A payment gateway allows merchants to securely accept credit card payments online or in person. In fact, the most popular payment gateways are actually payment processors, and many modern providers offer free or affordable payment gateway solutions with merchant accounts.

The best payment gateway offers easy integration and competitive transaction processing fees. But because not all businesses are the same, the challenge is finding the right provider to match your needs. For this guide, I evaluated dozens of options to provide you with the best payment gateways in the market today.

The best payment gateways are:

- Authorize.net: Best overall and most versatile

- Helcim: Best and cheapest for growing businesses:

- Square: Best free in-person and mobile setup

- 2Checkout (Verifone): Best for international sales

- Shopify Payments: Best for Shopify merchants

- Stripe: Best for integrations and customizations

- Payflow by PayPal: Best add-on for ecommerce

I also included a list of three runners-up for their unique features.

- Chase Payment Solutions®: Best for free & fast funding

- PaymentCloud: Best for CBD (cannabidiol), tobacco, and other high-risk merchants

- Amazon: Best for voice commerce

Best Payment Gateways Compared

Please note that all of the payment gateway providers in our list come with a merchant account; however, not all merchant accounts are the same. Read our guide on merchant accounts to find out which one is best for your business, or explore our guide on the best merchant services—all of which come with payment gateways.

Authorize.net: Best (& Most Versatile) Payment Gateway

Pros

- Most reliable/easy to use

- Option for standalone or with merchant account

- Works with high-risk merchants

- Easily connects with most small business software

Cons

- Has a monthly fee

- Does not sell terminals, POS hardware

- Imposes a chargeback fee

- Lacks native one-click payment tools

Overview

Who should use it:

Small and new businesses—whether you already have a merchant account or not and want a payment gateway that you can keep using even if you switch merchant account providers

Why I like Authorize.net:

Authorize.net is one of the most popular payment gateways, seamlessly integrating with most of the industry’s payment processors, merchant service providers, and point-of-sale (POS) systems. It supports almost all types of payment methods, including PayPal. It also has Payment Card Industry (PCI) compliance and offers competitive online rates for small and growing merchants.

You can choose from two plans—Authorize.net can be a pure payment gateway, letting you choose your own merchant service, or you can select the all-in-one plan, which provides payment processing at a flat rate. Both plans have a monthly fee.

Authorize.net earned real-life user scores of 4.2 out of 5 on G2 from around 190 reviews and 4.5 out of 5 on Capterra from about 170 reviews. Overall, merchants say they like Authorize.net’s features, although there is a slight learning curve when using the system.

- Monthly fee:

- All-in-one account: $25

- Payment gateway only: $25

- Card-not-present: 2.9% + 30 cents per transaction or 10 cents per transaction and 10 cents batch fee

- Card-present processing fee: 2.9% + 30 cents per transaction or 10 cents per transaction and 10 cents batch fee

- ACH/e-Check processing fee: 0.75% per transaction

- Chargeback fee: $25

- POS system: $0

- Virtual terminal: $0

- Card readers: From $65

- Terminals: Third party

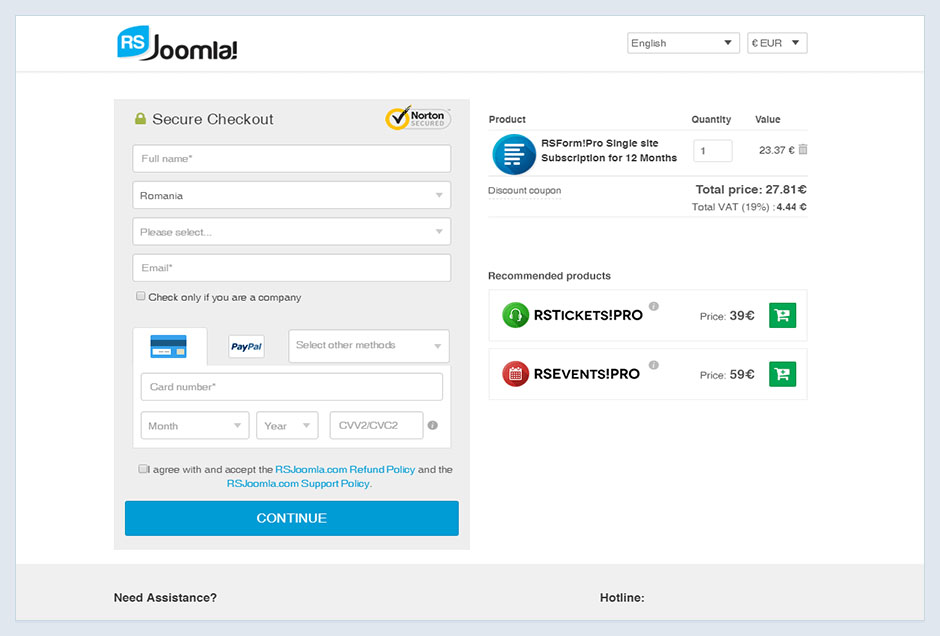

Authorize.net is the most popular payment gateway that’s compatible with most payment processors (Source: Authorize.net)

- Robust payment toolkit: Authorize.net can process online, in-person, and virtual terminal payments, and mobile wallets like Apple Pay and even PayPal. It is PCI-compliant and has strong fraud protection. Plus, you can use it to manage subscriptions and recurring payments.

- Popular and easy to integrate: Authorize.net integrates into more than 140 certified solutions from sales to accounting, kiosks to shopping carts, and even other payment providers like PayPal.

- Pays within 24 hours: Most payment processors take a day or two to pay out, except 2Checkout, which pays out each week. Some, like Square, charge extra for same-day payouts.

- Mobile: Authorize.net’s POS app lets you ring up purchases with sales tax and simple notes and accept credit card payments. Users say—especially recently—that they’ve had problems with logins and glitching.

Related: Learn about PCI compliance for small businesses.

Helcim: Best & Cheapest for Fast-growing Businesses

Pros

- No monthly fee or long-term contracts

- Interchange-plus transaction fees

- Free credit card processing program

- Automated volume discounts

Cons

- Limited business integrations

- Not compatible with high-risk merchants

- Expensive mobile card reader

- Application process geared towards more established businesses

Overview

Who should use it:

Helcim is our all-in-one payment platform of choice for fast-growing businesses with large-volume sales looking to keep their transaction fees as low as possible.

Why I like Helcim:

Helcim is our recommended cheapest payment gateway for large-volume businesses. While it’s impossible to accept online payments absolutely free, Helcim’s rates come closest to ensuring that you always pay the cheapest fees possible. It offers zero monthly fees, low chargeback costs, and inclusive features.

Helcim offers a payment gateway API feature, which allows real-time card payment authorization, data capture, voids and refunds management, and recurring payments. It is also easy to set up, so you can add this gateway to any existing website, shopping cart, or accounting system and start accepting payments in no time.

I’m glad to see an improvement in Helcim’s popularity. It earned a score of 4.2 out of 5 on G2 and 4.1 out of 5 on Capterra, with around 15 reviews each. Meanwhile, about 350 users on Trustpilot gave Helcim a score of 4.2 out of 5. Merchants mostly love Helcim’s fees but also say that there are bugs/issues with the system.

- Monthly fee: $0

- In-person processing fee: Interchange plus 0.15% + 6 cents to 0.4% + 8 cents

- Online processing fee: Interchange plus 0.15% + 15 cents to 0.5% + 25 cents

- Chargeback fee: $0 to $15 (reversible)

- ACH payments: 0.5% + 25 cents, $5 per return

- Virtual terminal: Included

- Card readers: $99

- Terminal: $349

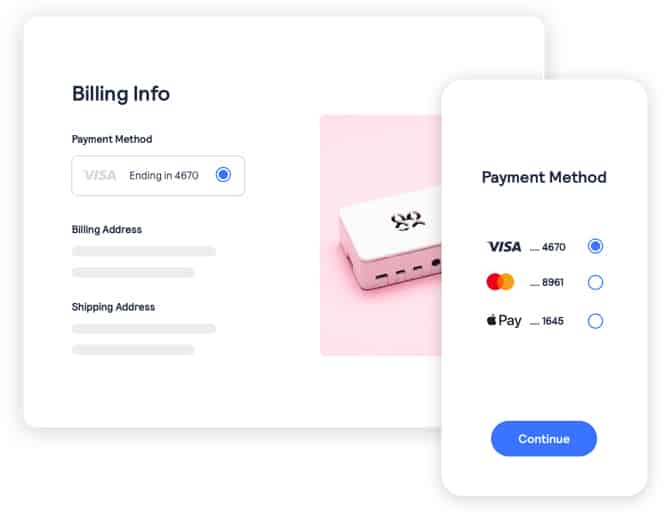

Helcim’s online checkout page includes a free credit card processing option for merchants who also accept ACH payments.

(Source: Helcim)

- Interchange-plus pricing: Helcim charges a volume-based service fee on top of the actual interchange and card network costs. This pricing model makes it possible to get the lowest rates possible every month automatically, depending on your monthly sales, without having to constantly negotiate for fees.

- International payments: Helcim can process overseas credit card payments. There are no additional fees for currency conversion, as the transactions are subject to your customer’s card network rates.

- Data management: Helcim’s full payment gateway API allows you to securely manage your business data all in one place with over 80 API actions available, including accessing and updating product catalogs and retrieving credit card and bank information.

- Dispute management: Helcim comes with a dispute management dashboard that lists chargeback details, claim statuses, and a link for uploading supporting documents. You can also filter the view depending on dispute status, response due date, and more.

- Zero-cost processing program: “Fee Saver” is Helcim’s zero-cost or free credit card processing program. Merchants accepting ACH payments with Helcim can choose to enable Fee Saver for each transaction. When used, the system automatically detects the type of free credit card processing program available to use based on the card type/network and business location. Customers can choose to pay with ACH instead of a credit card to avoid the fees.

Related: Learn more about zero-cost online card processing.

Square: Best for Free Point of Sale

Pros

- No monthly processing fees

- Free specialized POS software

- Offers a CBD merchant program

- Free website builder

- Prebuilt integrations with many website builders and ecommerce platforms

- No long-term contracts

Cons

- Locked into Square Payments

- Limited customer service hours

- Frequent complaints of payment holds and frozen accounts

- Not compatible with most high-risk merchants

Overview

Who should use it:

Small and new businesses looking for a very affordable, and easy-to-use all-in-one POS + payments solution

Why I like Square:

Square is a favorite among reviewers at Fit Small Business because it can do so much so well. As a payment gateway, it offers online payment tools at no extra cost. It supports easy-to-use shareable links and “Buy Now” buttons and its virtual terminal comes with all the features you would expect from more sophisticated solutions like Stripe. Square’s mobile card reader can also be connected to your computer with a Square dock so you can accept keyed-in, tap, and chip payments.

Square is the most popular in our list, with merchants giving the software a score of 4.6 out of 5 on G2 from about 150 reviews, and 4.7 out of 5 stars on Capterra from about 2,300 reviews. Users love the easy-to-use and reliable software while some complain of frozen funds and poor customer support.

- Monthly fee: $0 to $60

- Card-present processing fee: 2.6% + 10 cents per transaction

- Keyed-in processing fee: 3.5% + 15 cents per transaction

- Online/Ecommerce rate: 2.9% + 30 cents

- ACH processing fee: 1% with $1 minimum

- Rapid Pay fee: 1.75%

- Chargeback fee: Waived up to $250

- Virtual terminal: $0

- Card readers: From $49

- Terminals: From $299

- 30-day free trial

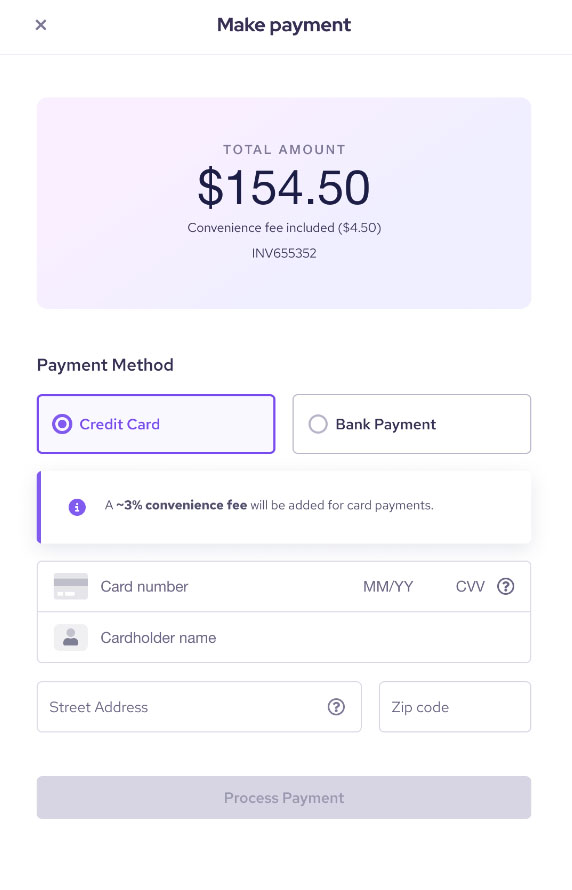

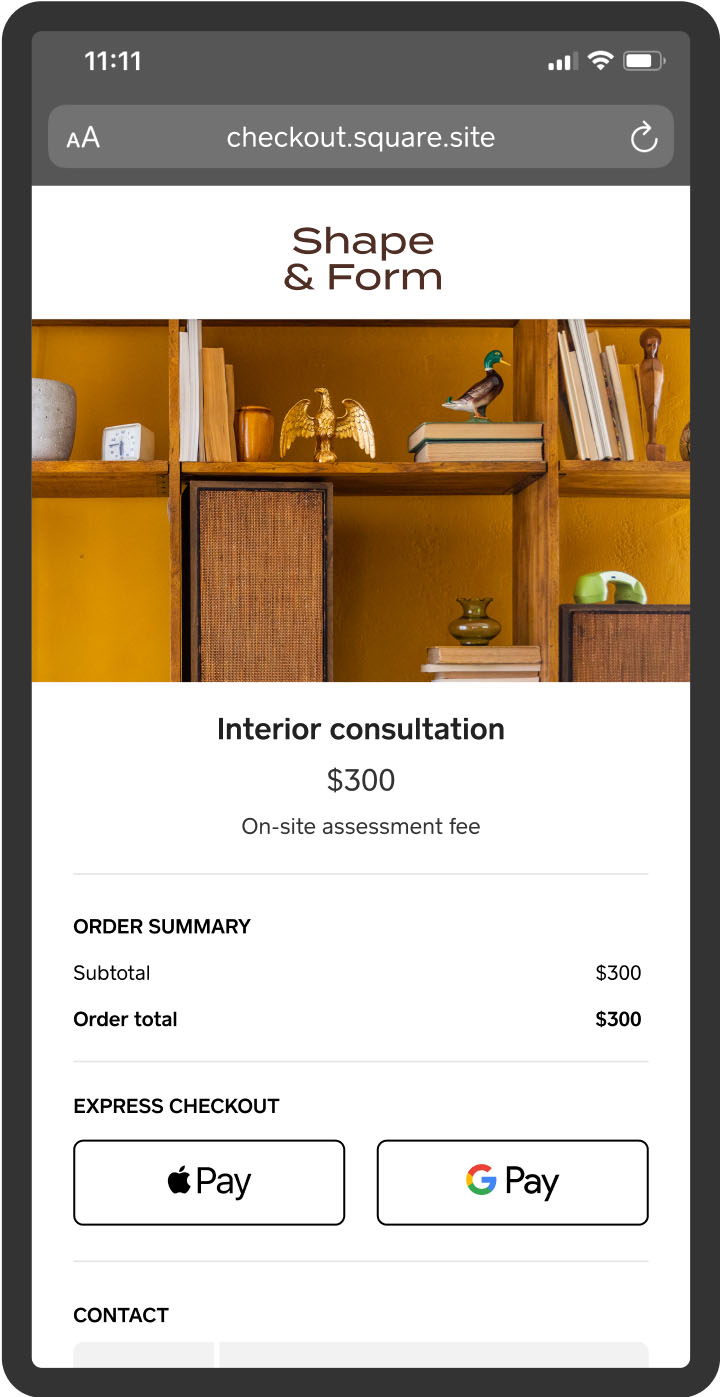

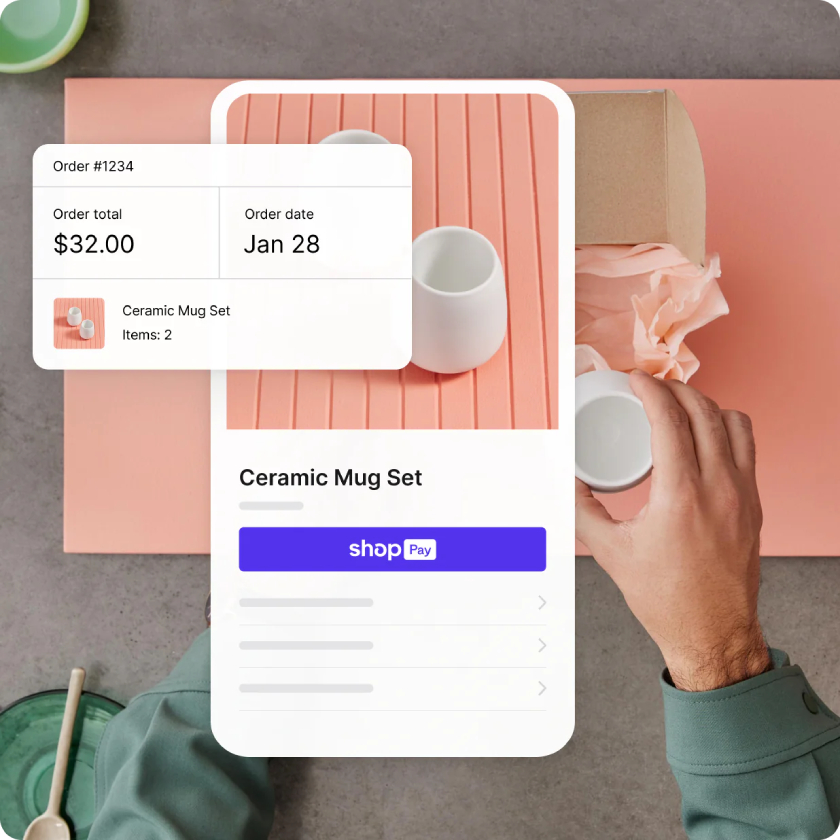

Square’s dynamic online checkout easily adapts to desktops and mobile screens (Source: Square)

- Priced for solopreneurs and startups: If you are only an occasional seller, such as a hobbyist, the free software and lack of monthly fees make it among the most affordable.

- Versatility: The ease of use and great mobile app means you can use it in-store or on the go. It has a virtual terminal for phone orders, a free website/online store, and invoicing for freelancers and B2B. (Others on this list charge for one or both of these features.)

- Free POS with inventory management: While many payment gateways on this list offer POS systems, Square’s is among the most complete with inventory, reports, and some customer management functions.

- Mobile app and card readers: Square tops our list of the best iPhone credit card readers. Users praise the ease of use and functions. Most complaints are about held funds or frozen accounts rather than the app.

- CBD Merchant Program: Square supports certain types of CBD merchants, allowing some high-risk merchants access to Square’s POS and gateway payment processing tools

2Checkout (Verifone): Best for Global Sales

Pros

- No monthly fees

- 45 payment methods

- Global merchant of record

- Over 120 ecommerce integrations

Cons

- Weekly payout

- Expensive flat-rate fees

- Lacks mobile payment

- Chargeback fees determined by a formula

Overview

Who should use it:

Online businesses with primarily international customers looking to save on transaction and conversion fees

Why I like 2Checkout:

2Checkout (Verifone) made our list of payment gateways because of its international scope (over 200 countries and 100 currencies). However, what makes it especially good for global sales is that it can act as the merchant of record, taking care of not only payment processing but also sales tax management and compliance. It’s also highly integratable with over 120 ecommerce integrations.

However, there is a clear room for improvement for this payment gateway. 2Checkout received a score of 3.9 out of 5 on G2 from around 200 reviews, 4.2 out of 5 on Capterra from nearly 100 reviews, and 2.6 out of 5 on Trustpilot from around 2,250 reviews. There is a growing number of complaints that customers cannot use Visa or Mastercard to pay at checkout and get redirected to PayPal. Customer support is also difficult to reach.

- Monthly fee: $0

- Processing fee: 3.5% + 35 cents to 6% + 60 cents

- Online transaction fee: 3.5% + 35 cents

- Chargeback fee: Varies

- Hardware sold by third parties

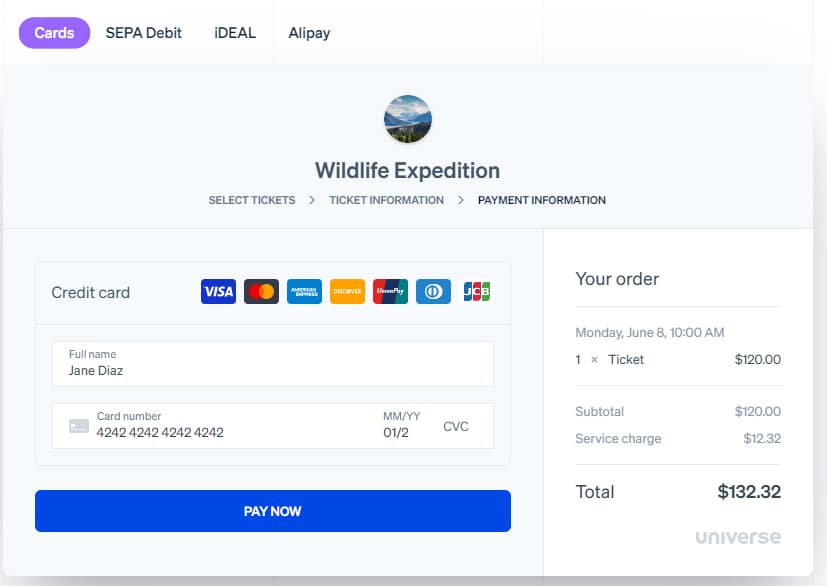

2Checkout’s payment gateway supports 100 currencies in over 200 countries around the globe. (Source: 2Checkout)

- Shopper myAccount: 2Checkout has a unique tool, myAccount, for your customers. It lets them see all the items they’ve purchased using 2Checkout (i.e., from your store and others that use this payment gateway). They can make changes to personal information and payment methods and contact support.

- International sales: You can process sales for over 200 countries and 45 different payment methods in 100 currencies. This includes recurring billing and individual sales. The highest plan has global VAT and sales tax collecting and handling—something you won’t find with the other payment gateways in this guide.

- Award-winning coding: 2Checkout has won multiple awards for its platform and programming, including awards from review sites like G2. It was also a finalist in the 2021 CODiE Awards and 2021 Cloud Awards.

- Add-on tools: Like Square, 2Checkout offers several add-ons to upgrade your plan. However, these are more focused on payment processing than POS. You can get tools for increasing conversion rates and A/B testing, complex subscription management, renewal recovery (like updating expired cards), networking with over 50,000 affiliates, and dedicated customer support.

Related: Learn more ways to accept credit card payments online.

Shopify Payments: Best for Shopify Ecommerce Platform Users

Pros

- 14-day free trial

- Accepts international payments

- Includes fast-checkout feature

- Accepts PayPal payments

Cons

- Ecommerce subscription can be pricey

- Advanced reporting only in higher plans

- Very limited offline mode capabilities

- Reports of frozen funds and accounts

Overview

Who should use it:

Ecommerce merchants using (or planning to use) the Shopify ecommerce platform

Why I like Shopify Payments:

With over 5 million online stores and an estimated 700 million customers, our list of online service providers won’t be complete without Shopify. Shopify’s payment gateway is a built-in payment processing service for merchants using the Shopify ecommerce platform. The online checkout supports a wide range of payment methods, including PayPal. Shopify also comes with an accelerated checkout feature, Shop Pay, that reduces friction and improves customer conversion.

Shopify is a strong competitor to Square as a multichannel payment gateway service and is similarly well-reviewed. It scored 4.5 out of 5 on Capterra from around 6,400 real-life users and 4.4 out of 5 on G2 by nearly 4,600 reviewers. Users love Shopify’s 14-day free trial and agree that the system is easy to use and easy to set up even for beginners.

Learn more about Shopify’s multichannel features from our Shopify ecommerce and Shopify POS reviews.

- Monthly account fee: $5 to $399

- Monthly payment gateway fee: $0

- In-person transaction fees: 2.4% + 10 cents to 2.6% + 10 cents

- Online transaction fees: 2.7% + 30 cents to 2.9% + 30 cents

- Chargeback fee: $15 refundable

- POS software add-on: $0 to $89 per month

- Card readers/payment terminals: $49 to $349

See detailed pricing in our ultimate guide to Shopify.

Shopify’s online payment gateway is customizable and mobile-optimized. (Source: Shopify)

- Integrations: Shopify Payments can be integrated with several third-party checkout services such as cart modification, cross-selling and upselling, and pick-up and delivery apps.

- Mobile app: With Shopify Payments, merchants can use Shopify’s mobile app (Shop for iOS and Android) that provides users access to shipping, accelerated checkout via Shop Pay, and package tracking.

- Multicurrency transactions: Using Shopify Payments on your website allows users to sell in multiple currencies and receive payments in their local currency. The checkout page can be configured to detect customer location and filter available local payment options.

- Easy sign-up: Each Shopify account comes with the Shopify Payments service and a merchant account. There is no application and approval process involved other than submitting your proof of business when you sign up for a Shopify online store.

Stripe: Best for Integrations & Programmability

Pros

- Extremely customizable

- Multitude of integrations, great API

- 24/7 support

- Top security and fraud management

- Quick, easy sign-up

- No long-term contracts, pay-as-you-go billing

Cons

- No native POS

- Service fee for invoicing and recurring billing payments

- Requires some technical expertise

- Limited hardware options

Overview

Who should use it:

Best for tech-savvy businesses looking to customize their online payment platform with developer-based tools.

Why I like Stripe:

Stripe is a terrific payment gateway for businesses—from startups to Fortune 500 firms. Its vast number of integrations (more than 660) make it a great choice for online, international, and B2B payment processing. However, it also made our list because of its programmability. Stripe’s API and SDK tools are some of the best on the market, making it a great choice for a business wanting to incorporate Stripe payments into its software or mobile app.

Even with some issues around ease of use, Stripe continues to be popular among small businesses. Around 300 users rated Stripe with a score of 4.3 out of 5 on G2, while around 3,000 users gave Stripe a score of 4.7 out of 5 on Capterra. Merchants found Stripe’s customization tools to be very useful but some say that the technical requirements can be challenging.

Learn how Stripe compares with our top payment gateway choice, Authorize.net.

- Monthly fee: $0

- In-person processing fee: 2.7% + 5 cents (card-present), 2.9% + 30 cents (touchless)

- Online processing fee: 2.9% + 30 cents per transaction

- Keyed-in processing fee: 3.4% + 30 cents

- Invoicing service fee: 0.4% with 25 free invoice processing per month or 0.5% per invoice, depending on plan

- Recurring billing service fee: 0.5% per month or 0.8% per invoice, depending on plan

- Discounts for volume sales, multi-products

- Chargeback fee: $15

- Virtual terminal: $0

- Card readers: $59

Stripe’s customizable checkout supports a variety of tools including address and language. (Source: Stripe)

- Billing and subscriptions: Stripe has a free invoice function for up to 25 payment requests per month. It also makes it easy to design a billing system for one-time or recurring payments. You can set up flat rates, multiple pricing, and usage rates (such as for electricity). It integrates with websites, mobile apps, and CRM systems.

- Integrations: Stripe was designed to be easily integrated and has over 660 partners and interfaces in accounting and finance, marketing and sales, operations, payments, and ecommerce. In addition, it has excellent SDK and API functions for creating your own integrations. In fact, Stripe processes over 250 million API requests per day.

- International sales: While we like 2Checkout best for international sales, Stripe is no slouch. With Stripe, you can accept payments in over 135 currencies. It charges extra for processing international credit cards in person, however.

Payflow by PayPal: Best Add-on Gateway for Ecommerce

Pros

- Supports international payments

- Free invoicing and POS software

- Known and trusted platform by consumers

- Most affordable in-person flat rate fee

- No long-term contracts

Cons

- High add-on fees

- Complicated fees

- Monthly fee required for virtual terminal and ACH processing

- Lacks B2B payments processing

- Potential for frozen funds

Overview

Who should use it:

Merchants looking to add PayPal payment methods on ecommerce checkouts.

Why I like PayPal:

It’s almost impossible to talk about online payments without PayPal, a household name. In fact, PayPal is highly trusted by shoppers, so much so that adding a PayPal checkout option to your site can help reduce shopping cart abandonment. Its standalone payment gateway, Payflow, can accept 25 currencies in more than 200 countries, so it’s also a good option for international businesses. However, 2Checkout and Stripe can work with more currencies and countries.

With over 400 million users, PayPal is among the most popular platforms in our list and like Square, is one of the most reviewed. The system earned a score of 4.4 out of 5 on G2 from around 2,000 reviews, and 4.7 out of 5 on Capterra from about 25,000 reviews. PayPal is known for being user-friendly but also constantly receives complaints about frozen funds.

- Monthly account fee: $0

- Monthly gateway fee: $0 to $25

- Monthly recurring billing: $10

- Monthly fraud protection: $10

- Payflow fraud protection per transaction: $0 to 10 cents

- Payflow transaction fee: 10 cents

- In-person processing fees: 2.29% + 9 cents

- Online card processing fees: From 2.59% to 2.99% + 49 cents

- Keyed-in processing: 3.49% + 49 cents

- Monthly virtual terminal: $0 to $30

- Cryptocurrency conversion fee: 1%

- Card reader: $79 ($29 for first reader)

- Terminal: From $199

- Chargeback fee: $0 to $20

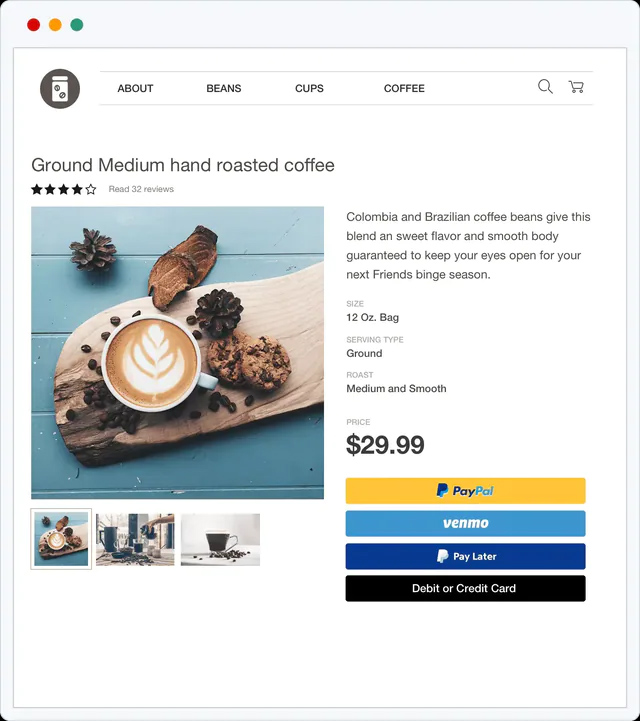

Aside from the traditional online credit card method, PayPal’s hosted checkout comes built-in with additional checkout options such as PayPal checkout, Pay Later, and Venmo. (Source: PayPal)

- International payments processing: PayPal accepts 25 currencies through its payment gateway.

- Hosted checkout: PayPal is one of the most trusted online payment processors providing hosted prebuilt and highly customized checkout pages. It’s easy to set up and integrate, allowing you to start accepting payments in minutes.

- Social media selling: Create a “Buy Now” or “Pay Now” button with PayPal’s payment button generator. You can paste the link on Facebook, Twitter, and most online marketplaces.

- Chargeback protection: Basic chargeback protection is included with PayPal’s payment gateway, but you can also add advanced fraud protection and seller protection.

- Recurring billing payments: PayPal’s invoicing app allows you to automate recurring invoice management. You can create and send invoices and accept card payments, eChecks, and PayPal-exclusive payment methods.

Notable Runners-up:

The following payment gateway providers did not make our list but offer stand-out, noteworthy features:

Not every payment gateway will work with high-risk merchants and those that do often have higher rates and more problematic services. PaymentCloud offers great service and a true focus on this subset of the retail world. It does not disclose rates, which is common for high-risk processors, as the specific fees will vary for each business and the level of risk involved. However, the provider offers competitive setups, especially for its client type.

PaymentCloud earned an overall score of 4.16 out of 5 based on our evaluation criteria and (apart from Authorize.net) stands out for its good reputation of working with high-risk industries. In fact, it continues to rank No. 1 on our list of the best high-risk merchant accounts. PaymentCloud does not charge setup, annual, or cancellation fees—which is a plus.

Chase Payment Solutions® is a direct processor that offers merchant services to SMBs. While it is possible to enroll in Chase Payment Solutions® with a different business banking service, you get the best value (and fastest payouts) when you also enroll in Chase Business Checking. As such, it’s a great choice for new businesses needing a checking account, a business credit card, and more. Like Authorize.net Chase has a large number of integrations and partnerships.

Chase earned an overall score of 4.16 out of 5. Feature-wise it’s up to par with most payment gateway functionalities of those that have made our list. Chase has local bank partnerships to support international payments like 2Checkout. It even has better in-person payment processing capabilities than Stripe. However, I had to dock major points for chargeback fees and ease of setup. I also took into account the recent data breach which caused Chase more points in our evaluation.

We found Amazon Pay to be one of the easiest and most popular ecommerce credit card processing options. It’s an excellent add-on if you want voice commerce options for your customers, with its order with Alexa function making it stand out from competitors. Like PayPal, Amazon Pay accepts international payments, and its streamlined checkout can reduce cart abandonment while improving the customer checkout experience.

Amazon Pay scored 4.11 out of 5 for this update. Unlike most small business payment systems, it does not have a POS or mobile payment option and takes 20 to 30 days to approve merchant applications. If you need something for online sales now, consider Stripe, Square, and Authorize.net.

Methodology: How I Evaluated the Best Payment Gateways

To complete this guide, I examined an extensive list of merchant services, payment processors, and payment gateways that we’ve researched over the years and narrowed them down to those that provide small businesses with reliable and popular gateways at reasonable prices. Then, I compared and tested each provider based on the quality of features, reputation, and ease of use.

I chose Authorize.net as the best payment gateway. As the only pure payment gateway in our list, Authorize.net is also often mentioned in conjunction with the best credit card readers, virtual terminals, and other software, as it is compatible with most merchant account services and payment processors. It continues to take the top spot for this guide.

Click through the tabs below for our full evaluation criteria:

25% of Overall Score

20% of Overall Score

The best payment gateways have a quick application process, easy integration/setup with a merchant services provider, and don’t lock you into a contract.

25% of Overall Score

20% of Overall Score

10% of Overall Score

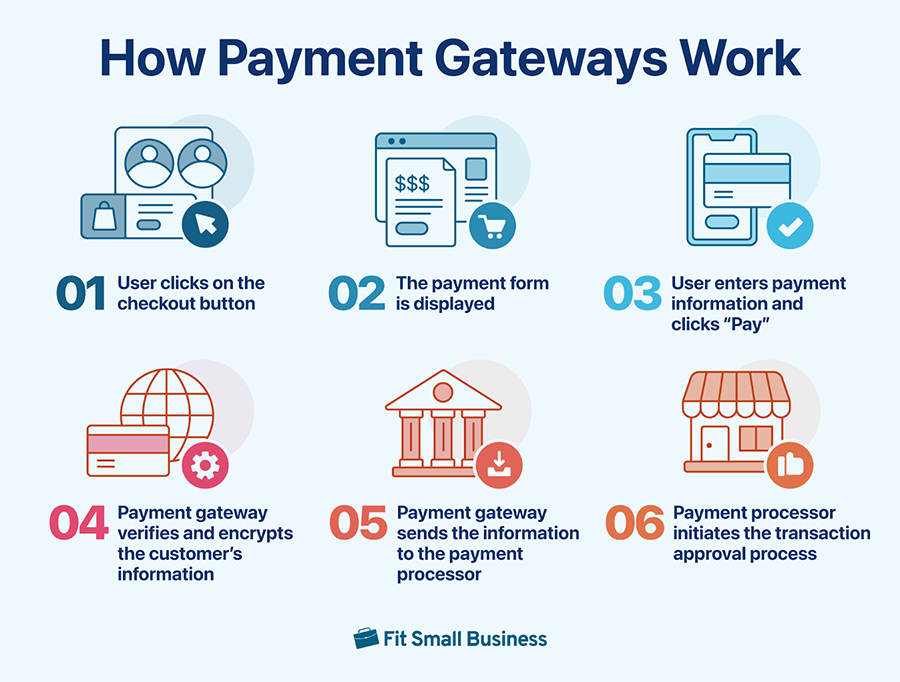

How Do Payment Gateways Work?

The payment gateway is a customer-facing, transaction processing platform that collects payment information and transaction data from customers. It captures the customer’s payment information and sends it through a system of authentication, verification, and approval (rejection) of a payment request.

Most payment gateways are used for online transactions (on checkout pages of your website or payment form). Mobile POS payments also use the payment gateway technology.

Payment gateways generally work as follows:

Learn more about payment gateways and how they differ from payment processors.

How to Choose the Best Payment Gateway in 3 Steps

To find the most suitable payment gateway provider for your business, follow these steps:

Step 1: Identify Merchant Service Providers That Work Best With Your Business Model

Businesses will need a merchant account to start accepting payments from a payment gateway. And since no business is created equal, not all merchant services and payment providers available can benefit all business types. To help you choose the best online payment processing system with a payment gateway, check out our recommendations for online payments, international payments, high-risk, B2Bs, and nonprofits.

Step 2: Compare Available Payment Gateway Tools Against Your Business Needs

Once you have your list of potential merchant service providers, start listing features that your business needs from a payment gateway. Do you need to accept alternative payment modes? Do you require invoicing? Compare your requirements against what your potential providers support and narrow down your list further based on the best match.

When choosing, look out for:

- Payment method options: Credit and debit cards, HSA and FSA cards, gift cards, ACH, e-checks, wire transfers

- Payment types: Via invoicing, recurring billing, stored-card payments, multicurrency, level 2 and 3 data processing

- Payment security features: Tokenization, encryption, fraud detection tools, PCI security

Most payment processors offer a varied combination of payment types and payment methods so it’s up to you to identify which provider will complement the way you want to accept payments.

Step 3: Compare Monthly & Transaction Fees

Now that your remaining potential providers all meet your payment gateway requirements, it’s time to look into the fees. By default, merchant and payment service providers charge monthly and transaction fees. Some even charge an additional monthly cost for certain services—including the use of their payment gateway.

Monthly account fees and transaction fees vary depending on the payment processor’s pricing structure:

- Payment gateway with no monthly fees: Often used by startups and small businesses on a budget. There are no monthly fees and no long-term contracts, but the transaction costs are based on a flat rate. The average card-present flat rate is around 2.6% while the average online flat transaction rate is at 2.9%.

- Subscription-based payment gateway: This type of pricing structure is used mostly by high-volume or fast-growing businesses. There are monthly fees that start at $4.99 to as high as $199 but the transaction costs are based on interchange plus rates that are much cheaper so businesses with large volumes of sales end up with huge savings. Find out more about interchange fees.

It’s important to point out that the lowest listed pricing may not always be the most affordable for your business. Use payment processing calculators to help get you an estimate of monthly costs for each provider, as these take into account your business sales volume. Use our payment gateway fee calculator above or visit our recommendation for the cheapest credit card processors.

Once you have made your choice, you can start signing up for a merchant account. If you need help, download our free merchant account application guide to help you get started.

Frequently Asked Questions (FAQs)

These are some of the questions I frequently encounter about payment gateway providers for small businesses.

You will need a payment gateway if you want to accept payments online. This application lets you send a payment link to your customers where they can securely complete a transaction. A payment gateway is also used for accepting in-person card and digital wallet payments in your POS system.

Note that most merchant account and payment services providers come with a free built-in payment gateway service, so there is no need to sign up for one separately.

The cheapest payment gateway for small businesses is Square. It offers competitive flat-rate transaction fees with no add-on service fees for using its payment gateway and virtual terminal.

Payflow by PayPal is the cheapest ecommerce payment gateway in the market if you need simple payment gateway features. Square is also an affordable option.

For high-volume businesses, Helcim is the cheapest payment gateway option for both in-person and online payments with its interchange plus fees and zero monthly subscription.

Based on our evaluation, Authorize.net is the best payment gateway for small businesses. While not the cheapest, Authorize.net provides competitive fees with the widest range of payment features, compatibility with most merchant service providers (including high-risk merchants), and easy account setup.

Bottom Line

Very few merchants, even hobbyists or solopreneurs, can get by without taking credit card payments. Fortunately, there is a wide range of payment gateways that work well with small businesses. Those that made our list are among the best for price, service, and POS or virtual terminals that help make it easy to take credit card payments.

Authorize.net earned top billing in this guide for its popularity, versatility, and integrations. It offers a full-service payment processing plan or can work as a gateway with the merchant provider of your choice. It charges a monthly fee, but if you need a reliable payment gateway, it’s worth considering. Sign up for an Authorize.net subscription today.