospecting. Sales producers can input a company name or search filter and obtain the lead name, phone number, and email contact data. Similarly, you can enrich contact profiles and ensure lead data stays up-to-date to reach out before each renewal period.

- You need multichannel outreach capabilities: Zendesk Sell is an especially excellent CRM for its lead outreach and nurturing features. Since most agencies sell the same coverages, insurance tends to be a volume game. Producers and account managers can optimize communication and ensure they engage insureds on all channels, including email, text, phone, and AI chatbots.

- You want to send insurance quotes from the CRM: Despite all its solid sales tools, Zendesk Sell does not include a proposal management tool to create and send signable quotes from the CRM. This capability requires third-party integrations with tools like PandaDoc or DocuSign:

- Alternative: Pipedrive has a full range of advanced proposal generation, deployment, and signature tools.

- You need more affordable bulk email tools: One issue for Zendesk Sell if you’re on a tight budget and need mass marketing tools is that the bulk email capabilities require the Growth plan for $49 per user monthly:

- Alternative: HubSpot CRM is the best alternative for mass email marketing, with campaign management features beginning on its free forever plan.

Zendesk Sell Monthly Pricing Plans*

*Pricing is based on annual billing on a per-user monthly breakdown. Monthly billing is available for a higher cost. Zendesk Sell comes with a 14-day free trial. Pricing reflects pricing info available at the time of publishing. While we update pricing information regularly, we encourage our readers to check current pricing here.

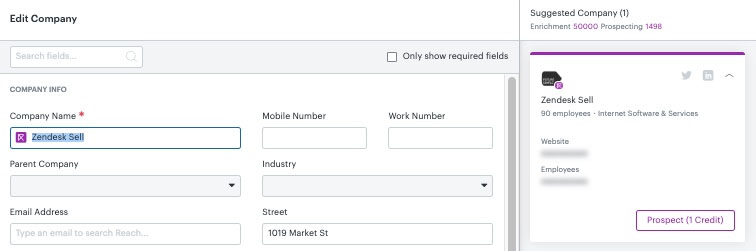

Zendesk Sell prospecting enrichment (Source: Zendesk)

Our Expert Opinion

Zendesk Sell is a particularly good option for optimizing early sales funnel stages. Producers and sales reps can leverage the prospecting tools to get lead data on those deemed a good client fit for the agency. This database pairs well with the multichannel communication tools via email, phone, and text to begin cold outreach and fill up the sales pipeline with new opportunities.

Bitrix24: Best for Multipolicy Sales Tracking

Pros

- Solid free plan with project management, deal tracking, and client profiles for activity planning and tracking for specific insureds

- Offers many business modules for managing functions, such as sales, marketing, projects, service, and human resources (HR)

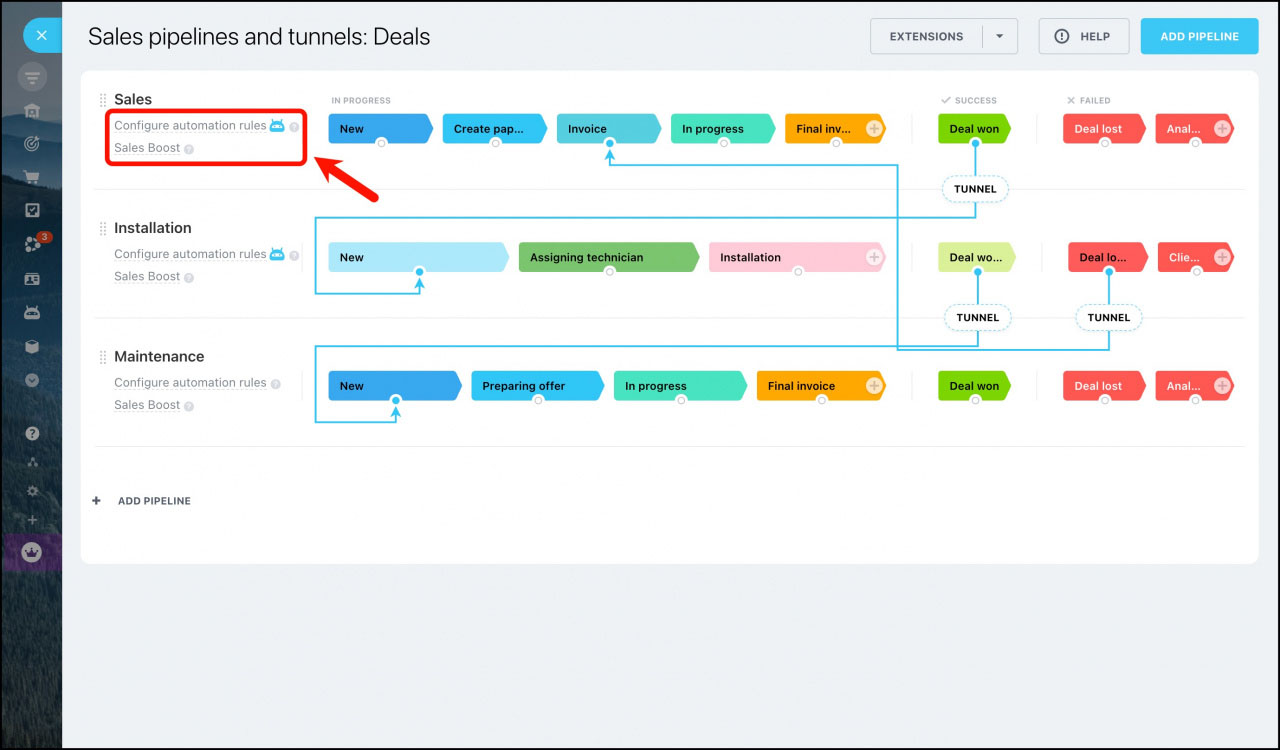

- Unique sales tunnel features for auto-moving leads from one pipeline to another; useful when tracking sales for different coverages

Cons

- Tough system to operate; a high learning curve is required to navigate the CRM

- Paid plans get expensive

- Email and telephone capabilities aren’t available for free

- You sell multiple insurance lines: In insurance, it’s common for an agency to sell multiple coverages at once, such as commercial property and casualty (P&C), personal auto and home, individual health and life, and group benefits. That said, Bitrix24 has multiple pipelines that can be used for each product and a unique sales funnel tool to connect pipelines. The sales tunnel feature auto moves or adds records based on triggers for, say, if a business wants quotes for both commercial coverage and employee benefits.

- You need a solid free insurance broker CRM: Bitrix24, while expensive on the paid plans, has a great free-forever plan for unlimited users. It includes useful tools like project management, unlimited stored contact records, pipeline tracking, and Bitrix24.Sign to get signatures from the CRM. There’s also free client profile management to plan and track activity associated with an insured.

- You need a more intuitive CRM: Bitrix24 is not an ideal solution for users new to operating a CRM system. It has a bulky interface and complex tools, requiring a steep learning curve:

- Alternative: HubSpot CRM and Zendesk Sell are the two best options in terms of product simplicity.

- You want a free phone system to engage leads: While Bitrix24 has a built-in phone system to place and receive calls from the CRM, it’s not available on the Free plan:

- Alternative: Freshsales is the best free CRM with a solid built-in phone system.

Bitrix24 Monthly Pricing Plans*

*Pricing is based on annual billing on a per-month breakdown. Monthly billing is available for a higher cost. Bitrix24 offers a 30-day free trial on paid plans. Pricing reflects pricing info available at the time of publishing. While we update pricing information regularly, we encourage our readers to check current pricing here.

Bitrix24 connecting sales tunnels (Source: Bitrix24)

Our Expert Opinion

Bitrix24 has some of the widest range of capabilities on this list. It also stands out for its solid freemium plan that includes project management, unlimited contact records, and the built-in esignature tool for agents to obtain client signatures. Even so, we mostly like the sales tunnel capabilities that allow insurance brokers to manage complex sales deals that involve different teams, coverages, and, ultimately—different processes.

Salesforce: Best for Insurance App Integrations

Pros

- Wide range of industry-specific CRM integrations including many insurance tools

- All-in-one solution for sales, marketing, and service management

- Includes unique opportunity-splitting tools that divides commissions when multiple reps are involved

Cons

- No free plan and relatively expensive paid plans

- Expensive to generate insurance quotes; requires Professional plan for $75 per user, per month

- Steep learning curve needed to get comfortable with the interface and sales tools

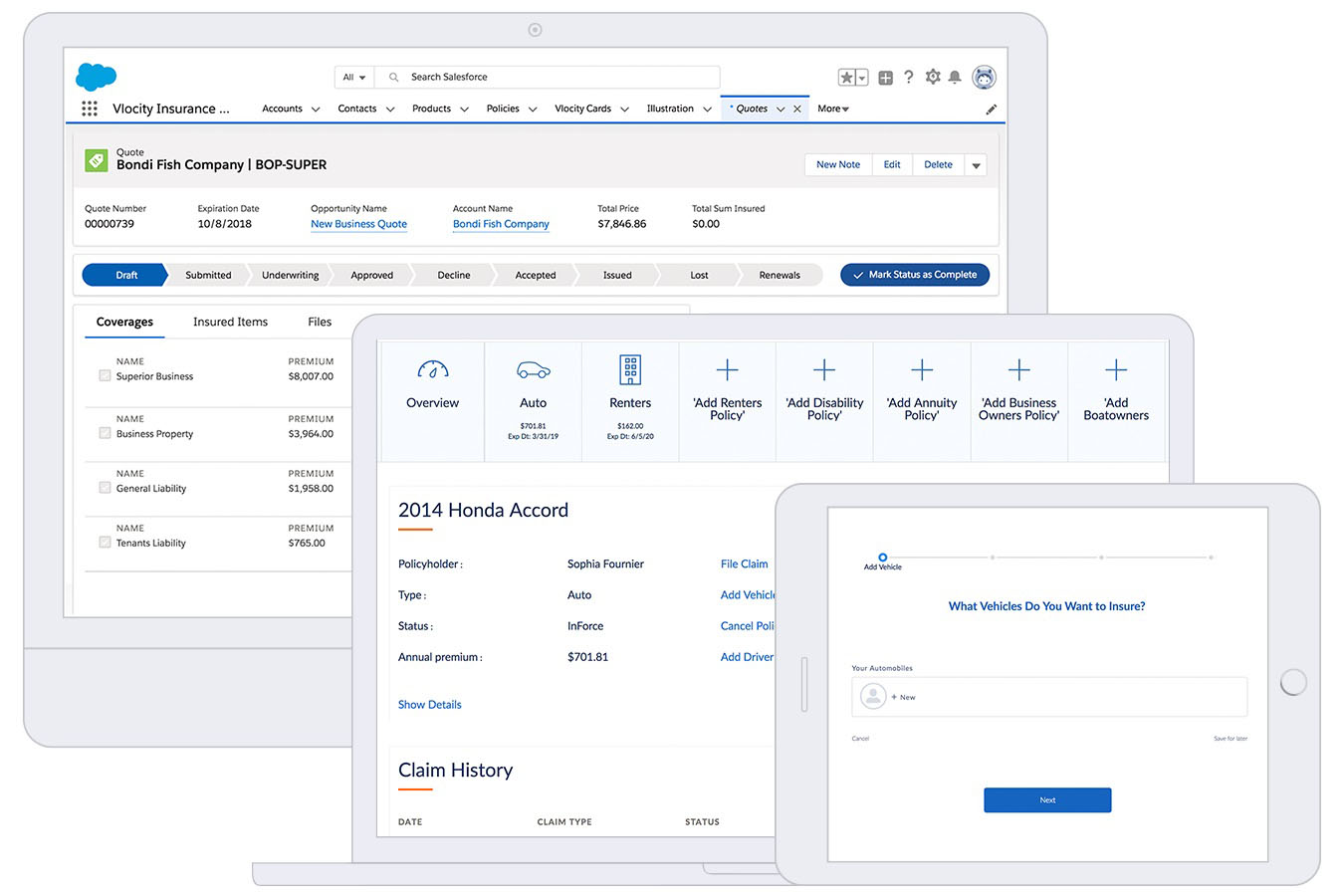

- You want a traditional CRM that can integrate with insurance apps: Salesforce Sales Cloud is a popular general-use CRM that can appear like a specialty product. Despite not being designed for insurance agencies, it offers countless CRM integrations of both general-use and industry-specific tools in the insurance realm. Teams can connect with products like Vlocity, InsuranceVue, Applied Epic, and many other tools to procure quotes, manage policies, and keep insured data in sync with the CRM.

- You need commission tracking tools: As part of its robust set of sales features, Salesforce comes with commission tracking tools to help monitor new premiums by rep and to allocate performance-based compensation. Additionally, the system allows you to do opportunity splits for when multiple agents are responsible for a sales deal to split commission accordingly.

- You need a free CRM for insurance sales: Because it’s highly advanced, the main downfall of Salesforce is affordability. There is no free plan, and the paid subscriptions get expensive:

- Alternative: Zoho CRM and Freshsales are the two best in terms of pricing—each offering freemium options and scalable paid plans.

- You want more affordable quote generation tools: Unfortunately, Salesforce does not begin offering quote generation capabilities until the Professional plan, which starts at $75 per user monthly:

- Alternative: HubSpot CRM includes quote generation on its free-forever plan.

Salesforce Monthly Pricing Plans*

*Pricing is based on annual billing on a per-user monthly breakdown. Salesforce offers a 30-day free trial on paid plans. Pricing reflects pricing info available at the time of publishing. While we update pricing information regularly, we encourage our readers to check current pricing here.

Salesforce integration with Vlocity Insurance app (Source: Salesforce)

Our Expert Opinion

Salesforce Sales Cloud serves as the best CRM for connecting all your insurance procurement, quoting, and policy management tools. Between the system customization and wide range of integration options, the platform can appear like a specialty CRM software designed for insurance agencies to bring in new business and service current clientele.

Zoho CRM: Best for Insurance Agency CRM for Customization

Pros

- Free and affordable plans available

- Highly customizable CRM for tailoring data fields, processes, automations, and modules to meet insurance agency needs

- Includes a built-in account management module to oversee insured clients

Cons

- Poor product usability ratings

- Doesn’t include free access to the Zoho Marketplace for third-party integrations

- Quote generation tools require Professional plan

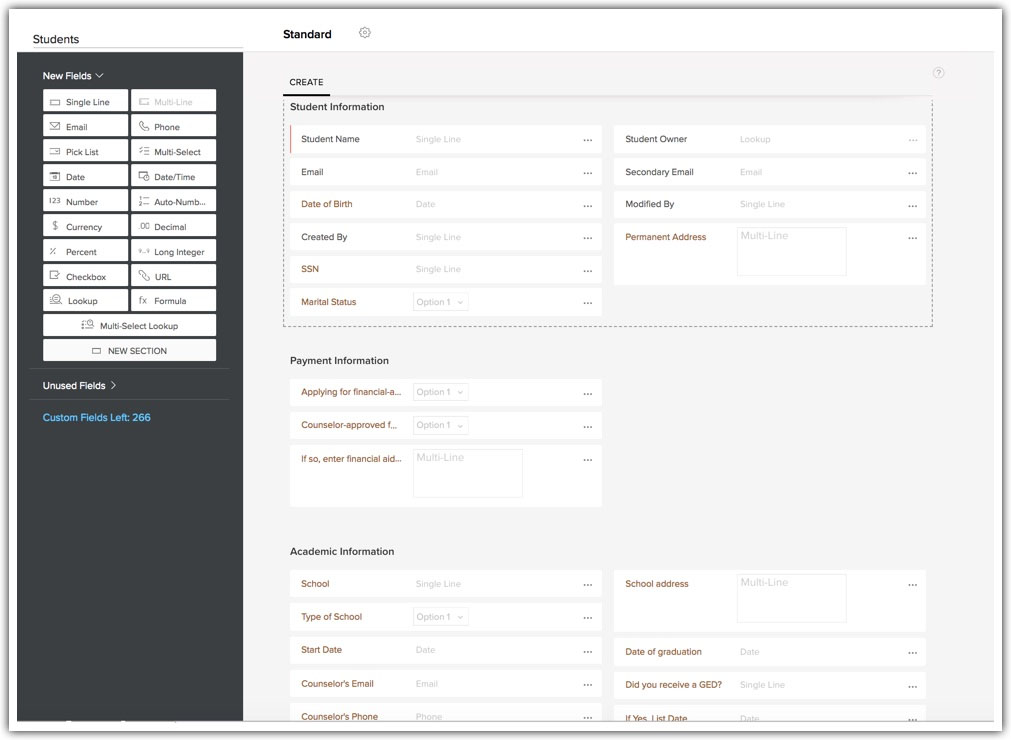

- You want to customize your CRM for insurance operations: Although Zoho is a general CRM system, users can customize many components, such as data fields, pipelines, and automations, to meet the needs of an insurance agency. On top of that, the platform allows you to create entire modules to meet any informational requirements. This lets you tailor your CRM for agency areas like policy management, client meetings, or renewals.

- You need free account management capabilities: Zoho CRM is renowned for its affordable plans, which include a freemium option with lead and contact management, documents storage, workflow automation, and deal tracking. Agencies can also access the standard account management module, which is prebuilt and ready to go to organize insured contact data, track activity, send communications, and monitor renewal dates.

- You need an intuitive CRM system: One of the most common user complaints is product usability. Users find that there’s a learning curve required for many of the built-in features, and it’s tricky to navigate due to all the available menu options:

- Alternative: Freshsales, HubSpot CRM, and Zendesk Sell are all better options for an intuitive CRM experience. Insureio is also a great alternative with great usability ratings if you specifically want a specialty life insurance CRM.

- You want third-party integrations included for free: Although it has a solid free plan, access to third-party integrations is not included. Users must upgrade to the Standard plan before connecting outside applications:

- Alternative: HubSpot CRM includes third-party integrations on its free-forever plan.

Zoho CRM Monthly Pricing Plans*

*Pricing is based on annual billing on a per-user monthly breakdown. Monthly billing is available for a higher cost. Zoho CRM comes with a 15-day free trial for the paid plans. Pricing reflects pricing info available at the time of publishing. While we update pricing information regularly, we encourage our readers to check current pricing here.

Zoho CRM creating information fields in custom modules (Source: Zoho)

Our Expert Opinion

Zoho is another solid general-use CRM that can appear like an industry-specific one with the right amount of tailoring, thanks to its custom CRM modules or apps. You can edit these tools to meet insurance data needs, such as current premium amount, claims history, policy period, lines of coverage, and so on. Once the module is created, you can configure your automatons and run your insurance operation.

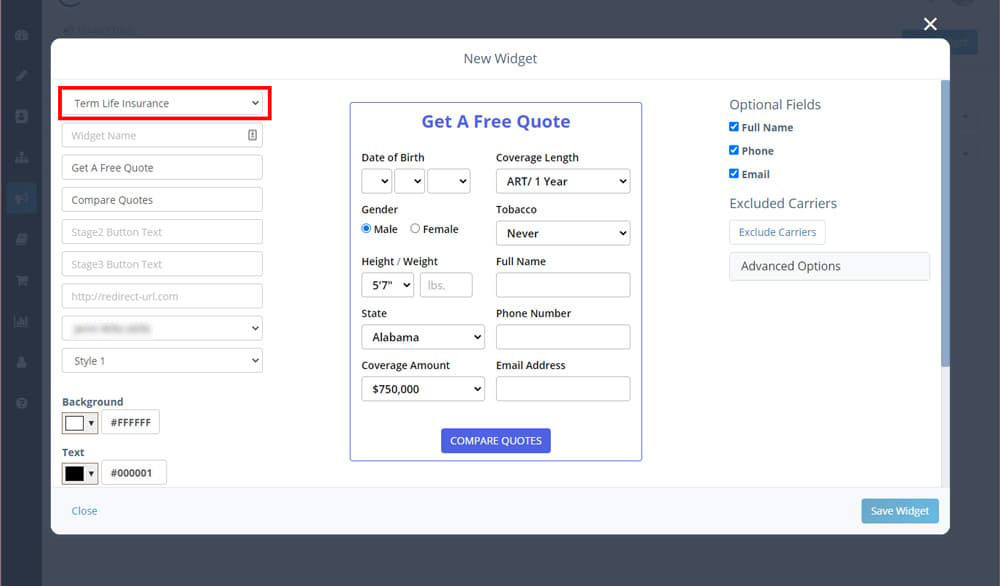

Insureio: Best CRM for Life Insurance Agents

Pros

- Specialty CRM built for life, disability, and annuities insurance sales

- Offers features for managing agency operations like agent recruitment tools and brand management

- End-to-end capabilities for generating leads, obtaining and sending quotes, binding and delivering policies, and managing accounts

Cons

- No free plan

- Relatively expensive to get automated lead assignment features

- Mass email features require Marketing plan which gets expensive

- You mainly sell life insurance: Insureio is a specialty-built insurance CRM for agencies and brokers that generate new business and deliver policies. Because it can integrate with more than 30 life insurance carrier portals, it is meant to be an end-to-end solution for getting quotes, managing policies, and supporting renewals for life insurance coverage.

- You want full agency management capabilities in your CRM: Insureio offers operations management tools that help agencies run smoothly. These include recruiting tools and email templates, brand management features, and company hierarchy tracking to help employees understand the organizational structure. There are also options to manage an entire insurance-based website from the CRM.

- You need affordable mass email tools: Some of the more expensive features Insureio offers are bulk marketing tools, which require the Marketing plan for $50 per month:

- Alternative: HubSpot CRM is the best email marketing CRM that includes templates, automate campaigns, and mass email on its free plan.

- You want a free CRM: Insureio, unfortunately, does not offer any free-forever plan for new users that want to test-drive their CRM in a risk-free environment:

- Alternative: Bitrix24, Freshsales, HubSpot CRM, and Zoho CRM are all great alternatives that can provide freemium options.

Insureio Monthly Pricing Plans*

*Pricing based on annual billing on a per-month breakdown. Monthly billing is also available for a higher cost. Insureio offers a 30-day free trial of paid plans. While we update pricing information regularly, we encourage our readers to check current pricing here.

**Does not include mass email, prebuilt campaigns, or website management tools

Insureio life insurance application (Source: Insureio)

Our Expert Opinion

Insureio is the best specialty CRM for life insurance. Thanks to its integration with over 30 carrier portals, users can directly get quotes and bind coverage from the CRM. This is in addition to the sales and marketing tools, case management features, agency management module, and supplemental features for financial planning and underwriting.

How We Evaluated the Best CRM for Insurance Agents

To determine the best insurance CRM software, we evaluated the specific features relevant for an insurance agency to manage sales, marketing, and operations. For instance, commission tracking lets an agency principal properly allocate sales producer earnings on premiums generated. We also looked at other critical CRM software attributes, including price, product ease of use, customer support, and general feats like integrations and system customization

The tabs below offer insight into our evaluation process of the best CRM software for insurance:

25% of Overall Score

We first looked at features crucial to any CRM regardless of its industry use case or company size. System customization, for example, lets you tailor your data field and modules to meet insurance agency requirements. Alternatively, access to insurance app integrations allow you to synchronize your policy data and client files between both systems. We also wanted to see a mobile app for on-the-go sales and solid reporting tools for sales and commissions.

20% of Overall Score

Pricing considered the overall affordability of each CRM system. This accounted for freemium plan options, low-cost subscriptions, and billing flexibility by allowing users to subscribe monthly or save with an annual plan. We also looked at the cost of features specifically useful for insurance agencies and whether they were available on the free or lower-tiered plans.

20% of Overall Score

We evaluated features specifically designed for insurance brokers or agencies to generate new business, support clients, and manage their operations. For example, sales team management lets growing agencies track and report premiums for various territories. We also looked at whether the platform offered commission tracking tools, quota monitoring on new premiums, proposal generation to send premium quotes to leads, and document storage.

20% of Overall Score

Extensive customer support prevents poor user experiences while using these insurance CRM systems. We wanted the providers of the software to offer multiple service channels via phone, email, and live chat. We also looked at self-service resources like knowledge base guides and community forums and the hours of customer support availability.

15% of Overall Score

In addition to first-hand experience with these insurance CRMs, we evaluated what actual users say about the products according to online reviews. This allows us to thoroughly understand how customers feel about the general and niche CRM features and whether they’re worth the cost. It also helped us gauge product usability in terms of navigating the interface, operating the features, and setting up the modules.

Frequently Asked Questions (FAQs)

An insurance CRM is software with tools for agencies to grow their business. It will include features like deal tracking, document management for policy files, and communication tools that let you engage leads via phone or email. Some of the more advanced insurance CRMs will even have commission tracking on premium sales, account management tools to support and renew insureds, and team management to oversee multiple policies or geographic territories.

The main benefit of using an insurance CRM is work centralization. Instead of navigating multiple tabs and doing double data entry in various apps, it’ll let you handle lead and client communications, document management, quote generation, sales reporting, and activity monitoring all in one system. Additionally, an insurance CRM will be a lower-cost solution because you can access your features from one subscription rather than multiple.

The best insurance CRM will depend on your feature needs and budget. If, for example, you need robust deal management and proposal generation tools to send insurance quotes to leads, we’d recommend Pipedrive. However, if you mainly want to market your agency, we’d recommend HubSpot CRM because of its comprehensive marketing and content management tools. Alternatively, specialty tools like Insureio are solid if you primarily sell life insurance policies.

Bottom Line

Insurance CRMs help agencies grow their book of business. These platforms will include tools for generating leads, delivering new policies, and managing current insureds. While we rated Pipedrive as the best overall insurance CRM system, other products could be a better fit depending on needs. For example, Zoho CRM is highly customizable to create modules specific to an agency, while Salesforce can integrate with numerous third-party insurance tools.