QuickBooks Online is by far the most popular small business accounting software in the US. I find it suitable for most small businesses, especially those with inventory and projects or that collect sales tax in multiple states. The primary features are tracking income and expenses, paying bills, invoicing customers, and running reports to prepare a tax return.

QuickBooks Online pricing ranges from $35 to $235 per month, depending on the number of users and features you need. If you’re interested in QuickBooks after reading my QuickBooks Online review, you can sign up for a 30-day free trial. However, I recommend you purchase without a trial to get a 50% discount for three months and a free one-time virtual session with a ProAdvisor to set up your company file.

Pros

- Nationwide network of QuickBooks ProAdvisors

- Very strong banking, invoicing, and bill management features

- Initiate electronic bill payments from within the accounting program

- Sales tax rates calculated based on customer address

Cons

- Expensive compared with competitors

- Mobile app missing few key features, like time tracking and bill management

- Advanced plan required to compare actual to estimated project costs

- Cannot record sales orders from customers

Pricing |

|

Discount | 50% for three months unless you sign up for a free trial |

Free Trial | 30 days; can’t be combined with the 50% discount |

Payroll | Starts at $50 plus $6 per employee, per month (read our QuickBooks Payroll review) |

Standout Features |

|

Scalability | Excellent—thanks to flexible tiered pricing, which is based on the number of users, user permission levels, advanced features, and more |

Ease of Use | Is generally user-friendly, but may require you to at least know the basics (you may check out our free QuickBooks Online tutorials to get started) |

Customer Support | Phone support (callback except for Advanced users), email, live chat, chatbot, and self-help resources |

Average User Reviews | Generally positive; praised for its ease of use and excellent feature set |

- Manual banking: Live bank feeds are unnecessary for small businesses that record transactions in their accounting software as they occur and create an additional unnecessary step. Unlike similar software such as Xero and FreshBooks, QuickBooks allows you to reconcile your bank accounts without needing to import your bank transactions, making it our overall best bank reconciliation software. See my discussion in the banking section below for details on my view of live bank feeds.

- Invoicing customers: QuickBooks Online is our leading invoicing software because of its ability to calculate sales tax based on the customer’s location and customize invoices to any industry.

- Ecommerce retailers: Its recent focus on built-in ecommerce connections makes it the clear winner for the top ecommerce accounting software.

- Property management companies: Its class and location tracking features allow property management companies to separate net profit by type of property and location, making it our top-recommended real estate accounting software.

- Working with an independent bookkeeper: You can easily set up an external bookkeeper, accountant, or tax professional as an Accountant User without using one of your paid-for user accounts. It’s also easy to find a QuickBooks ProAdvisor through the huge network.

QuickBooks Online Featured Industry Uses on Fit Small Business

As you can see below, QuickBooks Online is incredibly flexible and can be customized for almost any industry. We’ve awarded QuickBooks Online as the best overall choice in the following categories:

- Best small business accounting software

- Best accounting software for Mac

- Best cloud accounting software

- Best invoicing software

- best ecommerce accounting software

- Best farm accounting software

- Best real estate accounting software

- Best startup accounting software

- Best trucking accounting software (when integrated with RAMA Logistics)

- Best retail accounting software

- Best bank reconciliation software

- Best Xero alternatives

- Best FreshBooks alternatives

QuickBooks Online Alternatives & Comparison

| Users Like | Users Dislike |

|---|---|

| Simple to use | Very different from QuickBooks desktop |

| Lots of integrations | Sometimes slow, depending on your internet connection |

| Nice to send invoices and get paid faster | Some functions and features are not intuitive to find |

| Good reports | Tech support is hit-and-miss |

Here are the common sentiments from users and my expert opinion:

- Is easy to adapt to: One user mentioned that they could easily adapt to the software after using a desktop solution, but other users disagreed. I am proficient in QuickBooks Desktop and had no problem learning QuickBooks Online, but I can understand some users’ frustrations with the switch.

While the program is laid out differently, the underlying functionality is very similar. For instance, while the navigation and exact screens might be different, the basic steps of doing things like managing undeposited funds, issuing invoicing, paying bills, and tracking inventory are the same.

- Has many time-saving features: One reviewer likes its many automated features, including bank feeds and recurring invoices. With these and other powerful features, I believe that QuickBooks Online is the most robust accounting software on the market.

- Makes it easy to send invoices and get paid: Another user likes that they can easily create and send invoices and accept payments from their clients. I couldn’t agree more, and I appreciate the new invoicing form where you can see the actual final look of your invoice as you create it. However, some users noted issues with QuickBooks Payments support, the built-in merchant services provider.

- Is difficult to contact customer support: I understand user sentiments as I also sometimes encounter problems when contacting QuickBooks’ customer support. Most of the time, it’s easy to connect to an agent, but they would often pass me around to different agents before I get an answer. Sometimes, I don’t even get a useful answer at all. That said, I’d like to see QuickBooks improve its support.

- Is not that affordable: Plus costs $99, while other similar software like Zoho Books has a more affordable plan at only $50 monthly. In my experience, too many businesses are using Plus when they can get everything they need in Simple Start or Essentials. The most common reason to get Plus is if you deal with inventory or projects. We have a QuickBooks Online plans comparison to help you find the best one for your business.

The overall user review scores are decent but slightly lower than those of competitors Xero and Zoho Books. Here are the average QuickBooks Online review scores from third-party sites:

To determine how QuickBooks Online stacks up against similar software, I compared QuickBooks Online with Wave, Xero, and Zoho Books—my recommended alternatives above—using the Fit Small Business case study.

The chart below sums up the results.

QuickBooks Online vs Competitors

Touch the graph above to interact Click on the graphs above to interact

-

QUICKBOOKS ONLINE PLUS $99 PER MONTH

-

WAVE PRO $16 PER MONTH

-

ZOHO BOOKS PRO $50 PER MONTH

-

XERO ESTABLISHED $80 PER MONTH

Our case study reveals that Zoho Books—and, to a lesser extent, Xero—offers comparable features to QuickBooks Online. However, QuickBooks stands out in its usability score derived from a combination of customer service, ease of use, and—most importantly—bookkeeping support.

While Zoho Books is fantastic small business accounting software across most categories, it is soundly beaten by QuickBooks in the usability category. This is because you’ll be on your own to solve any bookkeeping problems that arise. Unlike QuickBooks Online, Zoho Books doesn’t offer any bookkeeping service, and it’s difficult to find an independent Zoho Books Advisor in the US.

The case study also shows that Wave is inferior to QuickBooks Online in all accounting features but still offers a great value at just $16 per month. I think it is a viable option for micro businesses that only need invoicing and a way to track income and expenses after the fact.

QuickBooks Online Pricing

QuickBooks Online is priced higher than its competitors. The Plus plan scored only 3.8 out of 5 in our Value metric, which compares the software’s cost with its rubric score before considering pricing. I believe the lower-priced Simple Start and Essentials tiers offer a better value for small businesses that don’t need the advanced features of Plus.

QuickBooks Online’s monthly pricing runs from $35 to $235, depending on the number of users and features that your company needs. I highly recommend paying what’s necessary to get the plan with the features you need because the money you’ll save with a lower plan isn’t worth having to account for inventory, projects, locations, or classes in a spreadsheet. That said, if you really don’t need the advanced features or additional users, Simple Start is an outstanding value.

Pricing & Features | Simple Start | Essentials | Plus | Advanced |

|---|---|---|---|---|

Our Value Score (out of 5) | 4.6 | 4.3 | 3.8 | |

Monthly Pricing | $35 | $65 | $99 | $235 |

Number of Users | 1 | 3 | 5 | 25 |

Manage & Pay Bills | ✓ | ✓ | ✓ | ✓ |

Track Employee Time | ✕ | ✓ | ✓ | ✓ |

Record Multicurrency Transactions | ✕ | ✓ | ✓ | ✓ |

Track Inventory & Cost of Goods | ✕ | ✕ | ✓ | ✓ |

Track Project Profitability | ✕ | ✕ | ✓ | ✓ |

Create & Send Invoices by Batch | ✕ | ✕ | ✕ | ✓ |

Manage & Track Fixed Assets | ✕ | ✕ | ✕ | ✓ |

Compare Estimated vs Actual Project Costs | ✕ | ✕ | ✕ | ✓ |

Set Up Custom User Permissions | ✕ | ✕ | ✕ | ✓ |

Access to Dedicated Success Manager | ✕ | ✕ | ✕ | ✓ |

Free Training for Staff ($3,000 Value) | ✕ | ✕ | ✕ | ✓ |

Don’t choose a QuickBooks Online plan based solely on the number of users you need. Let’s say you need to track inventory but only need three users, so you chose Essentials because it is limited to three users and is more affordable than Plus.

However, you’ll be disappointed when you find out that Essentials can’t track inventory and project profitability. If you need more help deciding which plan to choose, read our QuickBooks Online plans comparison.

QuickBooks Notable New Features

The features listed below have been recently added within the last three months of this publication.

- QuickBooks E-commerce: If you sell products through online channels, then you may appreciate the new Commerce tab in the left navigation menu. This new feature allows you to easily connect to and access major ecommerce platforms, including Amazon, Shopify, and eBay. It also makes it easier for you to sync important data, such as sales and inventory, directly into QuickBooks Online.

- Bookmarking pages: You can now bookmark your favorite pages so that you can easily access them in the future. In addition to main menu items, you can bookmark more specific pages such as Profit and Loss report.

QuickBooks Online aced my evaluation of general features. I can modify my chart of accounts and use account numbers, but they’re optional. In addition, I can invite my accountant to access and make changes to my books, and the accountant user doesn’t count towards my maximum allowed users.

As an experienced accountant, I like that QuickBooks Online allows me to enter adjusting journal entries (AJEs) when needed rather than using the standard input screens. Finally, I can set a closing date so I don’t inadvertently change the prior year’s information.

QuickBooks Online Plus also allows me to track income and expenses by class and location, as well as create and add custom tags to transactions. I can also set a closing date so that nobody accidentally changes the prior year’s information—which can create big problems if you’ve already filed a tax return using that prior year’s information.

I really like the banking features in QuickBooks Online because they are well suited to both businesses that issue a lot of paper checks and businesses that like to pay all their bills electronically. Unlike most less expensive software, I can print checks directly from the program—including the option to save checks and batch print them all simultaneously.

When I prefer making e-payments, I can actually initiate the payment from within QuickBooks without needing an integration. I’ll discuss the QuickBooks Bill Pay feature more in the Accounts Payable section.

Some other banking features included in QuickBooks include connecting bank feeds for both bank and credit card accounts, uploading transactions via CSV or bank statements, and automatically matching imported transactions to pre-existing transactions. If QuickBooks makes a mistake in matching, it’s very easy to undo the match and manually indicate the correct match.

QuickBooks Online has a true bank reconciliation feature that allows you to reconcile your bank accounts even when timing differences exist, like outstanding checks and deposits in transit. Some less expensive software, like Wave, claim to do bank reconciliation but don’t allow for any reconciling items. They require your bank account and books to be exactly the same, which is problematic if you record transactions in your books as they occur.

There are two ways to do bank recs in QuickBooks:

- Do a manual reconciliation, which doesn’t require any imported transactions. I can enter my bank statement balance and then check off book transactions shown as cleared on my bank statement.

- Import your bank transactions via a bank feed or by uploading a bank statement. I must still enter or confirm the bank statement balance, but then QuickBooks will automatically mark which book transactions have cleared the bank. Of course, I might have to troubleshoot if my reconciliation doesn’t immediately balance.

Regardless of the method I use, I can print a reconciliation report showing all of my outstanding book transactions that have not yet cleared the bank.

A final feature in QuickBooks that I find incredibly valuable for bank recs is the undeposited funds account. When used properly, the undeposited funds account groups customer payments into lump sum deposits so that the deposit in your QuickBooks check register matches the deposit on your bank statement. Learn more about how to use QuickBooks’ Undeposited Funds account.

QuickBooks covers all the basics I’m looking for to manage my accounts receivable. Invoices are easy to create and I can send them to customers by email, but I can also print them if I have customers who prefer paper.

Recording partial payments—as well as creating a credit memo and applying it to an outstanding invoice—is straightforward. The only shortfall I find in the QuickBooks A/R system is the lack of a customer portal where customers can pay their invoices and manage their accounts.

There are two advanced features that really stand out to me.

- I can assign time and expenses to customers as they are incurred, and then QuickBooks will prompt me to add them to the customer’s invoice the next time I create one.

- I can issue a receipt to acknowledge a customer payment that didn’t receive an invoice. Most of QuickBooks competitors require you to issue an invoice before recording the payment.

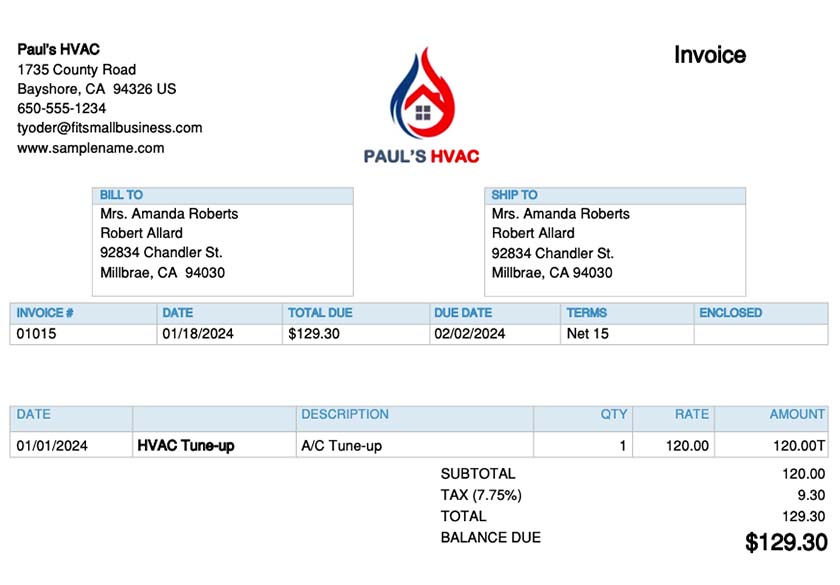

QuickBooks provides everything I need to customize my invoice. Beyond just the cosmetic aspects of the invoice, I can choose exactly which fields to show on the invoice and even create custom fields. Then, I choose a template, upload my logo, and customize the colors on my invoice. I can add a custom message to print at the bottom of each invoice as well as messages to include in the email delivering the invoice to my customers.

Sample invoice in QuickBooks Online

QuickBooks Online excels at managing unpaid bills and expenses. I can see everything I need from within the software without running reports. I can easily view vendors, unpaid bills, unpaid bills summarized by vendor, and a list of transactions by vendor. It’s also easy to short-pay a bill, create vendor credits, and then apply them to an outstanding bill from that vendor.

I wish QuickBooks Online provided a portal for my vendors to submit invoices and manage their own information. Other than that, QuickBooks has many great advanced features like recurring expenses, issuing purchase orders and converting them to bills, and tracking payments to 1099 contractors.

Additionally, QuickBooks has further improved its A/P management feature by incorporating the new QuickBooks Bill Pay. It allows you to pay vendor bills directly from within QuickBooks with your bank or credit card. It has features similar to other online bill pay platforms, like Melio and BILL, but they’re exclusively for QuickBooks Online and Desktop users. You can learn more in our QuickBooks Bill Pay review.

QuickBooks Online has a great receipt capture feature. I can submit receipts either by snapping a picture in my mobile app or emailing the receipt to a special email address I create with QuickBooks. Once received, QuickBooks will read the receipt and automatically create a transaction for me to review, edit, and approve. I can attach receipts to either an expense transaction or when creating a new bill.

QuickBooks Online offers good basic inventory features but is missing a few of the advanced features that competitors like Zoho Books and Xero offer. QuickBooks provides a perpetual inventory system by constantly updating the cost and quantity of inventory on hand every time I enter an inventory transaction.

When I sell a unit of inventory, QuickBooks uses the First-In-First-Out (FIFO) cost assumption to calculate the cost of that unit, remove the cost from the inventory asset, and add the cost to my cost of goods sold account.

I can view the total units and total cost of inventory on hand directly from within the software without the need to print a report. After my physical inventory count, I can record any shrinkage by entering an inventory quantity adjustment. QuickBooks will adjust the quantity on hand and transfer the LIFO cost of the disappearing units to an expense account.

The only real shortfall I see with the inventory features is the inability to view inventory available after considering both incoming inventory on purchase orders and outgoing inventory on sales orders. QuickBooks just shows you the amount on hand at the given time.

Note: There’s no separate video since QuickBooks Online’s inventory management is evaluated across the videos of the other categories.

I docked a few points for project accounting because I can’t compare project estimates and actual costs in the Plus plan—but it is available in the highest tier, Advanced. However, I can create projects and assign wages, income, and expenses to a project. I can also create project estimates and include inventories, sales taxes, and labor in those estimates.

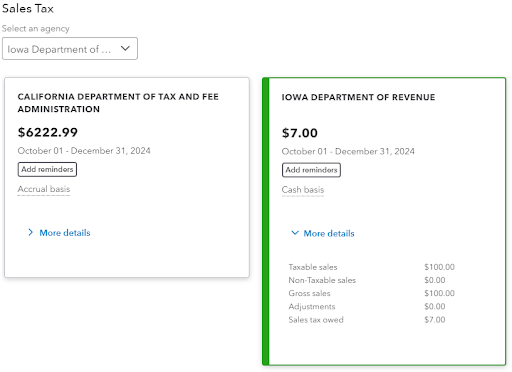

I really like QuickBooks’s unique sales tax features. After telling QuickBooks what sales tax jurisdictions I must collect and remit sales tax to, it will automatically determine when a sale is taxable based on the customer or delivery address.

For example, after telling QuickBooks that I have a nexus with Iowa, it automatically applies the 7% sales tax to any sale I have for a customer with an Iowa delivery address.

QuickBooks Online Sales Tax Center

The only thing missing from QuickBooks’ sales tax feature is the ability to actually electronically file the sales tax return directly from the program. While this isn’t a common feature, it would be a big time saver.

QuickBooks Online is arguably one of the best accounting software programs for reporting. It can generate over 100 reports, depending on your subscription. In our case study, I generated 16 different types of reports successfully, which isn’t possible in less expensive accounting software.

Whether you need standard reports—such as balance sheets, P&L statements, and cash flow statements—or sales reports by customer, location, or class, you can do it all in QuickBooks Online.

QuickBooks’ mobile app is functional, but I hope to see more features in the future, such as the ability to enter bills and record time worked. Available for Android and iOS devices, it contains many features in the browser-based desktop interface, making it one of our best mobile accounting apps. It also allows me to create and send invoices on the go, receive payments from customers, assign expenses to customers or projects, and view financial reports.

iOS users awarded the QuickBooks Online mobile app 4.7 out of 5 stars, while Android users gave it only 3.9 out of 5 stars.

As the leading small business accounting software in the US, software vendors catering to small businesses want their platforms to integrate with QuickBooks—and it shows. QuickBooks has hundreds of integrations of all sorts.

There are many industry-specific integrations to add features for specific industries like trucking and construction. Perhaps most importantly, QuickBooks has deep integrations for key functions that nearly every business will need, which are payroll, online payment acceptance, employee time tracking, and sales tax management.

I evaluated the usability of QuickBooks based on four areas: availability of bookkeeping assistance, customer service, ease of setup, and ease of use.

QuickBooks is far and away the easiest bookkeeping software in the US for finding bookkeeping assistance. Most bookkeepers in the US are familiar with QuickBooks, and many of them will be certified QuickBooks ProAdvisors. No matter where you live in the US, you’ll find a QuickBooks ProAdvisor near you.

In addition to the network of independent ProAdvisors, QuickBooks offers QuickBooks Live, which pairs you with one of its own ProAdvisors who will keep your books for you. You can meet with your ProAdvisor as often as necessary to ask questions. Learn more in our QuickBooks Live review.

QuickBooks lost points for its customer service because you can’t pick up the phone and call for help—unless you subscribe to the most expensive plan, Advanced. However, you can submit a form, and a QuickBooks representative will call you.

In addition to phone support, you can take advantage of the chatbot, chat with a live person, email customer service, or research your question using the library of self-help information and user community.

QuickBooks Online is relatively easy to use, but there will still be a learning curve for some users, especially since the platform has plenty of features to master. Fortunately, the interface is easy to navigate and has an organized dashboard where you can find the features you need easily. You can learn QuickBooks even without an accounting background, but it becomes much easier to use if you have some knowledge of basic accounting concepts.

QuickBooks Online is relatively easy to use, but there will still be a learning curve for some users, especially since the platform has plenty of features to master. Fortunately, the interface is easy to navigate and has an organized dashboard where you can find the features you need easily. You can learn QuickBooks even without an accounting background, but it becomes much easier to use if you have some knowledge of basic accounting concepts.

How I Evaluated QuickBooks Online

I evaluated QuickBooks Online using the Fit Small Business scoring rubric, which has 13 major categories. Our case study provides a more detailed description of our methodology.

5% of Overall Score

We first determined a pricing score by assessing the software’s price for one, three, and five users. We also considered whether there was a free trial, monthly pricing, and a discount for new customers. After determining the pricing score, we assigned a value score based on the pricing score and the solution’s total score across all categories except Value.

5% of Overall Score

We evaluated general features like the flexibility of the chart of accounts, the ability to add and restrict the rights of users, and how your information can be shared with an external bookkeeper. We also searched for ways to provide more granular information like class and location tracking and custom tags.

10% of Overall Score

This assessed the ability to print checks, establish live bank feeds, and import bank transactions from a file. We also looked closely at the bank reconciliation feature. We wanted to see the ability to reconcile bank accounts with or without imported bank transactions and a list of book transactions that have not yet cleared the bank.

10% of Overall Score

In addition to the basics of issuing invoices and collecting customer payments, we evaluated the software’s ability to create customized invoices. We also assessed whether it could handle non-routine transactions like short payments, credit memos, and the refund of credit balances in customer accounts.

10% of Overall Score

The A/P score consisted of the basics like tracking unpaid bills, recording vendor credits, and short-paying invoices, but it also included some more advanced features—such as paying bills electronically, creating recurring expenses, and working with purchase orders. Receipt capture and the ability to automatically generate bills from captured receipts were also part of our A/P evaluation.

10% of Overall Score

10% of Overall Score

At the very least, we looked for software that could create multiple projects and separately assign income and expenses to those projects. We also searched for the ability to create estimates and assign those estimates to projects. Ideally, the program would then compare the actual expenses to the costs on the original estimate.

5% of Overall Score

Software should be able to track sales tax for multiple jurisdictions with varying tax rates. It’s helpful to have a function to easily record the remittance of the sales tax by jurisdiction. The very best tool will also help determine which jurisdictions sales are taxable to based on the address of the customer or delivery.

10% of Overall Score

I evaluated basic financial reports (such as a balance sheet, income statement, and general ledger) and common management reports (like A/R and A/P aging).

5% of Overall Score

Ideally, a mobile app should have all the same features as the computer platform, including the ability to capture receipts, send invoices, receive payments, enter and pay bills, and view reports.

5% of Overall Score

While it’s nice to have as many integrations as possible, we focused our evaluation on the four integrations we believe are most critical for small businesses: payroll, online payment collection, sales tax filing, and time tracking.

10% of Overall Score

The largest component of usability is the ability to find bookkeeping assistance when users have questions. This could be in the form of a bookkeeping service directly from the software provider or from independent bookkeepers familiar with the program. Other components of usability include customer service and ease of use.

5% of Overall Score

Our user review score is the average user review score reported by Capterra and G2. Other review sites might be used if a score from Capterra or G2 is unavailable.

Frequently Asked Questions (FAQs)

Yes, but it is quite different from the QuickBooks desktop program, which frustrates many users. When converting from desktop to online, users should approach it as learning new software. Learn about the QuickBooks Online desktop app, which provides a similar dashboard as the desktop version of QuickBooks.

Speaking for myself—a CPA with 29 years of experience—yes, I like QuickBooks Online for small business users. It’s designed for business owners and non-professional bookkeepers. Accountants at larger companies might prefer software geared more toward professional accountants.

Some people might be leaving QuickBooks because its price is higher than that of other small business accounting software like Xero and Zoho Books. Others might be leaving because they don’t like that QuickBooks is pushing its customers away from its desktop software and toward QuickBooks Online.

As of October 2024, QuickBooks Desktop Mac, Pro, and Premier are no longer available to new customers—the only remaining desktop program is the expensive Enterprise edition. For this reason, the vast majority of small businesses will be better off buying QuickBooks Online. Read our QuickBooks Online vs Desktop comparison to learn more.

Yes, and you can learn via our tutorial on how to convert QuickBooks Desktop to Online.

Bottom Line

Every business is unique, and there may be instances where a program other than QuickBooks Online will be a better fit. For example, a business looking to just track income and expenses after the fact can save money by going with a cheaper program. However, QuickBooks Online is the better choice for most companies that actively use their software to invoice customers, pay bills, track inventory, and more.

User review references: