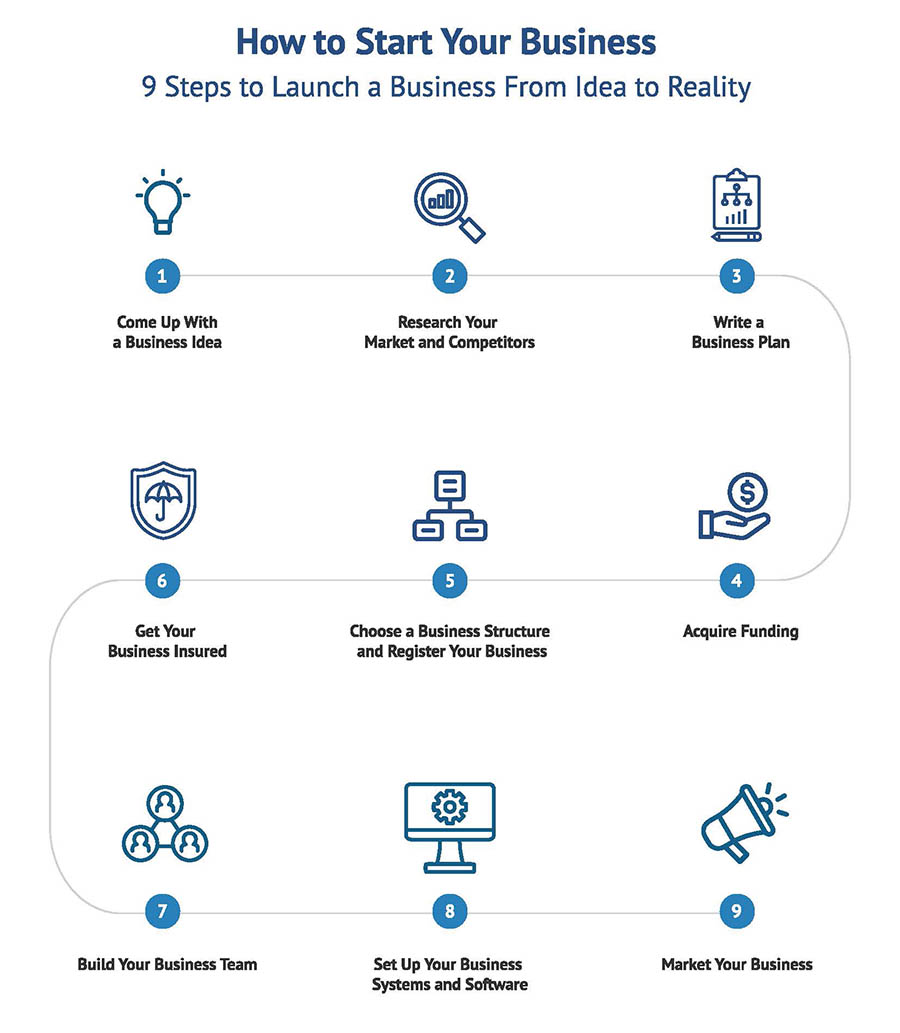

Starting a small business involves coming up with a business idea, testing the idea, writing a business plan, acquiring funding, choosing a business structure, registering the business, getting it insured, making key hires, setting up systems, and finally, marketing and promoting it.

Whether you’re starting a part-time business or quitting your corporate job to create your dream biz, you’ll find information in this guide to help you succeed. Throughout this article, you’ll learn how to start a small business from experts in finance, law, marketing, human resources, software, and insurance, as well as expert advice from former small business consultants.

Should you start a business? Before coming up with a business, it’s crucial to determine if you’re ready to become a business owner and there are many things to consider. Examine the main points to consider by reading our guide on determining if you should start a business.

Step 1: Come up with a business idea

All businesses start with the same first step — coming up with a business idea. When coming up with an idea for your business, here are the things to consider:

- Business trends: Check small business trends, emerging technologies, and shifts in consumer behavior. Look for growing markets, untapped niches, or innovative ways to improve existing products and services.

- Customer problems/pain points: Identify gaps in the market, common frustrations, or inefficiencies in daily life. Pay attention to online reviews, social media discussions, and personal experiences to spot opportunities.

- Your personality: Your business should align with your interests, skills, and work style. Are you a creative thinker, a natural problem-solver, or a numbers-driven strategist? Choosing a business that matches your strengths increases your chances of long-term success.

- Profitability and market demand: A great idea is only valuable if people are willing to pay for it. Research whether there’s a demand for your product or service and how much customers are willing to spend. Check how much small business owners make to get a rough figure of what to expect.

- Startup costs and resources: Some businesses require significant capital, while others can be started with minimal investment. Consider the startup costs you’ll need in terms of equipment, technology, and time before committing.

- Competition and differentiation: A competitive market isn’t necessarily a bad thing — it means demand exists. The key is finding a unique angle that makes your business stand out.

💡Tip: Keep a business idea journal

As you go through your day, jot down any ideas that come to mind. To help spark inspiration, ask yourself these guide questions:

- What problems do you face in your own life? Can you create a product or service to solve them? Chances are, others have the same problem.

- What do people frequently ask you for help with? This can reveal skills or knowledge you could turn into a business.

- Do you prefer working in solitude or engaging with people? Your ideal business should match how you are as a person and how you approach work.

- Would you rather build a small lifestyle business with flexibility or scale to an eight-figure company with employees? Understanding your growth vision helps you choose the right model.

- Do you want to start from scratch, buy an existing business, or invest in a franchise? Each path has pros and cons — consider what fits your goals.

- Are you willing to work long hours for rapid growth, or would you prefer a slower, more balanced approach? Your time commitment will shape your business strategy.

- What types of tasks energize you, and which ones drain you? Build a business that allows you to focus on your strengths.

- What skills, experiences, or hobbies do you already have that could be turned into a profitable business? Monetizing what you love can lead to long-term success.

- What industries or business models excite you the most? Passion and enthusiasm will help sustain you through challenges.

Think about these questions to help you begin with the end in mind. Your ideal business should align with your skills, lifestyle goals, and personal values. There’s no single “right” way to start a business — what matters is choosing a path that excites you and fits your long-term vision. Take notes, explore different possibilities, and stay open to ideas that might evolve as you learn more. The best business idea is one that not only makes money but also keeps you motivated for the long haul.

Business idea examples

Browse our list of business ideas for inspiration:

- Best Business Ideas to Make Money

- Best Business to Start

- Best Businesses to Start With Less Than $500

- Low-cost Business Ideas

- Mompreneur Business Ideas

- Family Business Ideas

- Business Ideas for Students

- Business Ideas for Kids

- Home-based Business Ideas

- Small Farm Business Ideas

- Fitness Business Ideas

- Photography Business Ideas

- Amazon Business Ideas

- 3D Printing Business Ideas

- Online Business Ideas

- Clothing Business Ideas

- Retail Business Ideas

- Low-cost Franchises

- Simple Part-time Business Ideas

- Ecommerce Business Ideas

- Bitcoin Business Ideas

- Recession-Proof Business Ideas

- Winter Business Ideas

- Crazy Business Ideas for Entrepreneurs

Additionally, you may want to browse “how to start a business” guides to learn more about a specific business idea:

- Cleaning business

- Clothing boutique or a consignment store

- Dropshipping business

- Bookkeeping business

- FedEx routes

- Juice bar

- Lawn care

- Lifestyle blog

- Online store

- Online T-shirt business

- Print on demand business

- Subscription box business

- Gift basket business

- Jewelry business

- Vape shop

- Vending machine

- Personal training

- Retail store

Starting from scratch vs buying existing vs a franchise

One question you may have is if you should start your small business from scratch, buy an existing business, or purchase a franchise. Two things to consider are your business experience and available funds.

If you have no experience running a business or in a particular industry, buying into a franchise can increase your odds of success. When you buy into a franchise, you’re mostly learning how to run the business. If you follow the franchise formula in a well-populated area, you’re likely to succeed.

The same line of thinking applies to an existing business. Purchase an existing business, and you’ll learn how to run the business — plus receive previous customers. This combination makes the likelihood of success higher than you’d have for a brand-new franchise.

However, the challenge with buying a franchise or an existing business is cost. The high cost is one of the main reasons most new entrepreneurs start their business from scratch. However, keep in mind that there are dozens of franchises under $25,000 that you can explore.

Related:

- Franchise vs Startup

- Financing a Franchise: 7 Best Loan Options

- 11 Franchise Marketing Tips to Grow Your Business

- 19 Best Franchises Under 10K

How much money do you need to start?

It’s essential to know the answer to this question before starting your business. I’ve met with several people who never got their business off the ground because it required too much money. Remember, if you don’t have the capital available: Dream big, but start small.

To start a business, such as residential cleaning or power washing, you may only need $1,000. Use these funds to register the business, purchase supplies, and get your first customers, and then you’ll be in business.

Opening a store with a location is more costly. You’ll need at least $50,000 in funding — and possibly several hundred thousand dollars more. For a very small retail store, you should plan on earning at least $100,000 a year to cover overhead costs and make a nice profit.

If you need substantial debt to open your first business — say, over $20,000 — you should seriously think about that decision. What’s the worst-case scenario? How long will it take you to get out of debt? If possible, start part-time with the business and acquire the necessary entrepreneurship skills. Or consider waiting. Save up cash, and take on as little debt as possible.

Learn more: How to Choose a Business to Start

Now that you’ve settled on an idea, it is time to dive into the market.

Step 2: Research your market and competitors

Once you have chosen your business idea, you need to test that to determine the likelihood that it will work. The majority of new business owners skip this step — that’s why 20–22% of small businesses fail within the first year, according to the Bureau of Labor Statistics.

Don’t skip this step! You may learn valuable information that alters the type of business you start or how you implement it. All the information you collect will go into your business plan (Step 3).

Validate your business idea

Before launching, ensure your product or service is something customers will pay for. True validation happens when people spend money on it, but you may not know its full market potential until it’s live.

This is where research is crucial. Use focus groups, surveys, or online communities to gather feedback. Crowdfunding campaigns can also test demand while raising initial funds.

- Evaluate your competitors. Identify the top five in your market — what strengths can’t you beat, and what weaknesses can you improve upon? If there are no competitors, ask why. A lack of competition might signal low demand.

- Identify your target demographic. Define your ideal buyer and estimate how many exist in your market. Tools like ReferenceUSA (available at many libraries) help you research local demographics to assess demand.

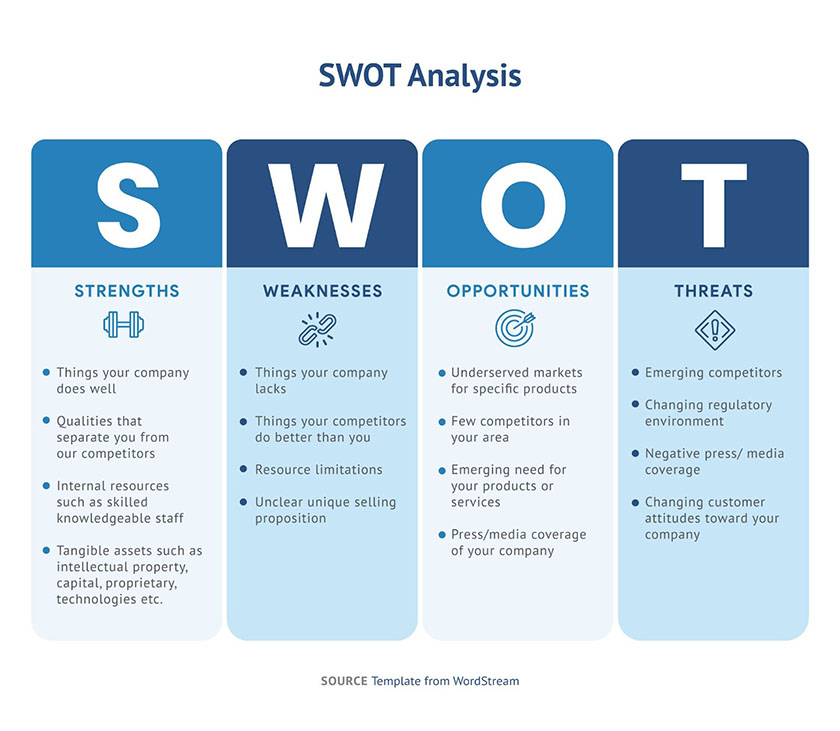

Perform a SWOT analysis

A SWOT (strengths, weaknesses, opportunities, threats) analysis is an exercise that helps you think critically about your business idea. SWOT analysis may reveal certain aspects of your business you have not considered — both positive and negative.

Go through each section below and list your ideas:

- Strengths: What will the business do well?

- Weaknesses: What may the business not do well?

- Opportunities: What external market opportunities are there, such as less competition and underserved segments?

- Threats: What external factors may make success difficult — such as regulations?

- Identify your competitive advantages. A SWOT analysis helps you identify your own competitive advantages. A question to ask yourself is: “What is my advantage that the competition will struggle to match?” Is it your quality of product or service, customer service, or knowledge? This question will help you determine if you can be the best at something. Being the best in a certain area of a business makes it more likely that the business will succeed.

Research a location

If you’re considering an office or storefront, start your research into the location now. You want to start early to make sure you can afford it. Look into potential locations to develop a rough estimate of the build-out cost (renovations) and monthly rent. The information you collect will go into your business plan and financial projections.

Once you have validated your idea, performed in-depth research, identified target demographics and possible locations, and performed competitive analysis, you are ready for the next step. So far, you have put together informal pieces of a business plan. Now, it’s time to write down information in a document as part of a formal business plan.

Step 3: Write a business plan

When you’re just starting your business, a business plan, along with a solid business philosophy, can help you plot your future. Additionally, a business plan is an opportunity to show why and how your business will become a success. All businesses need to create a business plan or a strategic roadmap to guide their decisions.

The business plan contains several elements, including market analysis, competitor analysis, and financial projections. If you’re seeking funding from a bank or investor, you will need a business plan. The plan shows on paper how you will start your own business. After you open it, the document keeps you focused and on track with your goals.

A typical business plan may contain over 40 pages of info about your business. You should plan on spending at least 30 hours creating a well-researched business plan. In addition to writing the plan, you will also spend time doing market research and creating financial projections.

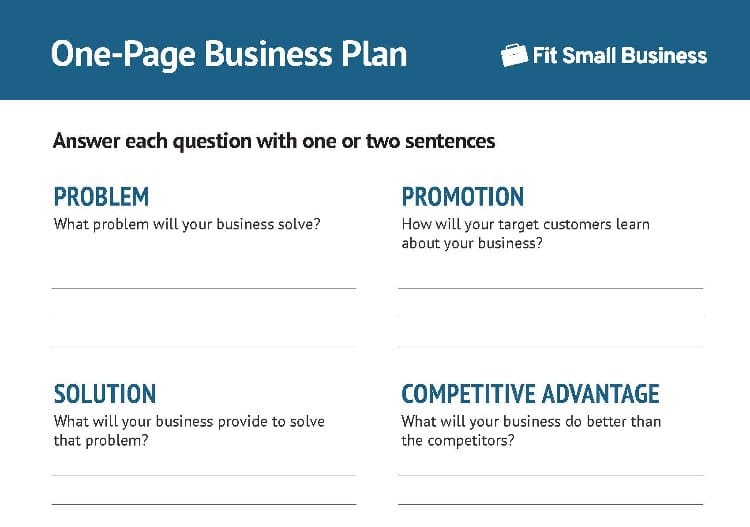

Starting small? Use a one-page business plan. If you’re launching a side business or a very small venture, a one-page business plan is a great starting point. In about an hour, you can outline key concepts like your business model (how you’ll make money) and competitive advantage (what sets you apart).

The trickiest part will be financial projections, as they require research to estimate income and expenses accurately.

Download our one-page business plan template to start your business planning today.

Most business owners can easily do the research and write the plan. Where most have difficulty are the financial projections, which require creating several financial documents. If you don’t have a financial analysis background or interest, it’s a wise strategy to purchase business plan software that walks you through the financial projection process.

Related: 4 Types Of Business Plans (Plus Software & Writing Services)

Here are nine sections to include in your traditional business plan:

- Opening organizational and legal pages: Cover page, nondisclosure agreement, and a table of contents

- Executive summary: A summary of the entire business plan in fewer than two pages; Complete this section last

- Company summary: Basics of the company, such as its history, location, facilities, company ownership, and competitive advantage

- Products and services: How your business makes money (business model), the products or services it provides, and future products or services

- Market and industry analysis: Analysis of potential customers and industry. Include any data here about your current (or ideal) customers, business industry, and competitors

- Marketing strategy and implementation summary: Discussion of marketing, sales, and pricing strategies

- Management and organization summary: Business ownership and operation. (If your business isn’t open yet, give a compelling reason why your background will make it a success. Include information on any managers in the business as well.)

- Financial data and analysis: Financial projections such as a profit and loss statement, projected cash flow, and business ratios

- Appendix: Any documents or information that doesn’t fit in the above categories goes in the appendix. You may want to include documents such as a floor plan, trademark, or marketing materials.

This might be a big undertaking for some, so there are business plan writing services you can seek help from. Alternatively, here are some industry-specific business plan templates that can help:

Learn more: How to Write a Business Plan

Step 4: Acquire funding

Obtaining financing for your startup business may be the biggest challenge you face in your company’s infancy.

If you don’t have sufficient personal funds to start your, you’ll need to secure additional funds. There are several funding options available for soon-to-be business owners, including various types of loans, investors, and crowdfunding.

A popular saying that many in startup financing like to say is, “You should always look to family, friends, and fools for funding before an investor or loan.” The reason is that family and friends (and fools) are the cheapest sources of capital.

The main downside of securing capital from family and friends is the potential for a damaged relationship. To avoid this, draw up an agreement that states how and when you need to pay back the funds.

Business loan amounts can range anywhere from under $1,000 to over $1,000,000. Just because you may qualify for a loan doesn’t mean you should use it. Start your small business with as little debt as possible. Remember, if your business were to fail, you would still need to pay off the debt you incurred plus interests, which could take several years.

Here are several different types of loans to fund your business:

- Business credit card: If you have good credit and open a new business card, it’s possible to have a 0% APR (interest) for up to the first 18 months.

See also:

- Personal business loan: This loan is typically under $20,000 and needs to be repaid within five years. Your credit score determines the interest rate.

See also:

- 7 Best Personal Loans for Business Funding

- Business Loans vs Personal Loans: Which Is Best for Your Small Business

- Rollover for business startups (ROBS): This is a popular option for those who would like to use part of their 401(k) or IRA (individual retirement account) to fund their startup.

See also: 7 Best Rollover for Business Startups (ROBS) Providers - Home equity loan or line of credit: These loans pull equity out of your home for a loan. They are appealing because of their low interest rate.

- Government microloan: Typically under $50,000, a microloan is funded by the SBA (Small Business Administration) or local government. It’s for certain businesses such as child care or those in underdeveloped communities.

See also: SBA Microloans: What They Are & How To Apply - SBA Loan: This type of loan is not common for a startup. It requires a “personal guarantee,” which means your personal assets will be collected if you default on the loan.

See also:

See also: How To Get Unsecured Startup Business Loans in 6 Steps

An angel investor is typically a wealthy individual who funds early-stage businesses. Investors usually want equity ownership in businesses in which they invest their money. Having ownership means they will collect a percentage of your profits in exchange for their investment. To get the full picture, you can read more about the pros and cons of angel investments.

Crowdfunding a small business is when you get customers to pre-order products or services. It’s a great way to raise funds before opening your business or creating a product.

Kickstarter and Indiegogo are crowdfunding platforms that assist with raising the money for your business. The cost to use the platforms is 5% of the final price raised plus payment processing fees, which are around 3%.

See also:

Business grants are funds given to start a business that don’t have to be repaid. Federal, state, and local governments are common sources of grants. Many new business owners seek them, but they are hard to find.

A business grant is typically reserved for a particular type of business, such as a research-based business. Grants may also come in forms other than money, such as reduced rent to open a business in a disadvantaged area designated by a city.

See also:

Venture capital is private equity designed to help startups with long-term growth potential scale. In this arrangement, groups of investors pool money to fund a startup in exchange for equity. Typically, venture capitalist firms also shape the strategies of the companies, provide expertise, and make introductions. Read more about the disadvantages and advantages of venture capital funding.

Learn More: Startup Business Loans: The 7 Best Ways to Fund Your Startup

Having difficulty with funding? Check out our guide on how to start a business with no money.

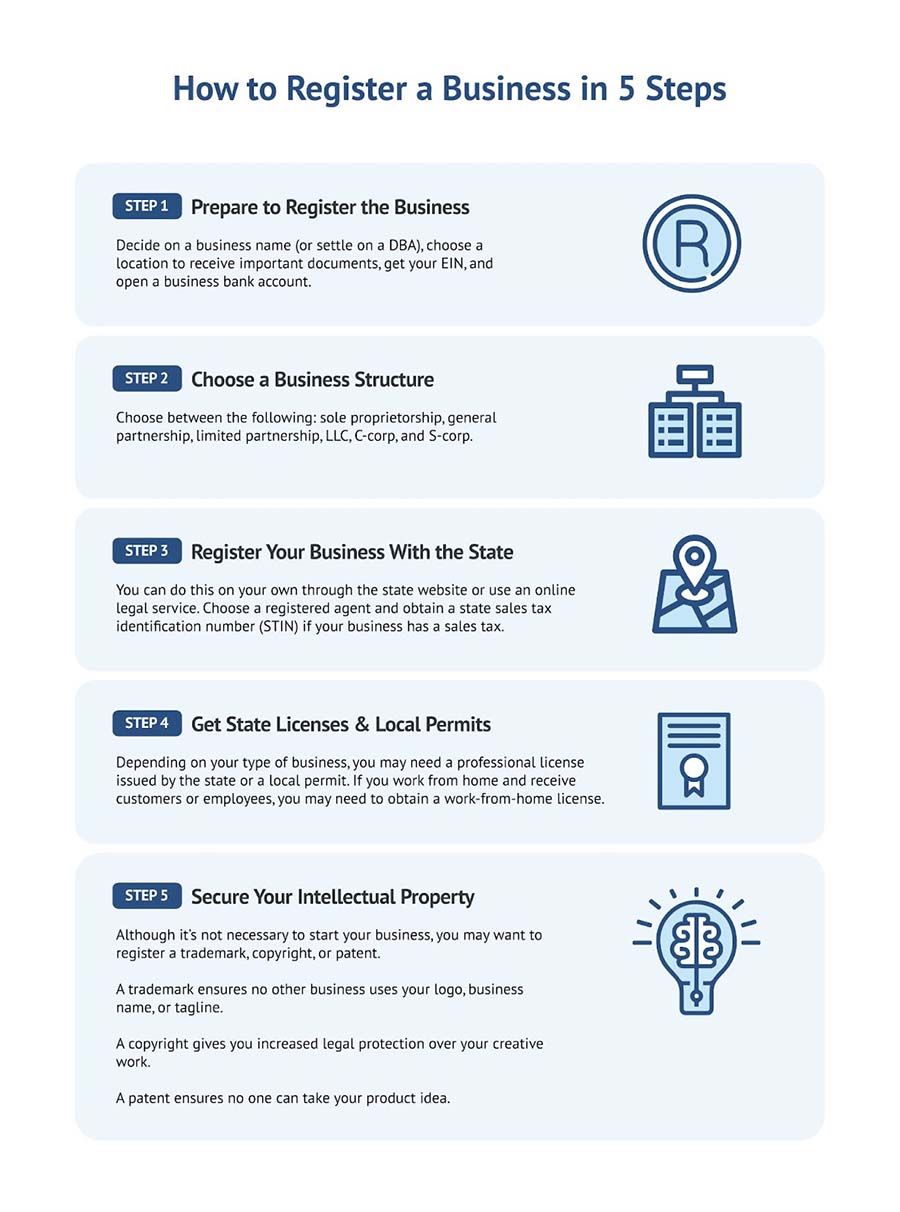

Step 5: Choose a business structure and register your business

Once you secure funding, it’s time to make things official. Registering your business ensures legal compliance, protects your personal assets, and safeguards your unique ideas from competitors.

Business registration costs vary by state, ranging from $40 to $500. You can register through your state’s official website or use an online legal service like Rocket Lawyer if the process seems complex.

Don’t wait until your first customer to register — proper setup helps you avoid legal issues like trademark disputes or home-business regulations. To stay organized, use our business registration checklist to track your progress and avoid missing key steps.

Prepare to register your business

This may only include obtaining an employment identification number (EIN), opening a business bank account, and registering the business as a legal entity in the state in which it operates.

Alternatively, registering your business can also grow into several tasks, including those above, in addition to obtaining a professional business license, getting a State Taxpayer Identification Number, and passing a city health inspection. It’s best to prepare for these tasks in advance to ensure they go smoothly.

- Choose a business name. Before taking any of the legal steps below, you need to decide on your business name. This is important to do first because your business name will be on all of your legal documents. Know that you don’t have to stick with this name forever. If you’d like to change the public-facing name of your business, you can always file a DBA (doing business as) registration with the state in which your business is primarily located.

- Choose a location to receive important documents. Your city or state may require certain documents to be signed and will mail them to you. Additionally, your state will mail documents to your address every year to remind you to re-register your business. It’s important to re-register on time because the late fee is often higher than the initial registration cost.

- Obtain your Employment Identification Number (EIN). Your EIN is a federal business number provided by the Internal Revenue Service (IRS) to primarily identify your business for tax purposes. It’s free to obtain your EIN, and you will use it on several documents. Many banks require an EIN before opening a business bank account, and even nonprofit organizations need to have an EIN.

See also: Can I Open a Business Bank Account Without an EIN?

- Open a business bank account. It’s important to open a business bank account before incurring any business expenses. This ensures you’re not mixing personal and business expenses. Many banks require a balance of at least $1,500, or they deduct a monthly fee.

Choose your business structure

We recommend all businesses register as a legal entity, such as a limited liability company (LLC), S corporation, or C corporation. Registering your business as a legal entity protects your personal assets if a lawsuit were to ever occur against the business.

Research and determine the right type of legal entity for your business. While these legal entities have different pros and cons, they all achieve the vital goal of separating the business owner from personal financial liability if the business is sued or goes bankrupt.

Here are the most common business structures:

- Sole proprietor: If you don’t register your business, this is the default business structure. Typically, only very low liability businesses should stay a sole proprietor, such as a beginner graphic designer or tutor.

- Partnership: Similar to a sole proprietor, except a partnership has two or more owners.

- LLC and LLP (Legal entity): This is similar to that of a sole proprietor, except it provides personal asset protection in the event of a lawsuit or business bankruptcy. An LLP (limited liability partnership) is for multiple partners.

- S-corporation (Tax status): Elect your LLC or LLP as an S-corp to save money on taxes. Consider this structure if you are paying yourself more than $20,000 per year from the business.

- C-corporation (Legal entity): This business structure provides several benefits, including transferable shares and perpetual existence. You’ll likely need to work with an attorney before forming a C-corp to create the needed documents.

Here is a snapshot of the different business structures you can consider and their key advantages and disadvantages.

Business Structure Comparison Table | ||

|---|---|---|

Business Structure | Advantages | Disadvantages |

|

| |

Best For: Low liability businesses, one-person online businesses, freelancers, small businesses that are just a hobby or part-time job for the owner | ||

|

| |

Best for: Starting a low liability business with an equal partner or partners that you know well and trust | ||

Limited Partnership |

|

|

Best for: Larger companies with investors that do not want day-to-day involvement | ||

|

| |

Best For: Small businesses that need liability protections, don’t need to raise a lot of money from investors, and want flexibility in how the business is managed and taxed | ||

|

| |

Best For: Freelancers, consultants, retail business owners, seasoned professional-based business, and corporations with under 100 shareholders | ||

|

| |

Best For: Larger companies, business with foreign owners, owners by another corporation, LLC, or trust, or several types of shareholders, companies going public, or those seeking venture capital or equity investors | ||

Now that you’ve done the research and chosen your business’ legal entity, it’s time to submit the entity registration to the state it’s operating in. You can do this on your own by navigating to your state government’s business registration website. Or you can use an online legal service to assist you in the process. Additionally, if your business has a sales tax, you’ll want to obtain a state sales tax identification number (STIN).

Get state licenses and local permits

Depending on your type of business, you may need a professional license issued by the state or a local permit. Additionally, if you work from home and receive customers or employees, you may need to obtain a work-from-home license.

- State professional licenses are typically for businesses that may pose a public health risk. Each state may require different professions to obtain a professional license.

- Local license and permit requirements vary by state; however, typically, before opening a physical location, you’ll need a local building inspection to ensure the facility is safe for the public.

- A home-based business license is needed if you’re accepting employees and customers or creating products from your home. This license is to ensure the business isn’t causing a public health risk. However, Most businesses that operate from a home won’t need a license.

Secure your intellectual property

Although it’s not necessary to start your business, you may want to register a trademark, copyright, or patent. A trademark ensures no other business uses your logo, business name, or tagline. A copyright gives you increased legal protection over your creative work. A patent ensures no one can take your product idea.

Related:

- Trademark Costs: DIY Registration vs Online Service vs Lawyer

- How Much Does a Patent Cost? The Beginner’s Guide

Step 6: Get your business insured

Business insurance is a form of protection small business owners can buy to safeguard their personal or business assets. Getting the appropriate coverage for your operations protects your assets by covering customer lawsuits, property damage, and other perils so the costs following a disaster don’t put you out of business.

Most businesses deal with third parties who may claim your business caused their property damage, bodily harm, or financial loss. Different types of business insurance cover these accusations by paying the associated costs.

Certain small business insurance policies are considered fundamental because they protect against risks that most business owners face. General liability is a good example of this because it covers claims that your business is responsible for someone else’s damages. Many business owners also get commercial property insurance because it pays for damages to their property.

Common types of small business insurance policies

Type of Business Insurance | Best For | What It Covers |

|---|---|---|

All types of businesses | Non-employee claims of bodily injury, property damage, and reputational harm | |

Commercial property insurance | Businesses that have business owned-properties | Damage to business-owned property, including buildings and their contents |

Most low-risk small to midsize businesses | Combines commercial general liability and property coverage | |

Professional liability insurance | Service-based businesses and professionals (accountants, architects, doctors, lawyers, consultants, etc.) | Clients’ accusations of financial losses due to your negligence, mistakes, or omissions |

Any businesses that use vehicles for work | Costs associated with accidents involving vehicles owned or used by your business | |

Businesses with employees | Employees’ medical bills and lost wages resulting from a work-related injury |

How to get business insurance

Small business owners can get business insurance online through brokers or directly from carriers. To get the appropriate coverage for your business, it’s important to first assess your risks and then find providers who offer coverage that protects against them.

Related:

Because no business is immune to general liability claims, getting coverage should be a standard business practice. However, cash-strapped small business owners who are looking for inexpensive general liability insurance should remember that price shouldn’t be the only consideration. Smart business owners evaluate coverage limits, additional fees, and the carrier’s reputation as well.

Step 7: Build your business team

After taking care of the necessary legal steps to get your business registered and protected, it is now time to make key hires. Your first employees will be vital to the success of your business. Additionally, many new business owners overlook the importance of hires outside of the business such as a bookkeeper, attorneys, and mentors.

Here are the key people to have on your team:

Business attorney

A business attorney can help you form your new business, create custom forms or contracts, and provide legal advice. Even if you don’t need one immediately, it’s wise to establish a relationship before legal matters arise. Finding an attorney before you need one saves stress down the road.

Free business mentors and advisors

The federal and state government funds several organizations that provide no-cost business consulting and mentoring. The SBDC has over 5,000 consultants across the United States that provide no-cost consulting in a variety of business areas. These consultants typically have advanced education or experience owning a business.

SCORE Advisers are volunteers who typically have previously owned a business. They serve as mentors to business owners. A SCORE Adviser can be a great asset to your business, especially if they have experience in your industry.

Bookkeeper or accountant

If you’re starting a part-time business, you can likely track your income and expenses with software such as QuickBooks Online. However, if you have a full-time business with multiple products and services and have several expenses to track, you may want to hire a professional.

Many new business owners are unsure if they should hire a bookkeeper or an accountant, but most people starting a small business only need a bookkeeper. If you need complicated financial statements or business tax advice, it’s wise to hire a certified public accountant (CPA).

Employees

Hiring great employees is the key to growing your business. A thoughtful hiring process includes well-written job descriptions, effective recruitment ads, and strong interview processes, all of which should promote your values and culture and adhere to fair labor practices.

Many first-time business owners find employees online these days — through job boards, LinkedIn, Facebook, and Instagram. You will likely hire your first employee through word-of-mouth or from one of your family members or friends.

Related:

- How to Hire Employees

- How to Create a New Hire Checklist [+ Free Template]

- Hiring Bias: 13 Unfair Prejudices & How to Avoid Them

- New Employee Onboarding Best Practices: Steps & Checklist

Step 8: Set up your business systems and software

As you organize your business, you will find yourself creating systems to manage repeatable tasks and ultimately increase profits. You’ll often find software to assist with the tasks.

Below, you’ll find two lists — one with processes and systems that almost all new small businesses will need to implement. The second list includes several systems and software that — if they apply to you — are highly recommended.

Must-have systems and software

- Payment processing: You’ll need this to accept credit card payments. Sign up with a merchant service provider before setting this up.

- Bookkeeping: This is how you track income and expenses. If you are managing it yourself, you’ll need accounting software. If not, consider hiring a virtual bookkeeper.

- Payroll processing: If you have employees, you’ll use this system to pay them. To make the process easier, consider payroll processing software.

- Business tax payments: It’s a best practice to make business tax payments to the IRS quarterly so you don’t have a large tax bill at the end of the year. Aside from tax software, you can often use your accounting and payroll software to submit early tax payments.

- Business phone number: You’ll want to secure a business phone number so that you can separate personal calls from business calls. You can get a virtual phone line for free or for a small fee.

- Branded business email address: You don’t want potential customers to email a “@gmail,” “@yahoo,” or another alternative. It looks unprofessional. Get a business email that ends with “@yourcompanyname” so that it looks more professional. Google Workspace provides this for $6 a month.

Additional systems and software to consider

- Business website: If potential customers are typing your business name into the search engines, you need a business website. You can set one up yourself and pay around $15 a month. Here are small business website examples you can use for inspiration.

- Sell online: Expand your products’ or services’ reach by selling to customers online. You can build an ecommerce website or use a platform such as Amazon, Facebook Shop, Instagram, or Etsy.

- Customer management: If you have dozens of customers (or more), you’ll need customer relationship management (CRM) software. This software helps you keep track of customer information, such as previous communications and contact info.

- Appointment scheduling: Don’t schedule appointments by hand (unless you want to). Use free appointment scheduling software to store your appointments in the cloud. Also, allow clients to schedule online without communicating with you.

- Work from home: Set up your home office and manage it so that you can keep up productivity and enjoy your working environment.

- Take video calls: Video meetings and calls have skyrocketed since the pandemic arrived. Give your clients the option to meet through video conferencing software.

Overwhelmed? Don’t be. Free business software helps your company save money and become efficient. You can use free business tools to do accounting, accept payments, and pay employees.

If you’re starting a business, going with free business tools is a great way to keep operating expenses at a minimum. Free business tools are a low-risk test as you figure out the best systems and software for you. If you like them, keep them and possibly expand their features with a paid version. If you don’t like them, stop using the software with no added costs to your business.

Step 9: Market your business

Your last step to starting your business is to get customers. You’ll use your marketing strategy to get your new business in front of potential customers.

There are a lot of strategies you can implement to get your business noticed. Don’t get overwhelmed! Remember, you don’t have to implement — and pay for — all of these strategies. A few done well will get your business enough customers to make it a success.

Before diving headfirst into any of the strategies, take time to write a marketing plan. Think through and plan out how you want to market your business. In your plan, outline your brand, such as the logo, colors, font, and tagline.

At a minimum, you’ll want to create business cards to hand out to potential customers and vendors or while networking. Other marketing materials to consider are brochures, flyers, cards, and branded apparel. Many new business owners make the mistake of relying too much on online marketing. Don’t overlook the effectiveness of having physical business marketing materials in someone’s home.

Market online

- Social media marketing: Connect with your customers where they are spending their time online. Don’t try to grow a following on all social media platforms. Choose one and spend the majority of your time growing your account there.

- Email marketing: Stay in touch with past customers by sending them valuable or entertaining emails. Don’t make your emails all about sales and discounts. You’ll lose subscribers.

- Content marketing: Create and distribute articles, videos, case studies, and other forms of online content created to attract leads, create brand awareness, move prospects through the buying journey, or convert them to customers.

- Google My Business (GMB) listing: This listing is free for all businesses looking for local customers. Many marketers are calling GMB the new small business “homepage.” It’s what customers see on Google before your website when they search for your business.

- Online directories: It’s likely your business can be on several online directories such as Yelp and Yellow Pages. Consider any industry-specific directories as well.

Network with local businesses

When you first open, explore networking groups available for local businesses. It’s always a good idea to meet and network with other business owners. Word-of-mouth recommendations and referrals may lead to some of your first customers.

Related: 8 Business Networking Statistics to Generate New Opportunities

Pay for advertising

You may want to pay to get your business in front of ideal customers. This paid marketing can give your brand recognition a jump-start. You can go for advertising online or through traditional advertising channels.

- Search engine ads: Pay to get your business at the top of Google or Microsoft. Typically, you will pay every time an interested searcher clicks on your ad. The cost of the click will depend on the number of businesses competing for ad space.

- Social media ads: Get your social media ad in front of both followers and nonfollowers. Ad cost depends on the competitiveness of the audience you’re targeting.

- Online directory leads: Depending on the directory, you can pay for higher rankings or leads. Yelp provides both options.

- Direct mail: Create cards or brochures and send them to the homes of potential customers near your business.

- Radio ads: This type of advertising is an excellent option if your business appeals to an audience in a broad industry, such as retail or home improvement.

- Billboards: The cost of a billboard varies depending on location. Pay anywhere from $250 per month for a rural area to over $15,000 per month in a larger market.

Media package

You want local media to know about your new business. Local media prefers information about your business submitted to them in a press release. A press release is a summary and story of your business. You also want to include owner headshots and photos of the business in the press kit. It’s important to include a hook, which is a way to present your business that creates interest so that the business journalist will cover the opening of your startup.

How to start a small business frequently asked questions (FAQs)

Click through the questions below to get answers to some of your most frequently asked questions about starting a small business.

How can I start a small business with no money?

You can start a business with no money, but it is not recommended. You aren’t required to spend money to register your business. When you don’t register, it is called a sole proprietorship. However, the problem with not registering is that your personal assets are at risk. For example, if you’re starting a lawn care business and something costly gets destroyed at a customer’s property, that customer can sue you for damages, and your personal assets are at risk.

What is the easiest business to start up?

The easiest business to start is one that relies on your expertise. People pay you for your expertise because you know more than they do. For example, if you are a social media manager for a business, you can take your social media marketing expertise and charge local businesses to manage their accounts.

There is little cost to this type of business because your time and expertise are the product.

How much does it cost to start a small business?

Starting a business does not need to cost a lot of money. If you’re providing a service like resume writing, the only cost is registering the business in your state. As you add additional components to your business, like a website, accounting software, and a branded email address, your business costs will increase. For example, adding a low-cost website is another $100 or more per year. A branded email address will cost another $100 or more per year.

Bottom Line

If you’re feeling overwhelmed with all the tasks involved in starting your business, don’t stress! Starting a business is a marathon, not a sprint. Be patient. Give yourself time to absorb and understand the above steps.

“The truth is, success is a process—you can ask anybody who’s been successful.”

– Oprah Winfrey

Be proud that you’re learning and trying to figure out this messy world of starting a business. Make your next move today: What micro-step are you taking today to make your idea a reality?