Because cloud POS (point-of-sale) systems have the flexibility to process customer transactions and manage operations from anywhere with an internet connection, they are ideal solutions for small businesses. To find the best cloud POS systems, we looked for easy setup, low price points, rich management features and reporting capabilities, ease of use, and overall value.

Based on our expert evaluation, the best cloud-based POS systems are:

- Square: Best overall and best free cloud POS

- Lightspeed: Best for managing inventory and store operations

- Shopify: Best for in-store and online (multichannel) retail

- Toast: Best for restaurants

- Clover: Best for choosing your own payment processor

Best Cloud POS Systems Compared

Our Scoring (out of 5) | Minimum Monthly Fee | Hardware Cost | Processing Rates | Offline Payment Processing | |

|---|---|---|---|---|---|

4.55 | $0+ | $0–$799+ | From 2.6% + 10 cents | Yes | |

4.36 | $89+ (Monthly pricing) $69+ (Annual pricing) | Custom-quoted | From 2.6% + 10 cents | No | |

4.33 | $39+ (Ecommerce plan) $15+ (POS plan) | $49–$299 | From 2.4% | No | |

3.92 | $0+ | $0–$1,234 | From 2.49% + 15 cents | Yes | |

3.81 | $799 + $14.95 per month | $799+ | Varies by processor; Fiserv starts at 2.3% + 10 cents | Yes | |

Looking for something else? Check out our top picks for the best retail POS systems.

Square: Best Overall & Best Free Cloud POS

Pros

- Free POS plan and free trial available

- Can process card payments offline

- Includes free ecommerce site and online ordering

- Includes employee time tracking and time card reporting

Cons

- Only basic inventory and reporting features

- Loyalty, payroll, and marketing cost extra

- Limited customer support hours. For restaurant POS clients, 24/7 support is only available for paid plans

What We Like About Square POS

Square is an all-in-one cloud POS and credit card payment processor that is easy to set up and use, with flexible payment options and no contracts. It has an excellent free plan, and the paid plans are specific to retail, restaurant, or service industries and include industry-specific and inventory tools. You’re tied to its payment system, but since it’s integrated, you can start processing transactions as soon as you sign up. Its versatility, low price point, and ease of use make Square the best overall POS system for small businesses.

Square scored 4.55 out of 5 in our evaluation, earning perfect marks for pricing, cloud and mobility, and expert score. It lost points because it does not have custom report building on the mobile app, and its loyalty program and other features cost extra. Consider Lightspeed to get these tools at a lower price point.

- POS software plans:

- Free ($0): Unlimited items, low stock alerts, saved carts, discounts, online store, sell on Facebook & Google, invoices, exchanges, gift cards, customer profiles, sales reports

- Plus: ($60 per month): Free + vendor management, advanced inventory, advanced reports, multiple wage rates

- Premium (Custom pricing): Plus + custom pricing on add-ons

- Hardware costs:

- Square Stand: $149 (iPad not included)

- Square Terminal: $299

- Square Register: $799

- Card readers: Start at $59 (first magstripe card reader free)

- Processing fees:

- In-person: 2.6% + 10 cents per transaction (2.5% + 10 cents with Plus plan)

- Online invoices: 2.9%–3.3% + 30 cents per transaction

- Ecommerce sales: 2.9% + 30 cents per transaction

- Recurring billing and card-on-file transactions: 3.5% + 15 cents per transaction

- Keyed-in payments: 3.5% + 15 cents per transaction

- AfterPay (Buy Now Pay Later): 6% + 30 cents per transaction

- Volume discounts: Available for businesses processing over $250,000 in credit card sales

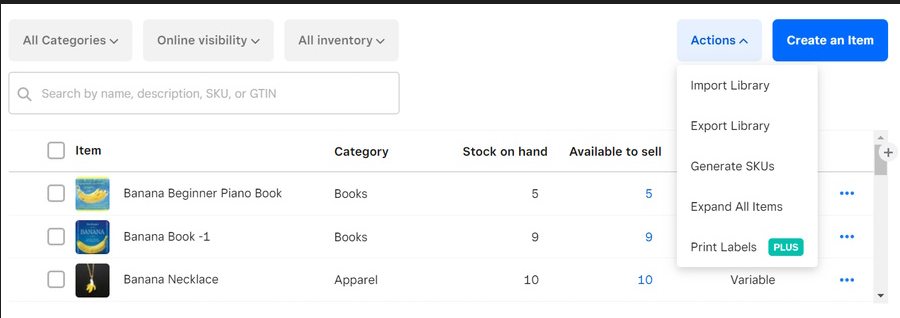

Create new items, import an existing one, and create variant products in the Square dashboard.

- Free plan: Square offers by far the best free plan of those on our list. If your inventory needs are few, then this plan may have everything you need, including an ecommerce solution and time tracking.

- Excellent mobile option: Square is the best POS system for those who want a totally mobile register. The app is highly rated on Android and iOS, and you get all the tools that you would with a register. It’s the best choice for selling at craft fairs or flea markets.

- Industry-specific plans: Unlike Toast and Shopify, Square POS offers paid plans that cater to specific industries. The Restaurant version, for example, includes table management, auto-gratuities, and auto-86ing of items. Meanwhile, Square Appointments lets clients book online, syncs to calendars, has no-show protection tools, and more. While Lightspeed has great versions for restaurant and retail, it can’t beat Square Appointments for spas, salons, and other similar businesses.

- Online sales and ecommerce: Square POS has lots of support for businesses that want to sell online. The built-in free Square Online store syncs online and in-person sales data to a centralized location. Square POS also integrates with other ecommerce platforms, including WooCommerce and Wix.

- Limited marketing: For loyalty programs, you need to pay for Square Loyalty, which is an additional $45 per month. If you want to run email and social media campaigns via your Square POS, you’ll also need to add Square Marketing at an additional $15 per month.

- Basic online store: Square’s online store is not especially advanced. If you need a strong ecommerce platform that can handle a high volume of online sales, consider Shopify.

Lightspeed: Best for Inventory & Back Office Management

Pros

- Built-in granular inventory management

- 40+ preset reports with customization options

- Choice of payment processor with some plans

Cons

- Does not process card payments offline

- Accounting, ecommerce, omnichannel loyalty, and advanced reporting require plan upgrade

What We Like About Lightspeed

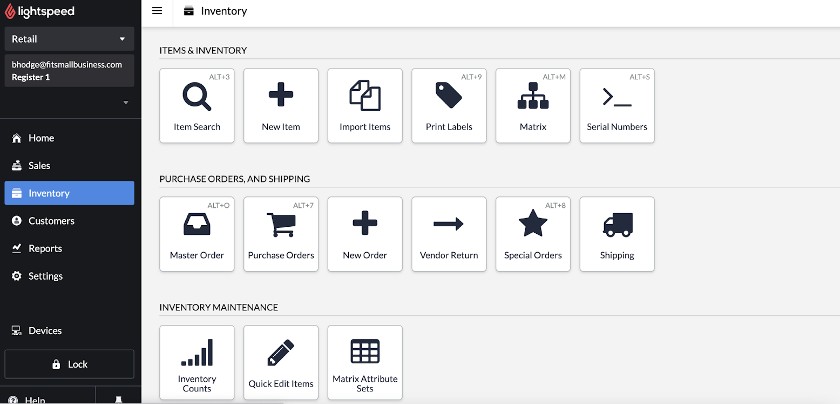

Lightspeed is a cloud-based POS system that operates on iPads or as a browser-based POS. It has special versions for retail, restaurants, and golf courses. Even its baseline plan can handle busy retail shops that require detailed inventory tracking and customer and employee management even while offline. This, along with remote access to the back office and POS (due to its cloud-based nature), makes it the best option for store management. It is our top POS for inventory management.

Lightspeed earned 4.36 out of 5 on our rubric. Its baseline store management features are comparatively superior, with a perfect score for ease of use, and high marks for everything else. However, the lack of ecommerce in its basic plan and lack of offline card payment processing capability cost it points.

- 14-day free trial

- Retail software subscription plans*:

- Lean ($89 per register monthly): POS system, dedicated account manager, 24/7 support

- Standard ($149 per register monthly): Lean + accounting and ecommerce

- Advanced ($269 per register monthly): Standard + omnichannel loyalty and advanced reporting

- Enterprise (Custom pricing): Advanced + unlimited personalized onboarding, consultation, premium support, reduced Lightspeed payment rated, and more

- Additional registers cost $59 per month

- Restaurant software: Runs $69–$399+ per month and includes take-out and delivery, order at the table, multiple revenue center support, and more

- Golf software (Custom pricing): Includes online booking, Tee-sheets, SMS marketing, and more

- Ecommerce: Runs $0-$82.50 and includes online store, social selling, automated taxes, discounts, wholesale prices, subscriptions, abandoned cart saver, and more

- Hardware cost: Runs on iPad and iMac. Custom-quoted devices and hardware kits are available

- Processing fees:

- Chip, tap, and swipe payments: 2.6% + 10 cents per transaction

- Keyed-in payments: 2.6% + 30 cents per transaction

- Volume discount: Available for businesses processing over $250,000

*Pricing is based on a monthly subscription and requires Lightspeed Payments. Lower rates are available with annual billing.

Lightspeed has many inventory control features, so you can take full control of your stock. (Source: Lightspeed)

- Inventory management: Lightspeed POS’s inventory management is the best on our list. You can track stock levels across multiple locations, set low stock alerts, and track variants. Advanced inventory features include integrated product catalogs and purchase orders, multiple item variants, aging product reports, work orders, layaway, and detailed product tagging and organization.

- Reporting and analytics: Lightspeed offers over 40 pre-made reports on sales, profits, stock, margins, sell-through, employee performance, and more. It offers some unique reports like “dusty inventory” to show what items are not selling and “commonly bought together” so you can see what items tend to pair. You get reports on customer purchasing history, too. Exporting your data into the reports module provides a more detailed picture.

- Integrations: In addition to Lightspeed’s robust functions, this cloud POS works with more than 80 third-party integrations. Integrations are available for employee scheduling, appointment scheduling, accounting, chatbots, payroll, equipment rental tracking, and third-party delivery platforms.

- Higher plan required for ecommerce: Lightspeed’s native ecommerce platform is only available with midrange and higher plans, which can mean you’ll have to spend more to sell online.

- No offline mode: Lightspeed can’t process credit cards offline. However, if you use the LiteServer, a small local server, you can take orders, create receipts, run reports, and perform some employee management tasks. For full offline payment processing, go with Square or Toast instead.

- Choice of merchant services costs extra: You pay extra for plans if you don’t use Lightspeed payments. This is similar to Shopify, although it charges an increased monthly fee instead of adding to the payment processing fee.

Shopify: Best Cloud POS for Multichannel Retail

Pros

- Includes robust ecommerce platform

- Competitive payment processing rates

- Includes marketing tools and automations in base plan

- Up to 88% discounts on shipping fees

Cons

- Not suitable for restaurants or service businesses

- Charges fee for third-party payment processing

- Limited reporting in baseline plan

- No offline payment processing

What We Like About Shopify

Shopify is an ecommerce platform first and a cloud POS for in-store purposes second. It is especially good at integrating online channels with in-person sales channels and tops both our lists of best ecommerce platforms and leading multichannel POS systems. The cloud POS comes with standard features like inventory management, CRM, and payment processing. Additionally, it supports order tracking for shipped purchases. Shopify is ideal for online merchants wanting to break into brick-and-mortar retail or pop-up shops that need support for temporary in-person activations.

Shopify earned an overall score of 4.33 out of 5. It received perfect marks for ease of use and leads the competition when it comes to omnichannel sales features. However, Shopify POS is only available to Shopify ecommerce subscribers, and key features—such as multiple staff roles and permissions, unlimited register, inventory management, and detailed reporting—are available only with the POS Pro plan. These limitations prevented Shopify from earning a perfect score.

- Shopify ecommerce plans (required to use Shopify POS):

- Basic ($39 per month): Online store, 24/7 support, social selling, discount codes, abandoned cart recovery, gift cards, marketing automation, international market management (including language and payment)

- Shopify ($105 per month): Basic + special shipping pricing and insurance

- Advanced ($399 per month): Shopify + third-party calculated shipping rates, and duties and import tax estimates

- Shopify POS plans:

- Lite POS ($15): simple customer profiles, product returns at original purchase location

- POS Pro ($89 per month): Lite + unlimited staff access, detailed customer profiles, inventory management, in-store analytics, loyalty insights, and more

- Hardware costs:

- Countertop kit for USB-C tablets: $459

- Shopify POS Go handheld: $299 (+ $39 for case)

- Shopify card readers: From $49

- Processing fees:

- In-person: 2.4% – 2.7%, depending on plan

- Online: 2.4% + 30 cents – 2.9% + 30 cents, depending on plan

- Use a third-party payment processor: add 0.5% to 2%, depending on plan

Shopify lets you customize the tiles on your checkout screen so you can access items and functions more quickly, and improve checkout speed. (Source: Shopify)

- Online sales and ecommerce: Shopify offers a comprehensive ecommerce platform for merchants, allowing you to build and customize your site with templates or custom coding. Everything is synced in real-time to ensure that you don’t sell something online that you don’t have on hand. It offers shipping discounts up to 88%, depending on the plan. It’s the best for online sales on our list.

- Social sales: Shopify also leads the pack for sales on social channels. While others on our list let you sell via Facebook or Google, Shopify offers a wider range of channels, from eBay to TikTok, even via Walmart online.

- Marketing: Square offers marketing tools like online blogging, SEO optimization, email marketing, and Facebook ads. You can also use automated emails to send order updates, digital receipts, and post-purchase promotions. Additional CRM features are available via integrations.

- Ecommerce-focused: Shopify is all about ecommerce, so stores that don’t do a lot of online business will probably find the POS functionally thin. As a result, you’ll need to pay for a number of third-party integrations for features such as a comprehensive CRM and detailed reporting tools to get the most out of the system.

- No offline mode: Shopify also does not have the ability to accept card payments while offline. Look at Square or Toast instead.

Toast: Best Cloud POS for Restaurants

Pros

- Offline functionality includes payment processing

- Subscription includes pay-as-you-go plan for tablet hardware

- Intuitive, easy-to-use interface

- Customizable reports

Cons

- Must use Toast payment processor

- Requires purchase of proprietary hardware

- Marketing, loyalty, and vendor management are add-ons

- 2-year contract

What We Like About Toast

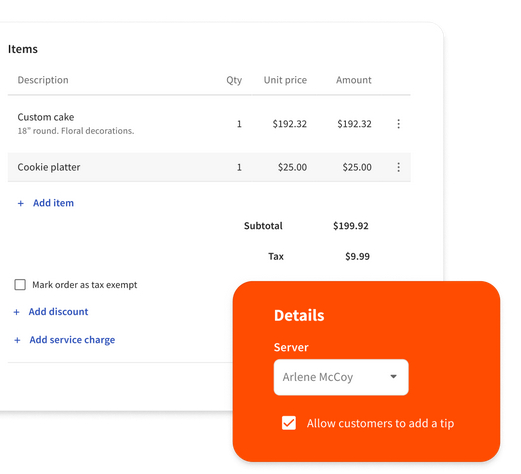

Toast POS delivers a suite of restaurant features that fully supports both back-end and front-of-house operations from a centralized, online platform. As our top recommendation in our best restaurant POS guide, it offers menu management, table mapping, and built-in integrations, such as kitchen display, self-order kiosks, ordering, and delivery tools. If you pay an additional fee to get the xtraCHEF by Toast add-on, you’ll also get invoice automation, recipe costing, supplier management, and more. Toast also designs its own industry-grade, proprietary hardware.

All things considered, Toast’s capability as a restaurant POS is unquestionable, with its robust cloud and mobility feature and multiple payment options. Here, it earned 3.92 out of 5. It lost points due to required additional costs for key functions like online ordering and marketing, which you’ll find in baseline plans of other solutions like Square. Long-term contracts also come with its pay-as-you-go plan.

- Monthly software subscriptions plans:

- Quick Start ($0): Choice of terminal or handheld kit hardware, order and table management, reporting, menu, invoicing, digital menus, 24/7 support

- Core ($69+): Choose your own hardware, Quick Start + custom configuration and options to add more features

- Growth ($165+): Custom configuration, online ordering, Toast delivery, Toast TakeOut App

- Build Your Own (Custom pricing): Choose the features you need, including automated inventory, employee benefits, scheduling, marketing and loyalty, payroll and tips management

- Software add-ons: Call for pricing

- Toast Mobile Order & Pay

- Partner Connect (for integrations)

- Scheduling and team communication

- Marketing, gift cards, and loyalty

- Payroll & team management

- Third-party delivery integrations

- xtraCHEF (ingredient pricing analysis)

- Hardware costs: $0–$1,234, depending on the type. Often free in exchange for accepting a higher payment processing rate

- Processing fees:

- Pay-as-you-go plan: 2.99% + 15 cents for both card present and card not present transactions

- Standard paid plan: 2.49% + 15 cents for card present and 3.5% + 15 cents for card not present transactions

Toast Invoicing lets you create and send itemized digital invoices, accept tips, and set payment due dates. (Source: Toast)

- Ingredient-level menu management: Toast’s dynamic ingredient-level inventory tracking is the backbone of its menu management module. You can create menu categories, subcategories, and multiple modifier screens, as well as adjust modifier pricing and view item countdowns to avoid stockouts. It identifies which dishes should be removed from your menu in an easy-to-scan grid.

- Online sales and ecommerce: While Shopify excels in social selling, and others have online stores, Toast’s strength is in its delivery services. Your Toast online system sends orders directly to your kitchen. The software also integrates with all the popular third-party delivery platforms.

- Reporting and analytics: Toast POS is the only system on this list with restaurant-specific reports that focus on ingredients, tips, and table turn time. It shows you how many patrons each employee served in any given shift, compares locations, and highlights which days and times are busiest. The software will also send an email at the end of each night with a comprehensive snapshot of the day’s sales and costs.

- Best Bar POS

- Best Bakery POS

- Best Cafe POS

- Best Delivery Restaurant POS

- Best Food Truck POS

- Best Pizzeria POS

- Android only: Unlike other cloud POS systems, Toast only works on its own custom-built Android devices. For more hardware flexibility, consider Clover.

- Contracts: Although Toast offers pay-as-you-go plans for its industry-grade hardware, you will be locked into a long-term contract with no flexibility in terms of a payment processor. If you want a restaurant POS that lets you choose payment processing options, consider Lightspeed for Restaurants.

Clover: Best for Choice of Payment Processor

Pros

- Multiple payment processors possible

- Access to proprietary hardware

- Offline credit card processing

- RACS-compliant age verification feature via integration

Cons

- Cannot reprogram equipment if you change payment processors

- Little oversight of third-party resellers means contracts vary in quality

- Lacks built-in vendor management tools

What We Like About Clover

Clover makes our list for its versatility in payment processing. Like Lightspeed and Shopify, you have many options for payment processing, but unlike them, you are not charged extra for using a different merchant account. In fact, some offer Clover free or at reduced prices.

The drawback is that they may have restrictions and contracts; be sure to research them well. Having said that, the software itself has a lot of great tools and even makes our list of the best vape shop POS systems. It’s an especially good choice for merchants in high-risk industries or who want interchange-plus payment processing.

Clover earned 3.81 out of 5 on our evaluation. It had a high score in almost all criteria for its robust features. However, it was our lowest ranking for price because this depends on the processor.

Clover’s plans are more complex than the other systems on our list, as the plan you sign up for not only determines your features but also determines the hardware and software you will have access to. In addition, some Clover resellers offer the system free if you use their payment processing—this often requires a multi-year contract.

Below is the plan for retail from the Clover website:

Starter | Standard | Advanced | |

|---|---|---|---|

Fee (hardware + software) | $799 + $14.95/mo | $1,799 + $49.95/mo | $2,398 + $64.90/mo |

Software plan | Essentials | Register | Register |

Card-present rate | 2.6% + 10 cents | 2.3% + 10 cents | 2.3% + 10 cents |

Card-not-present rate | 3.5% + 10 cents | 3.5% + 10 cents | 3.5% + 10 cents |

Available hardware |

|

|

|

- Hardware:

- $49–$1,799

- Financing options available

- Cloud-based

- Mobile POS app (iOS and Android)

- Option to use third-party systems

- Contract length: Month-to-month

- Integrated payment processors:

- Fiserv; programmable to any payment processor by third-party resellers (but once programmed, it’s not re-programmable)

- Setup:

- DIY (free)

- Professional installation (with fee)

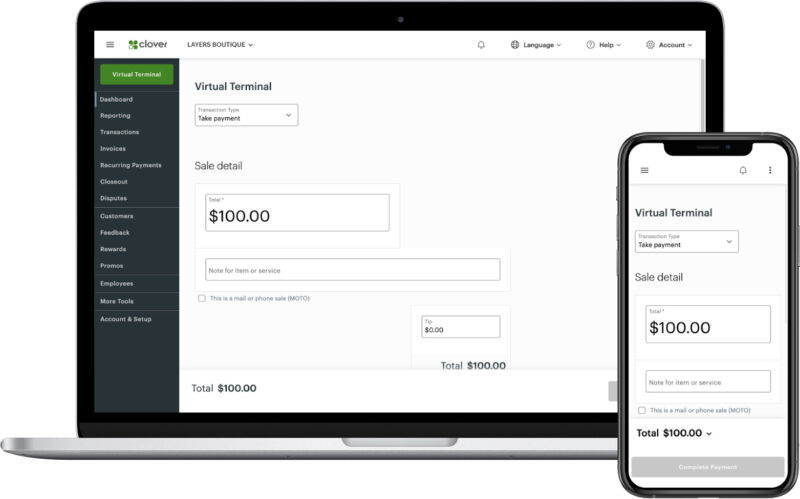

You can get Clover’s virtual terminal as a stand-alone for a reduced subscription. (Source: Clover)

- Loyalty programs: Clover is the only one on our list that comes with a complete, point-based loyalty program, in all its plans. You can also advertise promos on social media or via email or text messaging using Clover Promos. Upgrading to the Customer Engagement Plus plan unlocks automated or scheduled promos, targeted customer marketing, VIP bonuses, and more.

- Strong age-verification tools: Clover offers Retail Access Control Standards-compliant age-verification tools via integration, which make it a great choice for selling alcohol, cigarettes, or vape products. In addition, you can find a payment processor that will handle high-risk payments like CBD sales. It’s the best on the list for these kinds of sales.

- Virtual Terminal: Clover offers a virtual terminal. Unlike Square, whose virtual terminal can also process ACH, Clover only works with credit card payments. However, it does integrate with multiple apps, like Zoho CRM. Further, if all you need is a virtual terminal, such as if you do payment processing in an office, you can get a reduced price program at $14.95 per month, with 3.5% + 10 cents per transaction from Fiserv.

- Resellers not regulated: Clover has the hugest number of resellers and payment processing options of those on our list, but Clover/Fiserv does not hold them to a particular standard. Therefore, read contracts very carefully and consider our list of best payment processors.

How We Evaluated Cloud POS Systems

In this review, we looked at the most popular online POS systems with cloud capabilities. We based our evaluation on price, and tools like inventory management, customer relationship management (CRM), online ordering, and mobile reporting. We also considered ease of use and whether the service offered device compatibility, 24/7 customer support, and online tutorials and training.

Square rose as the best cloud POS, with a score of 4.55 out of 5. It comes with a free baseline plan that offers built-in inventory and ecommerce features, mobile reporting, and the ability to accept card payments while offline. Upgrading to Square’s industry-specific software starts at a very reasonably priced $60 per month.

Click through each of the tabs in the box below for our evaluation criteria in detail:

25% of Overall Score

We looked for a base plan that costs under $75 per month, a zero-cost installation fee, and the availability of volume processing discounts. We also gave points to those that allowed more than 10 users and devices and unlimited transactions. Square head a perfect score on this criterion.

25% of Overall Score

25% of Overall Score

Second to cloud and mobile functions, we looked for import POS tools like inventory management, employee monitoring, and customized reporting. We also considered whether the software provided robust CRM and loyalty tools. Lightspeed took top place here with a score of 4.75 out of 5.

15% of Overall Score

Here, we gave points to those that offer compatibility with devices that run on popular operating software, online training and tutorials, and 24/7 access to customer support. Lightspeed and Shopify earned perfect scores in this aspect.

10% of Overall Score

We considered user reviews, any standout features for each system, how easy to use each product is, and whether it generally offers a good value for its price. Lightspeed, Square, and Shopify earned 5 out of 5.

Cloud POS Systems vs Traditional POS Systems

Cloud POS systems are not the only type of POS system on the market. In addition to cloud-based software, there are also locally installed and hybrid POS systems. These options are often better suited for businesses that need additional security and offline functionality.

Locally Installed POS

A locally installed POS system stores data on a specific computer or device and cannot be remotely accessed. This is most popular among food service businesses, typically operating legacy POS systems. For example, SpeedLine, Aloha, and MICROS have been around for decades and operate by networking several terminals through a central server that is usually housed in a business’s back office. A locally-installed POS only works on-site and cannot be accessed via the internet, so you can only make updates and view reports from your business location.

Such systems tend to be more secure than purely cloud-based systems, and they have no problem with offline functionality. They, however, tend to be much more expensive upfront. A brand-new locally installed solution will set you back $10,000 to $15,000 or more, but they usually don’t have ongoing monthly fees.

Hybrid POS

A hybrid POS is a system that combines the flexibility of a cloud POS and the stability of a locally-installed POS. Many popular cloud-based POS, like Toast and Lightspeed, actually offer a hybrid installation option. A hybrid installation networks your terminals, printers, card readers, and other hardware through a free-standing server in your business location. The connections are usually made through Wi-Fi signals, though some rely on ethernet cabling.

This hybrid installation option is usually what gives some cloud-based POS stronger offline functionality. Hybrid systems tend to come at a slightly higher upfront cost than a purely cloud-based system, but they don’t even come close to the expense of a locally-installed system. You can expect such installations to add $500 to $1,000 to your upfront costs because they usually require a visit from an installation technician to set up.

Advantages of a Cloud POS System

Cloud POS systems primarily allow you to sell from anywhere, but they are also easier to maintain and require lower investment upfront. Learn more about the benefits of cloud POS systems below:

- High mobility: With a cloud system, you can access your POS from anywhere—which means you can sell from anywhere. This feature is perfect for traveling team members, staff working across a large sales floor, and any other situation in which you need to process a sale without access to a countertop POS register. You can also access business data and reports from any location, as long as you have an internet connection.

- Easy software maintenance: Maintaining and updating a cloud POS system is usually as easy as connecting to the internet and downloading updates which the POS provider should be releasing regularly. This maintenance shouldn’t take much time and effort, and should not interrupt your business operation.

- Low up-front investment: Most cloud POS systems (and POS systems in general) operate using a software-as-a-service (SaaS) model. This means that while you’ll be making regular monthly or annual payments to continue using the software, the up-front investments tend to be low. In many cases, there are no initial costs at all; you can simply begin monthly payments in order to use the system.

Disadvantages of a Cloud POS System

While cloud POS systems have many advantages, some drawbacks include:

- Security risks: Being constantly connected to the internet in order to use a cloud POS system makes you a potential target for hackers and other bad actors on the internet. In the worst case scenarios, internet thieves can steal your business data and even customer information such as credit card numbers. Minimize this risk by staying on top of security updates and best practices.

- Constant internet connection required: If you lose your internet connection while using a cloud POS system, your business won’t be able to operate at full effectiveness. You will likely lose the ability to process card payments, among other crucial functions. Some POS systems include an offline mode, but these are typically limited in functionality, and still require you to connect to the internet again eventually in order to sync data and transactions.

Frequently Asked Questions (FAQs)

Click through the following sections to learn more about what a cloud POS system is, and what you’ll need in order to use one.

A cloud POS system is networked to the cloud, which means its servers are maintained off-site by a third party (usually the POS service). All the information on the system is stored on the cloud, and you have access to it through the Internet or through a Wi-Fi connection where offered.

A traditional POS system has all business data in-house. Terminals are attached to a central server by wires, and information can only be accessed through an on-site computer or a remote connection login. You usually pay for this outright, whereas with a cloud POS, you pay each month for the software and services.

Like a traditional system, you need the software, a terminal, and a credit card processor. You also need internet connectivity.

Bottom Line

Small business needs are changing faster than they ever have before, and the flexibility, speed, and mobility of a cloud-based POS can help businesses navigate an ever-shifting consumer landscape. Every business has different requirements, and the type of software tools they choose will reflect that.

Square POS’s dynamic cloud-based tools come the closest to supporting the widest variety of small businesses with an unbeatable price tag. You’ll find everything you need to get even a micro-retail, restaurant, or service business started. And, as your business grows, Square offers affordable paid plans, add-ons, and hardware to scale along with you. Sign up for free to see if Square is the right fit.