Once you’ve identified a bad debt in QuickBooks, you can write it off by creating a credit memo and applying it to the outstanding invoice. To record and track those uncollectible amounts properly, we recommend setting up a bad debt expense account and a corresponding bad debt item.

Our guide walks you through how to write off bad debt in QuickBooks Online, including how to generate bad debt reports. We’ll also cover how bad debt write-offs affect your financial statements. Note that our tutorial focuses on the direct write-off method, which is a simple way to write off uncollectible amounts when they occur. Businesses that follow generally accepted accounting principles (GAAP) should use the allowance method. Our article on what debt is covers both methods for writing off bad debts.

To help you better understand this tutorial, let’s use a sample scenario.

Our fictitious company, Paul’s HVAC, installed an air conditioning system for ABC Builders. We sent an invoice for $2,000 with a 30-day payment term. Now, it’s been 90 days, and despite sending reminders and attempting to contact ABC Builders, we haven’t received any payment. We’ve decided that it will be unable to pay the $2,000, so we need to write off the invoice in QuickBooks.

Step 1: Identify the Bad Debt

If you already know which specific invoice you want to write off as a bad debt in QuickBooks Online, proceed to Step 2. Otherwise, you can run an Accounts Receivable Aging Detail report to identify potentially uncollectible amounts.

To do this, click on Reports in the left-side menu and find and run the Accounts Receivable Aging Detail report. From this report, you can review your outstanding accounts and determine which should be written off.

In the report below, we can see that our outstanding invoice for ABC Builders is over 91 days due. That said, we now consider it a bad debt, and we need to write it off in QuickBooks.

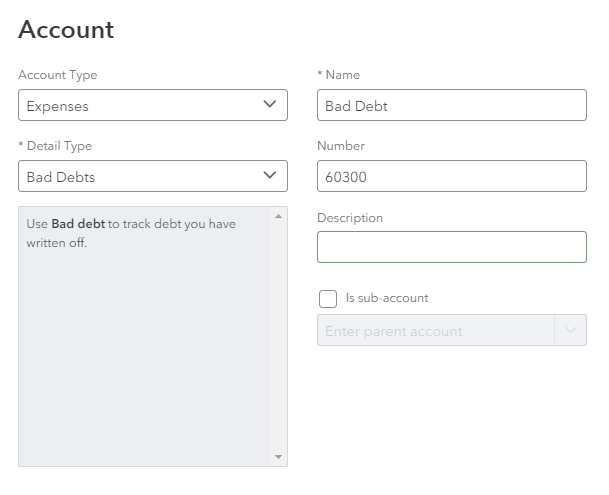

Step 2: Create a Bad Debt Expense Account

If you haven’t already, you must create a bad debt expense account to record uncollectible amounts properly.

To do this, click on the cog wheel icon (⚙︎) in the upper right corner of your dashboard and then select Chart of accounts under YOUR COMPANY. Click on the New button and proceed to create the new expense account. Select Expenses as the account type and Bad Debts as the detail type. You can name the account “Bad Debt” or something similar.

Creating a bad debt account in QuickBooks Online

Step 3: Create a Bad Debt Item

Next, create a bad debt item that will be used as a dedicated line item to record bad debt transactions in QuickBooks. Click on the cog wheel icon and then select Products and services under LISTS.

Tap New and proceed to create the item. Choose “Non-inventory” as the type and then designate the item to the bad debt account. This way, QuickBooks will record the debt to the correct account automatically when applying the credit memo to the outstanding invoice. Once done, hit Save and close to record the item.

Creating a bad debt item in QuickBooks Online

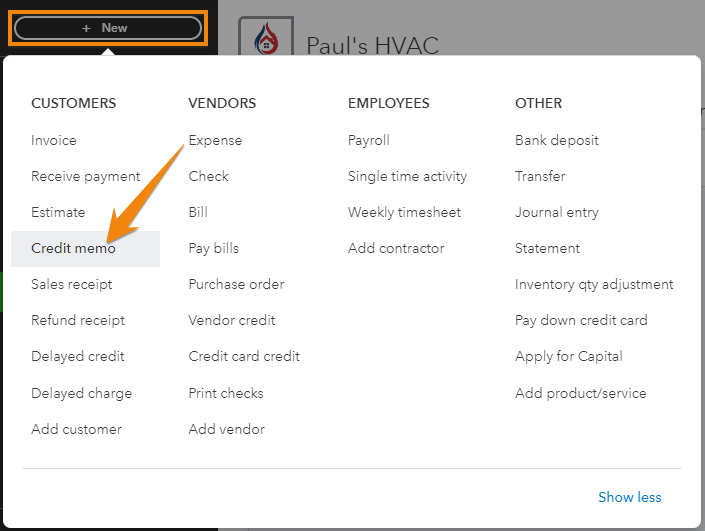

Step 4: Create a Credit Memo for the Bad Debt

Click on + New in the upper right corner of your dashboard and then select Credit memo under the CUSTOMERS category.

Navigate to ‘Credit memo’ in QuickBooks Online

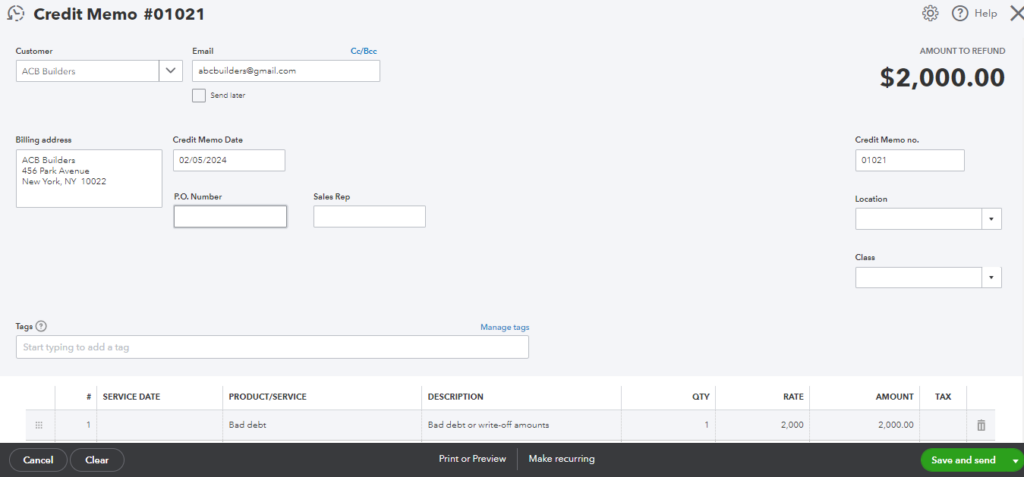

From the Credit memo form, select the customer for whom you are creating the credit memo and then select the product/service (bad debt) and enter the amount you need to write off (we entered $2,000 based on our example). Once done, click Save and send or Save and close.

Creating a credit memo in QuickBooks Online

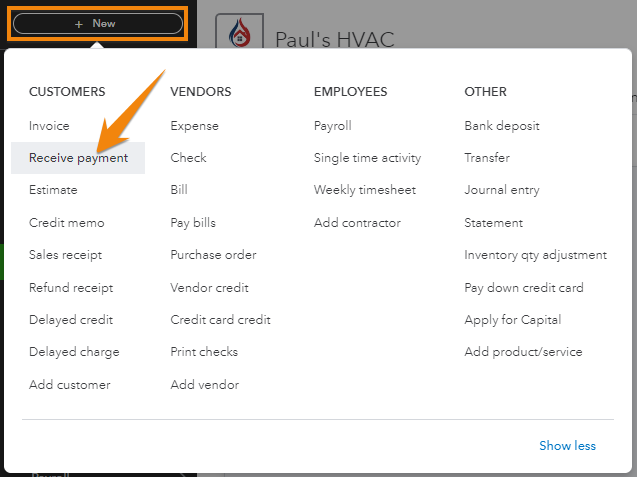

Step 5: Apply the Credit Memo to the Invoice

Once the credit memo is created, you must apply it to the invoice you need to write off. To do this, click on +New and then select Receive payment under CUSTOMERS.

Navigate to ‘Receive payment’ in QuickBooks Online

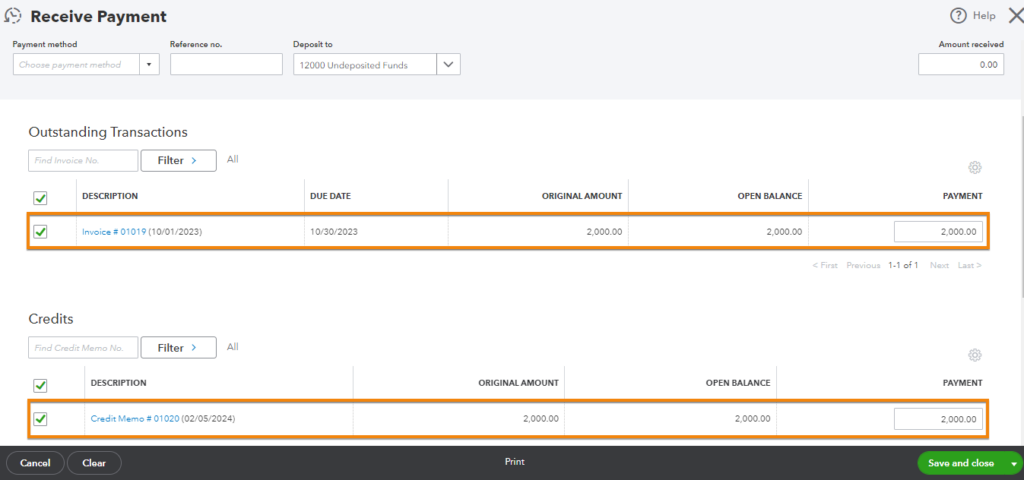

From the Receive payment form, select the appropriate customer and locate the invoice you want to write off from the Outstanding transaction section. Next, tick the checkbox before the invoice, and in the Credits section, mark the related credit memo.

Applying a credit memo to an invoice in QuickBooks Online

Once done, click Save and close.

Once you apply the credit memo to the invoice, it offsets the outstanding balance of that invoice—meaning the amount is no longer expected to be collected. This adjustment then reduces your outstanding receivables balance. It will also impact your income and expense accounts, which will be reflected in your profit and loss (P&L) report.

Step 6: Run Bad Debt Reports

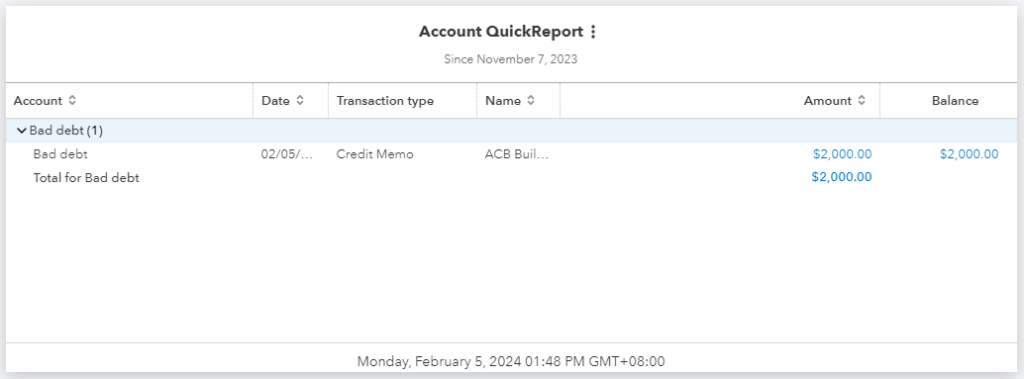

To view and track all the receivables you tagged as debt, you can run an Account QuickReport. To do this, find the bad debt expense account in the chart of accounts and then select Run report. QuickBooks will run an Account QuickReport, showing a list of uncollectible debts that have been recorded and written off.

Sample Account QuickReport in QuickBooks Online

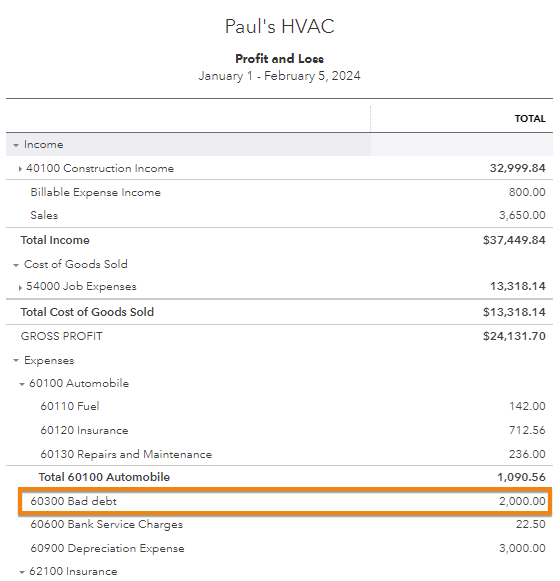

As mentioned earlier, bad debt write-offs are reflected in your P&L statement, and you’ll see them under the expenses section.

Sample profit and loss statement in QuickBooks highlighting a bad debt write-off

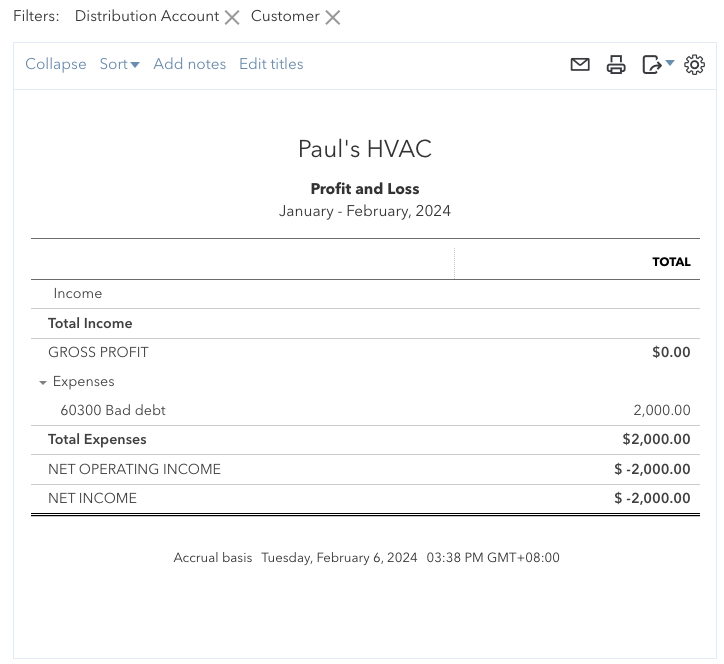

If you want to view bad debt write-offs for a specific customer, you can create a customized P&L report. While customizing the report, click on the Distribution account filter and then choose “Bad debt.” Next, click on the Customer filter and select the customer from the drop-down menu.

Meanwhile, QuickBooks will generate a customized report showing the bad debt expenses for that particular customer.

Sample customized P&L report to show bad debt write-offs for a specific customer in QuickBooks

Frequently Asked Questions (FAQs)

You must identify the specific invoice to write off, create a credit memo, and apply it to the invoice. Additionally, ensure you have created a bad debt expense account and a bad debt item.

Yes, especially if you are a small business with occasional bad debts. Larger businesses may use the allowance method for GAAP compliance.

It reduces your accounts receivable and impacts the income statement by recognizing the bad debt expense. In your P&L report, the uncollectible receivable is shown under the bad debt expense account.

Wrap Up

You’ve just learned how to write off an invoice in QuickBooks Online. Hopefully, you won’t encounter many bad debts, but at least now you know how to manage them properly so that your financial information stays accurate.

If you need additional help learning how to use QuickBooks, you may appreciate our free QuickBooks Online tutorial series.