If you’re transitioning to Intuit after having used a different payroll service, you may need to enter historical data into QuickBooks Payroll. This will help ensure your payroll and tax reports are accurate and not missing any information. If you owe taxes accumulated before using QuickBooks, this will be a vital step to ensure QuickBooks pays applicable tax agencies in full and that you won’t get penalized for late or inaccurate tax payments.

Did You Know? QuickBooks Payroll has released a “Contractor Payments” plan, which is optimal for businesses that hire and pay only contract workers. It costs $15 monthly for up to 20 contractors (plus $2 for each additional worker). For more information about QuickBooks’ payroll plans and features, check out our QuickBooks Payroll review.

Adding historical payroll data to QuickBooks Payroll typically happens during the setup process. Follow along with our video on how to set up your payroll account (entering historical data starts at the 3:00 mark) and get some quick tips on things to consider when you’re entering historical data.

1. Gather Data

You can only add past payroll data as summary information. Therefore, you will need the data found on each employee’s last pay stub. You may also have this information in a payroll report.

You need the following information:

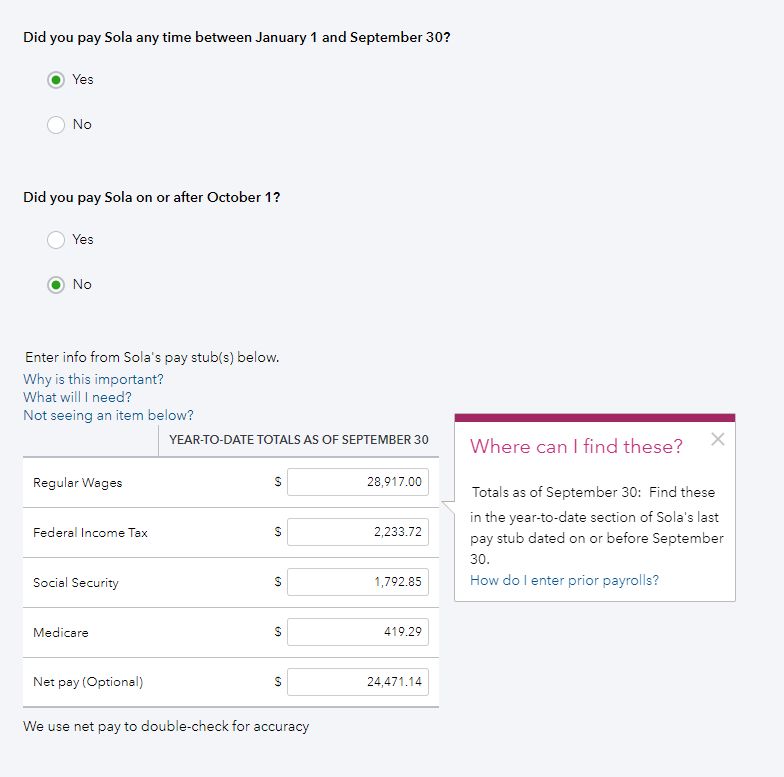

- Last time you paid your employee. It will ask by quarters, months, or pay periods, so you may answer several of these in a Yes/No fashion.

- Regular wages: This is the full wages your employee earned in the year-to-date, as shown in the last pay stub.

- Overtime: This is all the overtime earned, year-to-date, as shown in the last pay stub.

- Deductions (employees pay): There may be several lines, depending on the specific deductions, such as medical insurance, 401(k), etc.

- Deductions (company pays): There may be several lines, depending on the specific deductions, such as medical insurance, 401(k), etc.

- Federal income taxes withheld: This tax should show on every employee’s pay stub unless they are exempt.

- Social Security taxes withheld: Also known as FICA.

- Medicare withheld: Also known as FICA.

- State income taxes withheld: Also known as state withholding or PIT/SIT.

- State disability insurance: If applicable to your state. If not, it will not show up on the QuickBooks form.

- Net pay: This is optional, and QuickBooks uses it to check for the accuracy of calculations. If you do not add it, it will make this calculation for you.

Note: You can only enter historical payroll data under two conditions. Otherwise, you will need to contact the Payroll Support team for assistance.

- The data is for the current calendar year.

- You have not run any payrolls for the employee for whom you need to add data.

You cannot bulk upload historical data into the software and enter past years on your own.

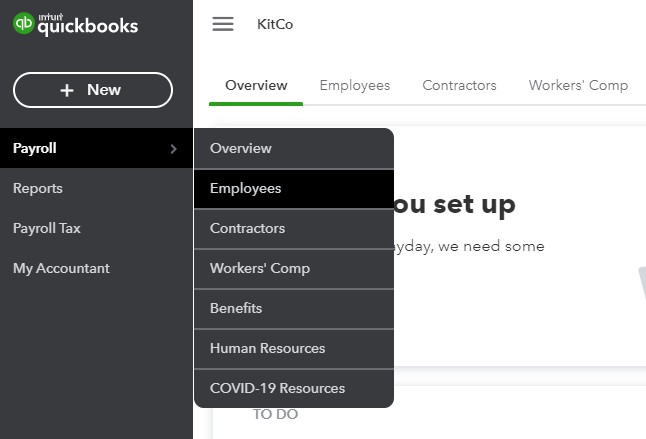

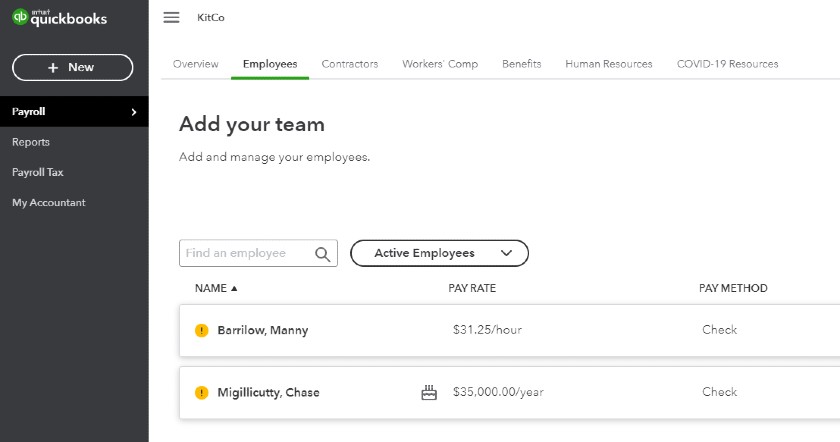

2. Find Your Employee

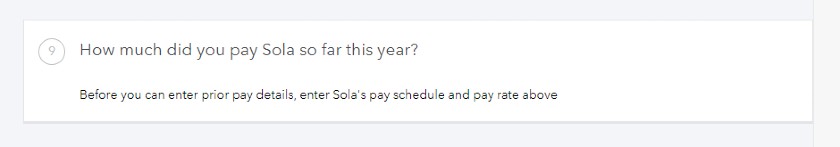

3. Input Totals From Your Payroll Reports or Employee Pay Stubs

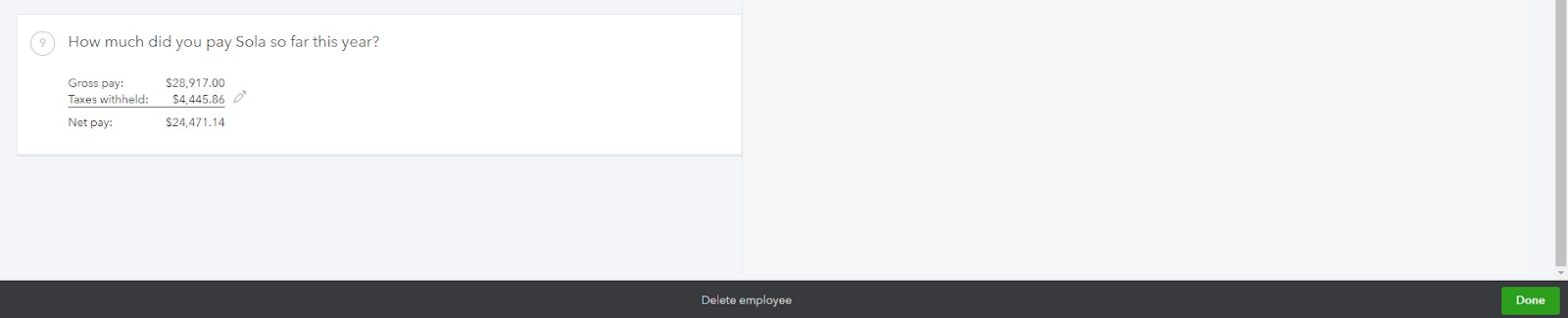

The Employee screen opens with all the information you need to input for payroll. It will ask, in step 9, for historical data.

If these numbers do not match what QuickBooks expects, it will not proceed until these are correct.

4. Complete the Input

When you finish, press Done in the lower right corner. QuickBooks will then update, showing you the gross pay, taxes withheld, and net pay to date. Click Done again to complete this employee.

5. Go to Next Employee

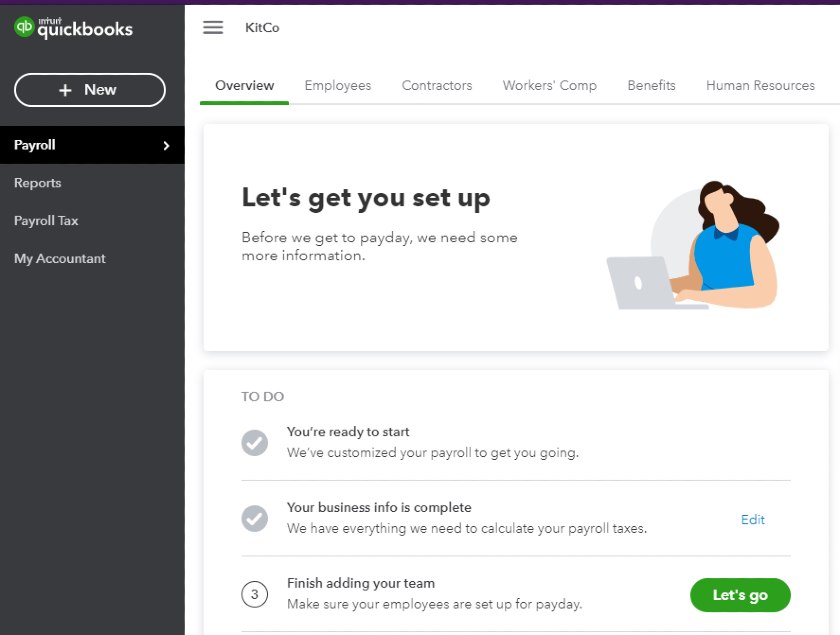

When you press Done, it takes you back to the Overview page. Click on Let’s Go to set up your next employee.

Bottom Line

Once all your employee data is set up in QuickBooks Online Payroll, you’ll be ready to run your payroll. You can also learn more about how to do payroll yourself here.

QuickBooks Payroll makes paying your team simple and painless, especially if you’re already a QuickBooks Online User. QuickBooks Payroll offers an easy to use interface, speedy direct deposits, and great reporting that makes tracking expenses easier than ever before. New users get 50% off payroll for the first three months.

Although having payroll software makes paying your employees the right way much easier, you still need to know the basics. Check out our tips on how to get the best payroll training to help.