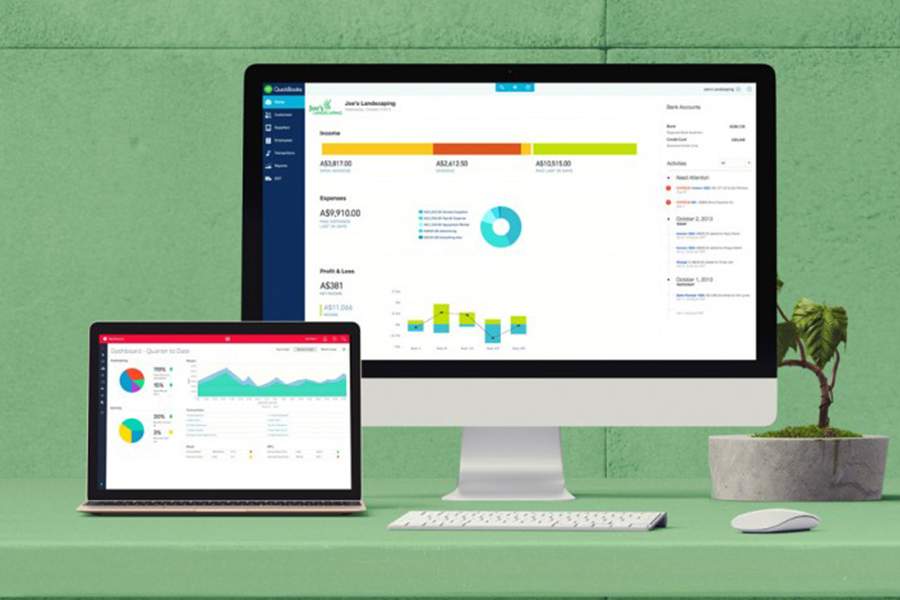

Welcome to Fit Small Business’ free QuickBooks Online tutorials. We developed these guides to help you better understand QuickBooks Online—whether you are starting or want to brush up on your skills. We cover everything from basic setup to advanced features, and most of the lessons include a video to better guide you through the process step by step.

Featured Partner

QuickBooks Online Tutorial: What’s Covered

There are 59 guides in our QuickBooks Online tutorial, spanning eight main modules. Plan at least two hours to complete the first module, which includes 14 video tutorials. About half of the guides have an average runtime of 5 minutes or less, and the longest is slightly less than 14 minutes long. Each lesson has been broken down into bite-sized tutorials.

To get the most from our free QuickBooks tutorials, I recommend following along in your QuickBooks Online account (if you already have one) and completing the tutorials in the order they are presented.

Our free QuickBooks course consists of eight main lessons.

Module 1:Setting Up QuickBooks Online

In this module, I’ll show you how to set up key areas of QuickBooks Online, including entering your company information, adding users, customizing your QuickBooks Online dashboard, and setting up the chart of accounts. By the time you complete this section, you will be ready to start using QuickBooks to manage all of your income and expenses.

The features and settings that you choose in this module will affect every area of QuickBooks. For example, you will set the default payment terms for customer invoices and vendor bills. You will also choose whether to turn on project tracking and inventory quantity and cost tracking.

This module includes the following tutorials:

Module 2:

Managing Sales and Income

In this section, I cover how to create sales forms and track sales and income in QuickBooks Online. By the end of this chapter, you will be able to keep track of your credit sales by creating and emailing invoices to your customers as well as recording cash sales where no invoice is needed.

I’ll also guide you on how to apply payments received to outstanding invoices and receive partial payments from customers. Furthermore, you’ll discover how to track billable hours and bill your clients for the time worked.

Below are the lessons included in this module:

Module 3:

Managing Bills and Expenses

This module covers how to manage your bills and record expenses in QuickBooks. As a small business owner or manager, you know that managing expenses is as important as generating sales. By the end of this QuickBooks lesson, you will be able to keep track of expenses in a couple of ways.

Here, I’ll explain how to write and print checks directly from QuickBooks to pay for expenses that require immediate payment. I’ll also cover how to enter and track bills and apply the payment of these bills correctly so that the expense is not recorded twice. Additionally, I’ll show you how to write off bad debts, which are recorded as an expense in QuickBooks.

This module includes the following lessons:

Module 4:

Managing Banking Transactions

I’ll walk you through how to manage all of your downloaded banking transactions in this module. Also, I’ll teach you how to enter basic banking transactions manually and how to use the Undeposited Funds account to temporarily hold cash and check payments before depositing them into your bank account. You’ll also learn how to reconcile bank and credit card accounts and undo reconciliations if needed.

Here, you’ll encounter the following tutorials:

Module 5:

Managing Business Credit Card Transactions

This module will teach you to download and track your credit card purchases in QuickBooks and reconcile them with your credit card statement to ensure they match. I’ll cover how to manage credit card sales with either a QuickBooks Payments account integrated with QuickBooks or a third-party credit card processor. You should consider accepting credit card payments as a convenience for your customers and to expedite the collection of outstanding invoices.

Our credit card-related tutorials are as follows:

Module 6:

Setting Up & Managing Payroll

Using QuickBooks Payroll will automatically include all your wages, salaries, and payroll taxes in your financial statements. In this section, we’ll walk you through how to set up employees in QuickBooks, enter and run payroll, pay employees by direct deposit or check, and reconcile your payroll taxes.

This module includes the following tutorials:

Module 7:

Reporting in QuickBooks Online

QuickBooks generates important reports that will provide you, your accountant, and your banker with important insights into your business’s financial health. In this module, I will teach you the importance of and how to print the profit and loss report, balance sheet report, statement of cash flows, and A/R and A/P aging reports.

One of the primary purposes of using bookkeeping software like QuickBooks Online is to determine the health of your business at any given point in time. Having the ability to produce solid, accurate financial statements can benefit you in the following ways:

- You might gain potential investors

- You might secure a business loan or line of credit

- You can make better business decisions, such as whether you should sell a new product or service or drop one that is not doing so well

This section includes the following tutorials:

Module 8:

Advanced Accounting in QuickBooks Online

In the final module, I’ll cover how to handle advanced tasks, including creating journal entries to adjust your accounts, closing a financial year to lock in your data, and using the QuickBooks audit trail to track changes made by users within your account. I’ll also teach you how to use advanced features like class and location tracking, recurring transactions, and project accounting.

This section contains the following tutorials:

- To help you further improve your learning experience, check out our expert QuickBooks Online tips and the most common QuickBooks mistakes.

- If you want to explore alternative ways to study QuickBooks, I created a guide on how to learn QuickBooks Online.

Frequently Asked Questions (FAQs)

Our free QuickBooks Online tutorials are comprehensive and educational resources designed to help you use QuickBooks Online for your business more effectively. Each course provides detailed step-by-step guides through a combination of comprehensive text instructions, practical examples, and video demonstrations.

No, as these courses are tailored for different skill levels, including beginners.

Yes, these training tutorials are updated regularly based on the latest feature updates or changes made by Intuit, the company behind QuickBooks.

Bottom Line

Our free QuickBooks tutorials will teach you the basics you need to know to start keeping the books for your small company or employer. Don’t be intimidated by the size of the tutorial―take one lesson or tutorial at a time. Get started today.